The shortest amount of time it can take to mine at least 1 bitcoin is about 10 minutes. However, the actual time it can take you depends on several factors such as the hashing power of your mining hardware, the overall network hash rate, and the Bitcoin mining difficulty. The speed at which you mine bitcoin is directly proportional to your share of the network’s total computing power. The bigger your share of the network’s computing power, the faster you can mine bitcoin.

How Is Bitcoin Mined?

Bitcoin is mined in blocks, which are created roughly every 10 minutes by a miner, who is then rewarded with newly minted bitcoin.

Mining is a random—or stochastic—process, more akin to a lottery than a construction project. Even though mining a block happens every 10 minutes, past effort doesn’t increase your odds of winning the next block.

➤ Learn more about what is bitcoin mining

Each block mined earns the miner 3.125 bitcoins, a reward known as the block subsidy. This amount is programmed to halve approximately every four years according to the Bitcoin protocol adopted by its network. Miners also collect fees from transactions included in the block they successfully mine, adding to their potential earnings.

➤ Learn more about what is a bitcoin halving

Mining’s random nature, the halving, and the variance in transaction fees make revenue from Bitcoin mining unpredictable for smaller miners over a short period. Blocks are difficult to find but extremely lucrative.

How Long to Mine 1 Bitcoin?

For an individual mining with just one ASIC, which are special computers built solely to mine bitcoin with extreme efficiency and speed, mining 1 bitcoin would realistically take many years. It is almost impossible for an individual to mine 1 bitcoin on their own due to the high competition and the vast amount of computational power required.

Hash Rate

The most important factor in determining how long it would take to mine 1 bitcoin would be your mining operation’s hash rate. The best way to win a lottery is to buy as many tickets as possible; the same is true for bitcoin mining. The higher the hash rate, the more likely you will mine at least 1 bitcoin.

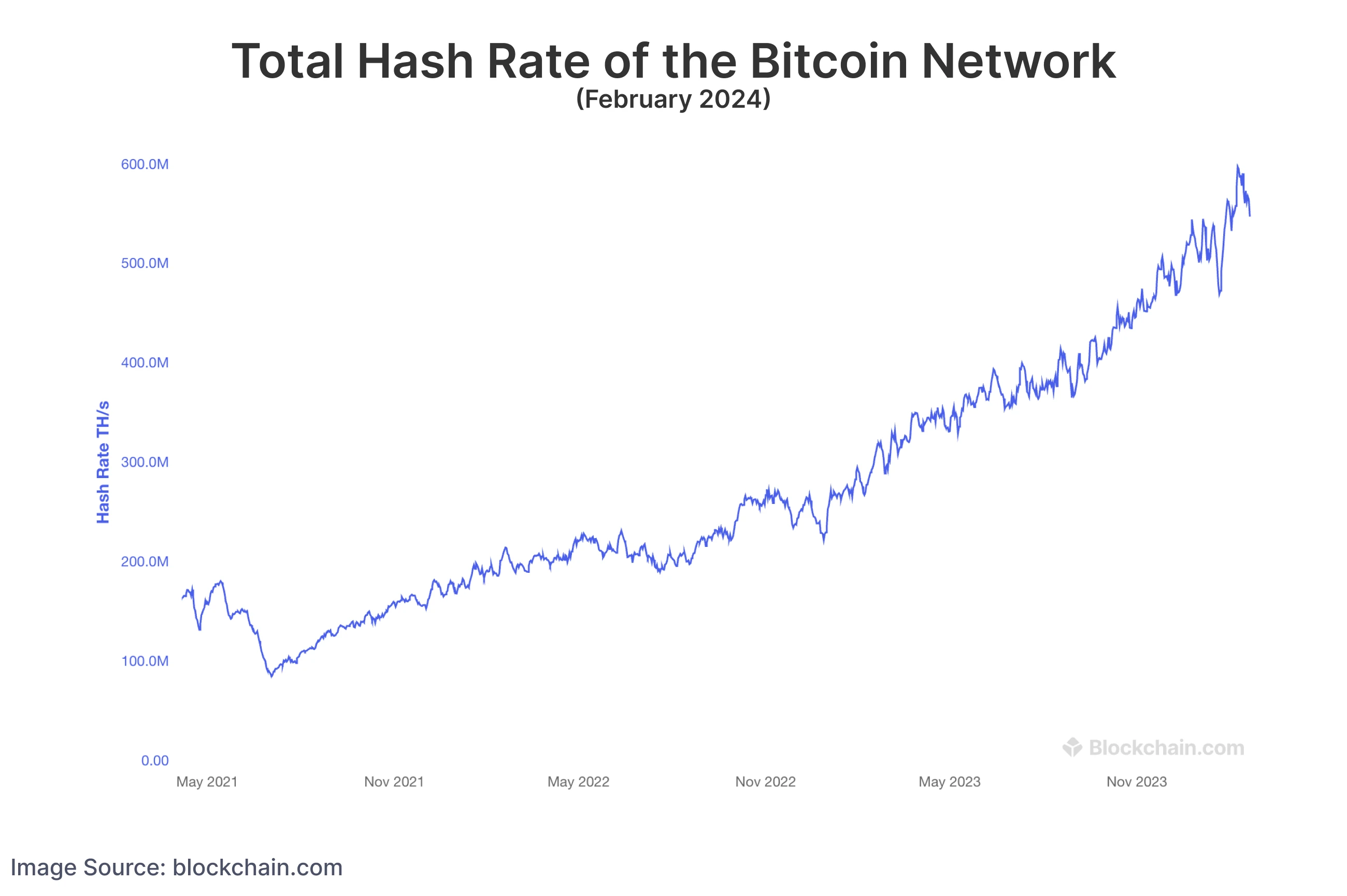

The total hash rate in the Bitcoin network in February of 2024 was about 600 EH/s. A single ASIC called the Antminer S19 Pro has a hash rate of 0.00011 EH/s!

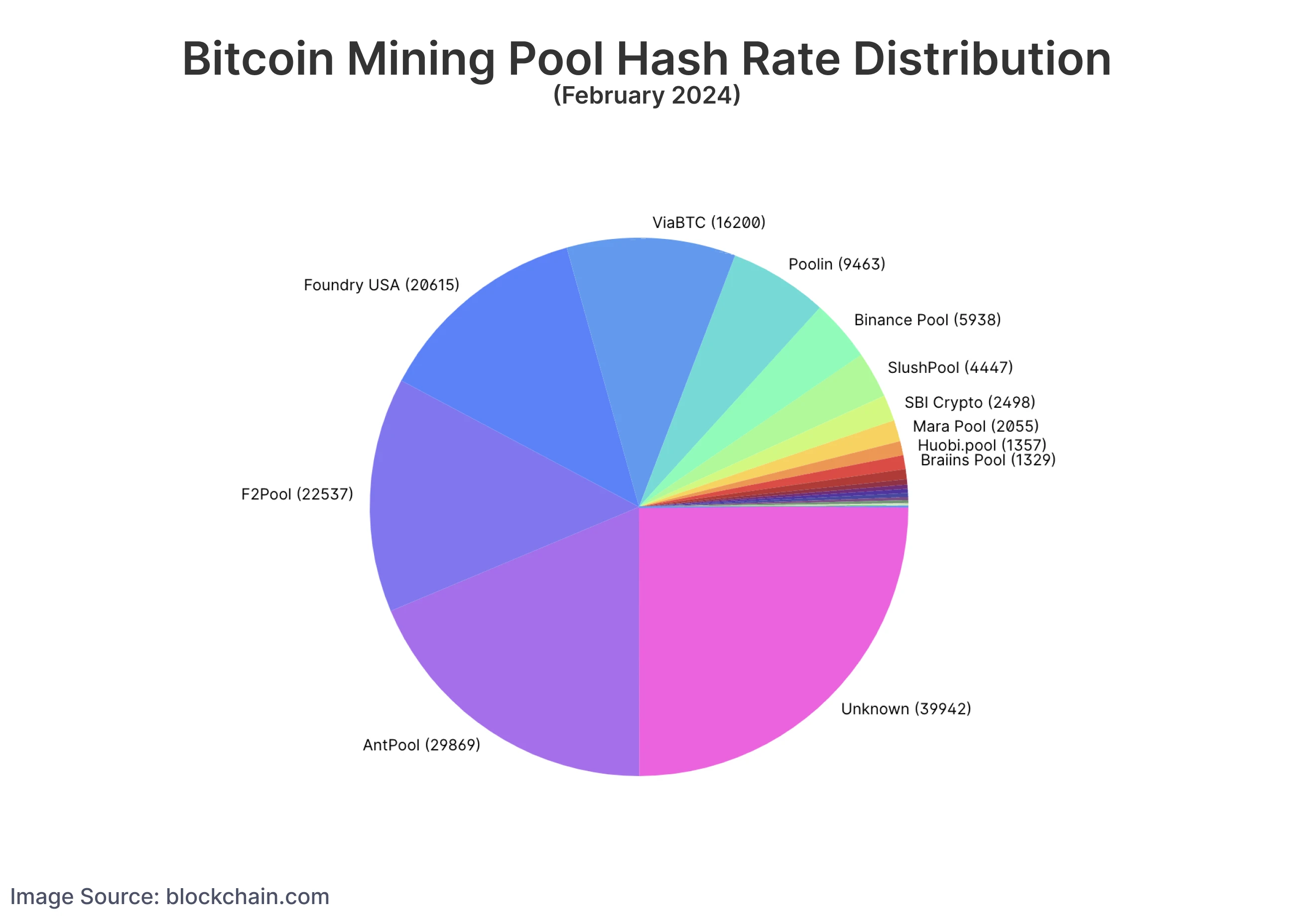

Therefore, most mining is done by pools, where miners combine their computational power to have a better chance of solving a block and then share the rewards.

➤ Learn more about how Bitcoin mining pools work.

The more ASICs a miner can deploy, the more lottery tickets they will accumulate, and the higher the chance that they will eventually create a block. Less than 7% of the bitcoin supply is left to be mined, and competition over it is fierce.

➤ Learn more about who owns the most bitcoin and how much is left.

Several factors determine the revenue of a bitcoin mining operation and the time it takes to mine a single bitcoin. These factors can provide meaningful estimates for the revenue of a mining operation in bitcoin terms, but given the volatility of bitcoin price, energy prices, and Bitcoin’s difficulty, all calculations are dynamic and probabilistic.

Therefore, it would theoretically take a solo miner with a substantial hash rate around 10 minutes to mine 3.125 Bitcoin.

However, practically:

- Solo Mining: It could take months or even years for an individual miner with average hardware to mine a full Bitcoin due to the high competition and network difficulty.

- Mining Pools: Miners often join mining pools to combine their hash power and receive a portion of the bitcoin mined, which provides a more steady and predictable income but distributes the rewards among all participants.

Example Calculation: If a miner’s hardware has a hash rate of 100 TH/s (terahashes per second) and the total network hash rate is 150 EH/s (exahashes per second), the miner would have approximately 1/1,500,000 of the network’s total hash power. Assuming a constant difficulty and network hash rate, this miner would statistically mine one block approximately every 1,500,000 blocks, or about 28.5 years, yielding roughly 0.219 Bitcoin per year (given the current block reward).

Joining a mining pool can significantly reduce this time, providing small amounts of bitcoin more frequently.

Bitcoin’s Difficulty Adjustment

The Bitcoin network has a mechanism for ensuring that no matter how much hash rate is produced by all miners, one new block is only created on average every ten minutes. This mechanism is called the difficulty adjustment.

➤ Learn more about Bitcoin’s difficulty adjustment.

The difficulty adjustment renders absolute hash rate less significant to an operation’s revenue than the miner’s share of hash rate relative to the entire network. If a mining operation has 10% of the network hash rate, they will mine an average of 10% of all blocks. Since blocks are produced at a constant, if probabilistic, rate, it is possible to calculate the operation’s expected revenue over a period of time.

Bitcoin’s Price

The calculation above determines the revenue of a given mining operation in bitcoin terms. However, most miners pay their costs—salaries, rent, and energy costs—in fiat currencies such as the U.S. dollar. Therefore, the price of bitcoin matters a great deal to miners.

As it occurred in 2022, when the price of bitcoin drops, some miners no longer find it profitable to mine. When they stop producing hash rate, the difficulty decreases, and remaining miners have an easier time finding blocks because they comprise a greater portion of the total hash rate.

Conversely, when the price rises, more miners join the network, driving the difficulty up. Every existing miner will see their share of total hash rate decline, leading to a decline in their expected revenue as denominated in bitcoin. However, since the price of bitcoin is rising, their revenue denominated in fiat could still rise.

Bitcoin Mining Profitability

The above calculations estimated Bitcoin mining revenue. However, Bitcoin mining involves heavy costs, often yielding thin profit margins.

-- Satoshi Nakamoto explaining how the cost of mining will mirror the price of Bitcoin

Due to Bitcoin’s difficulty adjustment, the marginal cost of mining one bitcoin will forever approach the value of one bitcoin. This means that, if the price of bitcoin is at $100,000, the price of mining one bitcoin will tend toward $100,000. For many individuals, the costs will greatly exceed $100,000, making it unprofitable to mine.

➤ Learn more about Bitcoin mining profitability.

Key Takeaways

- New bitcoin is created every ten minutes when a new block is added to the blockchain.

- Miners receive this new bitcoin as compensation for their work.

- Mining one full bitcoin can be done with sufficient equipment, energy capacity, and time.

- Mining is a random and unpredictable process. Miners join mining pools to mitigate uncertainty in their revenue.