Bitcoin mining is the process where new bitcoin are created and entered into circulation. Mining is one of the core components that secure the Bitcoin blockchain. It involves using specialized hardware, called ASICs, to perform millions of calculations per second to solve a computational puzzle.

Miners spend resources to create new blocks for transactions to be placed into and are rewarded for their efforts in newly minted bitcoin. Different from the regular connotation of mining, Bitcoin mining is the process in which specialized computers confirm transactions on Bitcoin’s blockchain. These transactions are processed by miners through the SHA-256 hashing algorithm, a cryptographic function invented by the NSA. This algorithm is used to secure transactions and is the backbone of the mining process.

Essentially, miners all over the world are running hundreds of thousands of computers to generate hundreds of trillions hashes. Transactions are confirmed when a miner can generate a valid hash that results in a new block being “found.” When a miner finds a new block that is accepted by the entire Bitcoin network, it is rewarded in newly minted bitcoin, and transactions waiting to be confirmed are placed into this new block and added to the blockchain.

These miners commit a lot of electricity, time, and resources to mine Bitcoin; this Proof-of-Work mechanism keeps the network secure and adds to Bitcoin’s value. Since there are so many miners and so much energy being used to mine bitcoin, an attack would be practically impossible.

➤ Learn more about why bitcoin has value

How Bitcoin Mining Works

Bitcoin miners play a critical role in confirming and validating transactions. Once a bitcoin miner produces a hash of a candidate block beneath the current target, a new block is found and added to the chain of existing blocks. When bitcoin is sent from one address to another, a transaction is created that is broadcast to the entire network and waits to be confirmed. Transactions that are “unconfirmed” sit in what is called a mempool. When a new block is found, as many transactions that can fit are placed into the block, the new block becomes accepted by nodes all around the world that verify this, and the transactions within it are confirmed.

Bitcoin blocks have limited capacity, which means only a certain number of transactions can be confirmed per block. Each subsequent block found and added to the blockchain afterward is considered an additional confirmation of these transactions. Most exchanges and services that accept bitcoin usually require up to 6 confirmations before they consider a bitcoin transaction to be “final.”

Bitcoin Miners Secure the Network

Bitcoin miners secure the network by performing proof-of-work, which makes it expensive and impractical for any attacker to modify or change past transactions. The energy that miners expend trying to find new blocks is measured in hash rate. Hash rate, as a result, is also a measure of how secure the Bitcoin network is at any given moment.

In order to attack bitcoin, one would need to spend a transaction twice, therefore making the first transaction worthless and corroding the value and reputation of Bitcoin as an immutable payment network. When transactions are sorted into a block that is accepted by the entire network, it prevents a user from spending the same bitcoin twice because the first Bitcoin transaction has now been recorded by every participant in the network. This solves the “double spend” problem, which has stymied many cryptographers in previous attempts to create a secure decentralized payment system.

In order to double spend a transaction, an attacker would need to obtain a majority of the hash rate of the network, and proceed to roll back all blocks that were confirmed after the transaction which is trying to be double spent—a virtually impossible task.

Bitcoin Miners Release New Coins

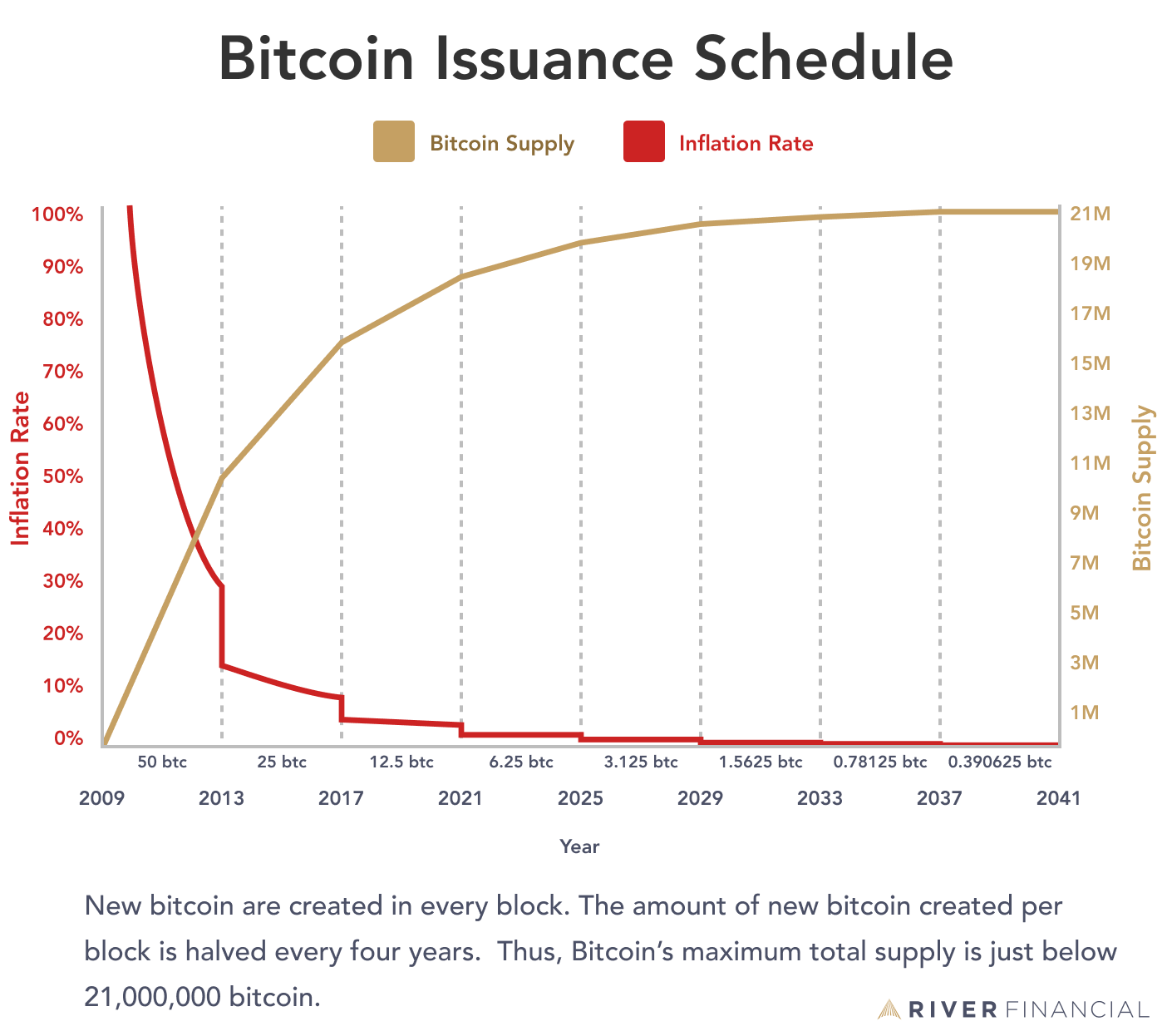

Bitcoin miners release new coins into circulation as a reward for creating new blocks. One of Bitcoin’s best attributes is its fixed monetary policy, which directly relates to mining; mining is the process by which new coins are released. At any point in time, it is definitively known how many bitcoin have been created, and how many are left to be minted until all have been released. There will only be just under 21 million bitcoin minted into existence, ever.

Satoshi Nakamoto designed Bitcoin to be released at a predictable rate, thanks to what is called the block reward mechanism. For every 210,000 blocks, the reward for finding a new block decreases by half. The first set of 210,000 blocks awarded the miner of a block 50 BTC; the next set awarded 25 BTC per block; and the current set of 210,000 blocks will reward miners 3.125 BTC per block. An inflation schedule provides a visual representation of the issuance process. The last bitcoin could be mined sometime around 2130.

➤ Learn more about what will happen after all Bitcoin have been mined.

History and Evolution of Bitcoin Mining

Bitcoin mining is an industry that has evolved from a hobby that requires the most basic computer resources to a multi-billion dollar industry that now requires cutting-edge technology in order to generate any meaningful revenue.

In Bitcoin’s early years, the average personal computer was able to mine profitably with central processing units (CPUs). Mining was relatively straightforward, as the Bitcoin network’s hashrate was low, and the difficulty of solving a new block was minimal.

The introduction of Application-Specific Integrated Circuits (ASICs) in 2013 marked the beginning of the commercialization of bitcoin mining. ASICs are custom-built hardware designed specifically for bitcoin mining, rendering earlier methods obsolete almost overnight.

ASICs brought about industrial-scale mining operations, with large facilities housing thousands of mining rigs. These operations were often located in regions with access to inexpensive electricity, as energy costs became a critical factor in mining profitability. This shift also introduced significant barriers to entry, as hobbyists were priced out by the high upfront costs of ASICs and the need for technical expertise.

What Are Bitcoin Mining Farms?

Today, bitcoin mining is dominated by large-scale operations. Bitcoin mining farms are comprised of large arrays of miners that are usually housed in warehouses. Setting up a mining farm often requires a very large investment as well as the ability to source cheap electricity, and is much more difficult to do today than it was many years ago. Instead of building a new mining farm, an alternative option is to join an existing one.

Economics of Bitcoin Mining

Bitcoin mining is a highly competitive industry that requires continuous monitoring of key variables:

- Network difficulty: The difficulty level is a fluctuating metric that dictates how much energy miners need to spend in order to find the next block. Network difficulty automatically adjusts approximately every 2,016 blocks (roughly every two weeks) to maintain a consistent block time of about 10 minutes. When more miners join the network and the total hash rate increases, the difficulty rises to ensure blocks are not mined too quickly. By automatically making it more difficult to mine blocks if more participants are mining, the difficulty ensures new Bitcoin blocks are found roughly every ten minutes and ensures the stability of the network.

- Electricity costs: Electricity is one of the primary factors influencing mining profitability. ASICs are energy-intensive hardware units that often run 24/7. Regions with low electricity costs, such as west Texas, Kazakhstan, and areas with abundant renewable energy like hydroelectric or geothermal power, have become popular locations for mining farms. Additionally, miners increasingly seek out surplus or otherwise wasted energy sources to lower costs and improve sustainability.

- Bitcoin price: Because mining rewards consist of newly minted bitcoin, the price of bitcoin affects the value of mining rewards. Miners must monitor bitcoin’s price and potentially adjust their operations to ensure they are always mining profitably.How Can I Start Mining Bitcoin?

Getting Started with Bitcoin Mining

Starting to mine bitcoin involves setting up your mining hardware and carefully managing resources to ensure profitability. Despite how competitive the Bitcoin mining industry has become, mining is still accessible to many people in the form of hosted mining. A hosting partner takes care of all the operational challenges for a fee, which makes it easier to get started.

To mine, you will need to have a Bitcoin mining rig and source some cheap (enough) electricity. The best way to ensure that an individual mining rig will generate some sort of returns is by connecting it to a mining pool.

➤ Learn more about whether mining or buying bitcoin makes more sense for you.

What Are Bitcoin Mining Pools?

Bitcoin mining pools are collaborative groups of miners who combine their computational power to increase their chances of solving the computational puzzle. The block rewards are proportionally shared to the amount of computational power provided to the pool. Joining a mining pool helps individual miners receive more consistent payouts in a competitive space.

The Bitcoin network aims to find a new block about every 10 minutes, which means that one lucky miner receives a reward over a fairly consistent period of time. It is not difficult to imagine that one particular miner might go a very long time before finding a new block, if ever. This is why mining pools were created.

Mining pools combine the computational resources of many miners and distribute the rewards that these miners earn evenly, based on the amount of resources each miner contributed. One of the most advantageous features of mining pools is the more reliable stream of revenue they provide. People who invest large amounts of money into Bitcoin mining sometimes don’t use mining pools, however, because their operation is large enough for them to find new blocks independently where they collect the entire reward and pay no mining pool fees.

Mining Other Cryptocurrencies

Cryptocurrencies that operate on a Proof of Work consensus model also involve mining. Due to their smaller market size, mining other cryptocurrencies is a much smaller industry, and typically less profiable than bitcoin mining.

- Ethereum: Before changing to a Proof of Stake model, Ethereum was the second largest minable cryptocurrency. During this time, Ethereum ran on an alternative hashing algorithm which was designed to be resistant to ASICs, favoring GPU mining. This meant mining Ethereum required less specialized hardware compared to Bitcoin.

- Dogecoin: Dogecoin is one of the largest alternative cryptocurrencies that can be mined today. Dogecoin uses an alternative hashing algorithm to Bitcoin, but can still be mined using ASICs designed for Dogecoin.

- Merged Mining: Cryptocurrencies that share the same hashing algorithm can be mined simultaneously using the same hardware. For example, Dogecoin and Litecoin share the same “Scrypt” algorithm, meaning that miners can reap the rewards of both networks at the same time.

Key Takeaways

- Bitcoin miners confirm bitcoin transactions, secure the Bitcoin Network, and release new bitcoin at a consistent rate.

- Bitcoin mining occurs at the individual and institutional scale. Most miners use ASIC miners to mine bitcoin.

- The bitcoin mining industry has grown rapidly and increasingly competitive, with large institutional miners searching for low-cost energy to maintain profit margins.