Once all 21 million bitcoin are mined by the year 2140, no new bitcoin will be created. This means miners will no longer receive block rewards for adding new blocks to the blockchain. Instead, their compensation will come solely from transaction fees paid by users. This shift could lead to higher transaction fees, as miners will need sufficient incentives to continue securing the network and validating transactions.

Skeptics have expressed concerns about whether transaction fees will maintain sufficient levels of security. While this concern is valid, the continuous adoption growth of the Bitcoin network and utility demonstrates that a mature fee market is possible.

Is Bitcoin Scarce?

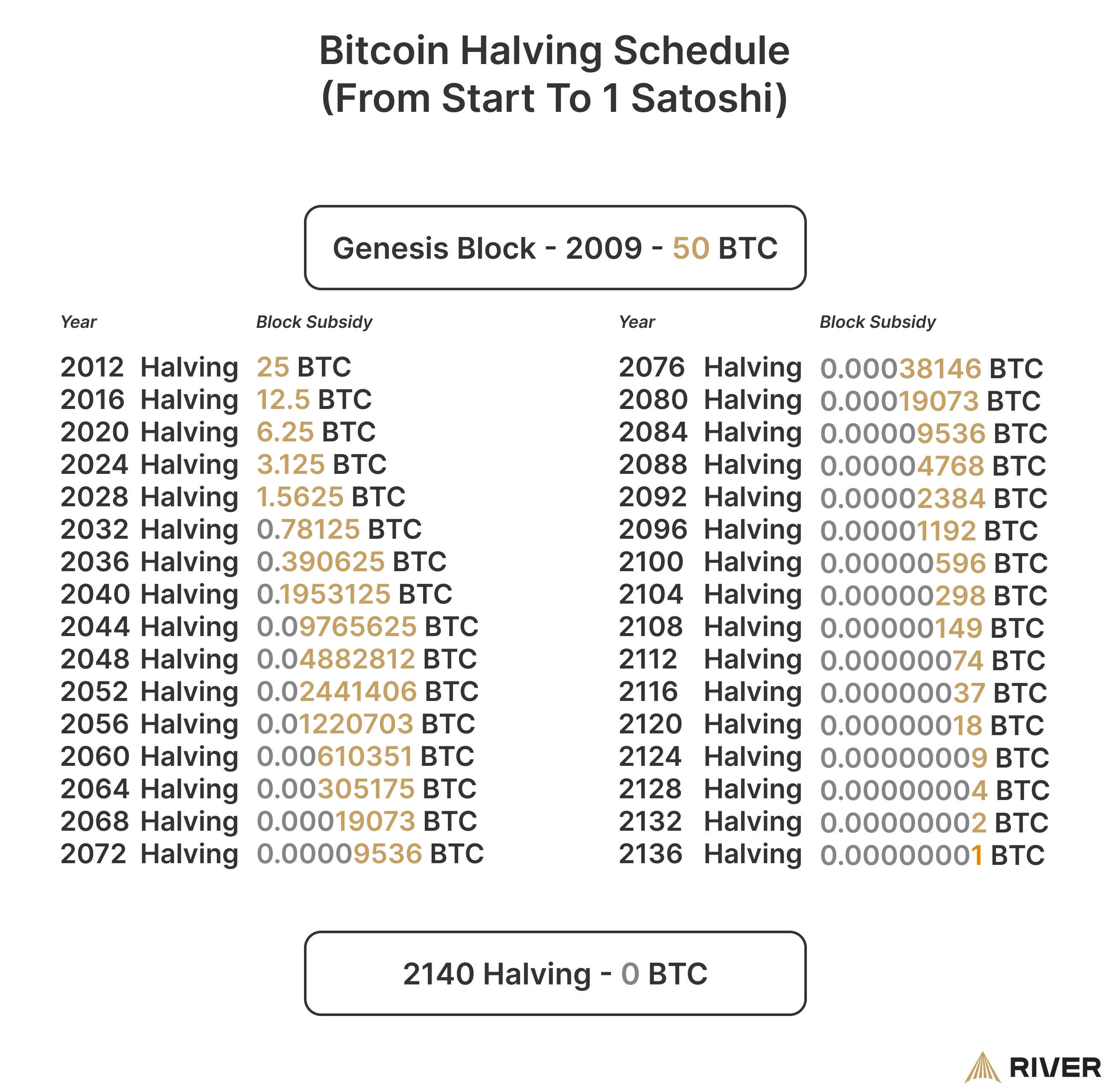

Bitcoin is the first asset in history with absolute, mathematical scarcity. This scarcity is verifiable by any member of the network and is regulated by an algorithm in Bitcoin’s source code called Bitcoin Core. This algorithm allows miners who create blocks to receive newly minted bitcoin. The block reward helps miners cover the high costs of mining. Every four years however, the algorithm cuts the block subsidy in half in an event called the halving. This process will continue until around the year 2140, when the flow of new bitcoin will drop from one satoshi per block to zero.

➤ Learn more about Bitcoin’s halving.

Bitcoin is designed to have a maximum supply of 21 million coins. However, because of the way Bitcoin’s code handles very small numbers, it rounds down when dividing rewards.

According to Amberdata, the block reward is 4,882,812.5 satoshis at at block number 2,100,000. However, the reward will be rounded down to 4,882,812 satoshis.

Imagine you have a pie that you keep cutting in half. Eventually, the pieces get so small that you can’t cut them any smaller without rounding down. Similarly, when Bitcoin rewards get small, the system rounds down to the nearest satoshi. This means that the actual total supply of Bitcoin will be slightly less than 21 million because of these tiny round-downs over time.

When a halving occurs, miner revenue is roughly cut in half. As with any industry, a 50% loss in revenue can force a business out of operation. In the case of Bitcoin, mining directly provides security to the network, so a flight of miners from the network could jeopardize Bitcoin’s security model. As the block subsidy trends towards zero, Bitcoin skeptics believe that low miner revenue could lead to lower security and a diminishing value proposition for Bitcoin itself.

Skeptics have also expressed fears of a deflationary currency. As Bitcoin’s inflation rate continuously falls, some economists have claimed that there will not be enough Bitcoin on which to base a monetary system and that Bitcoin will never support retail payments due to its high price.

Both of these concerns will be addressed in detail within this article.

Bitcoin Network Security Concerns

The total amount of mining occurring on the network, measured by hash rate, gives a rough estimate of the security of Bitcoin’s blockchain at a given point in time. As block subsidies fall, miners’ revenue and Bitcoin’s security thus threatened as well. However, several factors compound to allow miners to continue mining profitably and preserve Bitcoin security despite a halving of the subsidy.

Transaction Fees Become a Primary Source of Income For Bitcoin Miners

Firstly, miner revenue consists of the block subsidy—the newly minted bitcoin—plus the cumulative transaction fees paid in a block. This sum is called the block reward. So, while the block subsidy is cut in half, transaction fees are not.

As Bitcoin adoption grows over time, demand to transact on the network will grow, and fees are expected to rise to partially compensate miners. This is because only a certain number of transactions can be confirmed every ten minutes. Therefore, transactors must bid to have their transactions confirmed in a timely manner.

Technology Makes Bitcoin Mining Efficient

Secondly, Bitcoin mining technology is improving at an explosive rate. ASICs, the special microchips that miners use to mine as efficiently as possible, have seen rapid improvements since their introduction around 2013. If a miner can increase the energy efficiency of their mining operation and lower costs, this can offset an additional portion of revenue lost to the halving.

Cheaper Energy Makes Bitcoin Mining Profitable

Thirdly, the cost of energy varies across different regions. Bitcoin miners will often seek locations with the cheapest electricity to maximize profits. Bitcoin mining is geographically agnostic; a miner is free to locate their operations wherever the cheapest energy can be found. This allows miners to operate in remote places that are unsuitable for other types of businesses, such as on an oil field or near a hydroelectric dam.

➤ Learn more about what is bitcoin mining.

In addition, advancements in technology and shifts towards more renewable and efficient energy sources will contribute to a decrease in energy costs over time for some miners. If, over a four-year period, a miner can reduce their energy costs, they can sustain a loss of revenue without being forced to shut down.

It is worth noting that miners do not typically pay the consumer rate for energy. As large customers, typical mining operations are able to negotiate more directly with providers to source the cheapest possible energy.

Difficulty Adjustments Ensure Bitcoin Mining Continues

Fourthly, due to Bitcoin’s difficulty adjustment algorithm, a miner’s expected revenue is reliant on their relative share of the total Bitcoin hash rate. As such, if other miners are forced to shut down due to the halving, miners who managed to remain profitable should see increased returns because their relative share of the total hash rate has risen.

When the total hash rate declines, the difficulty of mining declines as well. For miners who continue to mine, a halving can increase profitability by weeding out competition and increasing their likelihood of finding a block and claiming the reward.

Bitcoin Price Impact on Miner Profitability

Lastly, the price appreciation of Bitcoin can turn a loss in Bitcoin-denominated revenue into a gain in fiat-denominated revenue. A vast majority of miners still pay their costs in fiat currency, so they are more concerned with their fiat-denominated revenue than their Bitcoin-denominated revenue. Therefore, if the price of Bitcoin doubles over a four-year period, a miner can sustain a 50% drop in the block subsidy without losing any revenue in fiat terms.

➤ Learn more about fiat currencies.

This last factor is especially significant, as bitcoin halvings can fuel upward pressure on the Bitcoin price. Since the halving reduces the flow of new bitcoin onto the market, if demand is held constant, the simple mechanics of supply and demand dictate that the price should rise.

➤ Learn more about how is the bitcoin price determined.

Indeed, this theory has played out over the first 13 years of Bitcoin’s existence. Between all three previous halvings, the Bitcoin price denominated in U.S. Dollars has increased at least 900%, more than enough to compensate miners for the 50% drop in Bitcoin-denominated revenue.

All of these factors commingle to maintain miner participation and network security after a halving. In fact, past halvings have not significantly or visibly affected hash rate. On the contrary, the Bitcoin hash rate has continued to break all-time highs.

While fees for transacting on the blockchain are expected to rise, all Bitcoin transactions don’t need to be settled on-chain. Additional layers such as the Lightning Network provide cheaper, faster ways of transferring bitcoin.

Bitcoin Deflationary Concerns and Economic Impact

As Bitcoin’s inflation rate is cut in half every four years, it will slowly become the hardest currency in the world. During the 2016 halving, when the block subsidy dropped from 12.5 BTC to 6.25 BTC, Bitcoin’s inflation rate dropped from ~3.7% to ~1.8%, making it less inflationary than the stated U.S. Dollar inflation target of 2%. The halving of 2024 will make Bitcoin less inflationary than even gold, an asset long valued for its low stock-to-flow ratio.

From an economic perspective, many academics fear the effects of deflationary money on an economy. They would argue that Bitcoin’s deflationary policy will leave insufficient money in a financial system, and would send interest rates too high, stifling growth.

To solve the perceived problem of a “lack of money” in a system, Satoshi Nakamoto created each bitcoin as divisible into 100 million units called Satoshis.

➤ Learn more about how many satoshis are in a bitcoin.

As Bitcoin appreciates in value and gains adoption, smaller and smaller pieces of bitcoin will carry larger and larger purchasing power. As Bitcoin rises in price, the price of goods denominated in Bitcoin will fall. Thus, the total amount of bitcoin in the system hardly matters; instead, it is the purchasing power of each satoshi that matters.

With regard to deflation, most Bitcoin advocates believe that fears of Bitcoin causing a deflationary spiral and killing demand for goods are overblown. As an inflationary money, fiat currency has incentivized individuals to spend their money immediately rather than save it for future use. Bitcoin certainly reverses these incentives, encouraging long-term investment rather than short-term consumption. However, no human can lower their consumption to zero.

Thus, Bitcoin would not destroy demand in an economy. Rather, it will shift the demand for present goods to the demand for future goods. Certain industries that sell frivolous, short-term goods may be negatively impacted by Bitcoin’s deflationary pressure, but industries such as the tech sector would thrive. In fact, the tech sector itself has experienced immense deflationary pressure over the last 30 years. The price of televisions, phones, and computers has remained flat or fallen while the quality, variety, and utility of these devices have exploded. Despite this deflation, consumers across the globe have continued to purchase devices in ever-larger quantities.

Key Takeaways

- When all bitcoin have been mined, miner revenue will depend entirely on transaction fees.

- The price and purchasing power of bitcoin will adjust to the lack of new supply.

- The scarcity of Bitcoin will make it more attractive to investors and users.