You may be reading this article because a friend told you that crypto is a great way to make a lot of money. Or, you may be looking to allocate a portion of your portfolio to cryptocurrencies and you worry that you might have “missed the chance” to invest in bitcoin.

This article aims to help you make a more informed decision when investing in cryptocurrencies. The two most popular approaches to investing in cryptocurrency are the “Bitcoin-focused” approach and the “crypto-portfolio” approach where people spread their money across a bunch of different currencies. We will help you understand the pros and cons of each.

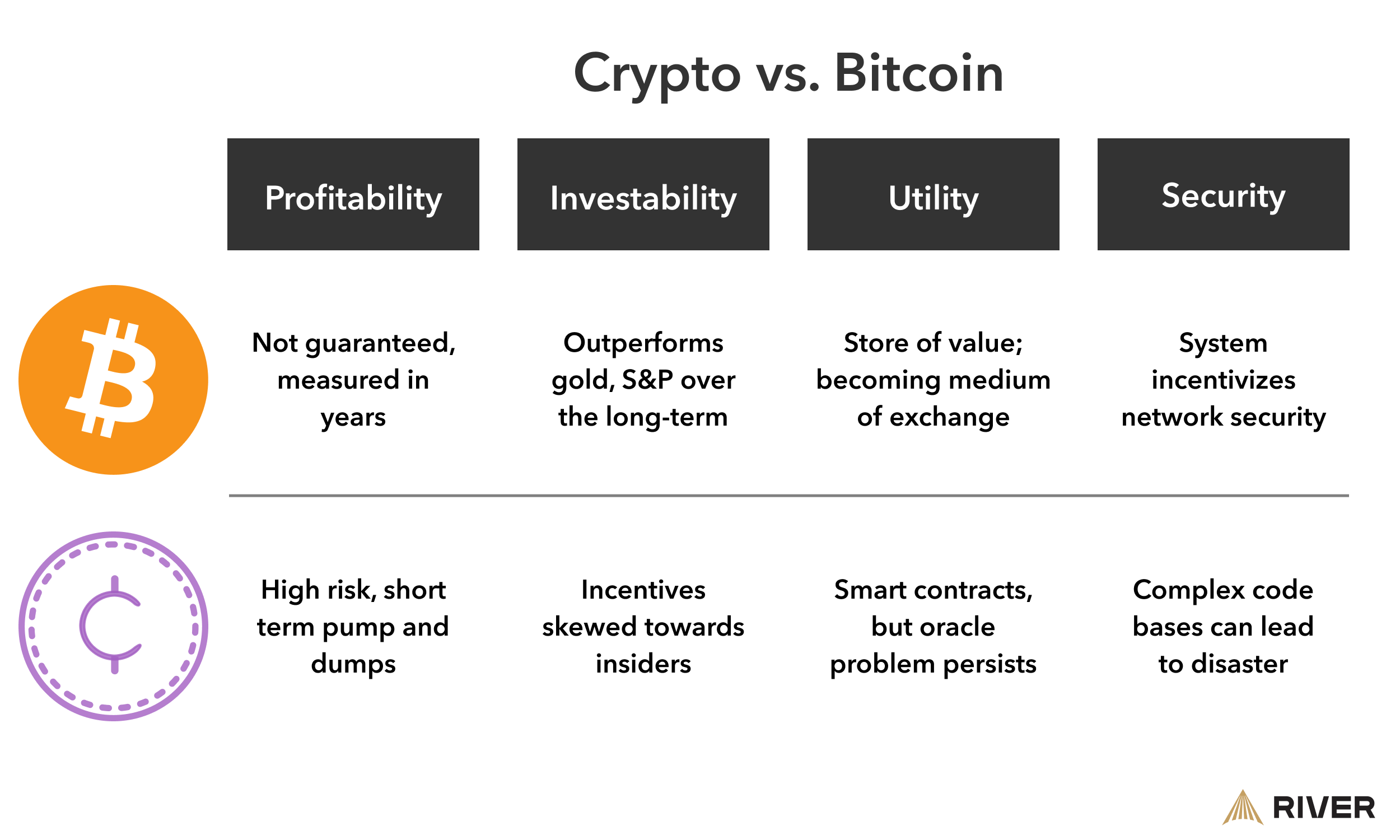

Throughout the article, we will make comparisons across four different aspects that could impact your decision: Profitability, Investability, Utility, and Security.

What is More Profitable: Crypto or Bitcoin?

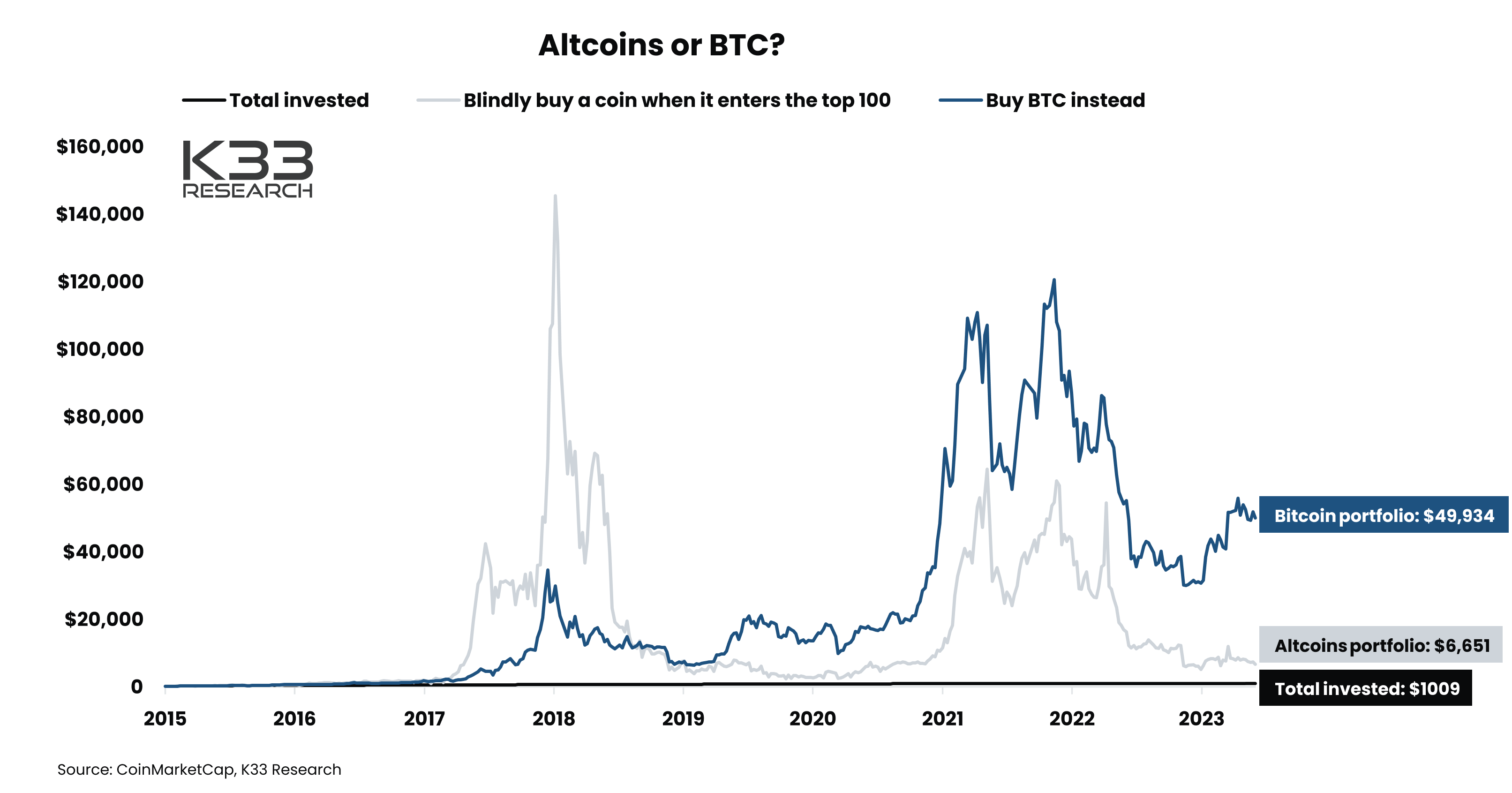

In 2025, buying bitcoin is more likely to be profitable than buying crypto. From 2017-2019, investing in crypto was more profitable than investing in bitcoin, on average. During that period, traders could randomly invest in “altcoins” and outperform bitcoin, but today, this is no longer the case.

According to data gathered by eToro, approximately 90% of crypto traders lose money.

Of course, you don’t hear the full story from the 90%. People don’t brag about losing 36% of their wealth to a bad investment, they share success stories, which give the impression that things are better than they look. Successful traders are highly disciplined and rigorously follow their trading system—the strategy, position sizing, risk management, and psychological disposition all play a role in their success.

Crypto Traders vs. Crypto Insiders

In crypto, the asymmetry of information is much more relevant to trading profitability than a particular trading strategy. The reason is simple: the ICO (initial coin offering) craze in 2017 provided a path for investment firms to effectively front-run the market by knowing in advance which projects/tokens/coins were going to receive funding, and therefore increase in value.

This has been the insiders’ go-to strategy for years. Unless you are willing to spend hours pouring over tokenomics of countless projects to try and figure out who the insiders are, and when they might be able to profit off of you, then it is wise to place your money elsewhere. In many cases the insiders hide in plain sight: they manage trading groups, run podcasts, or publish newsletters, in which they tell their followers what to buy and sell.

Ask yourself: What are you trying to accomplish with your investments? Are you looking to make a quick profit, or are you trying to build wealth for your future?

Crypto vs Bitcoin in Your Portfolio

Your investment horizon is another crucial factor in deciding whether to allocate your capital to crypto or bitcoin. Trading crypto might outperform a passive bitcoin accumulation strategy if you are a master of timing and have inside information.

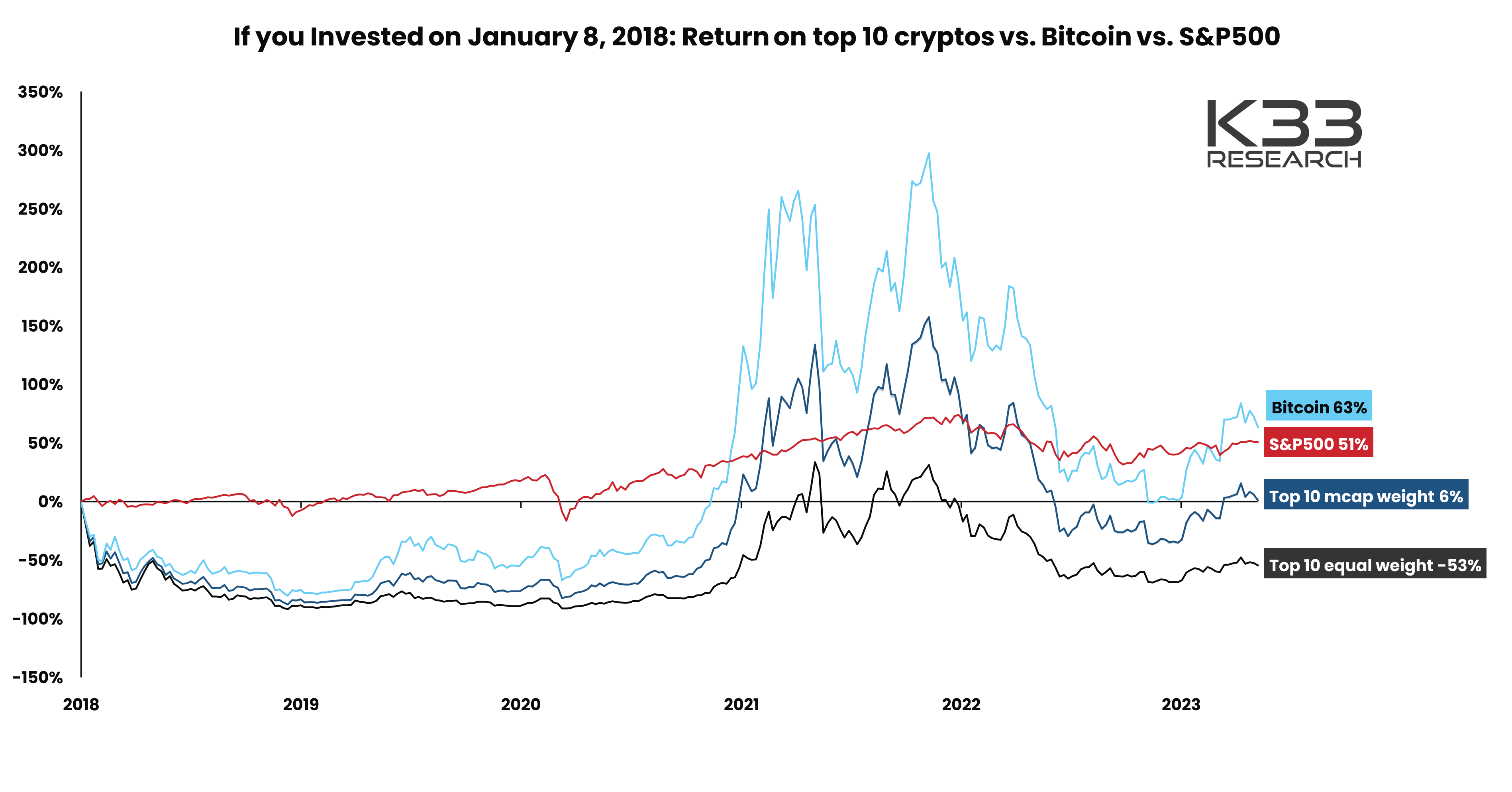

On a multi-year investment horizon, bitcoin outperforms crypto by a large margin. Even if you bought the 10 largest cryptos by market capitalization, you would still be underperforming a bitcoin-only investment strategy by over 50%.

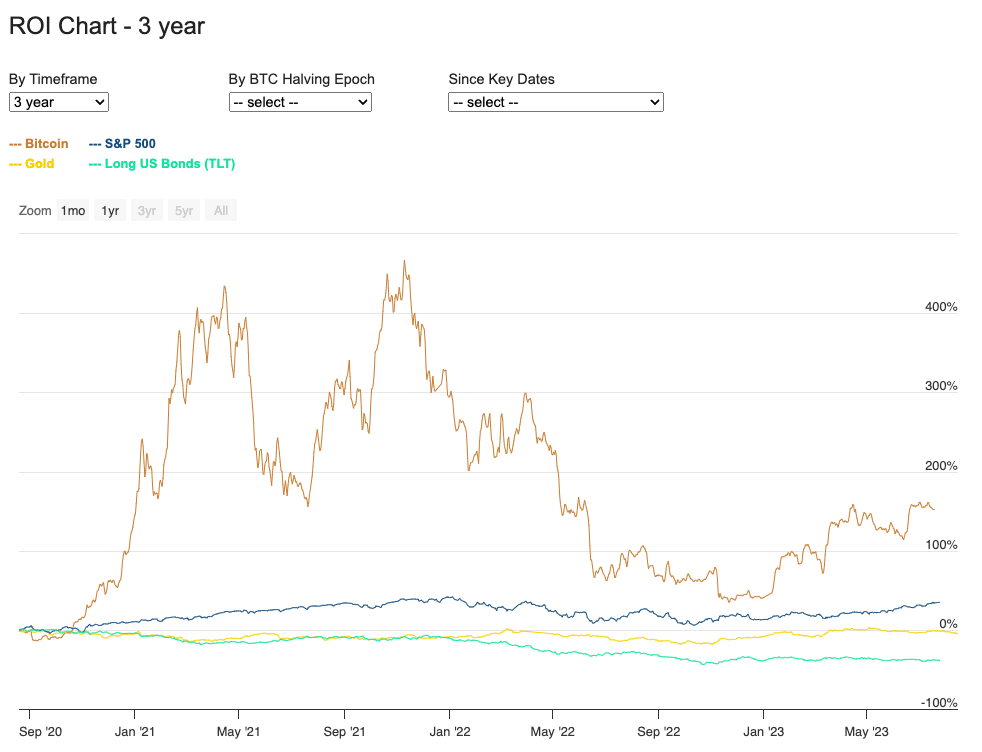

Bitcoin has demonstrated that it holds its value over the long term, and grows in purchasing power when compared to gold, treasuries, and the stock market. This is one of the main reasons why people choose to invest in bitcoin, rather than trading it on shorter timeframes.

Decentralization in Cryptocurrencies

Most applications of blockchain rely on a degree of decentralization. Incorruptible money, blockchain-based identification protocols, and blockchain-based finance applications all require a degree of decentralization to function properly. Otherwise, it is more efficient run an application on a centralized database.

Bitcoin is widely recognized as the most decentralized cryptocurrency. It is unique because the system assumes that people will act in their own best interests; the protocol aligns the incentives of participants such that the system as a whole benefits when people are greedy. How exactly are incentives aligned?

- Miners are incentivized via the block reward to continually add transactions to the blockchain.

- Bitcoin users (sometimes referred to as economic nodes) are incentivized to pay miners a transaction fee so that their transaction gets included in the permanent database that is the Bitcoin blockchain.

- Companies in the Bitcoin industry are incentivized to offer high-quality products and services to Bitcoin users to generate revenue. And since Bitcoin is software, the industry is incentivized to fund software development work that makes Bitcoin more robust.

- The software developers are incentivized to build new features and protocols that enhance the experience of themselves and other network participants.

Finally, all parties are incentivized to work together in a voluntary manner to ensure that Bitcoin the network functions properly, and thus, that bitcoin the asset maintains its value.

By contrast, other cryptocurrencies are typically created by a single company or small group of individuals. With full control over the blockchain, they have incentives that are not aligned with potential users.

Bitcoin’s origin as the first cryptocurrency with a creator who disappeared shortly after its creation granted it a unique and unparalleled level of decentralization that is nearly impossible to replicate.

Is It Too Late to Buy Bitcoin?

You might be thinking this because of how much bitcoin’s price has increased since 2009, but it’s not too late to start building your bitcoin position!

If the past is any indicator, we could see bitcoin increase in value as we approach the next halving—where the supply issuance (inflation) of bitcoin is reduced by 50%. This supply shock has historically tended to have a positive effect on bitcoin’s price.

Bitcoin is fascinating because it is the world’s only existing asset that has the property of absolute scarcity. Contrary to assets like gold, where more supply can be mined at the margin, once all 21 million bitcoin are mined and in circulation—there will be no new units produced.

➤ Learn more about Bitcoin’s hard cap of 21 million.

Absolute scarcity is unheard of in the context of a monetary good, and some have argued that Bitcoin’s growth and adoption resemble other revolutionary technologies like the internet, personal computers, automobiles, and flushing toilets. As such, there is much more market share for bitcoin to take in the future.

It’s worth noting that investing in bitcoin is not going to make you rich overnight, instead, owning bitcoin enables you to not get poor slowly through inflation. Since coming off of the gold standard in 1971, the U.S. dollar has lost nearly 87% of its purchasing power, and the money supply has increased by over 2,900%.

The real question is: for how long can you afford to watch your money be debased in real time?

Why Do People Own Crypto or Bitcoin?

In this section, we walk you through the rationales behind the “Bitcoin-focused” and the “crypto-portfolio” investment theses. We examine the top use cases for both assets and then assess the investment utility of the uses.

When assessing investment utility, you have to ask if these uses have the potential to add value to a portfolio long-term, or if their use is a passing fad.

What Can You Do With Crypto?

Speculative Trading

The most popular use case for crypto has been speculative trading, also known as gambling. The crypto community broadly exalts risky gambling behavior, they call themselves degens. Speculative trading does not provide investment utility to a portfolio. To be clear: we are not making a moral argument against gambling. As long as participants enter voluntarily and have some level of awareness of what they are doing, there is no issue.

Staking

Staking is another popular use for crypto; staking refers to locking up your crypto in order to validate transactions or contribute to a protocol’s liquidity in return for a reward, typically expressed as an annual percentage yield (APY). The potential to earn “yield” on assets is alluring, as it could represent a passive income stream, but the dynamic and opaque nature of the rewards reduces the overall investment utility.

➤ Learn more about why Bitcoin uses Proof of Work instead of Proof of Stake.

Smart Contracts

The programming flexibility of crypto enables the creation of smart contracts—pieces of code that enforce outcomes based on pre-specified conditions. These contracts enable the “DeFi” use cases of lending, borrowing, decentralized exchanges, and derivative products, to name a few.

Smart contracts are the most valuable use, as it is possible that they could provide access to financial products and services to people who would not otherwise have access. It is important to note that after existing for nearly a decade, there are few truly novel smart contracts for use cases other than basic financial services. Many of the envisioned smart applications on blockchains never achieved product market fit by solving a real problem.

What Can You Do With Bitcoin?

Store of Value

The top use for Bitcoin today is as a store of value. People feel comfortable storing their wealth in Bitcoin because:

- It is a scarce asset; there will only ever be 21 million bitcoin.

- The network is decentralized. Thousands of people run nodes around the world.

- Anyone can verify a transaction, or audit the total supply of the network instantly.

- Bitcoin’s monetary policy is enforced by code, not a governing body.

- It is a highly portable asset—12 words can represent billions of dollars!

- Bitcoin is divisible; one hundred-millionth of a bitcoin = 0.00000001 BTC = 1 satoshi.

Medium of Exchange

Bitcoin can also be used as a medium of exchange to purchase goods and services from vendors who accept bitcoin as payment. This use is partly enabled by Bitcoin’s second-layer Lightning Network. Bitcoin used in the second layer is the same as bitcoin on the base layer, the difference is that transactions on Lightning settle nearly instantaneously, which allows for much more economic activity to take place than is possible on-chain.

➤ Learn more about using bitcoin as a medium of exchange.

Bitcoin reflects the structure of the internet—layers of technology built on top of each other where each layer can do more and more useful things. Settling payments faster than credit cards at a fraction of the cost is just the beginning for Bitcoin; when combined with bitcoin’s properties as a store of value, bitcoin’s investment utility exceeds that of crypto.

Risks of Crypto and Bitcoin

Bitcoin is much less risky than crypto. Why is this so?

Many crypto projects attempt to “create a better version” of Bitcoin without fully understanding the tradeoffs involved. This has resulted in a lack of focus on security across the crypto industry: in 2022 alone, 10 hacks totaled over $2 billion in losses. Crypto’s biggest strength—its flexibility—is simultaneously its biggest weakness. Fundamentally, the more complex a system is, the more risky it is.

A general lack of understanding can also be observed in the crypto-staking ecosystem where participants seek so-called passive yield. So, what are the risks of staking?

- Asset risk: The token you earn as yield could devalue during your holding period.

- Liquidity risk: Staking a token without a sufficiently large market could make it difficult to take profit on your position, where will you be able to sell your holdings?

- Duration risk: How long are your assets locked up? Crypto prices tend to be volatile, and you could wind up at a net loss if price moves against you significantly.

- Dynamic reward risk: Many crypto projects change their payouts based on external factors; ensure you understand how a project incentivizes staking before committing.

- Security risk: There can (and have been) fundamental flaws in crypto security models. It is prudent to dig into how a given project thinks about securing assets, but understanding this is often far beyond the technical capabilities of the average investor.

This begs the question: Is Bitcoin Safe? The short answer is yes.

The Bitcoin blockchain aligns the incentives of users, miners, and node operators such that each contributes to network security by following their own self-interests. In order to attack Bitcoin as a network, a malicious entity would need to control a large percentage of miners—while technically possible, this would cost billions of dollars and would most likely be untenable for any extended period of time.

Conclusion

Bitcoin is more likely to be a profitable investment than taking big risks in crypto. Successfully trading crypto (or any asset) is difficult to do—especially when insiders have access to information that you do not. Furthermore, data shows that as an investment’s time horizon is extended, bitcoin is a better investment option than crypto, the S&P500, gold, or U.S. treasuries.

Bitcoin’s absolute scarcity, transparent monetary policy, and trust-minimized nature make it a superior store of value than crypto. We cannot predict the future, but considering that new layers are being actively developed on top of Bitcoin, it is reasonable to expect that the value of bitcoin will increase in the future as it becomes a more accepted medium of exchange on top of a growing store of value.

You could try to outperform bitcoin by trading crypto or other assets, but this strategy is statistically less profitable in the long run. There are good reasons why the world’s largest investment funds are looking to create bitcoin ETF products: Bitcoin is an open network that functions as intended and properly aligns the incentives of participants.

River was founded by bitcoiners, and built for everyone. We focus our energy on Bitcoin because it is the most technologically robust, and secure cryptocurrency.

Download our iOS app, or sign up through the website and start building your wealth today!

Key Takeaways

- Following the ICO craze of 2017-2019, Bitcoin has outperformed crypto by a wide margin.

- Bitcoin’s use as a store of value is well-established, and it continues to get easier to use it as a medium of exchange, too.

- Crypto is riskier to invest in than Bitcoin because it is difficult for an investor to accurately assess the risk associated with code from a highly complex and opaque system.