Last Thursday, bitcoin crashed by 20% to nearly $60,000. Swings of this size are extremely rare, and many people are still wondering what happened.

Below, we’ll break down what we know about the crash, and zoom out to examine the broader context of bitcoin’s ongoing bear market.

Why did bitcoin crash?

There are many theories circulating about what caused the sudden drop, including large exchange failures and market manipulation. So far, there’s no evidence that any of this actually occurred. Here is what we do know:

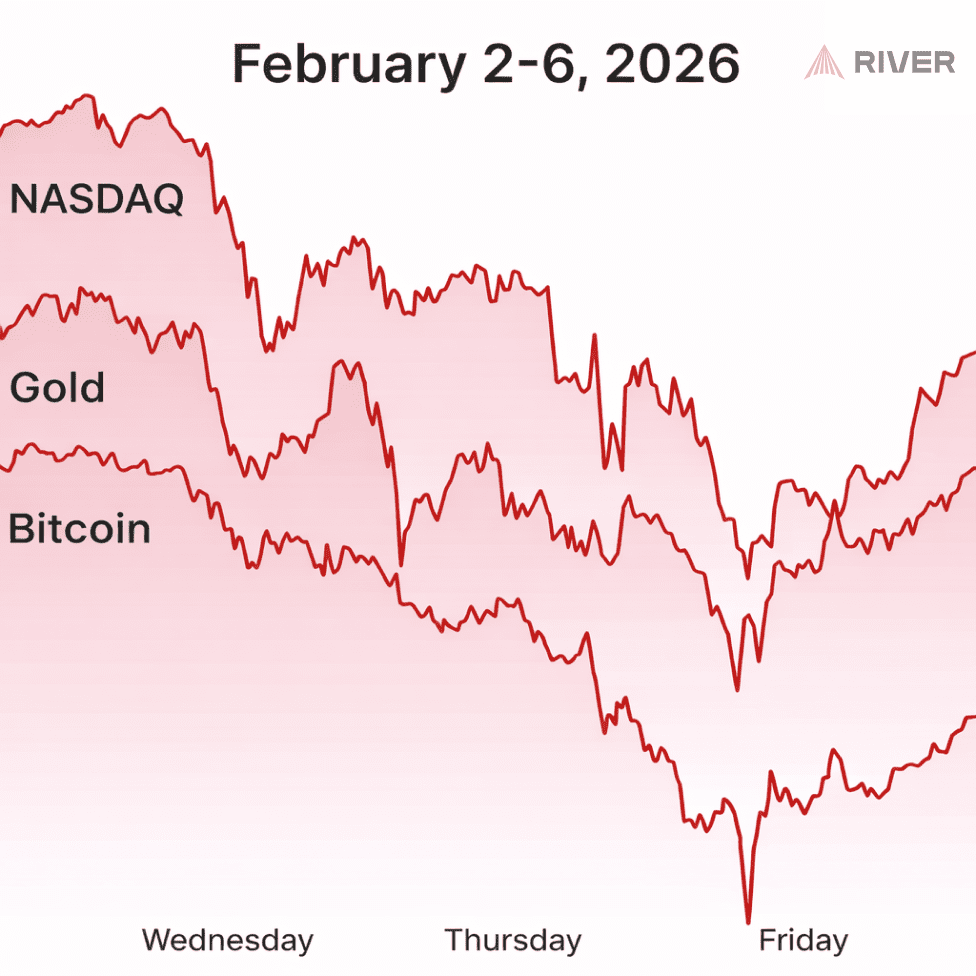

The setup: Over the last month, assets such as gold, silver, and tech stocks have been extremely volatile. When the entire market is volatile, different asset classes usually move in lockstep. At the beginning of last week, bitcoin was already moving in high correlation with stocks and gold, as shown in the chart below.

The catalyst and crash: After a week of poor earnings from stocks and worsening outlooks, traders moved to reduce risk across their portfolios. Stocks sold off Thursday morning, dragging bitcoin lower alongside broader markets.

Bitcoin’s decline was then amplified by record-setting activity in the options and futures markets, which are typically dominated by institutional investors such as hedge funds and market makers. Options tied to BlackRock’s IBIT ETF traded at roughly ten times their average volume since launch.

As bitcoin’s market capitalization has grown, it has become increasingly attractive to Wall Street institutions, particularly given the expanding suite of derivative products that can amplify leverage or support more sophisticated trading strategies. This financialization of bitcoin can lead to short bursts of extreme volatility that are difficult to fully dissect in real time.

What is clear, however, is that the selloff was not driven by any deterioration in bitcoin’s underlying fundamentals.

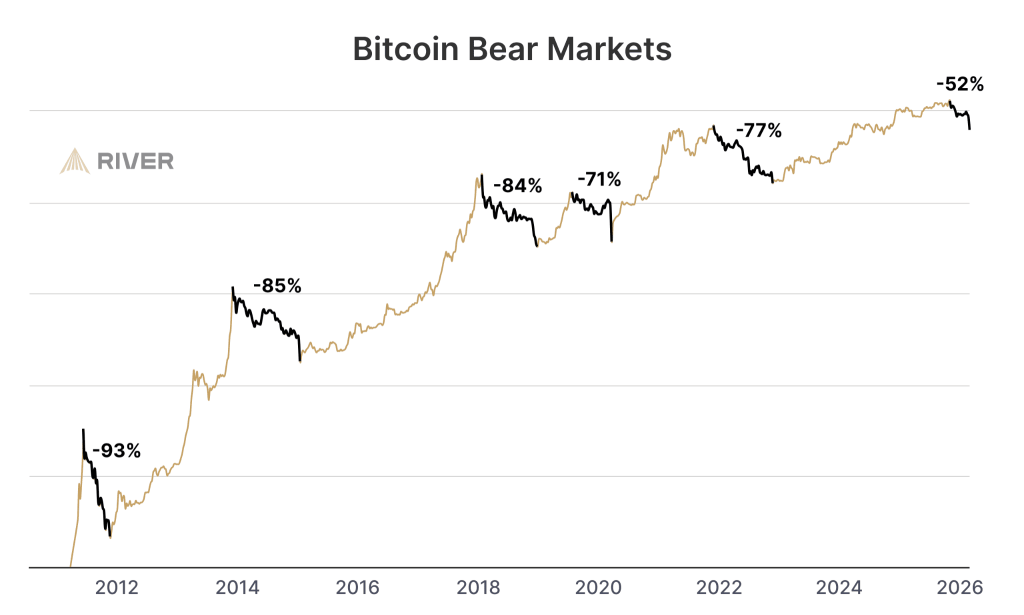

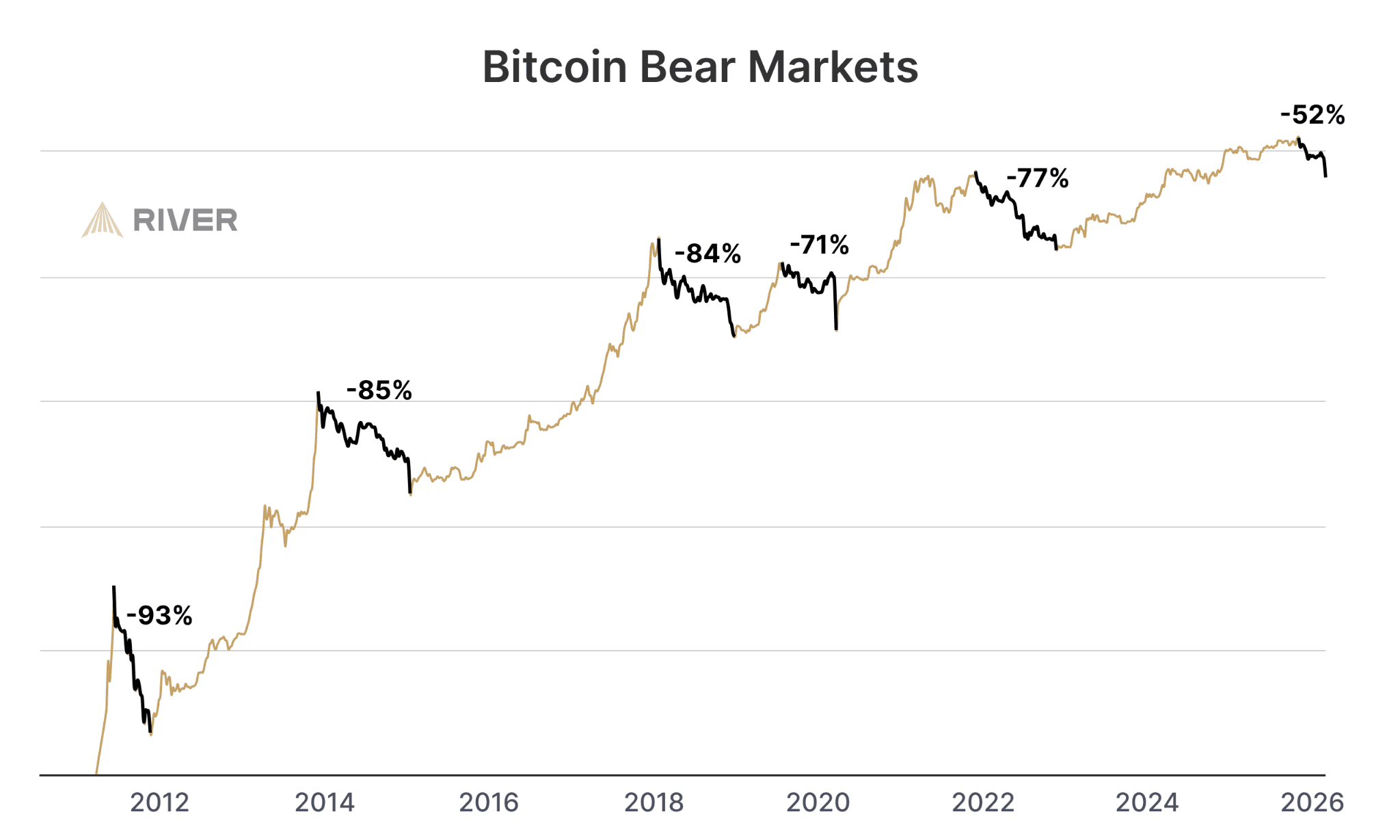

Bitcoin is in its sixth bear market

Zooming out, it’s now clear that bitcoin is in a bear market:

- It’s been 127 days since bitcoin’s last all-time high on October 6th.

- Bitcoin was down as much as 52% from all-time highs on Thursday.

- So far, it hasn’t been as long or deep as the five previous bear markets.

For years, many in the Bitcoin community believed its price follows predictable four-year cycles. That framework has clearly broken down. It’s impossible to know whether bitcoin has already found a bottom, and investors should be skeptical of anyone claiming certainty about where its price is headed.

If you’re trying to figure out what to do, remember the basics of responsible investing:

- Don’t invest more than you can afford to lose.

- Avoid speculating on bitcoin’s price in the short term.

- Keep a long-term mindset.

How River clients are reacting

For long-term investors, periods like this are great opportunities and many of you are already making the most of it. Here’s how River clients responded since Thursday’s historic price action:

- A majority of trading volume has been from clients buying the dip.

- Clients who had set up target price orders to prepare for lower prices ended up buying 4x the average of the past three months.

- Over 24% of all zero-fee recurring buys are supercharged, helping clients double down on the dip automatically.

Why so much buy action?

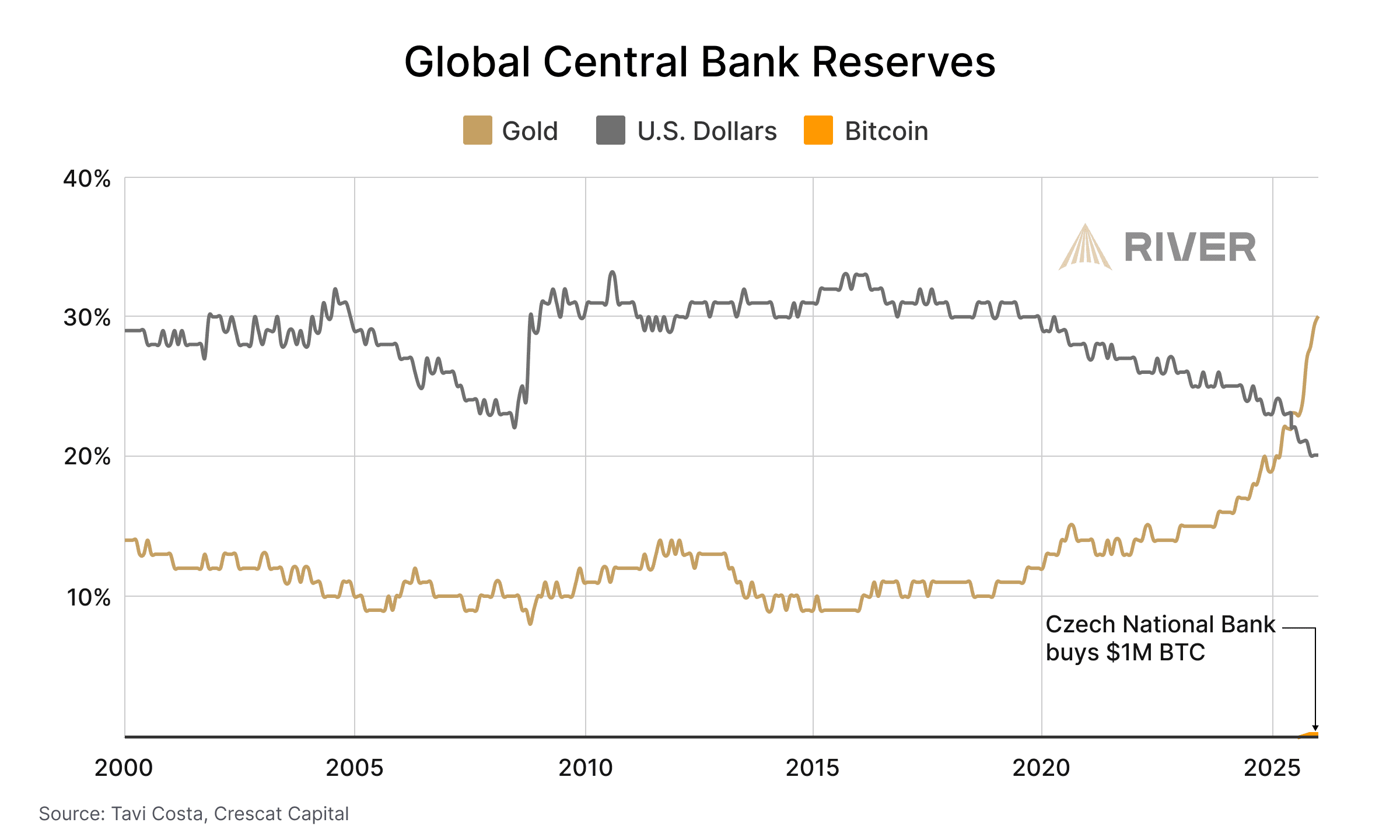

Because Bitcoin’s long-term thesis remains intact.

It’s still a scarce asset in a world defined by relentless money creation. Over time, more people are bound to recognize that.

You must be logged in to post a comment.