Bitcoin has become a household name, but have you ever wondered who is responsible for creating it? The process of creating new bitcoin is known as mining. But how do miners contribute to the creation of new bitcoin? In this article, we’ll explain the fundamentals of bitcoin mining, explore the technology and energy behind it, and discuss the rewards and challenges faced by miners.

Bitcoin Created Through Mining

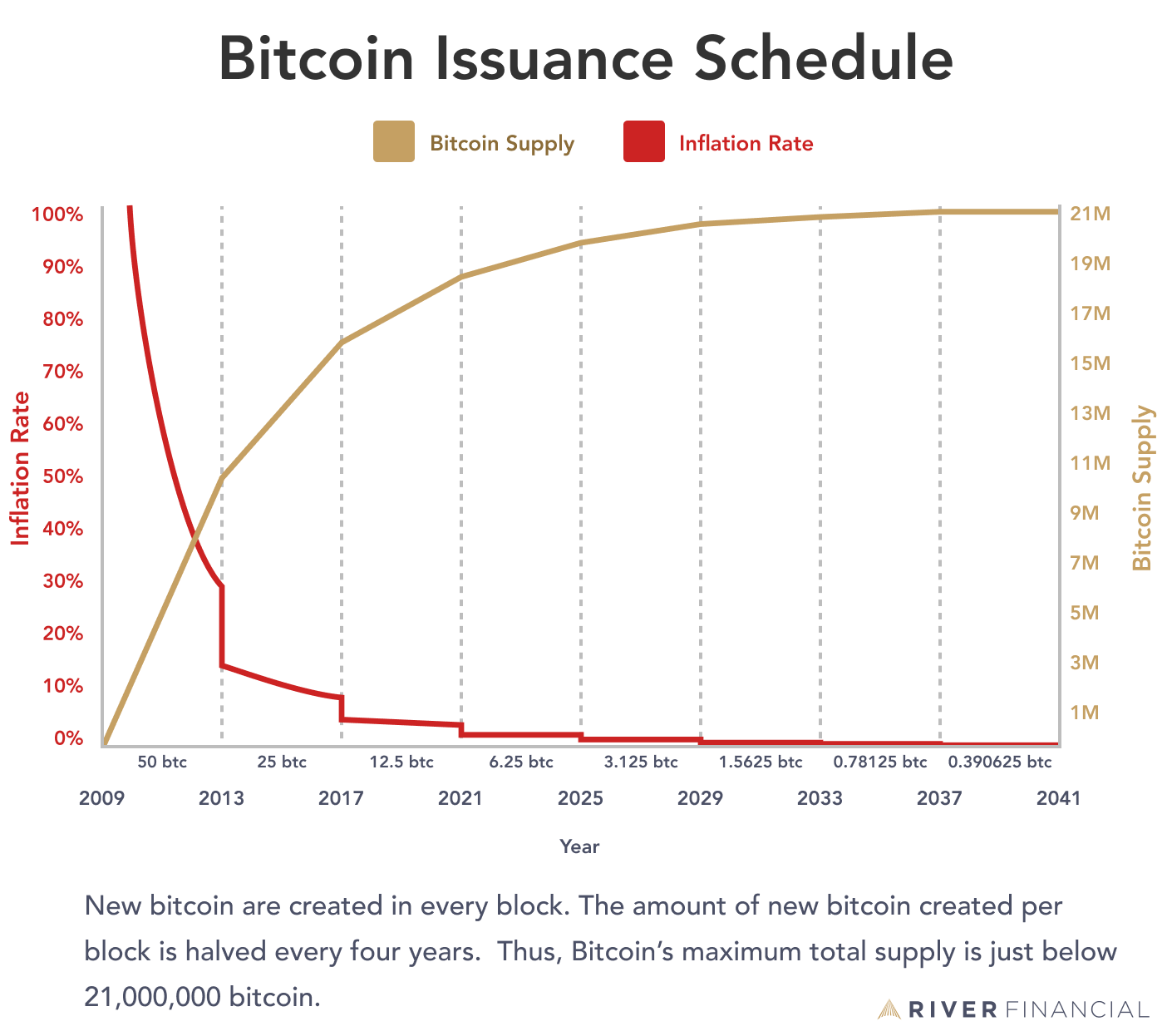

New bitcoin are released through mining, which is the process of confirming Bitcoin transactions and securing the entire historical record of transactions known as the blockchain. When a miner finds a new block, they are rewarded 3.125 BTC. Every 210,000 blocks, the subsidy for each new block falls by half.

Reducing the subsidy per block keeps the supply of new bitcoin at a constantly decreasing rate, and allows the current supply of bitcoin to always be known.

➤ Learn more about Bitcoin mining.

Bitcoin has a finite supply just below 21 million bitcoin. When the last bitcoin has been mined, the production of new bitcoin will end. Unless an overwhelming majority of the miners and node operators can convene to override the supply constraint, which is highly unlikely given the number of network participants required to change the rules in the software, no new bitcoin will be released.

➤ Learn more about what will happen after all bitcoin are mined.

Bitcoin Distribution

Miners receive new bitcoin as a reward for their efforts. However, almost all miners must pay their operating costs—new equipment, employee salaries, and most significantly, energy costs—in the local fiat currency. This forces most miners to immediately liquidate some if not all of their newly minted bitcoin. These new coins are sold on exchanges or OTC desks. Miners are thus a fairly consistent source of sell pressure on the network.

➤ Learn more about Bitcoin mining profitability

As Bitcoin’s inflation rate continues to be cut in half every four years, the impact of this miner-driven sell pressure will presumably decline as well. Additionally, if Bitcoin gains adoption within the energy sector, miners could begin paying some of their operating costs in Bitcoin.

Key Takeaways

- 3.125 new bitcoin are currently released roughly every ten minutes.

- New bitcoin are released when a miner produces a new block.

- The finite supply of Bitcoin will prevent new bitcoins from being released after the last bitcoin has been mined