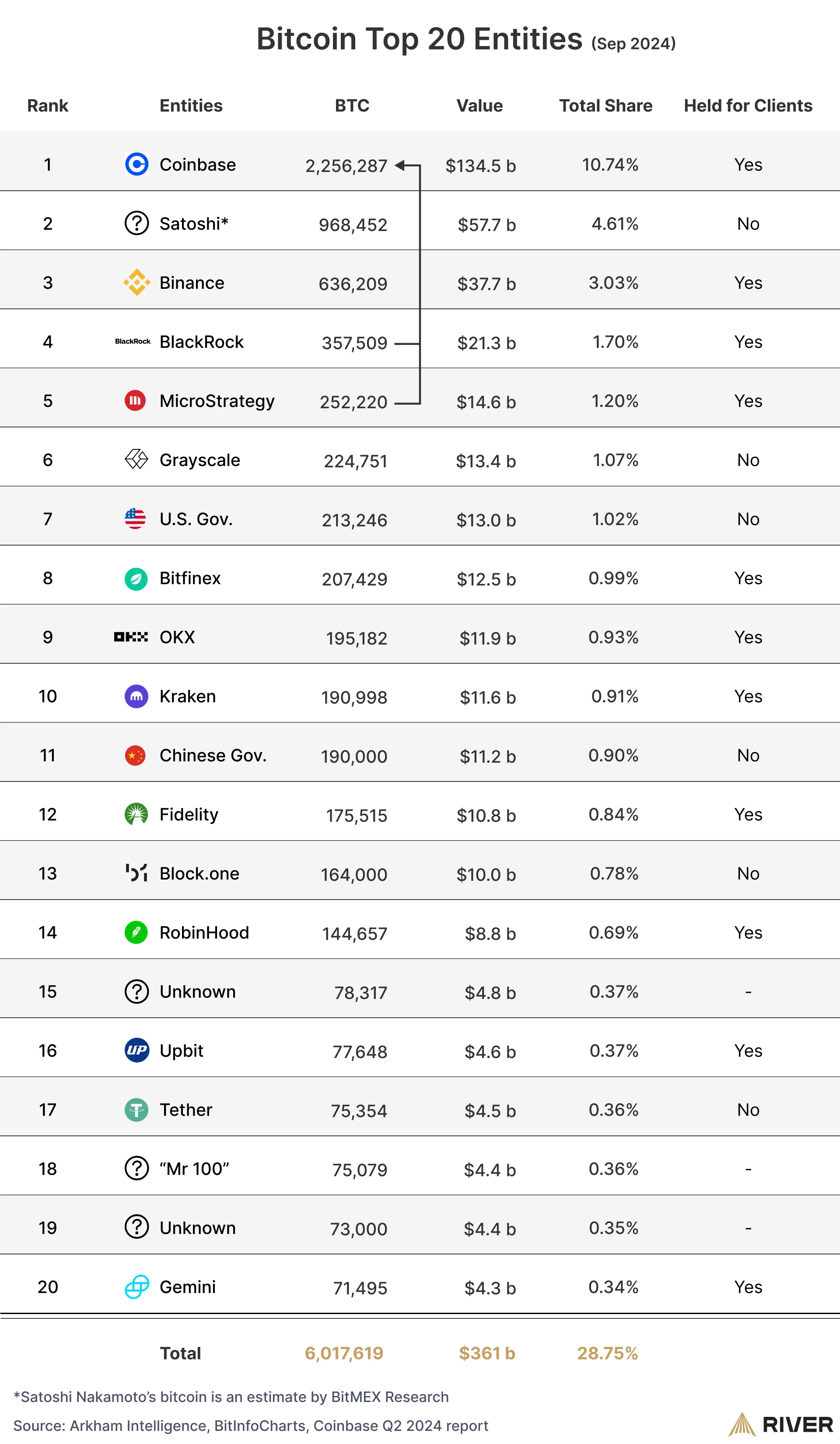

Who holds the most Bitcoin? The answer might surprise you. The ownership of Bitcoin is as diverse as it is significant. The largest holders of bitcoin include Satoshi Nakamoto, public companies like MicroStrategy and Tesla, institutional investment products such as BlackRock, individuals known as “Bitcoin whales,” and even some governments through legal seizures and strategic purchases like the United States and El Salvador. These diverse holders collectively influence the Bitcoin market and its dynamics.

Who Owns Bitcoin?

Satoshi Nakamoto is the anonymous creator of Bitcoin, but he doesn’t own the Bitcoin project. Nobody owns the Bitcoin project.

Bitcoin is software run by a decentralized network, which means no single party is in control of the set of rules in the software. These rules must be agreed upon by the network participants in order for them to transact.

So if no one owns the Bitcoin protocol, who are the biggest holders of the bitcoin (BTC)? We answer this question in the video below or continue reading the rest of the article.

Who Owns The Most Bitcoin?

Satoshi Nakamoto owns the most bitcoin, with an estimated 968,452 BTC. Satoshi not only invented but was also the first miner to create blocks of transactions. Satoshi was rewarded with nearly one million bitcoin in cumulative block rewards for the work. These bitcoin are spread across approximately 20,000 addresses and have remained untouched, except for a few test transactions.

With a current value of approximately $94 billion as of December 2024, Satoshi’s bitcoin stash is a significant portion of the total supply, yet it has never been spent. Satoshi left the project in 2010 and hasn’t been heard from since.

How Much Bitcoin Does MicroStrategy Own?

MicroStrategy has acquired 597,325 BTC, which represents roughly 2.7% of the total supply.

MicroStrategy under the leadership of Michael Saylor has employed a unique strategy in which they raise debt capital and use it to purchase bitcoin. The theory behind this strategy is that the company can repay the fiat debt by selling less bitcoin in the future. Other companies are beginning to mimic this strategy.

Bitcoin Billionaires

Tyler and Cameron Winklevoss

Following their 2008 settlement with Mark Zuckerberg for $65 million worth of Facebook shares and cash, the pair started an angel investment company. A few years later they would announce they had bought approximately $11 million worth of bitcoin at an average cost basis of $10 per coin. It’s estimated that the Winklevoss twins own ~70,000 BTC.

Tim Draper

The VC titan has been interested in Bitcoin for a while; so much so that he made one initial purchase of 40,000 BTC at the Mt Gox exchange.

Unfortunately, all 40,000 coins were lost in the hack and subsequent bankruptcy. However, in 2014, Mr. Draper purchased 29,656 BTC for $18.7 million at a cost basis of approximately $632 per coin.

Michael Saylor

The founder and chairman of MicroStrategy revealed in an October 2020 tweet that he personally held 17,732 BTC. It is reasonable to assume that he has since acquired more—being such a public Bitcoin Bull—but this is the only mention of his personal stash.

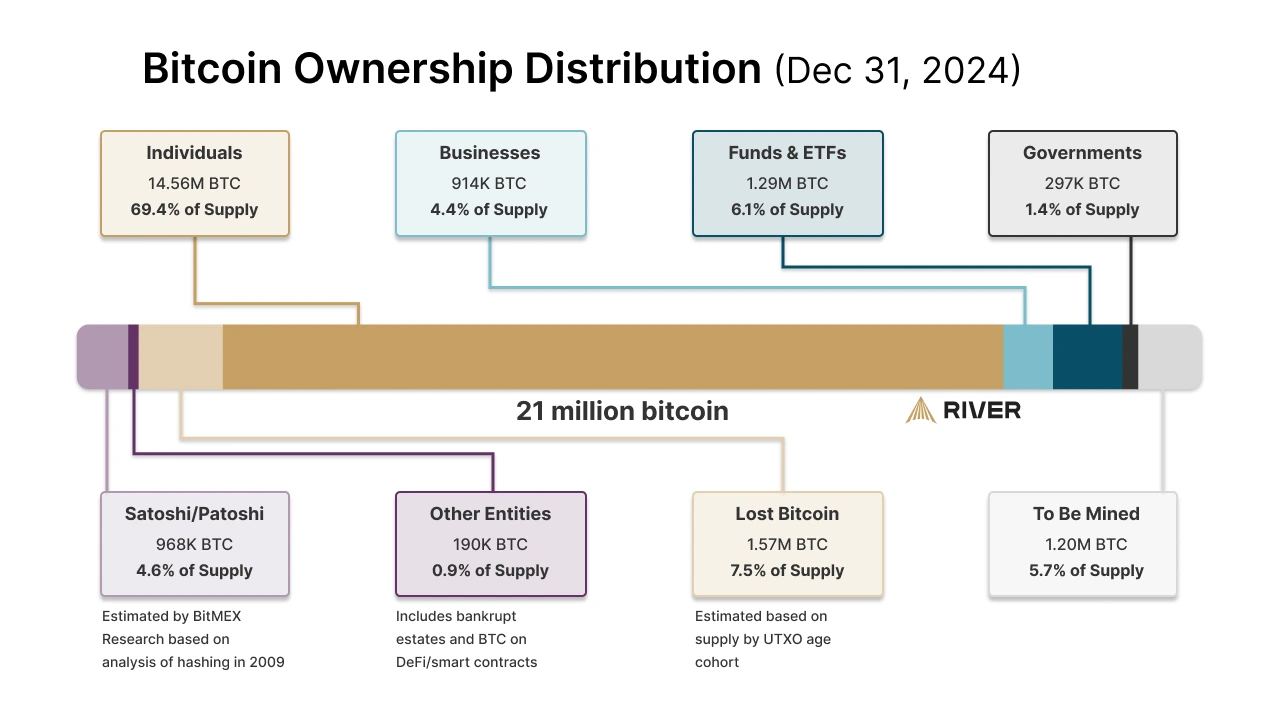

Bitcoin Wealth Distribution

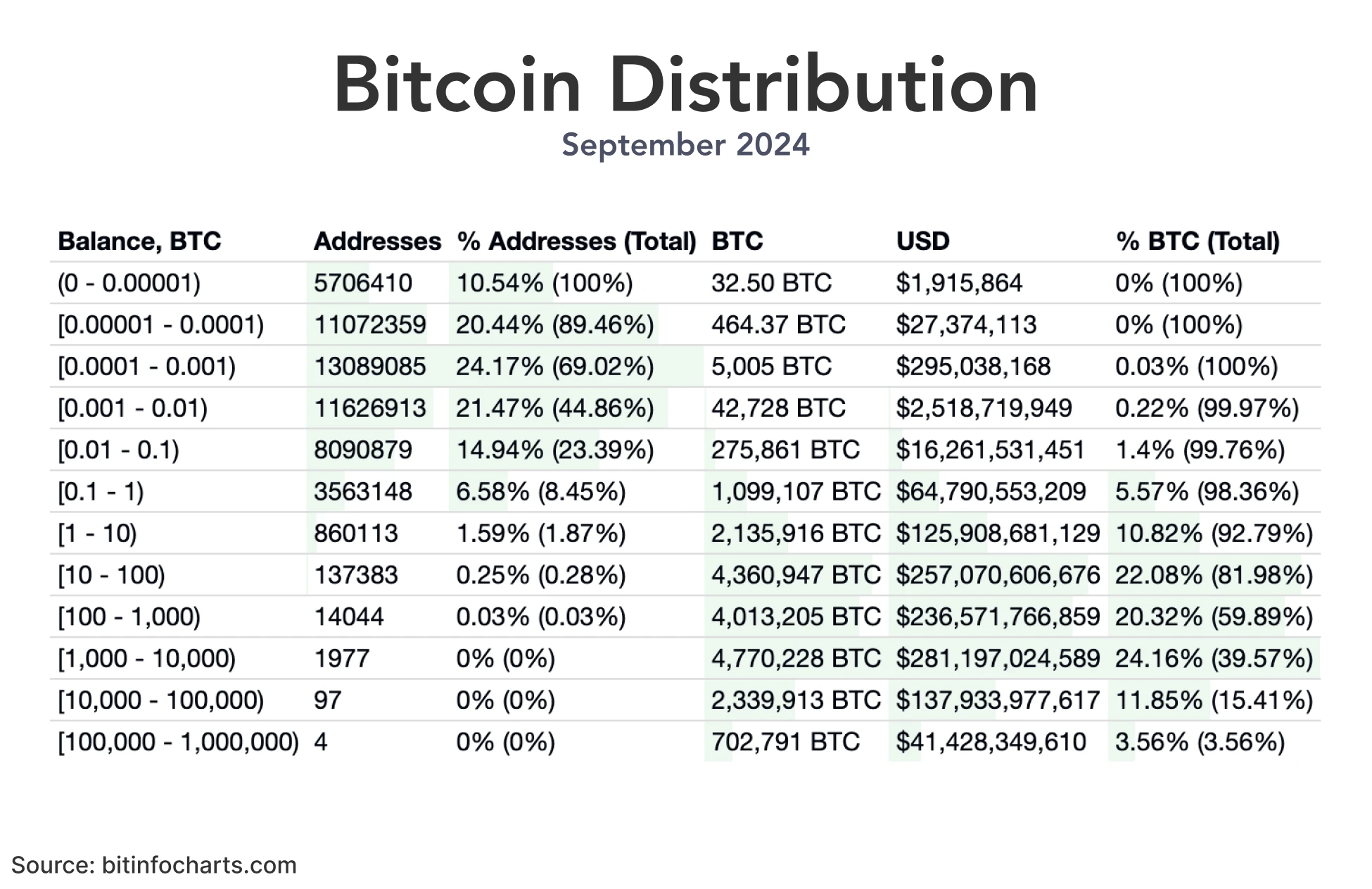

Over time, Bitcoin ownership has been grouped into different levels based on how much Bitcoin is held at a particular address. These levels, or “strata,” categorize addresses by the total amount of Bitcoin they contain.

➤ Learn more about what Bitcoin addresses are and how they're used.

The amount of bitcoin that each stratum of addresses owns in relation to the entire bitcoin supply fluctuates over time.

Today, four bitcoin addresses contain 100,000 to 1,000,000 BTC for a total of 704,497 BTC. The next 93 largest owners, who range from 10,000 - 100,000 BTC, own a total of 2,287,472 BTC.

These wealthiest addresses account for about 14% of the total supply. Bitcoin addresses with 10,000 or more bitcoin are sometimes referred to as whales.

At least 12% of the supply is held by exchanges on behalf of clients.

➤ Learn more about the top 100 richest bitcoin addresses.

Companies Holding the Most Bitcoin

Companies can use corporate savings, called a treasury, to buy bitcoin. The benefit of this strategy, employed by companies such as MicroStrategy, Tesla, and Galaxy Digital Holdings, is to protect their savings against inflation and negative-yield bonds.

Large corporations who can issue corporate bonds with low interest rates also have the opportunity to create cheap debt and use the funds to purchase bitcoin. In theory, as the dollar’s value decreases with inflation and bitcoin continues to store value, paying off fiat debt will require fewer bitcoin. This strategy is similar to buying on margin or using leverage.

Public Companies Holding the Most Bitcoin

Collectively, public companies own more than 554,670 BTC, equal to 2.60% of the total supply. We have covered this in depth in our report on Business Bitcoin adoption.

MicroStrategy was already covered above, holding 597,325 bitcoin.

Robinhood Markets, a financial services company offering stock, ETF, cryptocurrency trading has been on a bitcoin-accumulation strategy. According to Arkham Intelligence, Robinhood controls 136,755 BTC.

Marathon Digital Holdings, the Bitcoin Mining mega-company, owns 40,435 BTC.

Another public company holding bitcoin is Tesla, Inc. which holds 11,509 BTC.

Hut 8 Mining Corp. and Block Inc. round out public companies in the top ten Bitcoin holdings—according to Bitcoin Treasuries dot net. The company holds over 9,000 BTC.

Private Companies Holding the Most Bitcoin

Private companies own roughly 297,000 BTC, about 1.41% of the total supply. Mt. Gox, the formerly hacked exchange, is one of the largest private holder of bitcoin. It has a total of 44,899 bitcoin, or 0.2% of total supply.

Block.one, a Chinese corporation, is the second largest private owner of bitcoin. Block.one reportedly owns 164,000 BTC, representing 0.7% of the total supply.

Stone Ridge Holdings Group is an American private company that owns approximately 10,889 BTC.

Tether Holdings LTD, the company behind the USDT stablecoin, has roughly 82454 BTC—valued at $8.0 billion US dollars.

➤ Learn more about investing bitcoin in an LLC.

Indirect Bitcoin Exposure

Indirect bitcoin exposure is one investment method for investors seeking exposure to bitcoin price without directly purchasing bitcoin. Some investors also believe they can reduce risk by investing in an extensive portfolio with many bitcoin-related assets.

A bitcoin exchange-traded fund (ETF) may contain equities and other bitcoin-related assets that result in a more diversified portfolio. Bitcoin ETFs track the price of bitcoin, albeit imperfectly. Some proposed ETFs are also based on bitcoin futures and other derivative products.

ETFs and other funds own a combined 1,250,000 BTC, 5.90% of the total bitcoin supply. The largest holder in this category is BlackRock’s iShares Bitcoin Trust, which has approximately 530,831 BTC under management.

➤ Learn more about bitcoin ETFs.

Retirement accounts are another popular method for indirect exposure to bitcoin. A growing number of custodians offer financial services and Traditional or Roth IRA products that can include bitcoin.

➤ Learn more about investing bitcoin in a retirement account.

Governments Holding the Most Bitcoin

Governments across the world own an estimated 307,000 BTC, representing 1.50% of the total supply. The Chinese government reportedly holds 15,000 BTC that was recovered from the Plustoken scam in 2019. The Kingdom of Bhutan owns 12,578 BTC, primarily accumulated through Bitcoin mining. El Salvador’s holdings are currently at 5,963 BTC.

➤ Learn more about how much bitcoin governments own.

Total Bitcoin Supply

Under the current Bitcoin software rules, there can never be more than 21 million bitcoin. For that reason, percent ownership of the total bitcoin supply can be safely calculated using the hard cap of 21 million.

However, some models use the total supply of bitcoin excluding the more than 968,000 BTC that Satoshi Nakamoto received in block rewards and the estimated 1.6 million coins that are lost forever. This places the total supply of bitcoin closer to 18 million rather than 21 million.

Regardless of the model used, there is a strict upper limit on the number of bitcoin that will ever exist. Therefore, all bitcoin owners can be confident that their share of bitcoin will never be diluted below a certain percentage.

➤ Learn more about how lost bitcoin makes bitcoin more valuable.

Key Takeaways

- All bitcoin is controlled by private keys. The owner of a private key owns the bitcoin controlled by that key

- Ownership of bitcoin, even in large quantities, does not confer any control over the Bitcoin network

- The four wealthiest bitcoin addresses collectively own more than 663,306 BTC

- Microstrategy owns more bitcoin than any other publicly traded company