Whether a Bitcoin beginner or multi-cycle veteran, the prospect of earning the internet’s scarcest resource through mining it is certainly exciting. That being said, there are a number of considerations one must make before determining whether mining is right for them. This article analyzes the different factors associated with mining bitcoin profitably, and provides the first steps to get started.

Mining or Buying Bitcoin

There are a variety of reasons behind the decision to mine bitcoin. Some users prefer the additional privacy granted by mining virgin bitcoin versus purchasing bitcoin on an exchange requiring Know Your Customer (KYC) procedures. Some users are motivated to mine bitcoin out of service to the network, as without people willing to mine, Bitcoin would cease to exist. However, the primary motivation to mine is of course the expectation of profit.

Broadly speaking, mining is the more profitable option versus spot buying bitcoin for those with long-term bitcoin investment horizons. Naturally, this assumes the mined bitcoin is held rather than immediately sold. Given the hefty initial costs involved with mining, it is not geared for those looking to make a quick buck as it may take years to see a positive return on hardware expenses.

Revenue from mining essentially serves as an alternative means to invest in bitcoin where daily price volatility is smoothed out through routine bitcoin earnings to a miner’s wallet. In this sense, mining bitcoin is similar to buying bitcoin through a dollar-cost averaging plan.

Although Bitcoin is an open system where anyone can begin mining on the network, doing so profitably is no simple feat. Mining is a capital intensive endeavor that requires a solid understanding of the industry, yet entrepreneurs capable of keeping up with all the moving parts can see significant returns.

➤ Learn more about when to mine and when to buy bitcoin.

What Influences Bitcoin Mining Profitability?

ASIC Price

The specialized computers used to mine bitcoin, called ASICs, vary in terms of price and efficiency. Newer models offer greater efficiency, and therefore the ability to mine more bitcoin per unit of electricity, but come at a higher cost.

See our more detailed breakdown of how mining rigs work and the various models available on the market for more information.

Electricity Cost to Mine Bitcoin

The ability to source inexpensive electricity often becomes the most important factor to determine the profitability of a mining operation. Since retail energy prices are significantly higher than the kilowatt hour rates of most mining operations, it has become largely untenable to mine bitcoin at home unless free or excess electricity is available. Given this reality, mining has become increasingly location-dependent. Most mining ventures operate in locales with inexpensive electricity or abundant renewable energy sources.

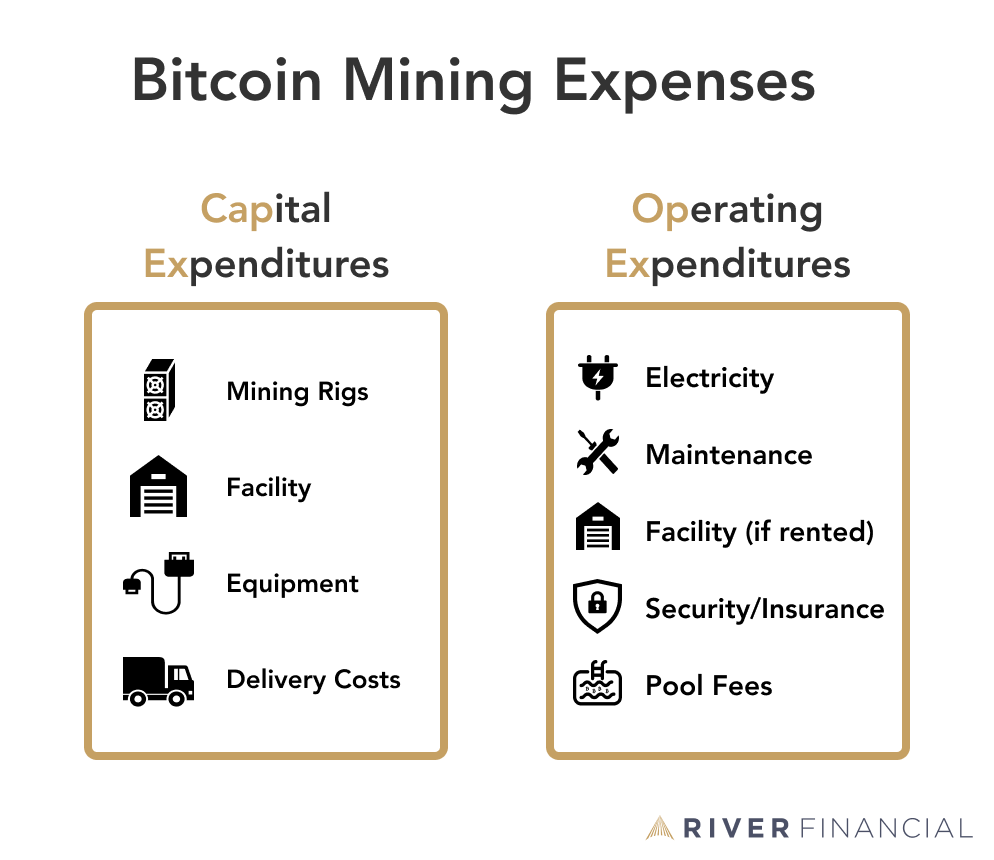

Mining Facility Cost

With home mining becoming increasingly difficult, mining rigs generally require their own dedicated facility. Whether that facility is rented from a colocation partner or built from the bottom-up, this naturally becomes another large expense. Often, as well as with sourcing electricity, this can be where hosted mining provides the greatest benefit.

Apart from rent or property costs, there are a number of additional purchases that come with a facility. If the facility is located near a residential area, noise-reducing panels become another consideration. Unless the location happens to have a natural cooling mechanism, an extensive cooling system is necessary to ensure the rigs do not overheat. Also, given the value of the machines housed inside the facility, some form of security and insurance is warranted as well.

Mining Rig Maintenance and Facility Downtime

With bitcoin mining still coming into its own as an industry, quality control standards are relatively nonexistent, and it is not uncommon to receive mining rigs with faulty parts. Not to mention these are complex machines which require specific temperature conditions or else they can break down. While replacing broken parts can be a nuisance, the purchase of new parts is far from the main impact maintenance has on profitability.

The largest incurred cost from machine maintenance is not the maintenance itself but the opportunity cost resulting from machine downtime. The same holds true if power outages or natural disasters would impact the facility in which the miners are held. When a rig is forced offline, that ultimately represents time the machine is not hashing and therefore not earning bitcoin. Therefore, on-site technicians to ensure prompt repairs becomes another necessary expense for larger operations.

Selecting a Bitcoin Mining Pool

Mining pools exist to reconcile the consistent costs and inconsistent rewards associated with solo-mining bitcoin. Since miners only receive revenue when they mine a block, mining as an individual with a small amount of hash rate is similar to playing the lottery. Thus, the prudent choice for small-scale miners is to join a mining pool, aggregate their hash rate together, and use their collective hash rate to mine blocks more frequently. Revenue from the pool is then distributed to the miners based on the amount of hash rate they contributed.

When joining a mining pool, there are a number of considerations to keep in mind. First, and the one that most directly impacts mining profitability, is the pool’s fee which can range up to 4%. Second, is the pool’s size as the higher the total hash rate, the more frequently the pool discovers a block, thus the more consistent the returns for members. Third, is the pool’s reputation and any additional services they may offer, such as better monitoring, a mobile application, an API, the ability to customize payouts to individual needs, and more.

Bitcoin’s Difficulty Adjustment and Issuance

To ensure the smooth operation of the Bitcoin network, an algorithm automatically updates the difficulty to mine a new block, once every 2016 blocks (roughly once per two weeks). This mechanism, known as the difficulty adjustment, ensures that on average a new block is found every 10 minutes, regardless of the number of miners on the network. Naturally, the higher the difficulty, the lower the profitability per mining rig.

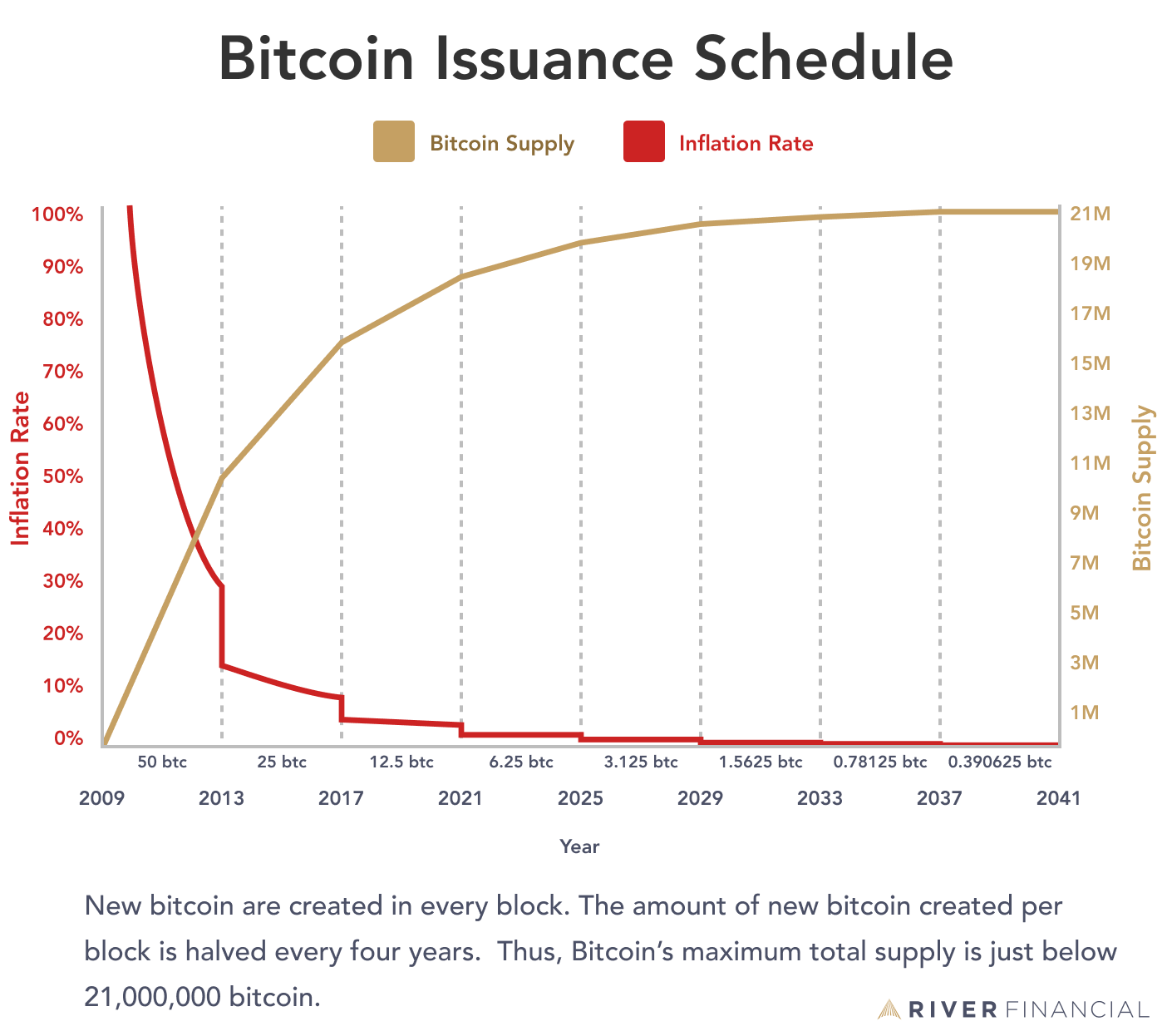

Bitcoin’s halving cycles also have a significant impact on the decision to mine. Every 210,000 blocks, roughly four years, the amount of new bitcoin minted each block is cut in half. Assuming all other factors remain constant, miner revenue is thus cut in half as well. Therefore, halving events often coincide with mass shutdowns of mining rigs.

Bitcoin Mining Legality

Regardless of how profitable it may be to mine bitcoin in certain geographical locations, it is important to consider if Bitcoin mining is legal in a particular jurisdiction. Profitability can entirely be negated if mining rigs are confiscated for breaking laws or failing to register with the authorities.

Bitcoin Mining Tax

With Bitcoin still in its infancy, tax implications from mining remain evolving and not as straightforward as simply reporting capital gains. There are two primary taxable events involved with bitcoin mining: one occurring when the bitcoin is mined and the other if/when the bitcoin is sold. Tax implications from the sale of mined bitcoin are calculated using the spot price of bitcoin at the time of mining as the cost-basis. Keep in mind these apply to U.S. based customers and tax implications may be different for other countries.

Often, individuals will register an LLC in order to take depreciation against their mining rigs and deduct more expenses than they would filing as a hobbyist. Our Bitcoin Mining Taxes and Regulation article contains more information on the reporting of mining profits, as well as other regulatory specifics.

Price Dictates the Best Time to Mine Bitcoin

Naturally, the price of bitcoin has a significant impact on mining profitability. The price of mining rigs follows the price of bitcoin, however prices for mining rigs move considerably less sharply. As such, launching a mining operation becomes more expensive as bitcoin increases in value. This adds complexity to sourcing rigs as prices change frequently and attempting to time the market correctly is as difficult as timing the bitcoin market.

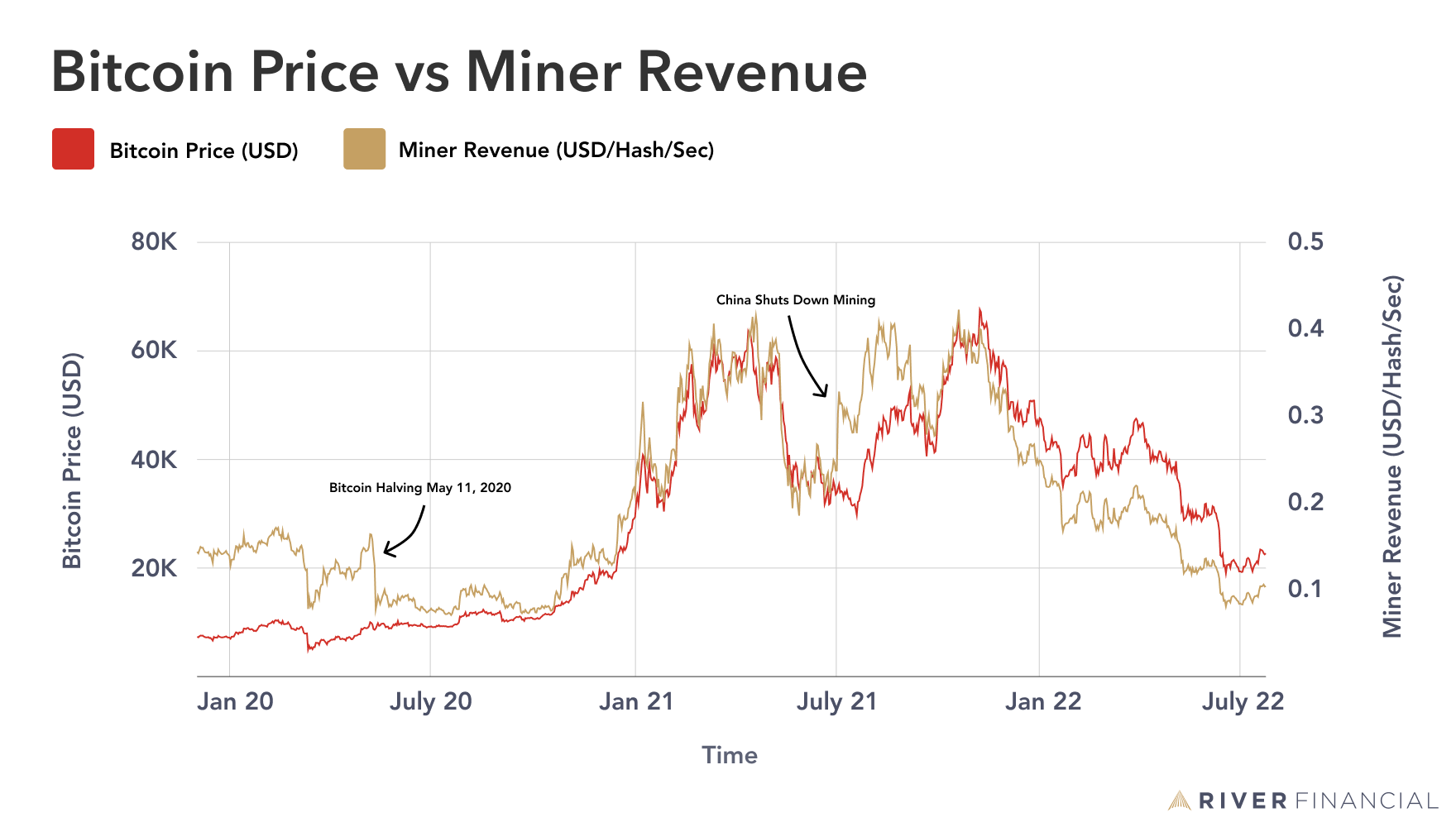

Evidenced by the chart below, mining revenues are heavily correlated with the price of bitcoin. Therefore, bull and bear markets present radically different environments for miners: each with their own benefits and drawbacks.

Bitcoin Mining in a Bear Market

During a bear market, the primary goal of a miner is survival. The last thing a miner wants is to shut off their machines, thus losing out on potential mined bitcoin and pushing back the timetable to recoup their initial investment. To ensure machines keep hashing, it is vital for an operation to understand its operating threshold. Now, this must remain top of mind in bull markets as well, but it is in bear markets where operating thresholds are put to the test.

A miner’s operating threshold is the minimum price of bitcoin and maximum network hash rate at which they are willing to mine. Operating thresholds vary by miner, as each miner develops their threshold based on their unique goals.

Generally, a miner starts by calculating the price where operating expenditures equal the value of mined bitcoin. Any point below this break-even line, the miner would be mining at a loss while any point above represents a profit. The same is then calculated, assuming the price of bitcoin as constant, for the break-even hash rate. This process normally turns subjective as some miners are willing to operate at a slight loss while others may choose to shut down immediately upon crossing their break-even point.

Mining is not all grim during a bear market, as the depressed prices on rigs presents a potential opportunity for miners looking to ramp up their operations. As miners shut down their machines, network hash rate falls, and difficulty usually falls. Mining then becomes easier for the miners still operating.

Bitcoin Mining in a Bull Market

Mining in a bull market, while an exciting and prosperous time, comes with its own unique stressors. As the price of bitcoin climbs, so too does the number of mining rigs plugged into the network. Mining hence becomes more competitive, yet the amount of bitcoin available to mine remains unchanged. Thus, while a miner’s revenue may be going up in dollar terms as the price of bitcoin appreciates, they will be receiving less bitcoin for their efforts due to more miners being incentivized to join the network. This will not matter to miners focused solely on profitability as revenues in dollar terms will remain high as long as the price of bitcoin is rising.

Mining ventures see their profits rise substantially during bull markets, and with that comes the decision whether to expand operations or not. Launching new miners during a bull market can open an operation up to additional risk during a bear market. Those miners, likely purchased at an elevated rig price, can become difficult to pay off in the event of a bear market where rig prices plummet and revenues decline. Still, as shown in the chart above, mining revenues are many multiples higher in a bull market so miners become more willing to take on that additional risk.

How Do I Get Started Mining Bitcoin?

While potentially offering slightly better margins, self-mining as an individual can be a risky endeavor. Not only does it require rather deep technical expertise, but the process of sourcing machines, electricity, and a facility presents a number of hurdles to jump through.

However, given the impracticality of self-mining for many individuals, a solution in the form of hosted mining has emerged. With hosted mining, a third-party custodian handles the procurement of machines, electricity, and facility in exchange for a monthly hosting fee.

Notice: River does not provide investment, financial, tax, or legal advice. The information provided is general and illustrative in nature and therefore is not intended to provide, and should not be relied on for, tax advice. We encourage you to consult the appropriate tax professional to understand your personal tax circumstances.Key Takeaways

- Bitcoin mining has evolved into a capital intensive endeavor and a competitive industry.

- Mining profitability depends on the hardware model, price of electricity, price of bitcoin, and the number of miners on the network.

- Household electricity costs are normally far too high to allow profitable mining.

- There are stark differences between mining bitcoin in a bull market versus mining in a bear market.