It’s hard to know the best time to buy bitcoin. There can be significant price volatility, which may cause uncertainty, fear of missing out, or the fear of participating at all.

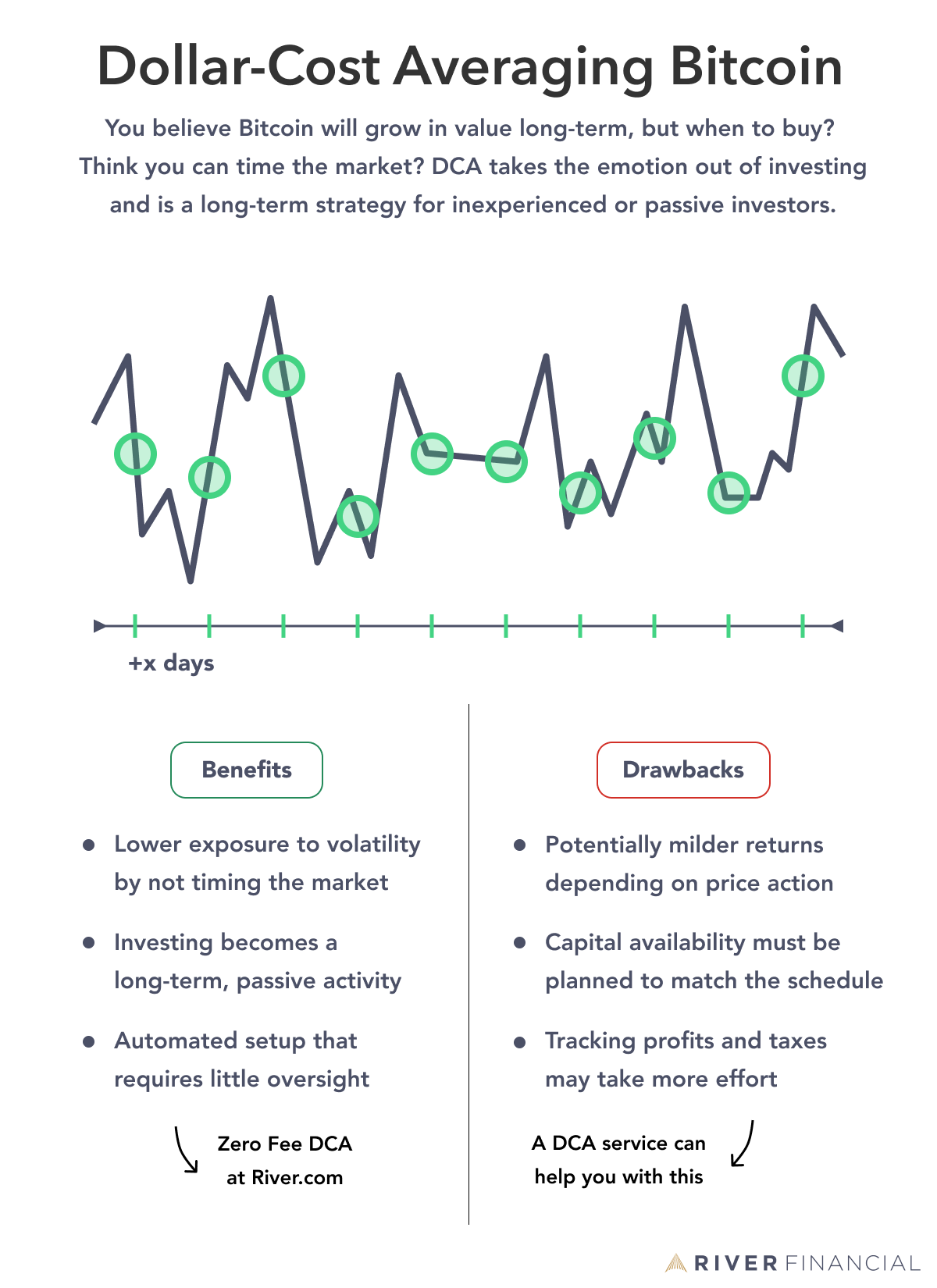

Instead of trying to time the market, a commonly advised way to invest in Bitcoin is through a strategy called Dollar-Cost Averaging. Is it a good approach? What are the risks? And how can you do it?

What is Dollar-Cost Averaging?

Dollar-cost averaging (DCA), also known as the constant dollar plan, is a long-term investment strategy in which an investor divides their planned total investment amount into periodic purchases. This spread reduces an investor’s exposure to short-term price volatility, as they gradually work towards their investment goal.

Dollar-cost averaging is typically done in an automated way, on a daily, weekly, bi-weekly or monthly basis. If you want to learn more about the different frequencies, see our research on Bitcoin DCA. On River, it is one of the most popular ways to buy bitcoin, because of our zero-fee recurring orders.

For example, if an investor wants to invest $2500 in bitcoin, they could buy $50 worth per week for 50 weeks, instead of making this investment in one go. The investor would not be locked into this schedule and could stop buying or extend the recurring order as they please.

Many people in the U.S. already use a DCA strategy without realizing it. DCA is used in 401(k) retirement plans, as a way to invest in regular intervals based on paychecks.

Why Dollar-Cost Averaging in Bitcoin?

The goal of dollar-cost averaging is to take the emotion out of investing. It compels an investor to continue investing a fixed amount to reach their goal, regardless of short-term fluctuations and volatility in the market. DCA can help to avoid the temptation to time the market, which is notoriously difficult, even for the most experienced investors using sophisticated market analysis.

Adopting a DCA strategy requires discipline and a long term outlook. It won’t always yield the best possible returns, but it does set an investor up for a growing bitcoin position over time.

Dollar-cost averaging makes sense under the assumption that the chosen asset will increase in value long-term, but will experience volatility along the way. Bitcoin is a relatively volatile asset today, and also a relatively new asset. Many investors who get involved still have a lot to learn about the technology and its implications for the world. As an investor dollar-cost averages into Bitcoin, they can also gradually continue to level up their knowledge over time, along with their bitcoin holdings.

What are the Benefits of Dollar-Cost Averaging?

There are many benefits to dollar-cost averaging that make it an attractive investment strategy for investors:

- Automation. Purchase can be scheduled for set time intervals through your River investment account, allowing your investment to grow with relatively little oversight. There are no fees on recurring orders after the initial setup.

- Lower Risk. Dollar-cost averaging allows investors to mitigate risk by buying at many different prices as the price of the asset fluctuates between their recurring purchases. In this way, dollar-cost averaging can lower an investor’s exposure to volatility and keep their average cost basis closer to the current price of the asset. Without dollar-cost averaging an investor runs the risk of buying a large quantity of an asset near a local price maximum.

- Passivity and Simplicity. Because dollar-cost averaging is a long-term investment strategy that isn’t based on purchasing at specific price points, it requires less attention, expertise, and analysis from an investor. Combine these qualities with automation, and it’s possible to achieve long-term asset growth without having to commit much oversight to your investment.

What are the Drawbacks of Dollar-Cost Averaging?

Dollar-cost averaging is known for being a straightforward, lower-risk long-term investment strategy. However, it’s not the right investment strategy for every investor. Depending on your investment goals, there are some facets of dollar-cost averaging worth considering before investing:

- Mild Returns. Dollar-cost averaging can successfully circumvent an asset’s volatility, but in doing so it misses out on ultra-high returns in favor of more normative return rates. If an investor is seeking a high investment return, dollar-cost averaging may not be the best strategy. It also cannot protect the investor against the risk of declining market prices.

- Capital Inefficiency. Properly deployed capital is expected to increase in value over time. For this reason money today is always better than money tomorrow. However, dollar-cost averaging delays capital deployment, negating the value of having money which could have been invested earlier.

- Higher Fees. When dollar-cost averaging, the investment made in each period is much lower than a lump-sum investment. As such, fees might be higher when buying in smaller amounts. If an investor is investing with a financial institution that charges higher relative fees for smaller amounts, or is generally weary of paying fees, there may be more efficient investment strategies for them.

To address this last point, we have made DCA orders more accessible at River by not charging any recurring fees after setting up the order.

How Does DCA Bitcoin Work in Practice?

There are a few simple steps to set up a DCA order:

- Identify the total allocation to bitcoin (or another asset).

- Plan the size and frequency of the DCA order.

- Find a service that allows recurring buys.

River is a great place to start with our zero-fee recurring buys.

Key Takeaways

- Dollar-Cost Averaging is an automated investment strategy for long-term value investing, not short-term gains.

- Dollar-Cost Averaging is an attractive approach for inexperienced or passive investors who are interested in volatile assets, such as bitcoin.

- There are various benefits and drawbacks to dollar-cost averaging.

- On River there are no fees for recurring orders to make DCA available to all.