An investor may consider investing in bitcoin through buying shares of a Bitcoin ETF, directly purchasing BTC, or even purchasing mining hardware. Each investment route comes with distinct trade-offs, making it essential for investors to choose a path that aligns with their strategy, risk tolerance, and background.

What Is an ETF?

Exchange-Traded Funds (ETFs) are a type of investment that tracks the price of an asset or a group of assets. The value of the ETF is directly tied to the value of the asset it contains. Similar to stocks, ETFs are also traded on the stock exchange.

What Is a Bitcoin ETF?

Bitcoin ETFs are a type of investment that tracks the price of bitcoin. They provide investors exposure to bitcoin’s price movement without the need to directly buy and store the asset. Bitcoin ETFs come in various forms, primarily categorized as either ‘spot’ or ‘futures’ ETFs.

Spot Bitcoin ETFs

A spot Bitcoin ETF is a type of ETF that directly purchases and holds bitcoin. The value of the ETF is based on the current or spot price of bitcoin in the market. Compared to other Bitcoin ETF types, it provides a more direct exposure to bitcoin price movements.

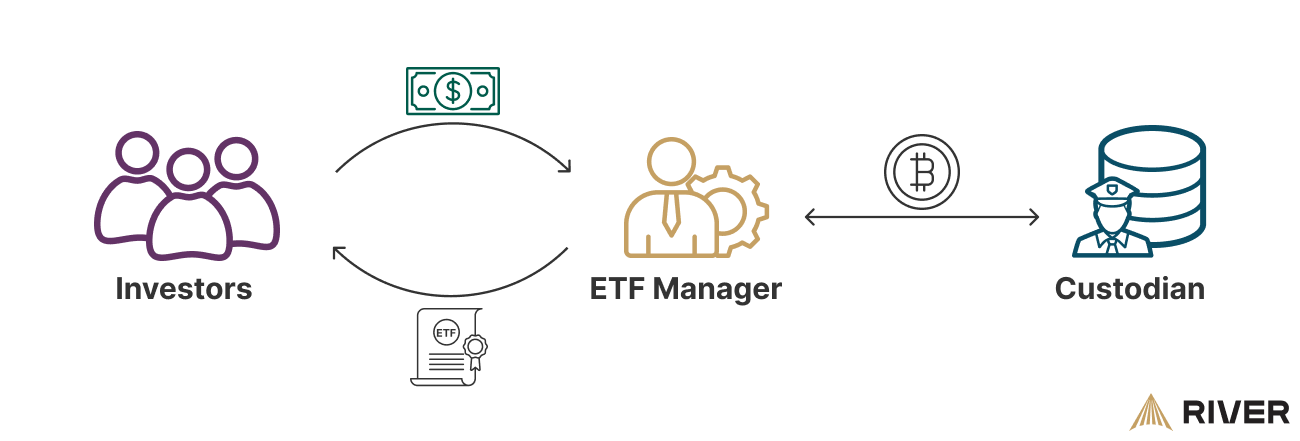

When investors buy shares of a spot Bitcoin ETF, the ETF fund manager will purchase an equivalent amount of bitcoin that will be stored with a third-party regulated custodian. Conversely, when investors sell shares of the ETF, the fund manager will sell a corresponding amount of bitcoin from the fund holdings.

If an investor purchases $5,000 worth of spot Bitcoin ETF shares, the ETF manager takes the proceeds to purchase $5,000 worth of bitcoin and stores it with a custodian. In return, the investor will get $5,000 worth of shares.

This buying and selling process by the fund manager ensures that the value of the ETF is always closely aligned with the actual amount of bitcoin the fund holds. As a result, the value of each share in the ETF directly reflects the current market value of the bitcoin held in the fund.

As of January 10, 2024, 11 spot Bitcoin ETFs have been approved from multiple companies, such as BlackRock, Fidelity, and Ark.

Bitcoin Futures ETFs

Unlike a spot Bitcoin ETF, which would directly hold bitcoin, a Bitcoin futures ETF invests in bitcoin futures contracts. A futures contract is an agreement to buy or sell bitcoin at a set price on a specific future date. These contracts are traded on financial markets, offering a way to speculate on bitcoin’s price.

The first ETF approved in the U.S. that was linked to Bitcoin was the ProShares Bitcoin Strategy ETF. It is a futures-based ETF that was approved in 2021.

Bitcoin ETF Fees

Almost all ETFs have an annual fee called the expense ratio, which is used to cover the operational costs of managing the ETF. The fee is a percentage of the fund’s average assets under management (AUM).

The expense ratio is automatically deducted from the fund’s assets, which reduces the fund’s Net Asset Value (NAV). While investors don’t pay these fees directly, they are bearing the cost indirectly. The fee is incorporated into the performance of the ETF and indirectly affects the investment returns.

Over time, even a small expense ratio can have a significant impact on the returns of a long-term investment. Since there are costs to custody solutions, it is likely that spot Bitcoin ETFs will also have an expense ratio. A futures Bitcoin ETF, BITO, has an expense ratio of 0.95% for example.

Hence, while an investor may buy ETF shares without a fee, they are indirectly paying an annual fee for maintenance. The long-term investors and HODLers may see a better return on investment (ROI) by paying the one-time transaction fee Bitcoin brokerage firms charge.

River charges 0% for recurring bitcoin purchases and charges 0.80% - 1.20% for one-time orders. While a Bitcoin ETF will have annual fees, there are no fees for custody at River or if you self-custody.

Why Was There No Spot Bitcoin ETF Before?

The first application for a Bitcoin ETF was a spot Bitcoin ETF filed in 2013.

However, all spot ETF applications are continuously being rejected by the Securities and Exchange Commission (SEC). They have consistently rejected these applications in the past on the basis of a lack of “surveillance-sharing agreements.” These agreements are an active effort of sharing detailed market data and trading information to monitor any market irregularities or manipulative activities.

The first Bitcoin ETF application that was eventually approved in October 2021 was a futures ETF called ProShares Bitcoin Strategy ETF (ticker: BITO). On January 10, 2024, 11 spot Bitcoin ETFs finally got approved!

Positive Impacts of a Spot Bitcoin ETF

The introduction of a spot Bitcoin ETF carries significant implications for Bitcoin. Despite having a Bitcoin futures ETF since 2021, a spot bitcoin ETF can be considered to be more aligned with the inherent qualities of Bitcoin. It provides a more direct and less complex investment vehicle when compared to a futures-based Bitcoin ETF.

1) Large Capital Inflows into Bitcoin

Since each ETF share represents a direct purchase of bitcoin, the launch of a spot ETF would increase liquidity as substantial capital would enter the market.

2) Legitimizing The Perception of Bitcoin

The traditional and regulated framework of an ETF can play a crucial role in enhancing Bitcoin’s image as being legitimate among the public.

3) Increasing Corporate Adoption

Some companies have already added bitcoin to their balance sheets such as Microstrategy and Tesla. The perceived safety offered by a Bitcoin ETF could encourage more companies to add bitcoin to their balance sheet, resulting in a cycle of increased acceptance and investment.

4) Increasing the diversity of the investor base

A spot Bitcoin ETF can attract a diverse group of new investors such as pension funds, family offices, and other institutions that previously could not directly invest in bitcoin due to internal risk management policies. An ETF provides an alternative solution to these investors.

5) Aligning Incentives

A spot Bitcoin ETF could align the interests of various financial institutions with Bitcoin. It would allow investment advisors to consider adding bitcoin exposure to their client’s portfolios as a part of their fiduciary responsibilities, which obligates advisors to act in the best interests of their clients. By offering a regulated investment option, advisors can provide clients with bitcoin exposure as a part of a diversified portfolio, which aligns with modern technological trends and risk management strategies.

6) Streamlining The Buying Process

A spot Bitcoin ETF eliminates the need for investors to set up new accounts on cryptocurrency exchanges or even manage digital wallets solely for bitcoin investments. They can conveniently remain with their existing financial service providers or brokers. As a result, a broader range of investors may be interested in such an offering, resulting in further integration of bitcoin into the mainstream financial system.

Negative Impacts of a Spot Bitcoin ETF

1) Risk of Centralization

There is a general concern in the bitcoin space about the amount of bitcoin that is held by third parties and the normalization of this practice that a spot Bitcoin ETF would bring.

If the vast majority of bitcoin ends up being held by a handful of custodians, this presents large potential risks for the decentralization of the network, as these custodians could have significant influence in the event of a fork in the network.

2) Risk of Custody

A spot Bitcoin ETF relies on a custodian to securely hold the bitcoin. This introduces counterparty risk, meaning if the custodian fails, the bitcoin could be at risk. The operational management, including the process of acquiring, storing, and managing the bitcoin introduces multiple points of attacks. Mistakes or failures in these operational processes can lead to loss or theft of the bitcoin.

3) Risk of Increased Paper Bitcoin

“Paper bitcoin” refers to financial instruments that represent a claim on Bitcoin. Each share of an ETF is like a receipt or claim of ownership of bitcoin. Hence, spot Bitcoin ETFs are a derivative of Bitcoin’s actual market.

Institutions can potentially use their ETF shares as collateral to conduct other complex transactions. This can lead to a scenario where more bitcoin claims exist than the actual number of bitcoin available.

It dilutes Bitcoin’s value proposition as a scarce asset, as the market could become flooded with these paper claims. The potential of increased paper bitcoin through ETFs introduces a layer of centralization and traditional financial market dynamics into the Bitcoin ecosystem.

4) Risk of Market Manipulation

Furthermore, the existence of paper bitcoin through ETFs could increase the risk of market manipulation. Large investors could shift a significant portion of bitcoin trading to these derivative products. This can result in the price discovery of bitcoin increasingly influenced by the trading of ETFs rather than the trading of actual bitcoin.

Custody of Bitcoin vs Bitcoin ETFs

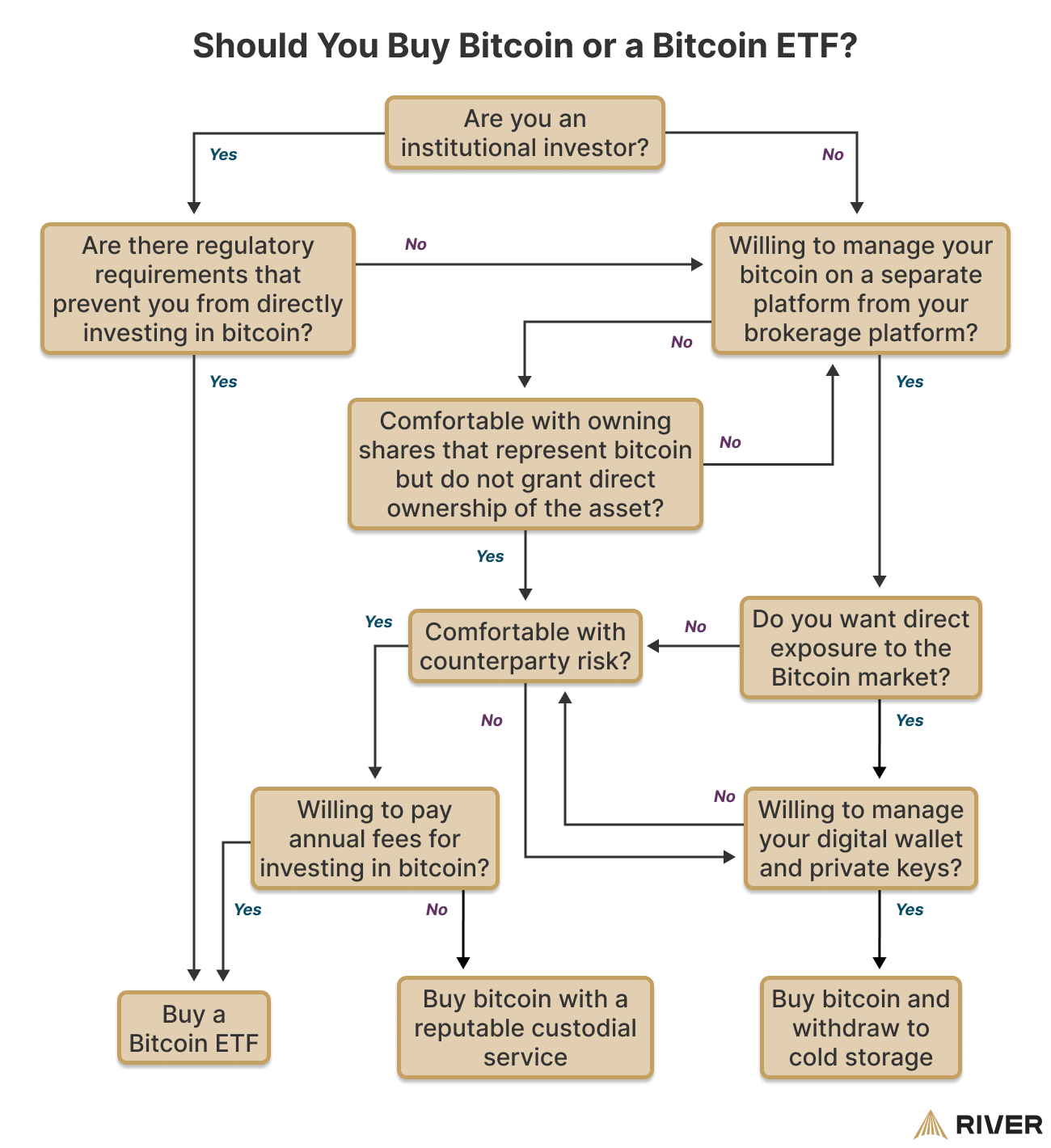

How should an investor decide whether to deploy capital to bitcoin directly or to a spot Bitcoin ETF? The answer depends on the investor profile and their preferences.

Counterparty Risk vs Bitcoin Self-Custody:

A disadvantage of Bitcoin ETFs is the added counterparty risk. Unlike self-custody, where individuals control their own bitcoin, ETFs involve trusting a third party to manage the investment, which in turn usually trusts a custodian to hold the bitcoin for them.

Investors unfamiliar with crypto exchanges or uncomfortable with self-custody might prefer ETFs as a more traditional investment option. ETFs offer a way to invest in Bitcoin without the responsibility of managing private keys and wallets.

However, other investors may be drawn to Bitcoin’s decentralization and the ability to have full control over their assets through self-custody.

Different Bitcoin Custody Models

It’s crucial to distinguish between self-custody, custody on platforms with a full Bitcoin reserve (e.g., River), and other custodial exchanges where rehypothecation could occur.

Rehypothecation is the practice of reusing or lending out Bitcoin deposits to generate additional profits. Rehypothecation increases the risk of insolvency and systemic risk.

Spot Bitcoin ETFs typically do not allow investors to redeem the shares for BTC. However, services like River offer the ability for investors to redeem their bitcoin from their River accounts into any self-custodial Bitcoin wallet. This highlights a key difference between investing in bitcoin through an ETF and using a platform that allows direct ownership and withdrawal of bitcoin.

Cash vs In-Kind Redemption Models

Cash settlements and in-kind settlements are two different methods for handling transactions in ETFs.

Cash settlements involve the exchange of cash for the shares during the creation and redemption of the ETF shares.

- When new ETF shares are created, the Authorized Participants (APs), typically large financial institutions, pay cash to the ETF provider. The ETF provider uses this cash to purchase bitcoin, and in return, the APs receive ETF shares of equivalent value.

- When ETF shares are redeemed, these APs return the ETF shares to the provider and receive cash in exchange. The ETF provider would sell the bitcoin to pay cash to the APs.

In-kind settlements involve the exchange of securities instead of cash.

- During share creation, APs provide bitcoin to the ETF provider and receive ETF shares in exchange.

- When redeeming, APs return the ETF shares in exchange for the bitcoin.

Most ETFs opt for in-kind settlements due to their tax efficiency, as they avoid the need to sell securities. However, the spot Bitcoin ETFs approved on January 10, 2024, follow the cash model. This cash-create model minimizes the number of intermediaries that have access to the actual bitcoin.

Conclusion

While Bitcoin ETFs offer a bridge to traditional finance, they come with risks that must be carefully weighed. Investors should consider their comfort with counterparty risk, redeemability, and whether their financial goals and values align with Bitcoin Spot ETFs.

It is worth considering that the expense ratio makes buying a Bitcoin ETF more expensive over time than purchasing bitcoin directly on a platform like River, especially when using a zero-fee recurring buy.

Key Takeaways

- The investor’s situation and preferences determine whether buying bitcoin or buying a Bitcoin ETF is better.

- The expense ratio of a Bitcoin ETF can have a significant impact on the returns of a long-term investment. It is cheaper to invest in bitcoin directly.

- The introduction of a spot Bitcoin ETF will bring about significant changes in the Bitcoin industry.

- Investors need to carefully consider the implications of someone else holding their bitcoin keys or using self-custody.