In the wake of Bitcoin’s popularity as the world’s first and biggest cryptocurrency, governments and central banks have started exploring the possibility of releasing their own digital currencies.

At face value, CBDCs seem harmless and full of potential benefits for society, but in practice, they carry enormous risks for human freedom and flourishing that are rarely discussed.

What Are CBDCs?

Central Bank Digital Currencies are digital currencies issued by central banks, with a value linked to the issuing country’s official currency.

A CDBC is not designed to be a new currency, but rather a different form of an existing currency, more tightly controlled by a central bank.

Although some initiatives have been marketed as using a blockchain or distributed ledger, most implementations will not be using these technologies and simply rely on centralized, highly scalable databases.

Why Create CBDCs?

Over 100 countries accounting for 95% of the world GDP have either launched, or are researching, developing, or piloting a CBDC. According to a 2022 report by OMFIF, 66% of Central Banks expect to issue a CBDC within 10 years, and 24% within 2 years.

In the European Central Bank’s report “Towards the holy grail of cross-border payments,” CBDCs are described as the best candidate to deliver on this promise, along with the international linking of instant payment systems. However, the potential societal implications of this technology are not at all considered in the analysis.

CBDCs fundamentally change the relationship between a government and its people. They may seem appealing at first due to faster payments, lower costs, and more automation. However, the risks of CBDCs vastly outweigh the benefits they could bring to society.

The Risks of Central Bank Digital Currencies (CBDC)

A CDBC in the hands of an oppressive government is a superpower to control its population. They can use it in a large variety of ways:

- Did you say something the government doesn’t like? Your account may be locked.

- Are you associated with anyone the government doesn’t like? Your taxes increase.

- Is your hobby unproductive in the eyes of your government? Transaction declined.

- Does the government disapprove of your religion? Your funds may be frozen.

- Did you consume your limit of meat or gas for your car? You can’t buy more.

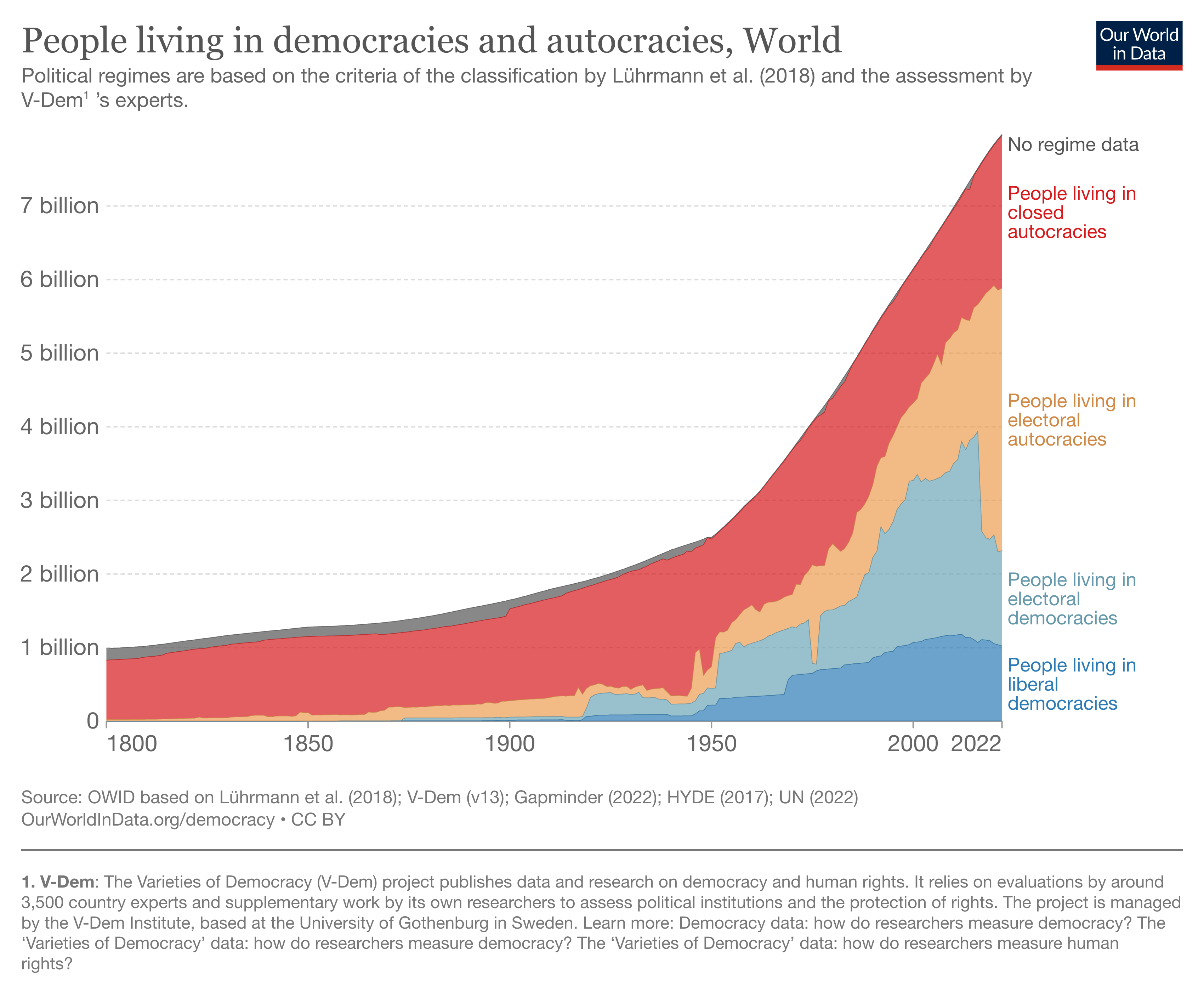

To people in highly developed countries, such scenarios may seem unthinkable, but the unfortunate reality is that at least 70% of the global population lives in autocratic countries, in some of which governments will happily abuse CBDCs or equivalent tools.

Image source: Our World in Data

Even democratic governments will increasingly look towards CBDCs to “stimulate” results. Initially, this would be done with the best intentions, likely against fringe groups in easily justifiable cases. The risk is that this is such an effective tool that it would be increasingly used to enforce any policy.

In many countries, promises and proposals will be made to implement rules or systems that would prevent such abuse. However, in practice, most if not all countries would see a decrease in liberty over time after adopting a CBDC. The temptation to abuse this tool will be far too great, as has been proven many times in the history of money manipulation.

CBDC Risks for Business

It is worth noting that CBDCs could also negatively affect businesses. They could be used as a weapon in political disputes, blocking transaction flows between countries and hurting international trade. On a national level, CBDCs could be used to force business compliance with certain rules. In a management role at a company, you may no longer be able to advocate for certain personal beliefs in public, as they could negatively impact your company and employees.

Conclusion

The only way a CBDC would not ultimately become a tool to control a population is by not being a centrally controlled system, but a decentralized system in which no individual or group can alter the rules. The incentives and technology of this system need to be set up in such a way that the system does not centralize over time. Unsurprisingly, we have not yet seen an attempt from CBDC working groups to replicate these characteristics.

Key Takeaways

- Central Bank Digital Currencies are hailed by governments and banks as the next evolution in financial services.

- Over 100 countries have launched, are researching, developing, or piloting CBDCs as of 2023.

- CBDCs are a dangerous tool for governments to control their populations, but the risks are underdiscussed.