By the year 2140, all 21 million bitcoin will have been mined. After that, no new bitcoin will be created, and miners will no longer earn rewards for adding new blocks to the blockchain. Instead, their income will come only from transaction fees paid by users. This could lead to higher fees, as miners need to stay motivated to secure the network and process transactions.

Some people worry that transaction fees might not be enough to keep the network secure. While this concern is understandable, the continued growth of Bitcoin’s adoption shows that a strong fee market is possible.

Is Bitcoin Scarce?

Bitcoin is unique because it has absolute, mathematical scarcity. This means there will only ever be 21 million bitcoin, and anyone in the network can verify this limit. Bitcoin’s source code known as Bitcoin Core, controls this scarcity by rewarding miners with new bitcoin when they create a block.

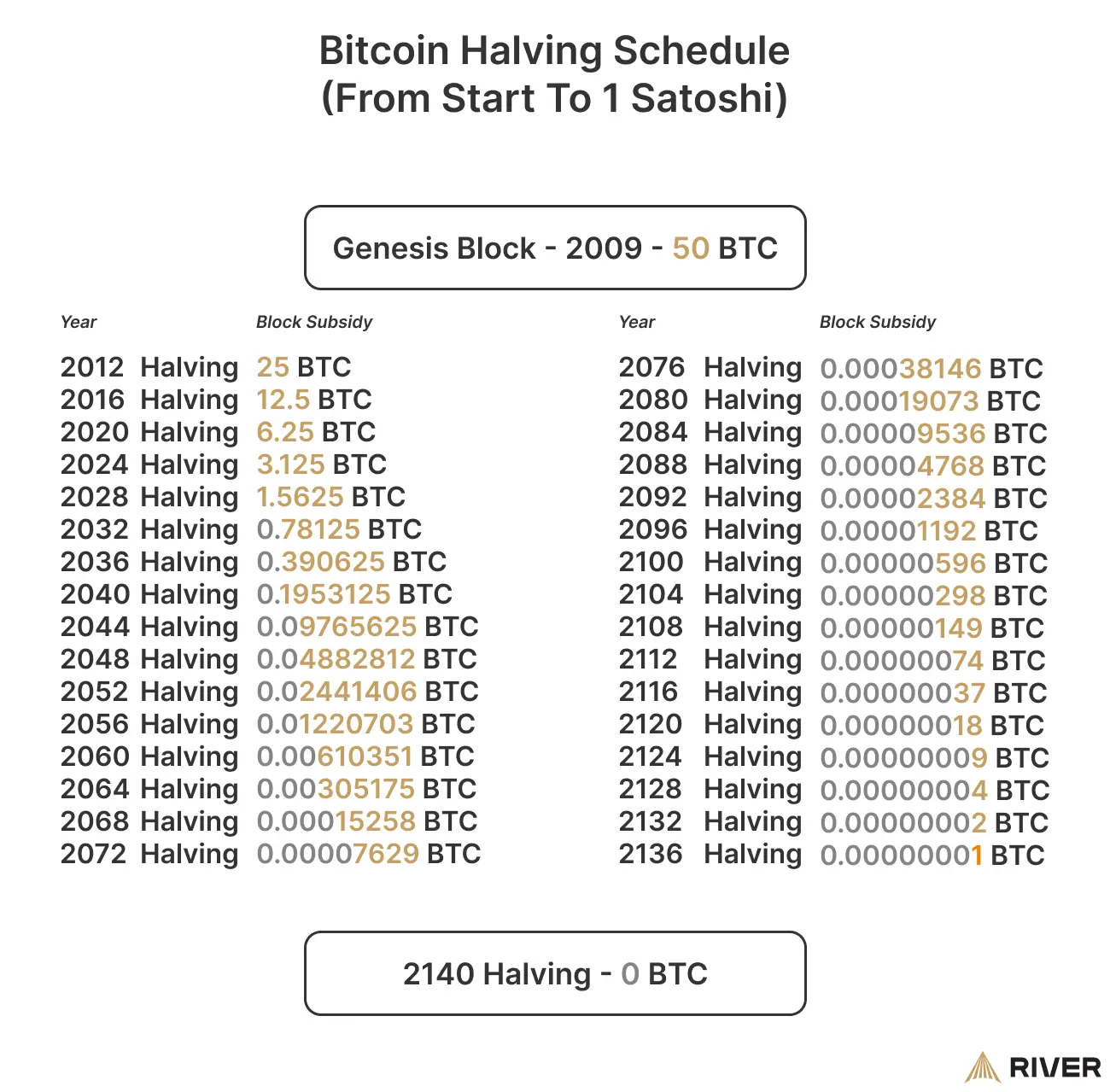

About every four years, the amount of new bitcoin miners get is cut in half, in an event called the halving. This process will continue until around 2140 when no more new bitcoin will be created as the flow of new bitcoin will drop from one satoshi per block to zero.

➤ Learn more about Bitcoin’s halving.

However, due to how Bitcoin handles small numbers, the actual total supply of bitcoin will be slightly less than 21 million because of rounding down when dividing rewards. According to Amberdata, the block reward is 4,882,812.5 satoshis at at block number 2,100,000. However, the reward will be rounded down to 4,882,812 satoshis.

When the halving happens, miners’ income is cut in half, which could make mining less profitable. This could lead some miners to stop mining, which might affect Bitcoin’s security. Skeptics worry that lower miner revenue could reduce security and hurt bitcoin’s value.

Skeptics have also expressed fears of a deflationary currency. As Bitcoin’s inflation rate continuously falls, some economists have claimed that there will not be enough bitcoin on which to base a monetary system and that Bitcoin will never support retail payments due to its high price.

We will address both of these concerns below.

Bitcoin Network Security Concerns

The more mining happening on the network, measured by hash rate, the more secure the Bitcoin network is. When the rewards for miners are cut in half, their income drops, but there are several reasons why miners could continue mine profitably and preserve Bitcoin security despite a halving of the subsidy.

Transaction Fees Become a Primary Source of Income For Bitcoin Miners

Firstly, miners earn income from both the new bitcoin they receive from the block subsidy and the transaction fees users pay. While the block subsidy is cut in half, transaction fees are not. As more people use bitcoin, transaction demand rises, and fees increase, helping miners earn more. This is because only a certain number of transactions can be confirmed every ten minutes. Therefore, the users must bid to have their transactions confirmed in a timely manner.

Technology Makes Bitcoin Mining Efficient

Secondly, Bitcoin mining equipment, called ASICs, is constantly improving at an explosive rate. This allows miners to mine more efficiently and lower their costs, making it easier for them to stay profitable even after a halving.

Cheaper Energy Makes Bitcoin Mining Profitable

Thirdly, miners often set up in regions with cheap energy, like near hydroelectric dams, in order to maximize profits. Bitcoin mining is geographically agnostic as a miner is free to locate their operations wherever the cheapest energy can be found. As renewable and efficient energy sources grow, energy costs could fall, allowing miners to stay profitable.

➤ Learn more about what is bitcoin mining.

It is worth noting that miners do not typically pay the consumer rate for energy. As large customers, typical mining operations are able to negotiate more directly with providers to source the cheapest possible energy.

Difficulty Adjustments Ensure Bitcoin Mining Continues

Fourthly, due to Bitcoin’s difficulty adjustment algorithm, a miner’s expected revenue is dependent on their relative share of the total Bitcoin hash rate.

As such, if other miners are forced to shut down due to the halving, the miners who managed to remain profitable should see increased returns because their relative share of the total hash rate has risen.

When the total hash rate declines, the difficulty of mining declines as well. For miners who continue to mine, a halving can increase profitability by weeding out competition and increasing their likelihood of finding a block and claiming the reward.

Bitcoin Price Impact on Miner Profitability

Lastly, the price appreciation of Bitcoin can turn a loss in Bitcoin-denominated revenue into a gain in fiat-denominated revenue. A vast majority of miners still pay their costs in fiat currency, so they are more concerned with their fiat-denominated revenue than their Bitcoin-denominated revenue. Therefore, if the price of Bitcoin doubles over a four-year period, a miner can sustain a 50% drop in the block subsidy without losing any revenue in fiat terms.

➤ Learn more about fiat currencies.

This last factor is especially significant, as bitcoin halvings can fuel upward pressure on the Bitcoin price. Since the halving reduces the flow of new bitcoin onto the market, if demand is held constant, the simple mechanics of supply and demand dictate that the price should rise.

➤ Learn more about how is the bitcoin price determined.

Indeed, this theory has played out over the first 13 years of Bitcoin’s existence. Between all three previous halvings, the Bitcoin price denominated in U.S. Dollars has increased at least 900%, more than enough to compensate miners for the 50% drop in Bitcoin-denominated revenue.

All of these factors commingle to maintain miner participation and network security after a halving. In fact, past halvings have not significantly or visibly affected hash rate. On the contrary, the Bitcoin hash rate has continued to break all-time highs.

While fees for transacting on the blockchain are expected to rise, all Bitcoin transactions don’t need to be settled on-chain. Additional layers such as the Lightning Network provide cheaper, faster ways of transferring bitcoin.

Bitcoin Deflationary Concerns and Economic Impact

As Bitcoin’s inflation rate is cut in half every four years, it will slowly become the hardest currency in the world. During the 2016 halving, when the block subsidy dropped from 12.5 BTC to 6.25 BTC, Bitcoin’s inflation rate dropped from ~3.7% to ~1.8%, making it less inflationary than the stated U.S. Dollar inflation target of 2%. The halving of 2024 made Bitcoin less inflationary than even gold, an asset long valued for its low stock-to-flow ratio.

Some economists worry that Bitcoin’s deflationary nature will make it hard for it to support an economy as there is not enough bitcoin to go around.

To address this, Bitcoin is divisible into 100 million units called satoshis, meaning even as Bitcoin’s value rises, smaller amounts will hold more purchasing power.

➤ Learn more about how many satoshis are in a bitcoin.

As Bitcoin’s price increases, goods and services priced in Bitcoin will become cheaper. What really matters is the value of each satoshi, not the total number of bitcoin.

While some fear deflation will kill demand for goods, many Bitcoin supporters believe these concerns are overblown. Bitcoin encourages saving and long-term thinking instead of short-term spending. However, people won’t stop spending entirely. They’ll just shift their focus toward future goods rather than immediate purchases.

Industries that rely on frequent, short-term purchases may be negatively affected by Bitcoin’s deflationary trend, but sectors like tech, which thrive on long-term investment, would benefit. For example, over the last 30 years, the prices of phones, computers, and TVs have fallen while their quality has improved. Despite this deflation, people are still buying these products in huge numbers.

Key Takeaways

- When all bitcoin have been mined, miner revenue will depend entirely on transaction fees.

- The price and purchasing power of bitcoin will adjust to the lack of new supply.

- The scarcity of Bitcoin will make it more attractive to investors and users.