Bitcoin mining is an ever-evolving practice that has already seen a few notable paradigm shifts. In Bitcoin’s earliest days, the computing power of an ordinary laptop was sufficient to mine. As Bitcoin grew in popularity and more miners joined the network, mining turned competitive and specialized hardware soon became necessary to continue mining profitably.

While mining was once a niche hobby conducted at home, it is now a multi-billion dollar industry dominated by publicly traded companies with dedicated data centers. This evolution into a highly competitive industry with significant capital costs and complex moving parts has left mining inaccessible for many. To help combat these barriers to entry, an alternative in the form of hosted mining has emerged.

What Is Hosted Mining?

Hosted mining, also known as custodial mining, is a process where a third party hosts mining rigs on behalf of a client. In most cases, the client purchases the mining rigs directly through the hosting company. The mining rig is fully the property of the client, not the hosting company, and the client pays to the provider a monthly hosting fee dictated by the power draw of the mining rig. Generally included within this single fee, in addition to electricity and rack space, are all the ancillary services to ensure operations run smoothly such as security, customer service, and monitoring.

Some hosting companies specify an expected uptime within the contract, normally around 95%. This serves to protect clients from unexpected interruptions in services, as time a machine sits idle is time it does not earn bitcoin. Reputable hosting partners also will help coordinate machine repairs, and most have on-site technicians to get the machine back to hashing as quickly as possible.

Hosting terms are typically fixed for a predetermined amount of time. Since the mining rig is the client’s property, the client can request physical delivery of the machine if they so wish but may incur a penalty if delivery is initiated before their term is up.

Benefits of Hosted Mining

Hosted mining is attractive to prospective miners for a number of reasons, primarily for the accessibility, convenience, and peace of mind. Additionally, hosting models often present better mining economics for clients. Since the hosting provider procures mining rigs in bulk and partners with enterprise-level colocation sites, it can pass the benefits from economies of scale on to their clients. Colocation sites gain access to significantly lower electricity rates than the cost of electricity in residential areas. As such, hosted miners are able to mine more profitably in a low BTC price/high network difficulty environment than home miners.

As is the case with any service, the incentives determine the health of the client/provider relationship. Working in a hosting client’s favor is that the incentives align for a hosting partner to provide their clients with the best possible experience. The better a hosting provider can maintain a client’s miners, the more months of hosting fees the provider can receive.

Accessible Bitcoin Mining

With mining so dependent on access to low electricity rates, most prospective miners are constrained by their physical location. Not only is mining unprofitable for many based on location, but often is entirely infeasible due to space, heat, and noise considerations. In such cases where mining is inhibited by location, hosted mining becomes the only practical option.

Mining With a Low Time Investment

In the eyes of most hosting clients, the greatest benefit of mining through a hosting partner is the convenience. Bitcoin mining is a nascent space where certain expenses and considerations are not always obvious, and addressing them requires subject-matter expertise. The primary mining expenses are machines, electricity to power the machines, and a facility to house the machines. However, any miner soon realizes that expenses which at first glance may appear optional, often become necessities.

Unless a natural cooling system is present, a mechanism to ensure mining rigs do not overheat is essential. Not only do these machines release a great deal of heat, but they also emit noise at levels unsuitable for residential areas. Given all these additional considerations, the convenience afforded by having a single service handle every detail of the mining process makes hosting the preferred option for many prospective miners.

Investing in Bitcoin Mining

To go along with the added convenience, hosted mining is also attractive for the peace of mind it offers users. In the hands of a trusted hosting partner, clients can find comfort knowing their machines are safely mining without any input required on their part. This leaves users to focus only on the revenue they are receiving, rather than the stressful work that goes into maintaining those revenues. It turns mining from an activity into an investment.

In some sense, owning a hosted mining rig draws parallels to owning real estate. Investors own the physical asset, in this case a building, and leave it in the hands of a property manager to run day-to-day operations while the investor collects their monthly rent checks. Relating this back to mining, hosting providers often show a window into the mining experience, through an app or website, so clients can monitor their performance and see how their machines are hashing.

Drawbacks of Hosted Mining

Within the Bitcoin community, there is a strong ethos of self-custody as evidenced by the common mantra of “not your keys, not your coins.” To some, that sentiment extends to mining and is used as an argument against any form of custodial mining. Ultimately, when hosting, a user is placing their trust and the reliability of their machines in the hands of someone else. In the event a provider becomes unresponsive or does not serve a client’s best interest, the reliance upon a hosting provider becomes a clear drawback. Here, the necessity of partnering with a reputable provider becomes evident.

For some, a primary motivation behind the desire to mine bitcoin is often the ability to receive virgin bitcoin via non know-your-customer (KYC) procedures; however, this is not the case with hosted mining and deters some users who prioritize privacy above all. Most hosting providers require KYC during onboarding, therefore causing the mined bitcoin to be KYC-compliant.

While clients are able to take physical delivery of their machines, it is often an undesirable option. Receiving the machines requires the client to cover shipping costs as well as any penalties that may incur from ending a hosting term early. Most importantly though, this is a lengthy process that will inevitably result in significant machine downtime. Therefore it is not only the cost of delivery, but also the cost of lost bitcoin that makes delivery an expensive hassle. The hassle presented by machine delivery makes clear the importance of selecting a partner with a proven track record, to ensure as little reason to withdraw machines as possible.

One threat posed by hosted mining, and a source of criticism from some in the Bitcoin community, is that hosting models promote the centralization of miners. The fear lies in the notion that if hosted mining grows in popularity, hash rate consolidates into fewer hands and locations. Thus potentially leaving bitcoin mining, and accordingly Bitcoin’s security, more vulnerable to regulatory crackdown, miner insolvency, or natural disaster. That being said, hosted mining in its current state is not a significant driver of miner centralization, and it remains to be seen whether it will be such in the future.

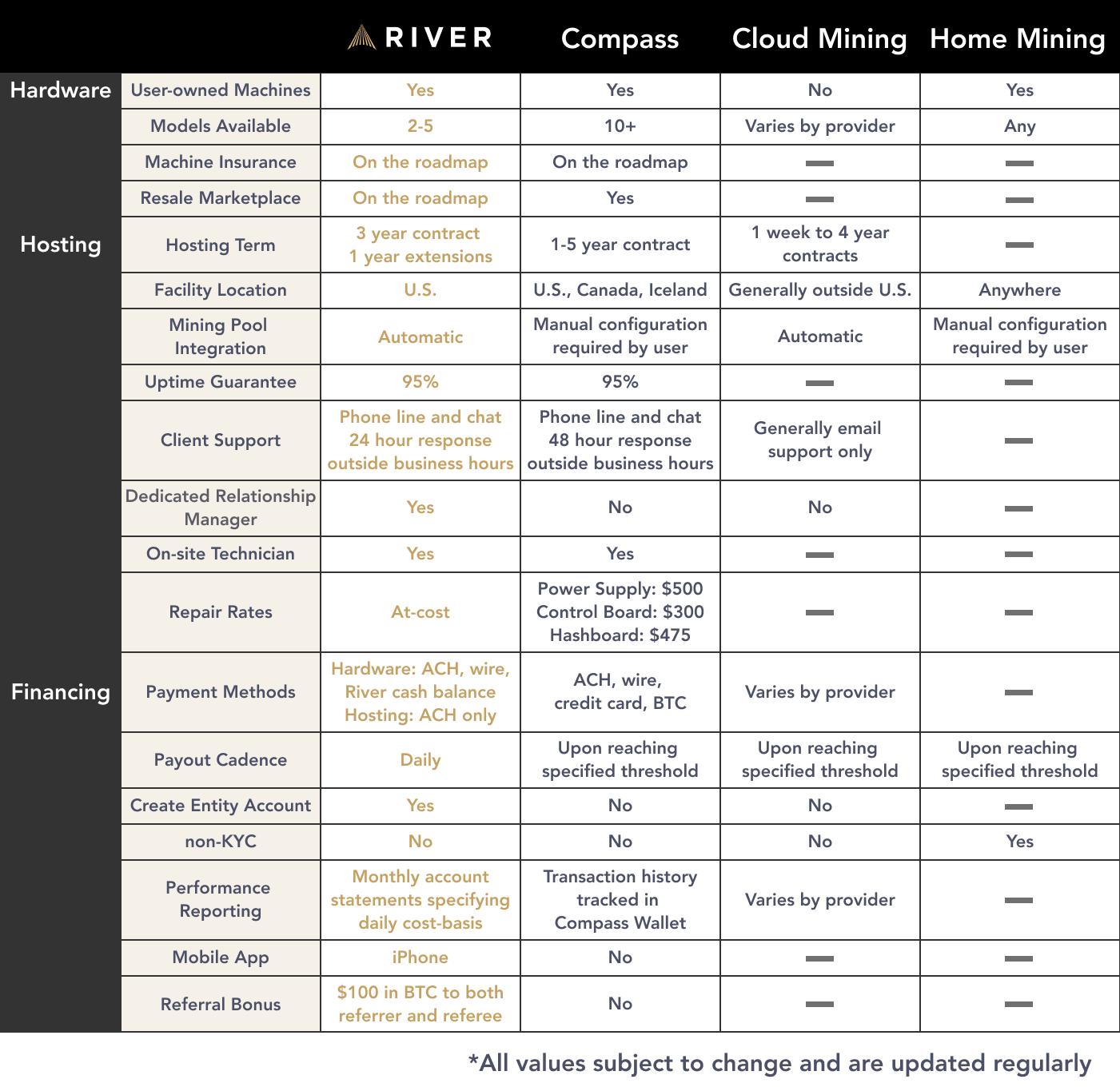

Hosted Mining vs Cloud Mining vs Home Mining

Cloud mining is another alternative that, similar to hosted mining, exists to make mining more accessible. While cloud mining and hosted mining share some similarities in objective, there are a few stark differences. The most immediate difference is that with cloud mining, a user does not own any mining hardware. Instead, users directly purchase hash rate from a mining operation.

While remotely purchasing hash rate can significantly lower entry costs, this form of mining carries with it additional risks. Users own nothing other than an agreement to receive a share of mining profits proportional to the hash rate they are renting. Historically, cloud mining’s lack of tangible ownership has unfortunately allowed scams to proliferate within the space.

Although not as feasible as it once was, there still remains a passionate group of home bitcoin miners. With home mining, the procurement of machines, building out facility infrastructure, and performing maintenance falls squarely on the user. As such, user expertise is a necessary prerequisite for home mining, yet even an expert home miner faces a number of challenges. Retail electricity rates are significantly higher than the rates available to colocation sites, so unless a home miner has a free or abundant energy source, already thin margins can quickly be squeezed in a bear market.

All this is not to say home mining is without any advantages. For one, there is the ability to purchase used machines for a lower price than offered through hosting services. Also, home mining enables the acquisition of non-KYC bitcoin; as mentioned earlier, a desirable trait for privacy-conscious miners.

If done correctly, a home miner has the most control over their margins. A number of home miners, however, are more motivated by privacy and their desire to support the network than to maximize profits.

Selecting a Hosted Mining Partner

Above all else, selecting a hosting partner comes down to trust. While hosted mining services may appear similar at first, the quality of the partner and economics will have a significant impact on both the mining returns and experience. Ultimately, this leaves price and reputation as the key differentiators among providers. For a number of prospective miners, lower priced hardware and hosting options are most appealing. Slight discounts on hardware or electricity, however, matter little in the event those machines cannot stay online.

A hosting partner must be trusted to safeguard valuable hardware and promptly respond to any facility issues causing machine downtime. And, perhaps most importantly, a hosting partner must be trusted to remain solvent during market downturns to ensure your machines stay your machines. As a product predicated on peace of mind, reputation proves vital when determining a hosting partner.

Key Takeaways

- Hosted mining makes mining more accessible as the hosting company takes care of all operations.

- Carefully selecting a hosted mining partner is important, there are benefits and drawbacks to each option.

- River offers a hosted mining product to our US-based clients.