A stablecoin is a digital representation of a fiat currency, most commonly the US dollar. Stablecoins are typically issued on blockchains to enable cheap, fast, and global transactions. They are issued and controlled by centralized, for-profit entities that ensure the value of the stablecoin always tracks the currency they represent. This entity maintains total control over the supply. Below, we explore the growing significance of stablecoins and how they are being used today.

Significance and History of Stablecoins

The first widely recognized stablecoin, Tether, launched in 2014 on the Bitcoin blockchain. By 2017, stablecoins began appearing on Ethereum, a blockchain platform offering smart contract capabilities.

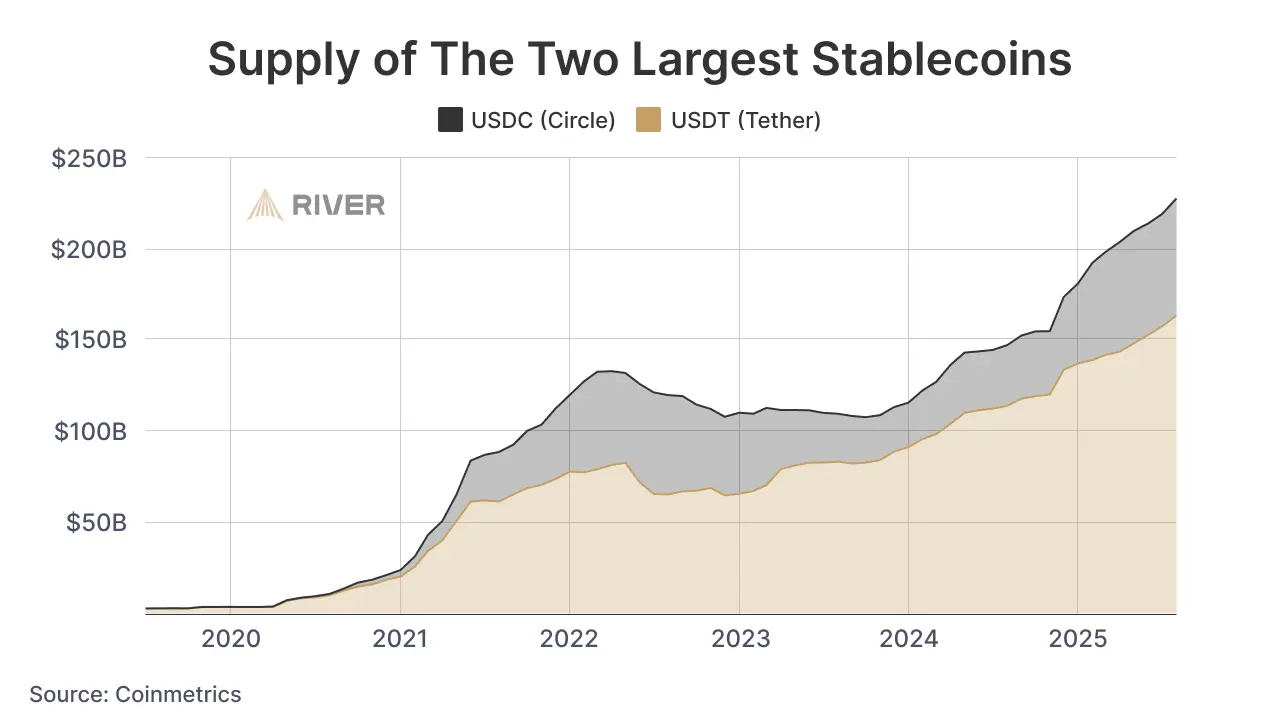

Their popularity surged in 2020, spreading to highly centralized blockchains like Tron and Solana, which provide faster transactions and lower fees. A significant portion of stablecoin adoption has come from people outside the United States seeking easier access to US dollars. As of August 2025, the top two issuers collectively have more than $200 billion worth of stablecoins in circulation.

What Are the Largest Stablecoins?

The vast majority of stablecoins are issued by two companies:

- Tether (Issuer of USDT): Launched in 2014 and headquartered in El Salvador, Tether is the oldest and largest stablecoin by market capitalization, with $164 billion in circulation as of August 2025. It operates across multiple blockchains—including Ethereum, Tron, Solana, and Avalanche—and has announced plans to expand to the Lightning Network.

- Circle (Issuer of USDC): Introduced in 2018 by Circle (in partnership with Coinbase), USDC is a US-regulated stablecoin, headquartered in New York, with $65 billion in circulation as of August 2025.

What Are Stablecoins Used For?

Stablecoins are most commonly used for speculating on cryptocurrencies. Typically, this means trading between tokens or earning yield on an exchange or decentralized finance application.

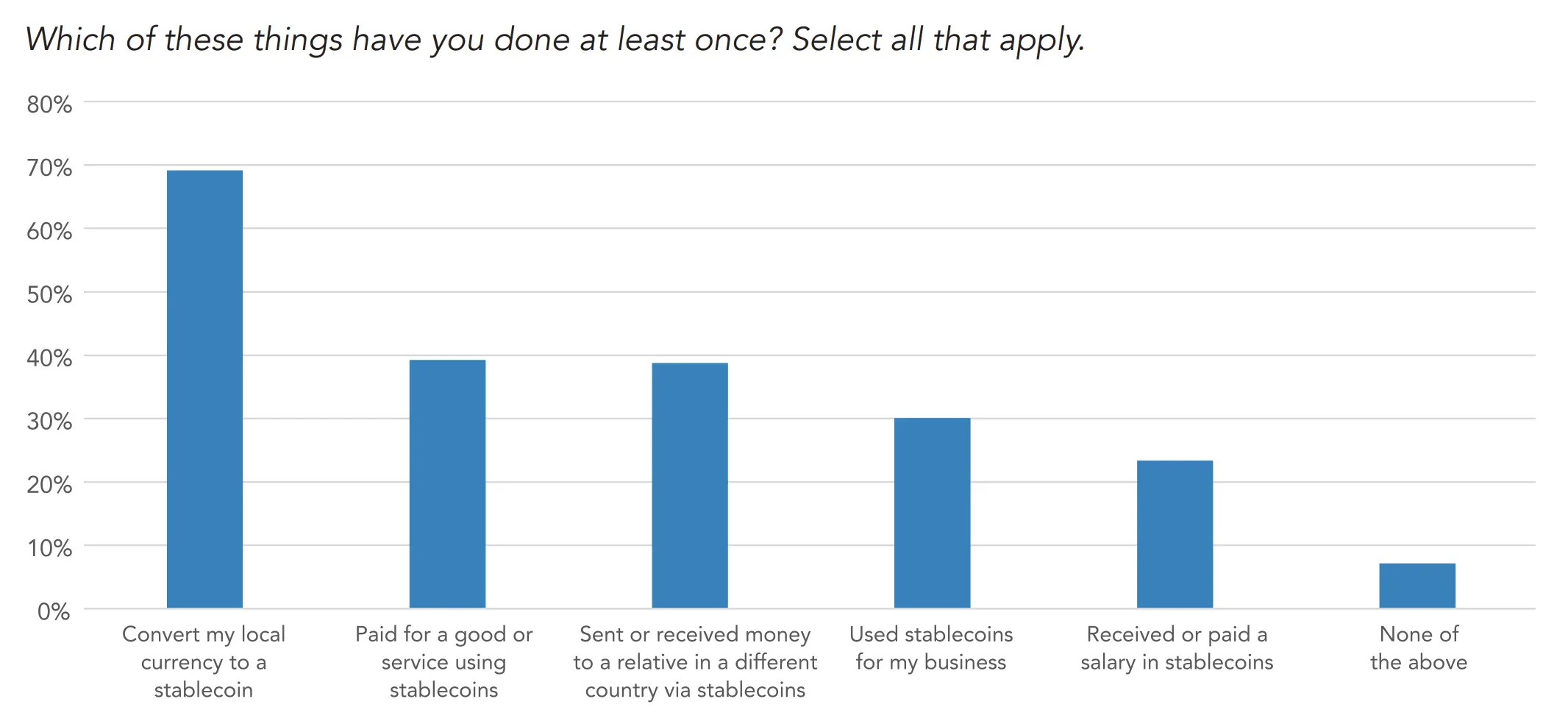

However, stablecoins are gaining traction for non-crypto use cases. According to a report by Castle Island Ventures, the most common non-crypto uses for stablecoins involve local currency conversion, remittances, and small payments, as shown in the chart below.

Benefits of Stablecoins

Stablecoins are valuable because they combine the benefits of blockchain technology with the existing network effects of the US dollar as a medium of exchange. Beyond using stablecoins for cryptocurrency trading, they offer two primary benefits:

Stablecoins Provide Global Access to Dollars

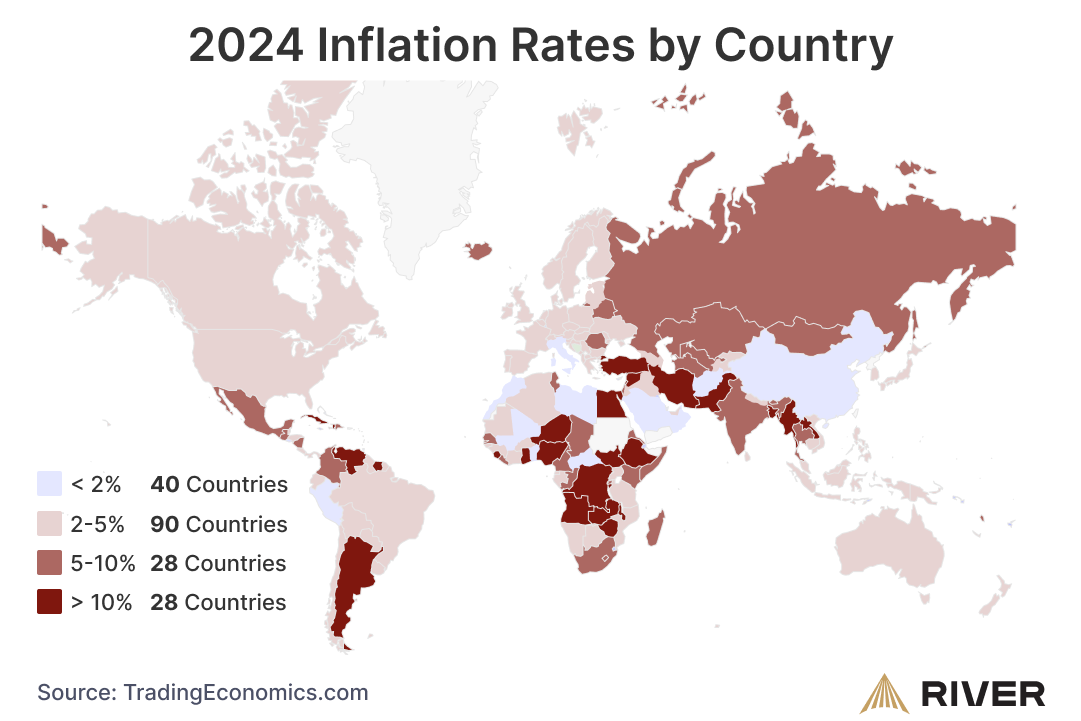

More than one billion people worldwide either lack access to a bank account or live in countries with highly inflationary currencies, as illustrated in the map below. In such environments, stablecoins offer a practical savings option when no better alternatives exist, despite the US dollar’s gradual decline in purchasing power. For many, they serve as a financial lifeline, providing a way to preserve value and transact freely in otherwise financially repressive economic conditions.

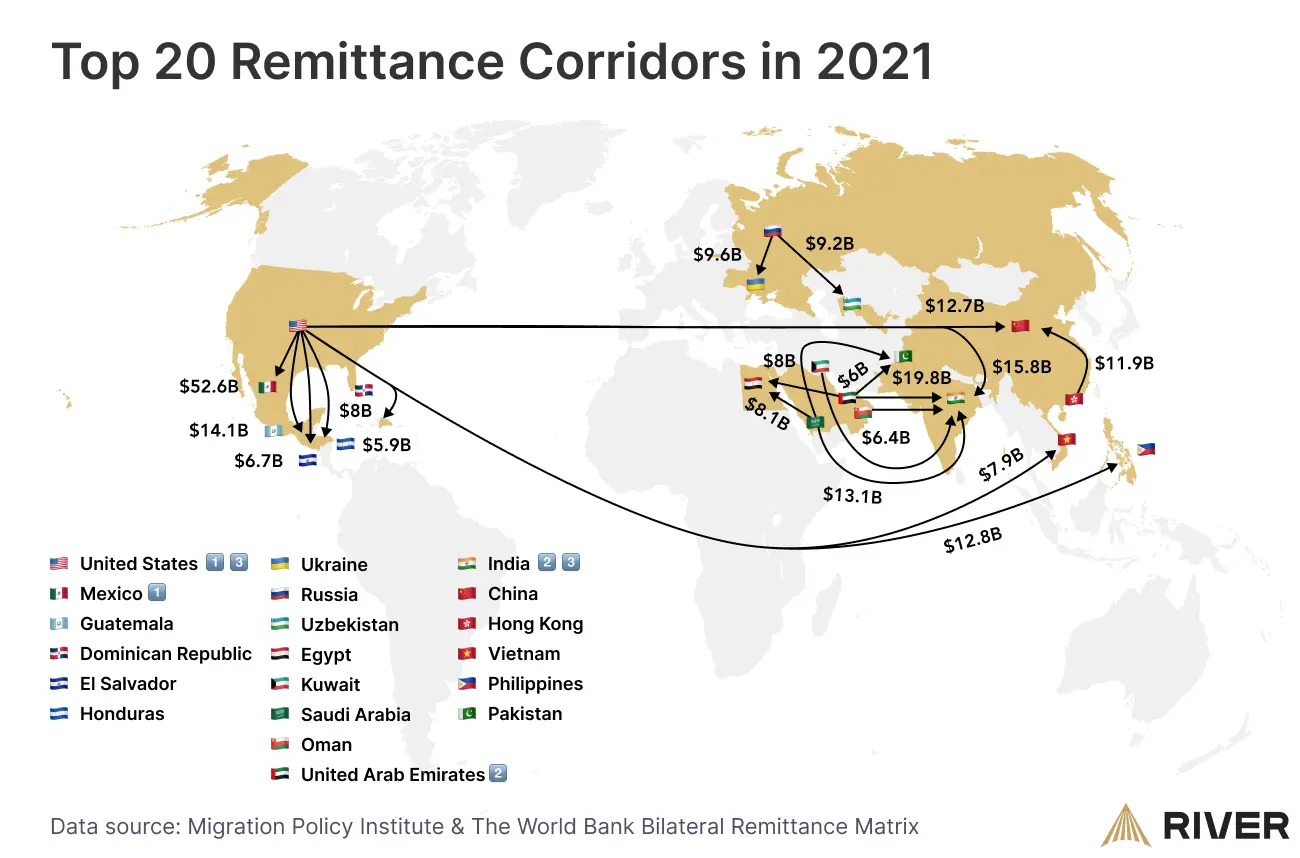

Stablecoins Provide Efficient Cross-Border Payments

Each year, people send over $900 billion of remittances across borders. Traditional methods of sending these payments, such as through a money transfer operator, are often expensive and slow. As of early 2024, the World Bank reported a global average fee of 6.35% per remittance transaction. While transfer speeds for these payments can be under an hour, they frequently take up to several business days to complete. In contrast, stablecoin transfers typically process within minutes and cost less than $0.01 per transaction.

Drawbacks of Stablecoins

Because stablecoins are ultimately controlled by centralized companies, they do not have many of the advantages seen in a decentralized, permissionless digital asset such as bitcoin:

- No true self-custody: Even if you store stablecoins in your own wallet, you still face counterparty risk. Their value depends on the issuer’s financial health and willingness to honor redemptions. Issuers also retain the power to freeze or confiscate funds, regardless of where they are held.

- Restricted transacting: As regulated entities, stablecoin issuers must comply with KYC/AML rules, sanctions, and legal orders to block or freeze transactions. These restrictions apply even in countries without specific stablecoin laws, as issuers operate under broader financial regulations. In contrast, Bitcoin transactions are settled on a decentralized network with no central authority to block payments. Such compliance measures can make stablecoins difficult to use in authoritarian regimes or under strict capital controls.

- Limited privacy: Most stablecoin issuers conduct identity verification and maintain detailed transaction records. Combined with the transparency of public blockchains, this means stablecoin transactions are often traceable to real-world identities, making them more vulnerable to government, regulatory, or third-party surveillance, unlike Bitcoin, which offers pseudonymous transactions.

- No long-term appreciation potential: Because stablecoins are tied to the value of the US dollar or other fiat currency, they are unsuitable as a long-term store of value or savings vehicle.

How Do Stablecoins Work?

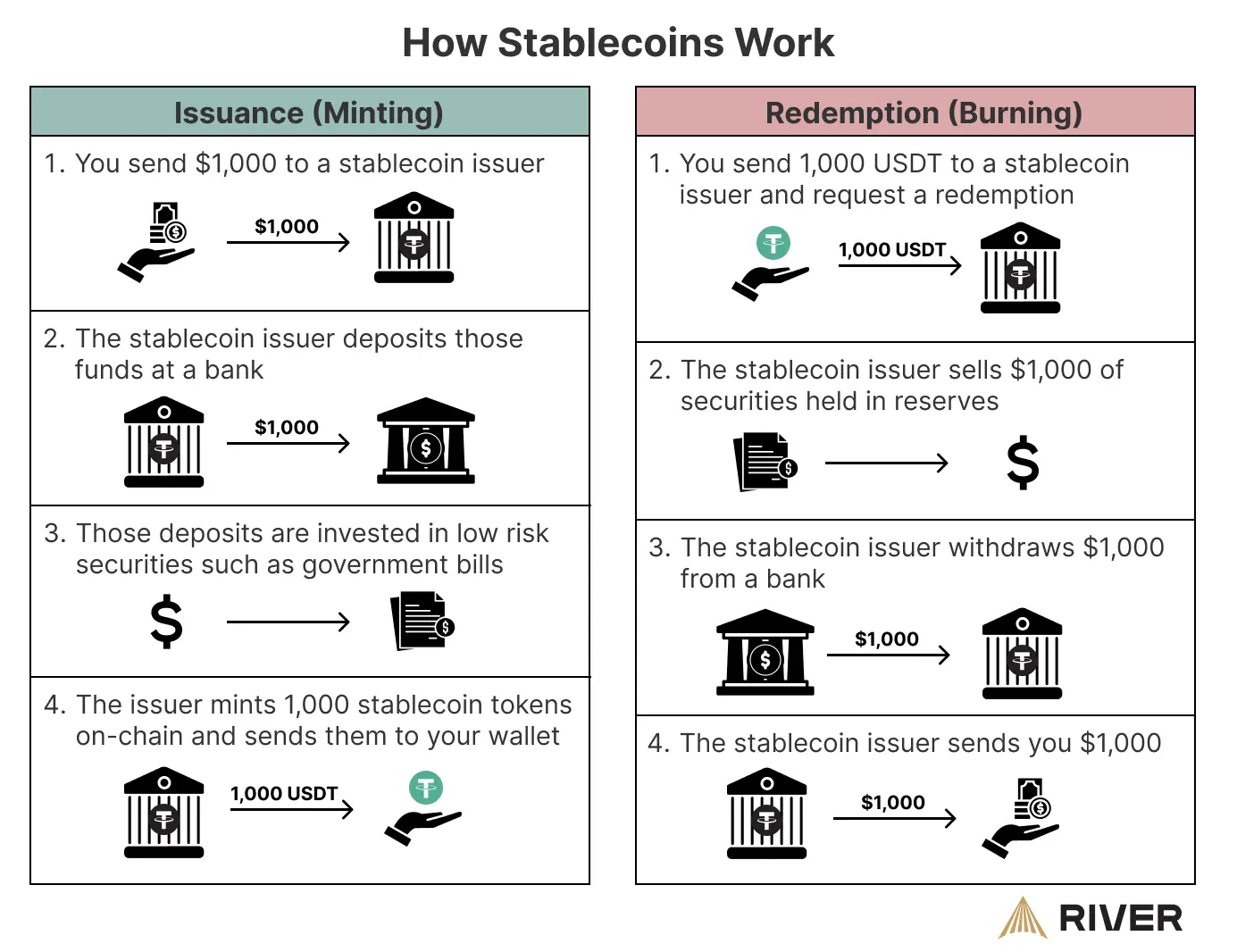

In most cases, stablecoins are issued by centralized entities, such as Tether and Circle. Stablecoins are added and removed from the blockchain by the process of issuance (minting) and redemption (burning), as shown in the diagram below.

Once a stablecoin has been issued, it can be transacted over the blockchain, similar to any other token.

How Are Stablecoins Regulated?

U.S. Regulatory Landscape: The first comprehensive regulatory framework for stablecoins in the United States was established in July 2025 with the passage of the GENIUS Act. This legislation establishes a federal licensing regime, requiring issuers to meet strict standards around reserve backing, disclosures, consumer protection, and operational integrity. The law is set to take effect in January 2027, or earlier if federal agencies finalize implementation rules before then.

International Perspective: Stablecoins have seen greater adoption outside of the US, although laws and regulations differ by country. The European Union leads with its Markets in Crypto-Assets (MiCA) regulation, which requires stablecoin issuers to register with national regulators and maintain reserve transparency. Singapore and Japan have also introduced licensing regimes focused on ensuring financial stability and consumer protection. In contrast, China has banned private stablecoins altogether, instead promoting its central bank digital currency (CBDC), the digital yuan.

Stablecoins vs Central Bank Digital Currencies (CBDCs)

While both stablecoins and Central Bank Digital Currencies (CBDCs) provide a digital representation of fiat money, they differ in their design, governance, and intended role in the financial system.

Stablecoins are created and managed by private entities. They are usually backed by reserves of the currency they represent and are issued on public blockchains. CBDCs, by contrast, are issued directly by a nation’s central bank and function as official legal tender. They may use blockchain technology, but many are built on centralized infrastructure controlled entirely by the state. This gives governments full authority over issuance, circulation, and, in some designs, even the ability to program funds with specific conditions or expiration dates.

Stablecoins operate within the bounds of existing financial regulations, complying with requirements like know-your-customer (KYC) checks and anti–money laundering (AML) rules. However, because they exist on open networks, they can often move across borders more freely than traditional bank transfers. CBDCs are inherently subject to the monetary policies of the issuing government, with built-in traceability that allows for comprehensive oversight of transactions.

In practice, stablecoins have already achieved wide adoption. CBDCs remain largely in pilot programs or early rollout stages. In short, stablecoins represent a market-driven innovation in digital currency, while CBDCs are a top-down, government-controlled evolution of national money.

Do Stablecoins Affect Bitcoin?

Contrary to popular belief, stablecoins do not pose a threat to Bitcoin, as they serve fundamentally different purposes. Bitcoin is primarily used as a store of value, due to its provable scarcity. By contrast, stablecoins are used as a transactional currency. Rather than competing, the two complement each other: stablecoins offer the short-term price stability needed for commerce, lending, and remittances, while bitcoin functions as a long-term hedge against monetary inflation and a form of savings that can be held in self-custody. In fact, stablecoins often serve as a powerful on-ramp for bitcoin, allowing people to access bitcoin who might not otherwise be able to.

Notice: River does not provide investment, financial, tax, or legal advice. The information provided is general and illustrative in nature and therefore is not intended to provide, and should not be relied on for, tax advice. We encourage you to consult the appropriate tax professional to understand your personal tax circumstances.Key Takeaways

- A stablecoin is a digital token that is intended to maintain a constant peg with some other asset, usually a fiat currency.

- Stablecoins are issued by centralized third parties, but have so far remained less regulated than fiat currency.

- Stablecoins are used by traders and exchanges to rapidly and borderlessly move fiat currency.

- Stablecoins help traders seize arbitrage opportunities and help other individuals move fiat across borders.