Rehypothecation

1 min read

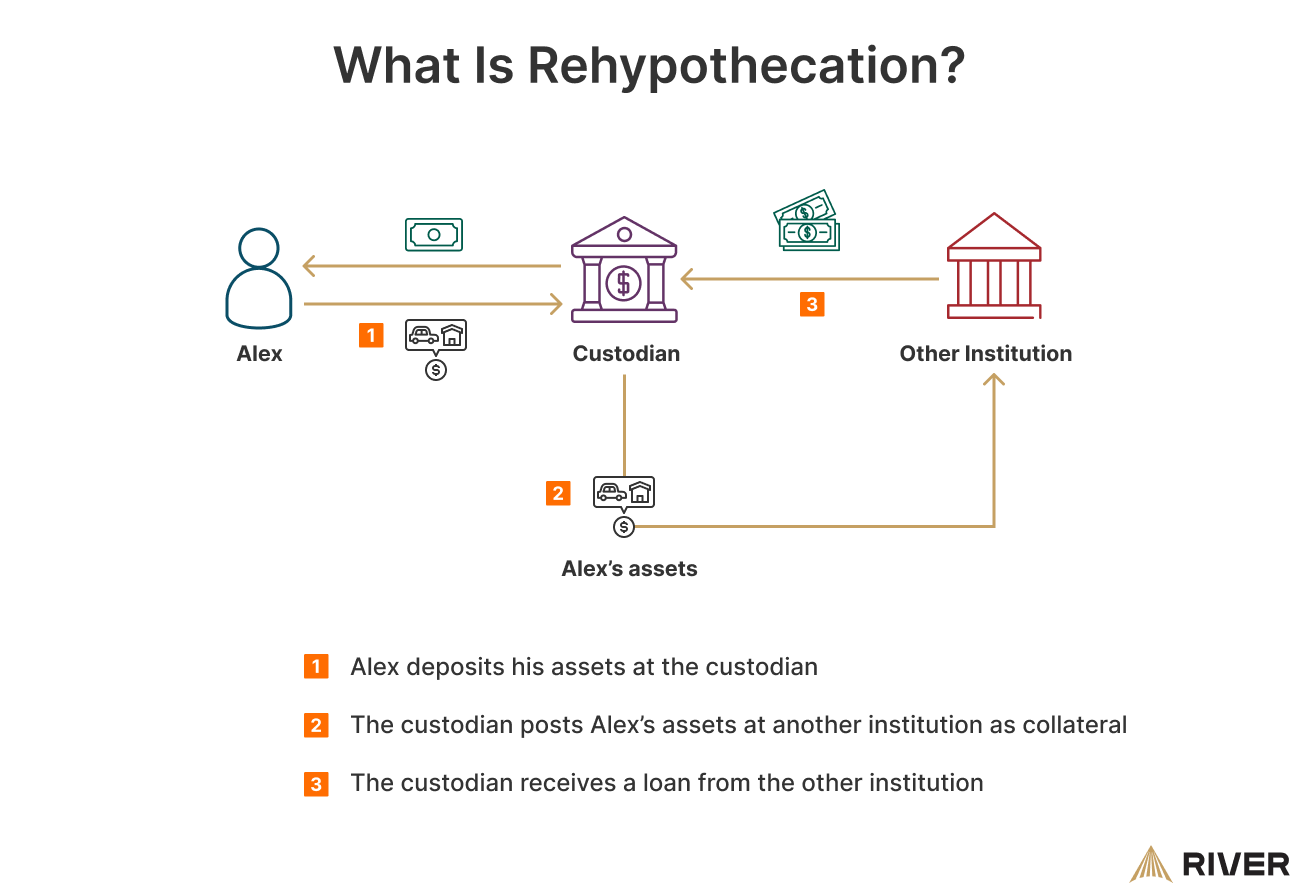

Rehypothecation is the practice where custodians, such as banks or brokerages, use assets that have been posted to them as collateral for their own financial gain, such as borrowing money or making other investments. For example, when a client deposits securities or cash with these custodians, the custodian can lend out these assets to others. This process is used to generate additional revenue for the custodian.

Typically, when a hedge fund provides securities as collateral to a prime brokerage, the brokerage can rehypothecate, or reuse, these securities to back its own transactions and trades. Depositors may receive benefits such as reduced borrowing costs, lower fees, or more favorable interest rates in exchange for allowing their assets to be rehypothecated.

However, it’s important to note that rehypothecation carries risks, particularly in volatile markets or in situations of financial distress, where the original owners of the assets may face challenges in reclaiming their collateral. The Lehman Brothers collapse in 2008 is an infamous example where the firm rehypothecated client assets to finance its own operations and investments. When the value of these assets plummeted, Lehman Brothers faced a liquidity crisis and ultimately declared bankruptcy.