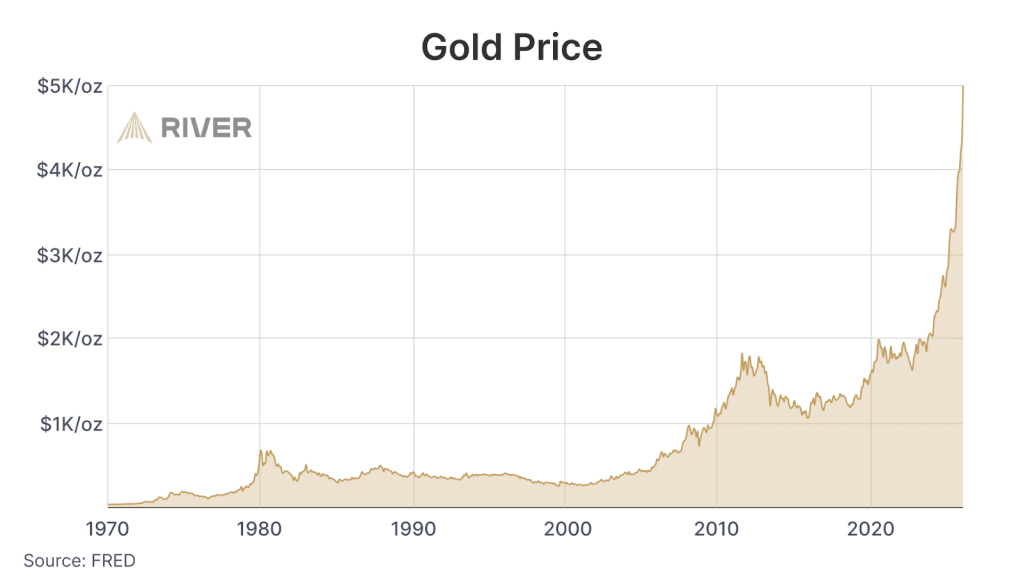

Gold has been on a tear, soaring to over $5,000/oz and doubling in a year. You’re either feeling pretty good about owning some, or wondering why bitcoin hasn’t joined in (yet). So what’s happening in the precious metals space, and what does it mean for bitcoin?

The primary purpose of gold and silver

Gold is primarily used as a hedge against inflation and government spending, just like bitcoin.

Most of the world was on a gold standard until 1971, when President Nixon removed the dollar’s peg to gold. Our Learn Article explains why this single political decision still affects our lives and the economy today.

In fact, if you look at the price of gold since 1971, it looks eerily familiar to that of bitcoin.

Silver is also a store of value, but is used far more as an industrial commodity, making it behave differently than gold. It’s a key input in electronics, solar panels, electric vehicles, medical equipment, and other critical technologies.

Why gold and silver are rallying

So why have gold and silver rallied so much in the past year? And why isn’t bitcoin doing the same thing?

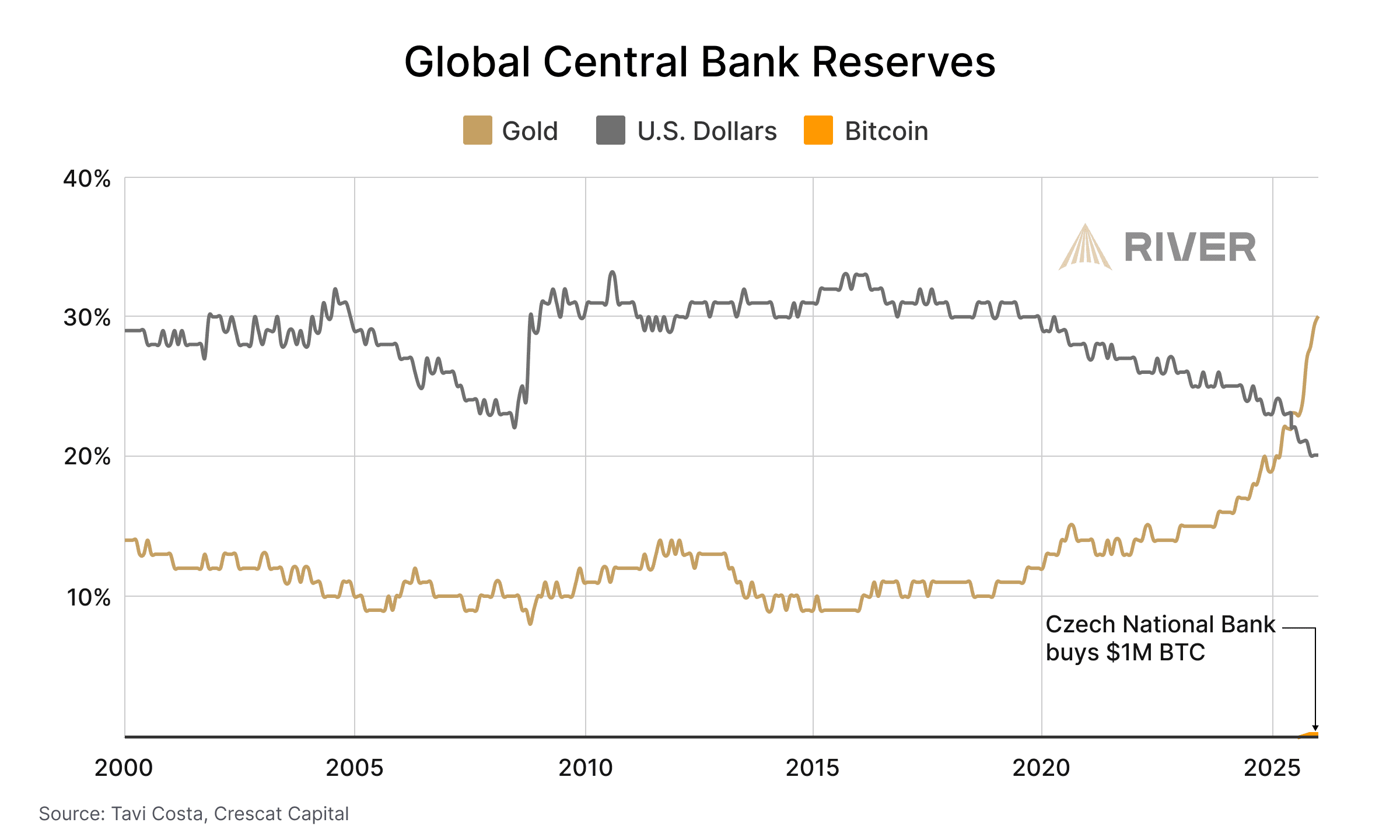

The largest holders of gold today are central banks. They hold trillions of dollars worth of US dollars, foreign currencies, and gold to promote trust in the value of their own currencies

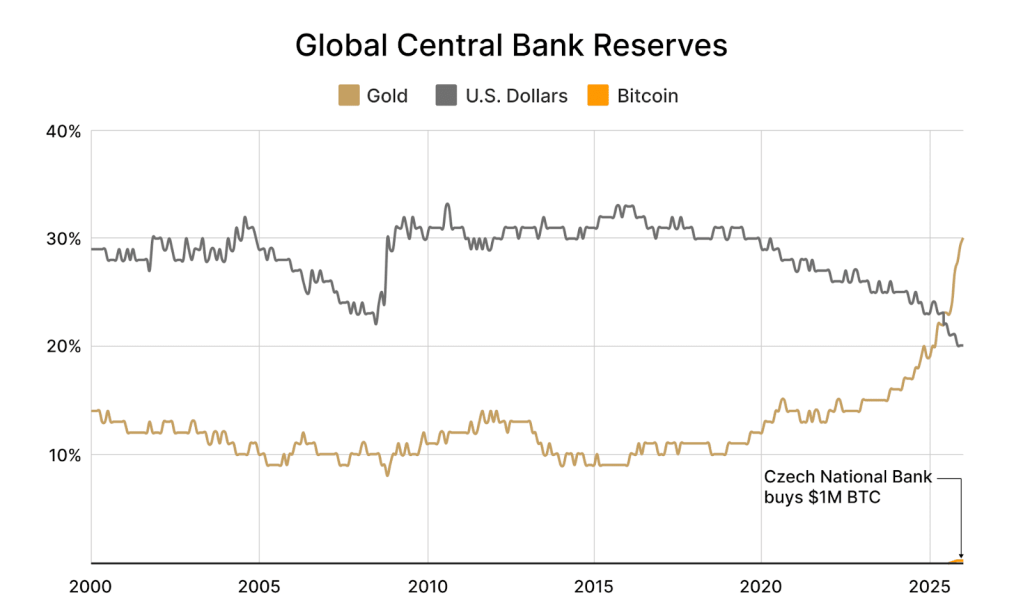

Up until 2020, US dollars (more specifically, US government bonds) were the main global reserve asset. Dollars made up the largest portion of central bank reserves by a long shot. Over the past 6 years, however, central banks have been reducing their holdings of US dollars and buying gold instead.

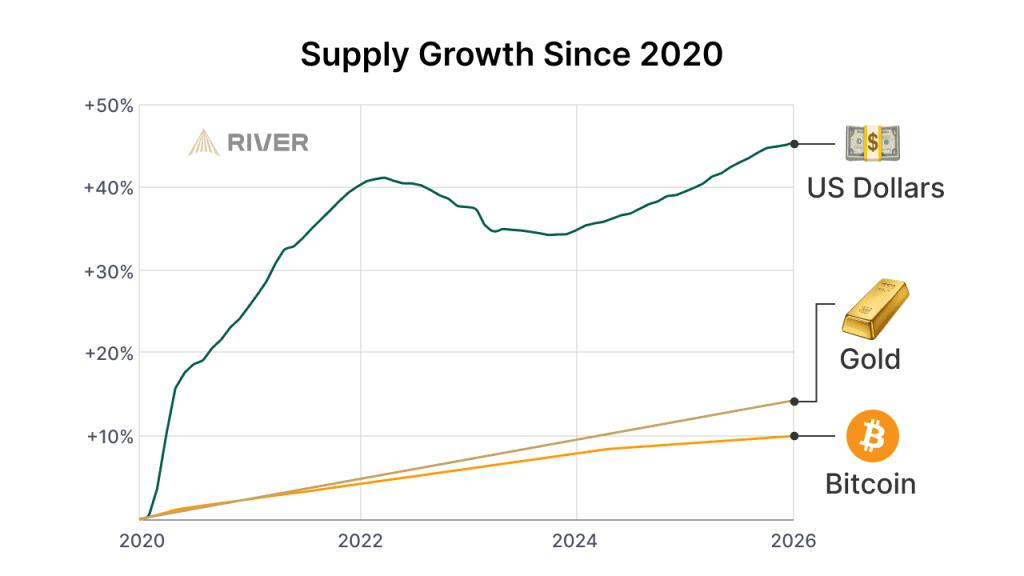

This is because after decades of government overspending and inflation, foreigners have less trust that the US dollar will maintain its value, and would rather own something scarce.

At some point over the past year, gold overtook dollars as the primary reserve asset of central banks. The last time it held this position was over 50 years ago.

Central banks have enormous amounts of money and the power to print more of their own currencies. The price of gold is rallying simply because it is being bought by the largest and most powerful entities in the world.

Silver is a bit more complicated. While silver is a store of value, it isn’t owned much by central banks. Instead, it’s being bought by smaller investors looking for an inflation hedge, and by the manufacturers of cars, electronics, solar panels, etc.

The problem is that when silver gets more expensive, it raises the cost of many things we use like cars and electronics. Those higher costs eventually get passed on to consumers, pushing prices up across the economy.

Where Bitcoin fits in

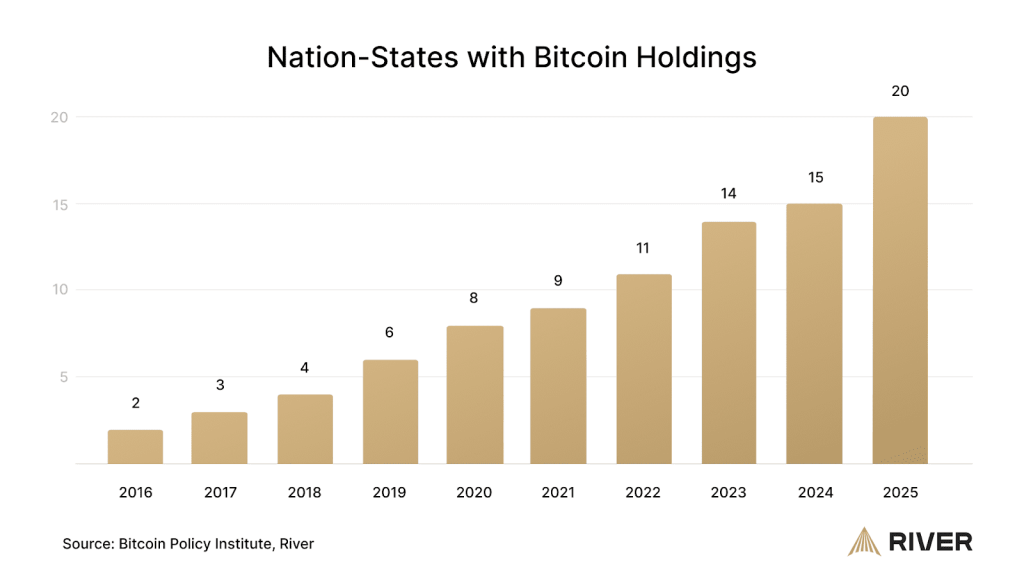

Bitcoin remains just a blip on the radar of central banks, while gold is taking all of the attention. This isn’t a bad thing.

Most institutions still haven’t bought bitcoin. Some don’t really understand it, some aren’t allowed to invest because of politics or regulation, and others are just waiting for someone else to go first. That hesitation gives the rest of us a huge opportunity. Bitcoin is still mostly owned by individuals, but that probably won’t last forever.

In November 2025, the Czech National Bank became the first central bank to buy bitcoin with a $1 million “test” transaction. That makes the Czech Republic the 20th nation-state to own bitcoin. If the current trend of nation-state bitcoin adoption continues, central banks may view bitcoin the same way they view gold in just a few years.

After all, bitcoin is the most scarce asset on the planet: Only 1 million bitcoin can still be mined in the future, whereas major new gold deposits are found each year.

Gold does have real advantages over bitcoin. It has thousands of years of history, universal recognition, and deep liquidity. Central banks understand it, trust it, and can hold it without worrying about political backlash.

But bitcoin has advantages gold simply can’t match. It’s provably scarce, easy to verify, cheap to store, and can be moved anywhere in the world instantly. You can send bitcoin across borders in minutes and self-custody it without relying on vaults or intermediaries.

Owning both is perfectly reasonable. But in a world that’s becoming increasingly digital, bitcoin is built for how money actually moves today. Over the long run, that’s why bitcoin is likely to win out.

You must be logged in to post a comment.