The Bitcoin halving, also called “the halvening”, is an event that cuts in half the reward that miners earn for mining blocks. The event takes place after every 210,000 blocks are mined. Satoshi Nakamoto hardcoded the halving into the Bitcoin protocol to ensure that Bitcoin remains a scarce digital asset.

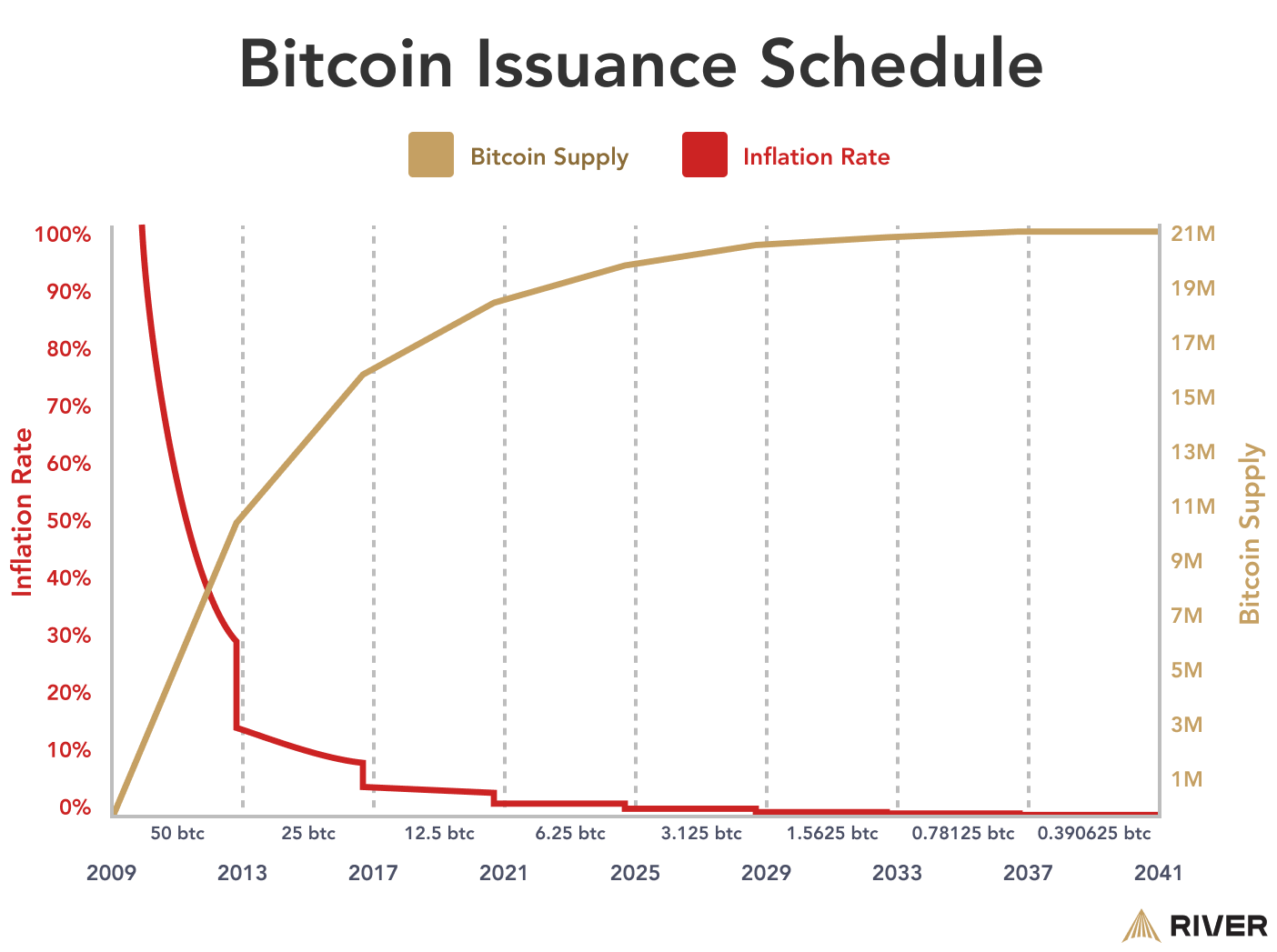

Bitcoin has a hard cap, or supply limit, of 21 million coins. The halving ensures that the rate at which new bitcoin is created slows down, making Bitcoin a deflationary asset. Bitcoin’s low inflation rate is trending towards zero.

When Is the Bitcoin Halving?

The next Bitcoin halving is estimated to occur on April 18, 2028. The bitcoin halving occurs after every 210,000 blocks are mined, or approximately every 4 years. Bitcoin miners currently earn 3.125 BTC for each mined block. After the April halving in 2028, miners will earn 1.5625 BTC.

What Are Block Rewards?

Block rewards are the amount of bitcoin miners receive from the network for “finding” or mining the next block in Bitcoin’s blockchain. In brief, mining computers produce “hashes” (long strings of numbers and letters) at an incredible rate of trillions per second to guess the proper hash that will link the previous block in the blockchain, where transactions are stored, with the next block. For their efforts, successful miners receive a block reward in the form of the block subsidy—the new bitcoin that are mined with the new block—along with any fees from the transactions included in the block.

Why Do Miners Get Block Rewards?

Miners get block rewards as an incentive for them to use their computational power to mine and secure the network. Miners receive block rewards, in part, to mint new bitcoin for circulation. Miners typically need to sell the majority of the bitcoin they receive in a block reward to cover electricity and operating costs. Bitcoin mining is very power intensive, and this underlies the other rationale for the block reward: because miners spend so much money, time, and energy to extract bitcoin, they are disincentivized from doing anything that might jeopardize their income, such as attacking the network.

When Does a Halving Happen? Is There a Schedule?

The Bitcoin network is scheduled to undergo its reward halving every 210,000 blocks. Assuming an average block time of 10 minutes, a halving will occur roughly every four years. The third halving, on May 11, 2020, took Bitcoin’s issuance down from 12.5 BTC to 6.25 BTC every block. Before this, the second halving took place on July 9, 2016, reducing the mining reward from 25 BTC to 12.5 BTC. On November 28, 2012, Bitcoin’s initial block reward of 50 BTC was cut in half in the first-ever halving. You can track the countdown to the next halving.

This process will continue every four years until roughly the year 2140, when the 33rd halving will take Bitcoin’s final block reward from 0.00000001 BTC to 0. The total supply will then cap out at 20,999,999.9769 bitcoin. The reason is that after the 10th halving, a rounding error starts occurring as bitcoin has 8 decimal places and the 9th number is discarded, which adds up all the way to the year 2140.

Does the Halving Influence Bitcoin’s Price?

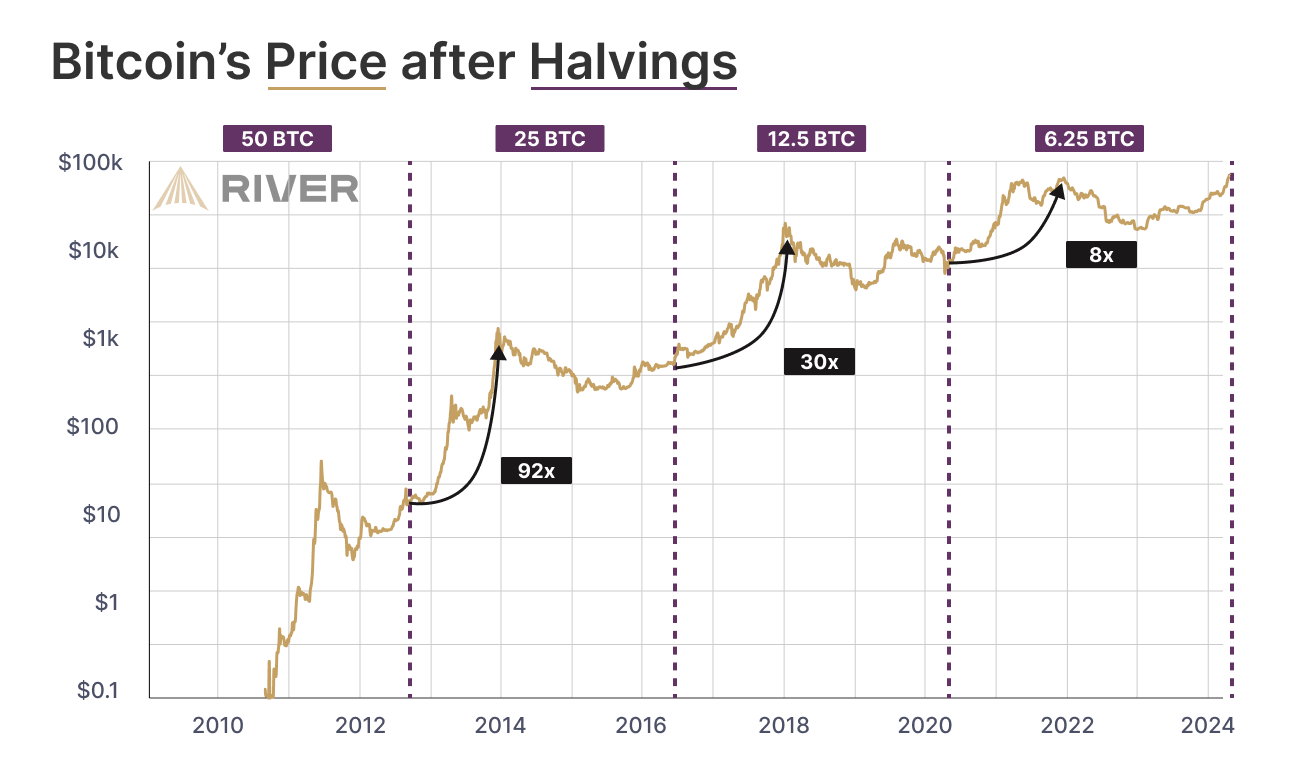

Historically, bitcoin’s price has increased significantly in the months after a halving, but correlation does not always imply causation.

Some in the Bitcoin community debate that the halving does influence Bitcoin’s price. “Stock-to-flow” (S2F) advocates argue that a reduced inflation rate and the supply squeeze it creates will produce a positive effect on price. Their argument follows that as long as buying demand remains at pre-halving levels, the price should go up because there are half as many new bitcoin entering the open market from miners.

Others do not believe that the halving directly correlates to Bitcoin price increases. Their rationale is that the halving does not create demand in itself, even if it does make the bitcoin supply more scarce over time. Per this argument, just because miners may be selling a reduced number of bitcoin each day does not mean the aggregate selling on the open market will be reduced. Other opponents of the S2F model believe halvings should be priced in because their occurrence is public knowledge.

Is Bitcoin Price Correlated with the Credit Cycle?

It is clear that bitcoin tends to increase in price following each halving event, but it is less clear why that is the case. One argument that has been gaining traction is that Bitcoin’s halving coincidentally lines up remarkably well with the phases of expansion and contraction within the credit cycle.

Essentially, this line of reasoning asserts that bitcoin’s price is a function of the liquidity available in the market, hence why bitcoin has been correlated with tech equities, in recent years. Independent market analyst TXMC outlines how bitcoin’s halving events line up with the cycle of the Purchasing Manager’s Index—a metric that measures the month-over-month activity in the manufacturing sector.

Ultimately, it is very difficult to say whether bitcoin’s price action following the halving is a product of the constrained supply of new bitcoin, or a coincidental alignment with the traditional economy, or some mixture of both factors!

➤ Learn more about how macroeconomic factors affect Bitcoin.

What Will Happen When the Block Reward Becomes Too Small?

This is also a subject of heated debate. Ultimately, transaction fees will replace the block reward as the primary revenue for miners. Critics argue that this will be economically untenable, but many of Bitcoin’s leading voices say that these fears are overblown. They argue that advancements in transaction batching and other layer-two technologies will likely iterate this problem away.

➤ Learn more about what will happen after all bitcoin are mined.

Key Takeaways

- Every 210,000 blocks or roughly 4 years, the amount of new bitcoin miners can mint per block is cut in half.

- From 2009-2013, 50 BTC were minted per block. After 34 halvings, the total supply of Bitcoin will cease growing and rest at just below 21 million BTC.

- Block rewards are critical to incentivizing miners in the early years, but as the block reward shrinks in size, miners will need to draw revenue from transaction fees.

- Miners usually exert sell pressure on the market by selling the block rewards to cover their high operating costs. When these rewards are cut in half, sell pressure may also decrease, yielding a price rise.