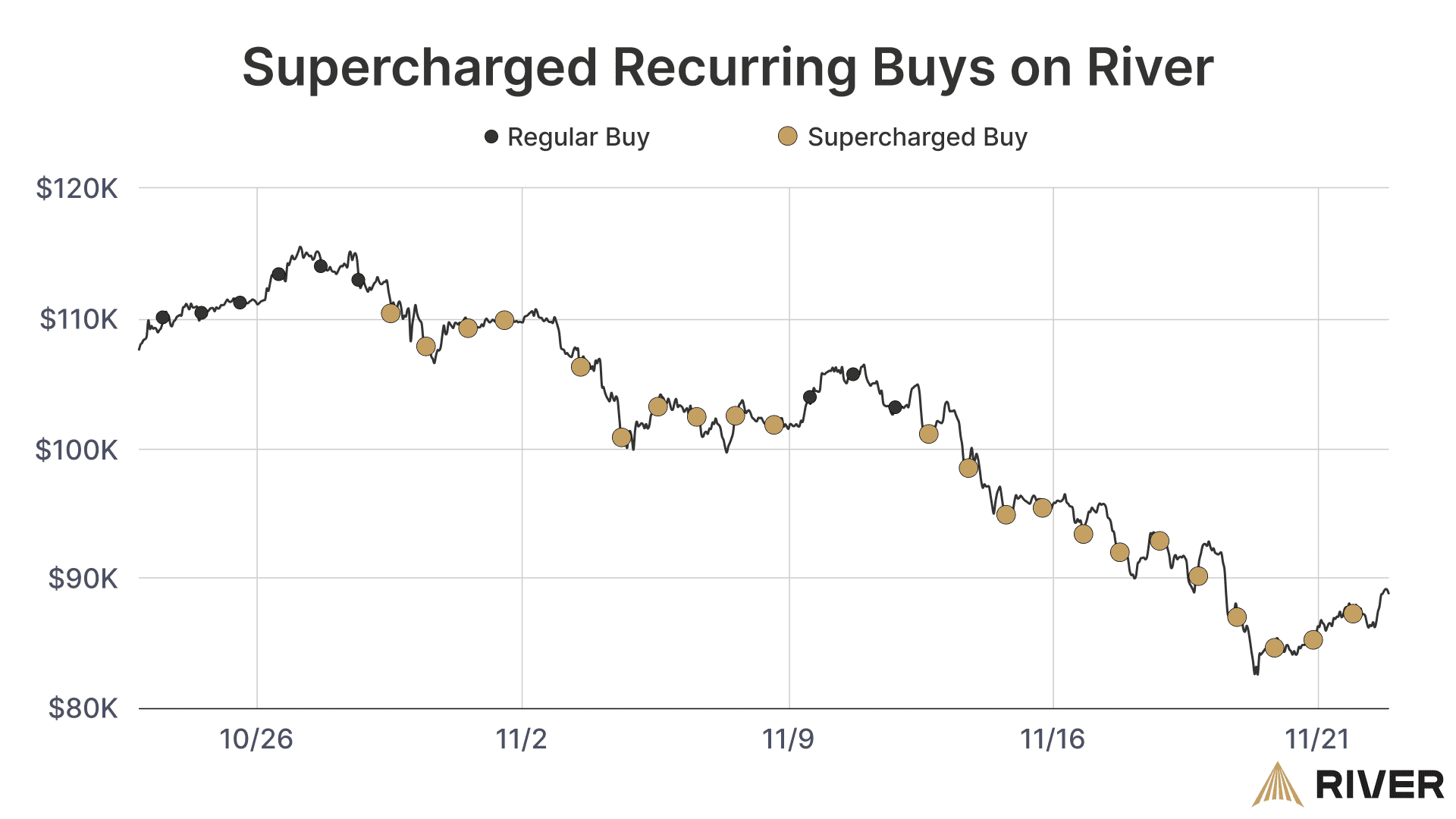

It turns out timing your recurring buys can actually give you an advantage.

More on this and how the largest bitcoin holders have shifted their positions in this newsletter.

What’s the best time to regularly buy bitcoin?

Recurring bitcoin purchases, often referred to as dollar-cost averaging, are a popular investment strategy because they remove the stress related to timing the market. Many River clients happily follow this “set it and forget it” strategy, and benefit from zero fees on their recurring buys.

But does the timing of a recurring order matter? Are there certain times of day or days of the week when you consistently get more bitcoin for your dollar? To find out, we dug into bitcoin’s historical price data.

For daily and hourly recurring buys, timing has little impact on price. The difference between the best and worst times to place a daily recurring buy is less than 0.1%.

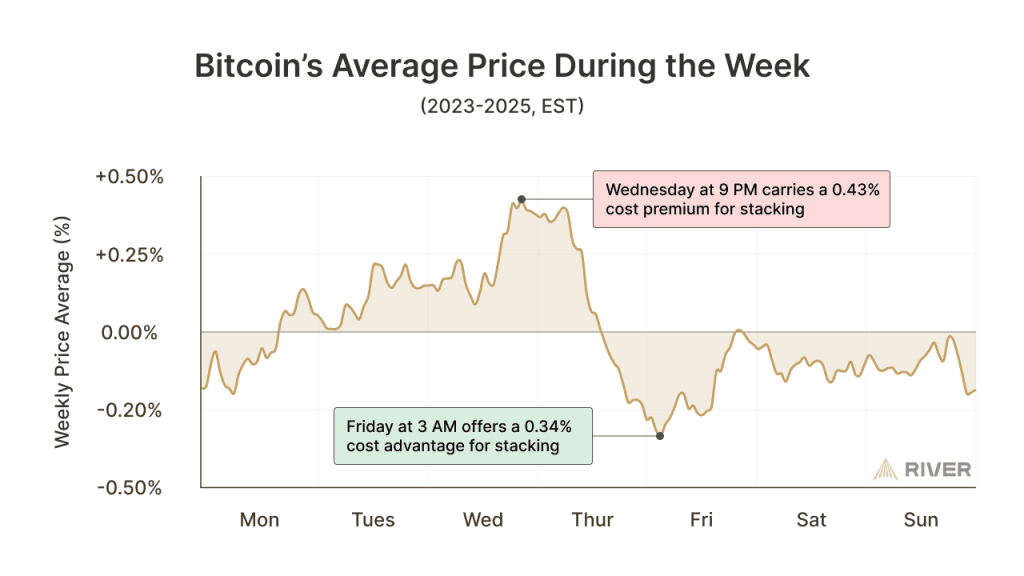

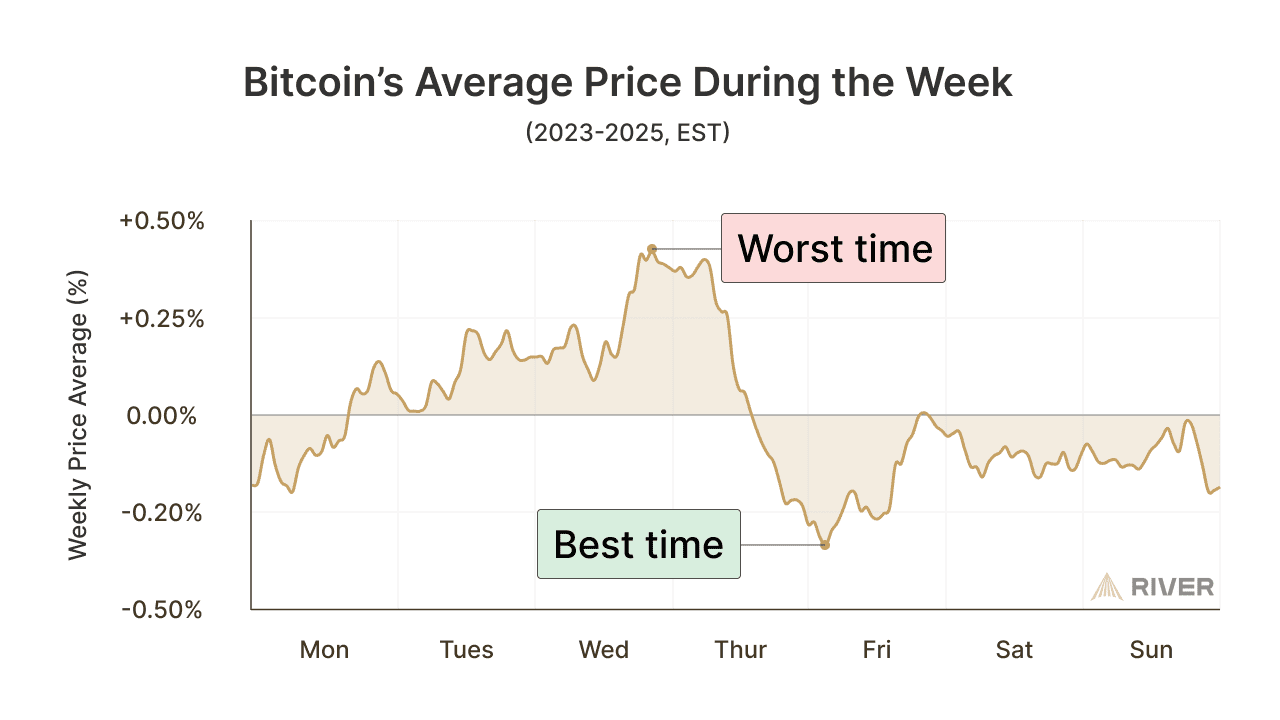

Weekly recurring buys, however, have a difference of 0.77%.

Based on bitcoin’s historical price data since 2023, Friday at 3:00 a.m. ET has been the most favorable time to place a weekly recurring order. On average, buying bitcoin at this time has been 0.34% cheaper than placing a weekly order at a random time.

In other words, a $100 weekly recurring buy from January 2023 through October 2025 would have resulted in $253 more bitcoin acquired at the best time compared to the worst.

Why might this be the case?

Early Friday mornings fall during a quieter part of the global trading week. U.S. markets are closed, Europe hasn’t fully opened, and many traders are reducing risk ahead of the weekend rather than adding new positions. While Bitcoin operates 24/7, Bitcoin ETFs can only be traded during business hours. The combination of these factors can lead to softer prices and fewer aggressive buyers, which helps explain why recurring buys placed at this time have, on average, been a bit cheaper.

Wednesday nights, on the other hand, line up with the start of the Asian trading day and a more active part of the week. New liquidity is entering the market, traders are more willing to add exposure, and prices are often pushed slightly higher as a result.

Weekends typically being a bit lower on average also makes sense. Since most assets can’t be traded during weekends, bitcoin is often the first to react to geopolitical events that cause unrest among investors.

Of course, there’s no guarantee that Friday mornings will continue to be the best time to buy. And a 0.34% cost advantage won’t meaningfully change long-term outcomes on its own. Still, it may be a useful consideration the next time you set up a weekly recurring buy.

Check out our new research if you would like to dive deeper into this analysis.

The largest bitcoin holders are buying

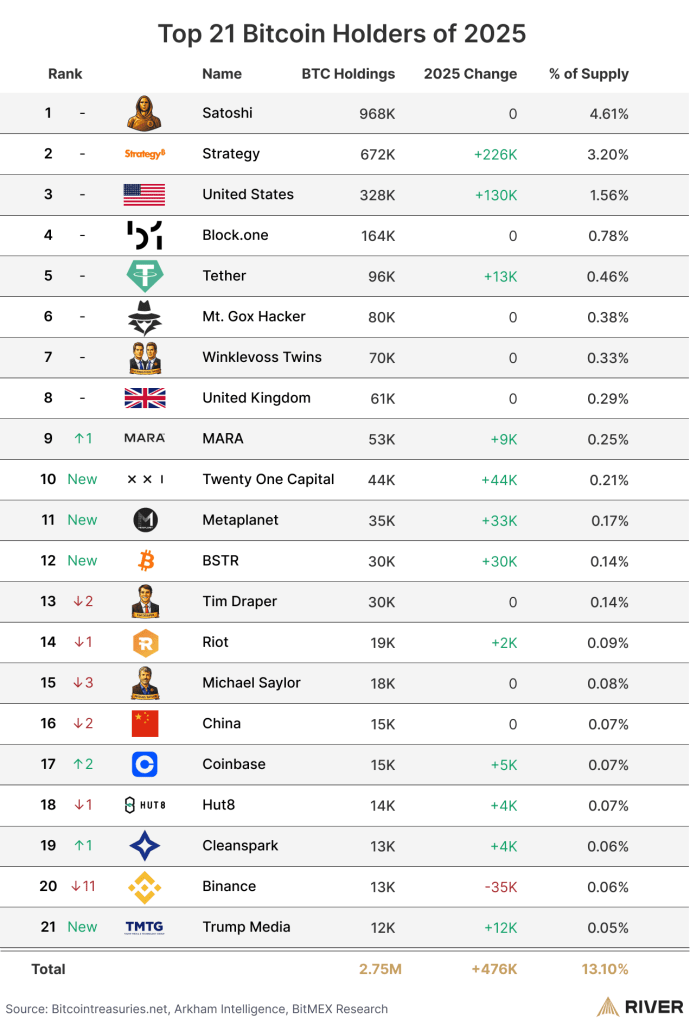

Our yearly list of the 21 largest bitcoin holders shows a stable top 7, four new entrants, and in total 476k bitcoin being bought or transferred towards them.

You may be far from making this list, but if you own any bitcoin at all, you’re already way ahead of roughly 8 billion people. Don’t stress it and keep stacking!

Thanks for trusting us with another year of your bitcoin journey. We’re here to help you keep building for the long term.

You must be logged in to post a comment.