While regularly buying bitcoin and securing it in self-custody is smart, most people do it incorrectly because they do not consider future expenses. If you frequently receive small amounts of bitcoin, you may be shocked by the high transaction fees you will pay when spending your bitcoin at some point in the future. Bitcoin operates on a unique model known as the UTXO (Unspent Transaction Output) model. This model plays a critical role in how transactions are processed and verified on the Bitcoin network. Understanding the UTXO model and how to manage UTXOs can help you navigate and use Bitcoin more effectively.

In this article, we explain how to reduce your future bitcoin transaction fees by managing UTXOs, an increasingly important consideration in a world where on-chain fees continue to rise. If you already understand UTXOs, feel free to jump ahead to “What is Bitcoin UTXO Management.”

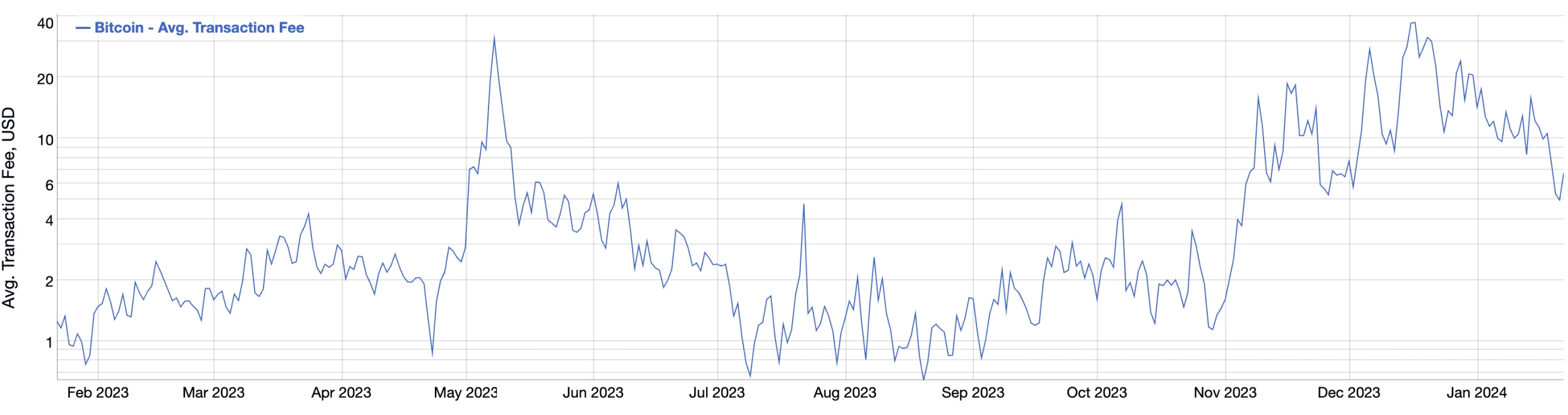

Here is a graph from bitinfocharts.com that illustrates the rising fees into 2024.

If you already understand UTXOs, feel free to jump ahead to “What is Bitcoin UTXO Management” or watch the video below:

What Are UTXOs?

Unspent Transaction Outputs, or UTXOs, represent specific amounts of Bitcoin that you have received but not yet spent. Each UTXO is like an individual bill in your wallet, each with a unique value.

For example, a balance of 0.52 BTC in your wallet may consist of several UTXOs like 0.2, 0.15, and 0.17 BTC. Each UTXO is distinct and can hold any amount of bitcoin. They are the pieces of bitcoin you haven’t spent yet, and you use them to make new payments.

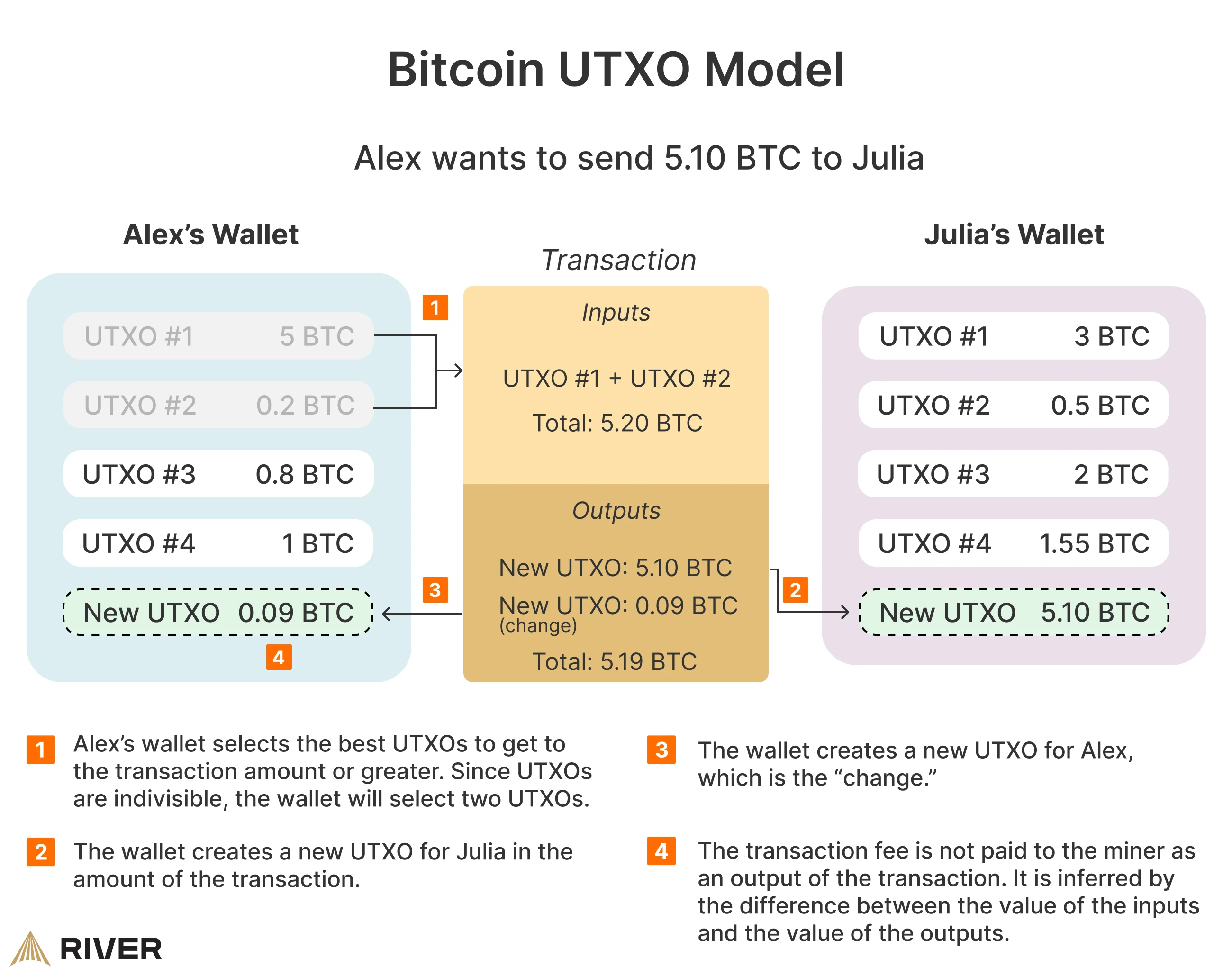

As its name suggests, a UTXO is an output of a bitcoin transaction. An output exists as a UTXO until it is used as an input in a future transaction. When someone sends you bitcoin, what you receive is a UTXO. The bitcoin balance in your wallet is the total of all the UTXOs received.

The UTXO set is the collection of all UTXOs on the bitcoin blockchain at any moment. Bitcoin nodes track this set to agree on identifying existing coins and their owners, helping to prevent the issue of double spending, which had plagued previous attempts at a decentralized digital currency.

➤ Learn more about The Double Spend Problem

How Are UTXOs Created?

UTXOs are created when existing ones are consumed by transactions. Each bitcoin transaction consists of inputs and outputs. Inputs in a transaction use up old UTXOs, while outputs generate new ones. So, if old UTXOs are destroyed to create new UTXOs, how are UTXOs created in the first place? Answer: coinbase transactions. This cycle starts with a coinbase transaction, which miners use to introduce new Bitcoin into the system, creating initial UTXOs without prior inputs.

A coinbase transaction is a special type of transaction that creates new bitcoin as a reward for the miner of a block. Since this transaction is creating new bitcoin, the coinbase transaction has no inputs and one or more outputs. Like all normal outputs, the output of a coinbase transaction is a new UTXO.

Each UTXO has the following characteristics:

- A fixed value

- Tied to a bitcoin address

- A transaction ID that created the UTXO

How Do Bitcoin UTXOs Work?

When you make a new transaction, your wallet will select enough UTXOs to cover the transaction amount. Since UTXOs cannot be divided, sometimes you will receive change back as a new UTXO.

Similar to cash payments, you can’t pay someone $5 by ripping a $10 bill in half. Instead, you must pay with the $10 bill and receive the change back. UTXOs work similarly as they must be entirely spent and change is received as a new UTXO.

How Are Bitcoin Transaction Fees Determined?

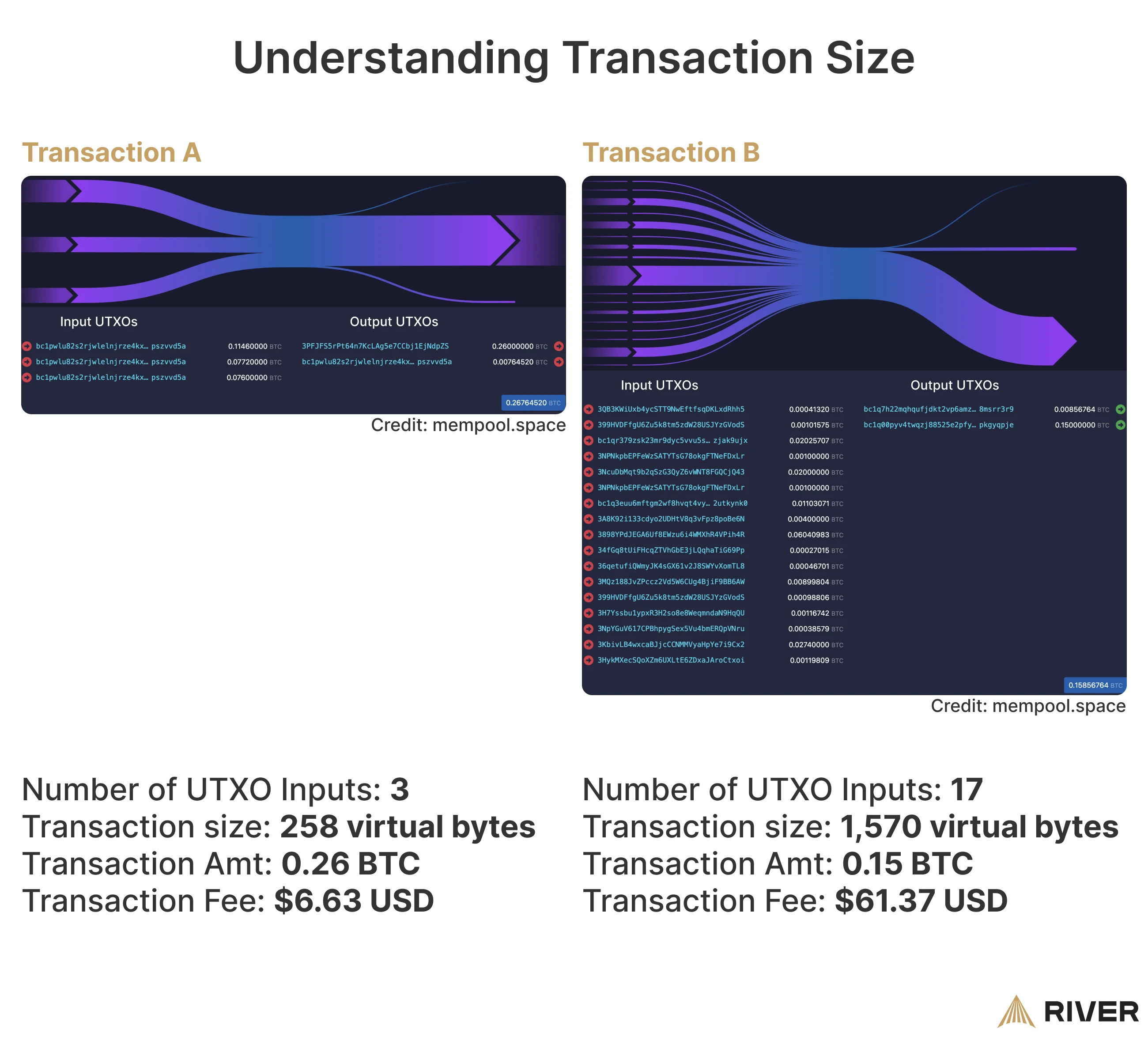

The fee of a bitcoin transaction is determined by the number and data size of the UTXOs involved. For example, using many small UTXOs to make a large payment increases the transaction size and, subsequently, its cost. You can think of this like paying a large bill with many small coins.

Usually, when transactions get more complicated, there can be several outputs. On the other hand, the amount of UTXOs your wallet uses as inputs is determined by how you received those UTXOs from previous transactions.

For example, imagine you consistently receive $5 bills and want to buy a shirt for $100. Your only option will be to use twenty $5 bills to pay for the shirt. On the other hand, if you had a $100 bill, you would only need to use one $100 bill for the transaction. Each bill, or UTXO, takes up space. Thus to get the transaction into the Bitcoin blockchain, you pay higher fees for the transactions with more UTXOs, as you take up more space.

In practice, this means that how much bitcoin you are sending does not influence the fee, and a billion-dollar transaction could have the same cost as a $10 transaction. For example, this $2 billion transaction in 2021 cost only $0.78 in fees.

Transaction A had only 3 inputs while Transaction B had 17 inputs. This resulted in Transaction B having a larger data size. Hence, Transaction B costs almost 800% more than Transaction A, despite Transaction B transacting a smaller amount of bitcoin.

What Is Bitcoin Dust?

Bitcoin dust refers to UTXOs (Unspent Transaction Outputs) that are so small in value that spending them is not cost-effective, as the transaction fees would be higher than the value of the bitcoin itself. If you receive small amounts of bitcoin regularly, you will likely have an excessive amount of UTXOs, risking that you accumulate Bitcoin dust. Thus, Bitcoin dust is bitcoin that essentially becomes unspendable, hurting your bitcoin portfolio. While the threshold on what amount is considered dust changes based on network activity, a common rule of thumb is to have no less than 500,000 satoshis as a UTXO.

Now that you understand UTXOs and what impact they have, let’s explore how to manage them to save on fees.

Why Are UTXOs Important?

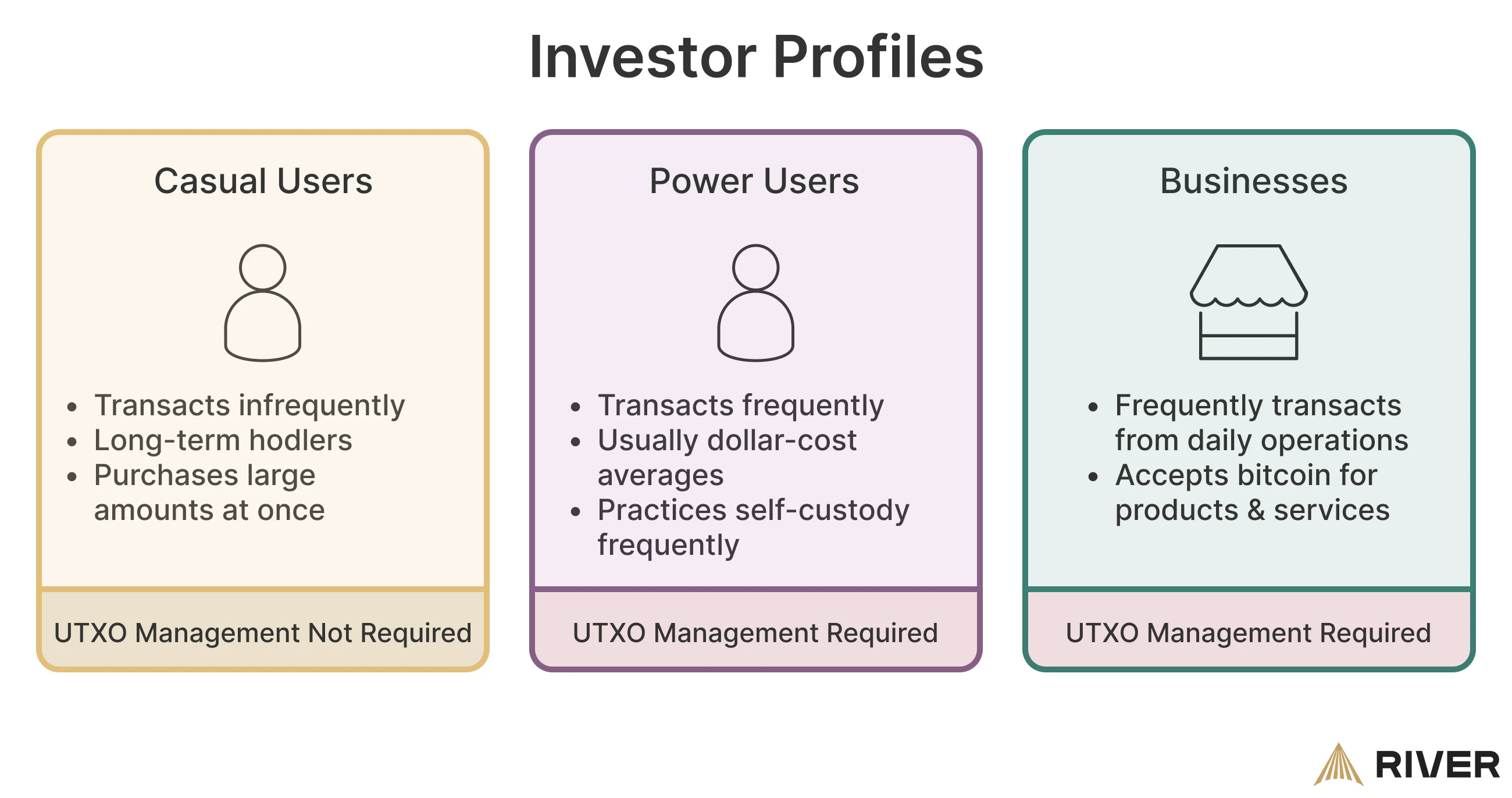

Being conscious about your UTXOs depends on what kind of Bitcoin user you are.

- For individuals who interact less frequently and HODL bitcoin as a long-term investment, active management of the UTXOs may not be necessary. These bitcoin users usually purchase larger amounts of bitcoin at once.

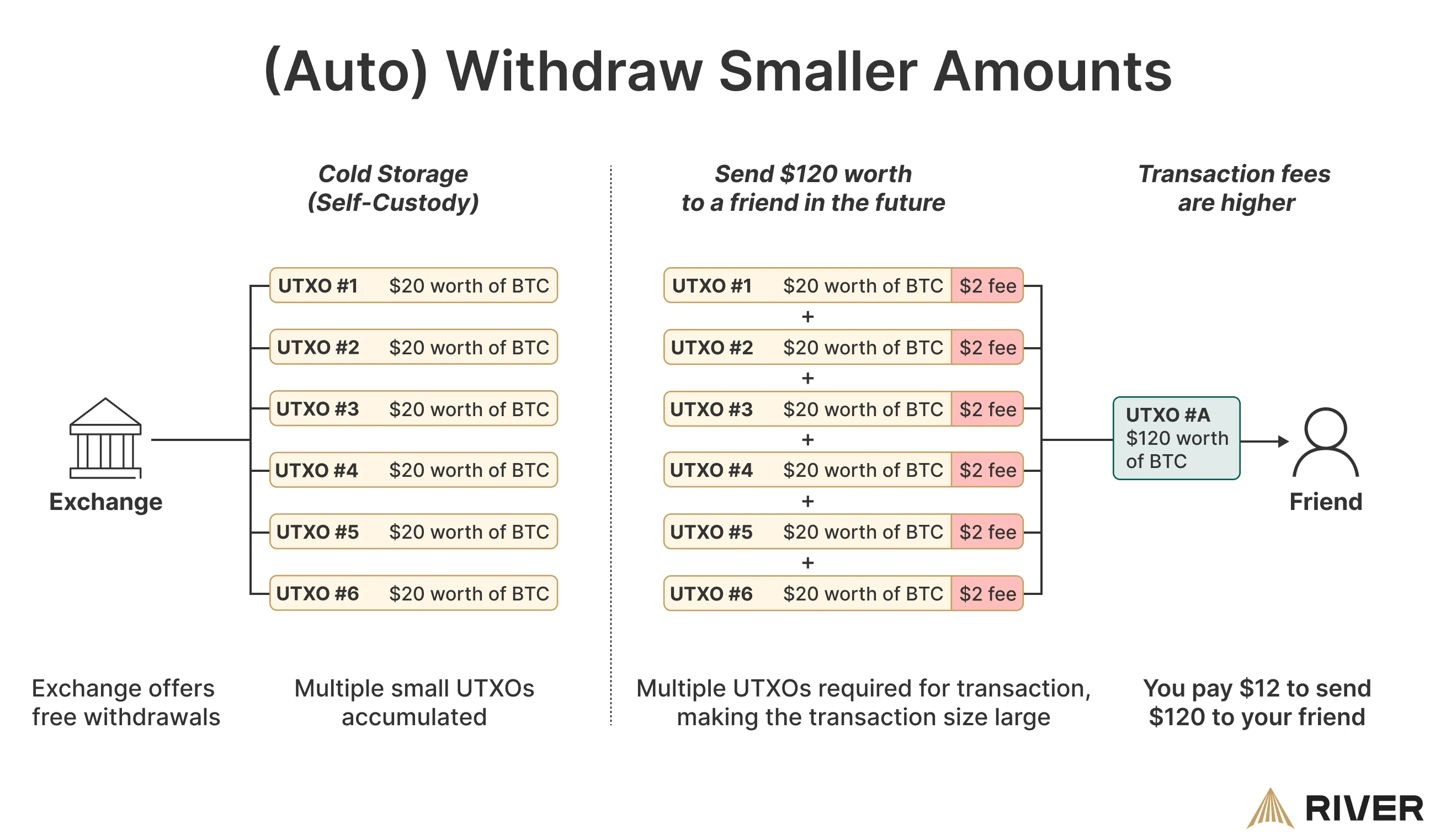

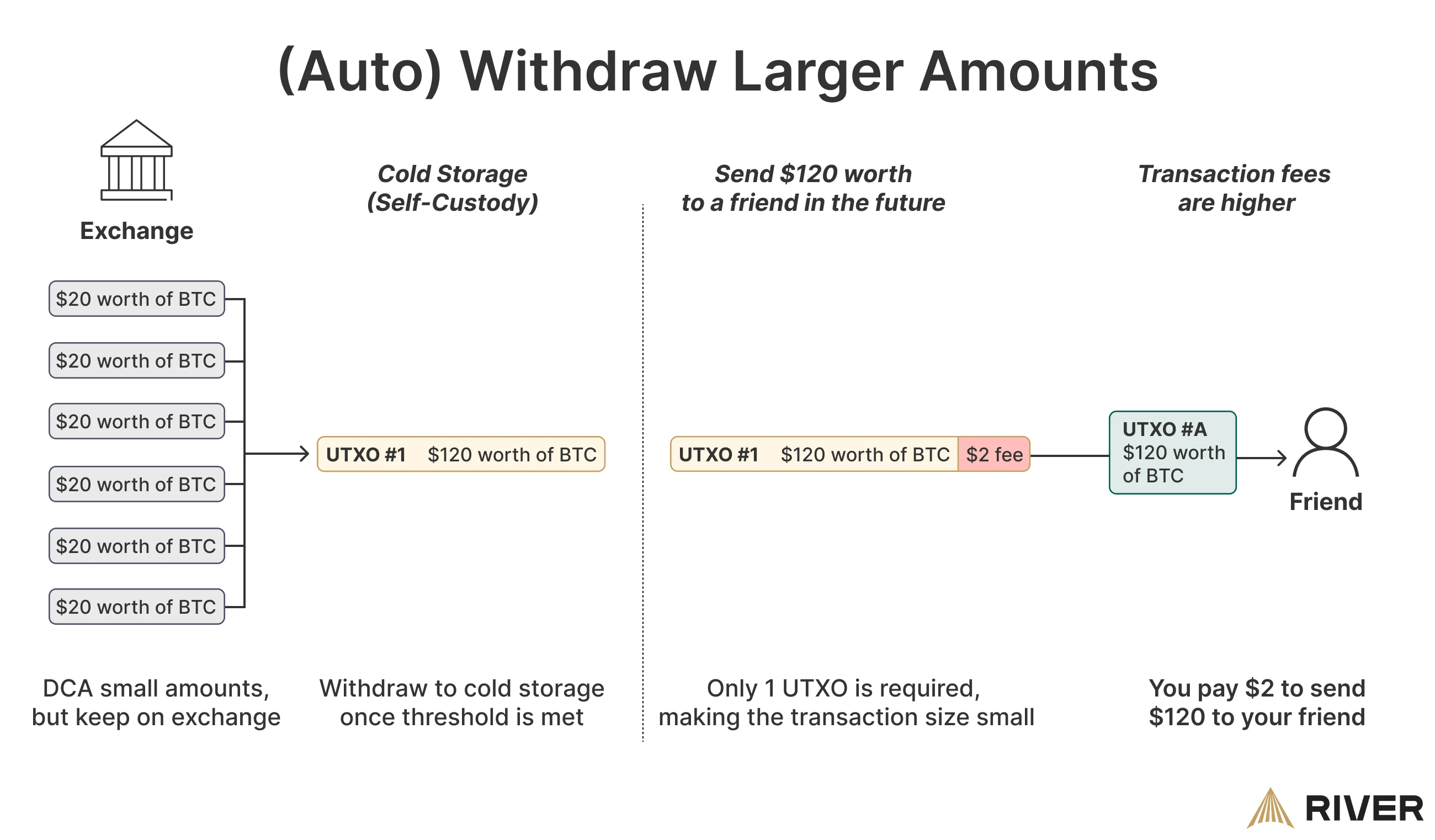

- For individuals that dollar-cost average (DCA), UTXO management is critical because they could end up with a high number of UTXOs. This is especially the case for those that DCA small amounts and automatically withdraw from exchanges into self-custody.

- For individuals or businesses who actively transact in bitcoin for their operations, managing UTXOs is critical for costs.

What is Bitcoin UTXO Management?

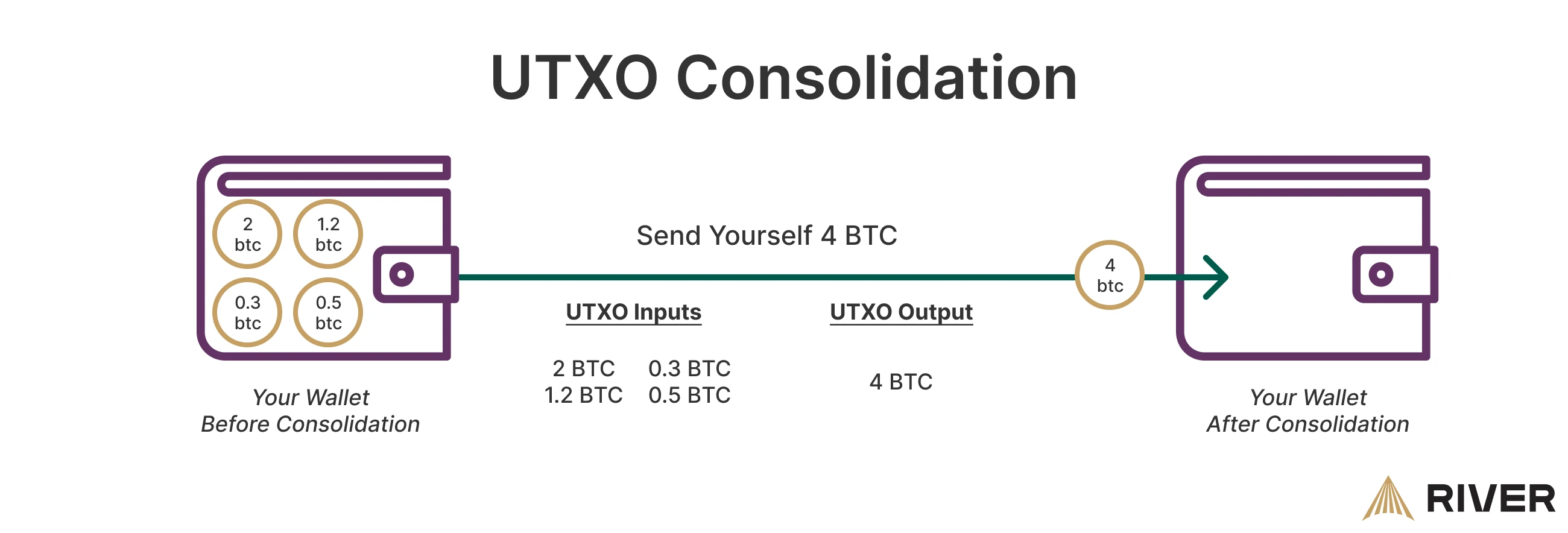

UTXO Management is the strategic handling of UTXOs to improve transaction efficiency and reduce transaction fees. UTXO consolidation is a management technique where multiple UTXOs are combined into a single UTXO.

To consolidate your UTXOs, you simply need to send a transaction to yourself. This transaction will combine all your existing UTXOs and return the total amount as a single UTXO. While this process might seem odd, it effectively makes your bitcoin holdings more efficient for future use.

UTXO consolidation is similar to exchanging multiple smaller bills at the bank for one large bill. While sending UTXOs back to yourself does incur a transaction fee, you could end up saving more in the future.

A Bitcoin wallet automatically selects the lowest number of UTXOs to minimize transaction fees. Some wallets feature advanced options, allowing you to manually consolidate by selecting specific UTXOs. For instance, Sparrow Wallet and Trezor include ‘coin control’ features, enabling you to manage your bitcoin with greater precision.

Benefits of UTXO Management

UTXO management streamlines Bitcoin transactions, offering several key benefits to both users and the network:

- Reduced Transaction Fees: Consolidating your UTXOs lowers the number of UTXOs used in future transactions, potentially cutting down on fees.

- Simplified Management: The overall UTXO set of the network is smaller, which makes it easier to run nodes.

UTXO Management Best Practices

When managing UTXOs, there are certain guidelines to follow.

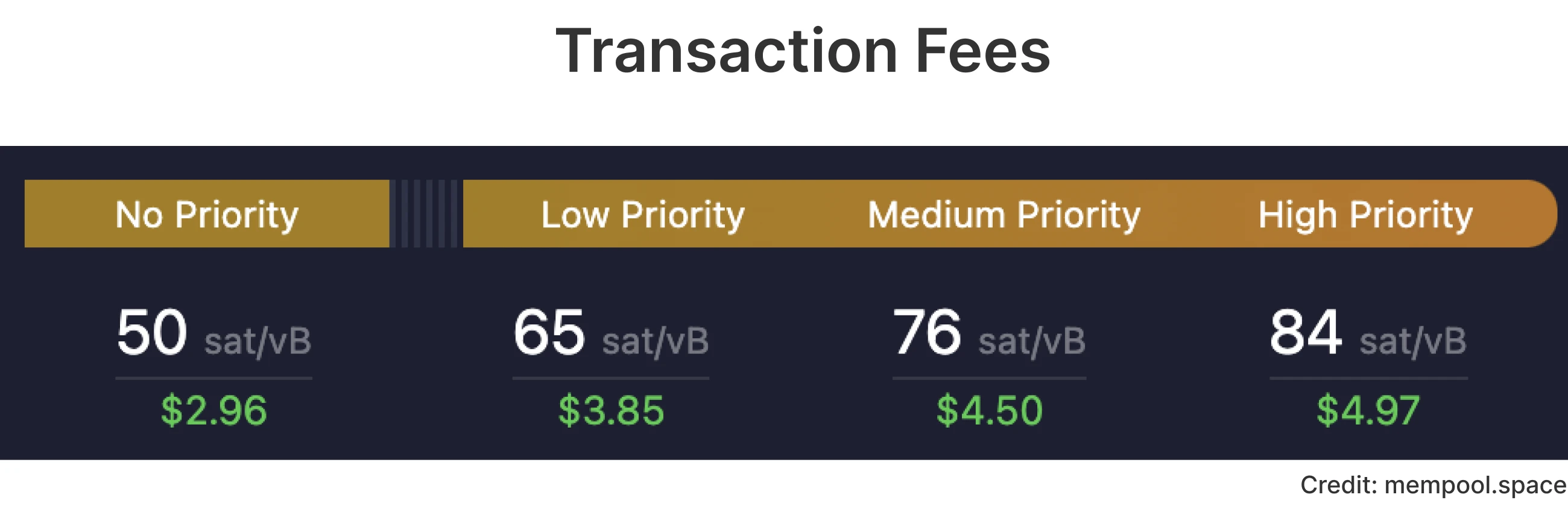

- Consolidate when fees are low: If you fear that you have many UTXOs that you accumulated over the years, wait until the network is less congested before you consolidate. This can feel like paying a fine, but it prevents high fees in the future. You can go to mempool.space to see what the current fees are in the network.

These are not flat-rate fees, but the typical fee of an average transaction size of 140 vBytes. This means that when you consolidate, your transaction fee will likely be higher as it includes a larger amount of data. - Withdraw from exchanges in larger amounts: Many individuals who DCA into bitcoin also enable auto-withdraw to self-custody. Depending on your risk tolerance and investment style, consider increasing the amount of bitcoin you withdraw in each transaction from exchanges.

Determining the right balance for this is a personal decision. For context, at River, we currently have a minimum auto-withdrawal threshold of 0.005 BTC, but if you are comfortable with higher amounts, this may help in the long term. - Label your UTXOs: Some wallets have a feature where you can label your individual UTXOs. This is particularly useful for consolidation purposes.

Using Lightning Network as an Alternative to UTXO Management

Transacting on the Lightning Network can be an alternative to UTXO management for small transactions. However, you still have to pay the on-chain transaction fee for transferring the bitcoin into or from a lightning channel. On the other hand, you can decide to accumulate a certain amount of bitcoin on Lightning before transferring it back on-chain.

UTXO Model Vs Accounts Model

The UTXO model and accounts model are two distinct systems used to record and manage transactions.

- UTXO Model: the balance in a user’s wallet is not a single figure like in a balance in a bank account. Instead, it’s the total of all “unspent” outputs from previous transactions that the user can spend. The UTXO model doesn’t adjust a stored balance figure with each transaction. Instead, it keeps track of individual pieces of bitcoin (UTXOs) that have been received and not yet spent.

- Accounts Model: it is a balance-based approach similar to traditional banking. When a transaction occurs, the system simply deducts the specified amount from one account and adds it to another, directly adjusting the balances. Most traditional financial systems, like your bank, use the accounts model.

The account model comes at the cost of transparency and auditability. For example, auditing the total supply of U.S. dollars in all bank accounts is impossible. Users in account models also risk chargebacks and overdrawn accounts.

Since a bitcoin transaction must reference the exact UTXOs being spent, there is almost no possibility of an invalid transaction being added to the blockchain. The UTXO model makes Bitcoin more auditable, transparent, and efficient than traditional financial systems, which rely on accounts, balances, and third parties.

“The inputs of any bitcoin transaction can be traced back throughout history”

Key Takeaways

- Frequently moving small amounts of bitcoin into self-custody can result in exorbitant fees when you spend that bitcoin later.

- UTXO management is key to minimizing transaction fees and avoiding the accumulation of bitcoin dust, particularly for frequent small-amount transactions.

- Consolidate UTXOs when network fees are low and withdraw larger amounts from exchanges, balancing the need for self-custody with transaction cost efficiency.