Understanding the Byzantine Generals Problem

The Byzantine Generals Problem is a game theory problem that describes the difficulty decentralized systems face in reaching consensus without a central authority. First introduced in 1982 by Leslie Lamport, Robert Shostak, and Marshall Pease, it was initially framed as a theoretical computing problem:

In a network where no participant can fully verify the identity or honesty of others, how can they all agree on a single version of the truth? This question is critical for decentralized networks like Bitcoin, where trust is not placed in a single party but distributed across many participants.

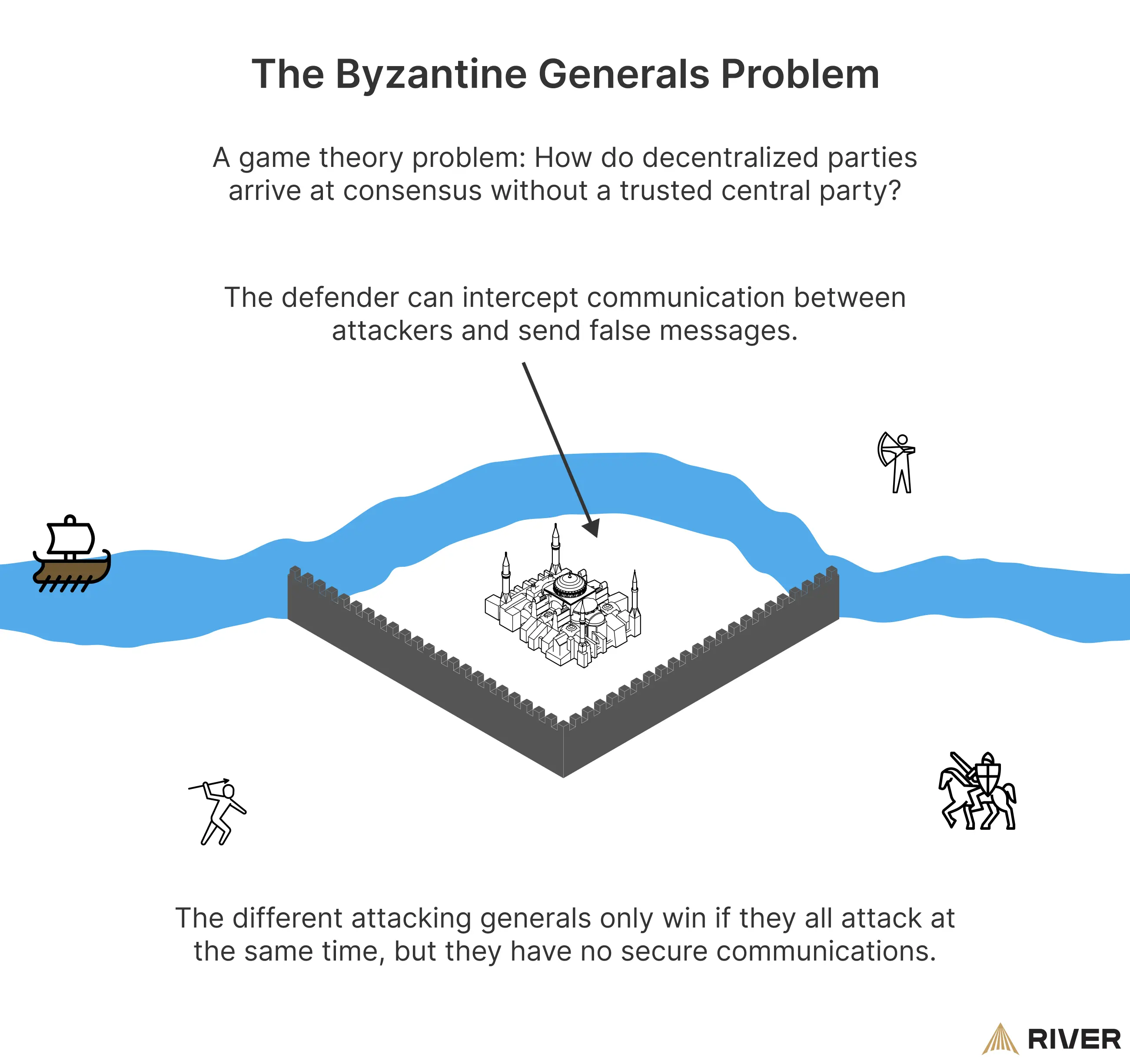

The Byzantine Generals Problem is best understood through an analogy. Several generals are besieging a city called Byzantium and must decide when to attack. If they all attack simultaneously, they win. If they attack at different times, they lose.

However, the generals have no secure communication channels. Messages can be intercepted, delayed, or modified by the enemy. This makes coordination difficult and introduces the risk of deception. How can the generals organize to attack at the same time?

The problem highlights the challenge of achieving consensus in decentralized systems, where no single participant can be trusted to relay accurate information.

How Centralized Systems Avoid the Byzantine Generals Problem

Only decentralized systems face the Byzantine Generals Problem because they lack a single, trusted source of truth. In centralized systems, an authority is responsible for verifying and distributing accurate information.

For example, in traditional finance, banks are trusted to maintain accurate balances and transaction histories. If a bank were to manipulate data or commit fraud, a central bank or government authority is expected to intervene and restore trust.

However, centralized systems do not solve the Byzantine Generals Problem; they bypass it by relying on a central authority. While this approach provides efficiency, it also creates risks. For example, if the central authority is compromised, the entire system is at risk of failure or corruption.

What Is Byzantine Fault Tolerance?

To overcome the Byzantine Generals Problem, decentralized networks must be designed with Byzantine Fault Tolerance (BFT). This means they can continue functioning correctly even if some participants act maliciously or send false information. A Byzantine fault-tolerant system does not require every participant to be trustworthy because it only needs a majority to maintain consensus.

Bitcoin is an example of a Byzantine fault-tolerant system. It achieves this through its Proof-of-Work consensus mechanism. In this system, miners must expend computational energy to propose new blocks. Because bitcoin mining requires real-world resources, attempting to deceive the network becomes prohibitively expensive. Any dishonest behavior, such as broadcasting false transactions, is rejected by the network.

Byzantine Fault Tolerance is essential for decentralized networks, allowing them to function reliably without a central authority. Without it, consensus would be impossible, making trustless systems unworkable.

Money and the Byzantine Generals Problem

Money is a great example of the Byzantine Generals Problem. How can a society create a form of money that everyone trusts and agrees on? Throughout history, people have used scarce resources like gold, shells, or glass beads as money. Gold became widely accepted across different trade networks, but its weight and purity were difficult to verify. To solve this, governments took control of minting money to make it more reliable.

But this did not actually solve the Byzantine Generals Problem. It just shifted trust to a central authority. Over time, governments abused this trust by changing, debasing, or even seizing money.

Unlike Bitcoin, fiat currencies rely on central banks and governments to manage supply and demand. Historically, this trust has been abused, leading to inflation, capital controls, and even currency devaluation.

A prime example is Zimbabwe in the early 2000s, where excessive money printing led to hyperinflation. People lost faith in their currency.

➤ Learn more about the history of monetary collapse in Zimbabwe

For money to truly solve this problem, it must be verifiable, resistant to counterfeiting, and not rely on any central authority. This was only achieved with the creation of Bitcoin, the first form of money that works without trust in a single entity.

– Satoshi Nakamoto discussing the significance of Bitcoin’s decentralized nature.

Bitcoin’s fixed supply of 21 million coins prevents manipulation. It doesn’t require trust in a government or central entity. Network consensus ensures that no more bitcoin can be issued arbitrarily. This makes Bitcoin the first truly decentralized monetary system that directly solves the Byzantine Generals Problem.

How Bitcoin Solves the Byzantine Generals Problem

Bitcoin solves the Byzantine Generals Problem by allowing a decentralized network to reach agreement on transactions without needing to trust a central authority. Unlike previous attempts to create independent money, Bitcoin succeeded by using a combination of blockchain technology and Proof of Work to ensure all participants can verify transactions for themselves.

➤ Learn more about Bitcoin’s predecessors.

Blockchain Prevents Double Spending

For Bitcoin to work as money, it needed a way to track ownership and prevent people from spending the same bitcoin twice. To do this without relying on trust, Bitcoin uses a blockchain, which is a public, distributed ledger that records every transaction. In the Byzantine Generals analogy, the blockchain is the shared truth that everyone must agree on.

Nodes, which are members of the Bitcoin network, verify transactions and agree on the order in which they happen. This allows Bitcoin to function as a trustless system without a central authority.

➤ Learn more about the Double Spend Problem.

Proof-of-Work Solves the Byzantine Generals Problem

Bitcoin solves the Byzantine Generals Problem by using Proof of Work. This system ensures that every new block added to the blockchain follows clear and objective rules. The mining process is costly, which discourages dishonest behavior and incentivizes miners to publish accurate information.

Because the rules of the network are objective, no one can manipulate transactions. The system also determines who can create new bitcoin and ensures that once a block is added to the blockchain, it is nearly impossible to change.

Every node independently verifies transactions and blocks. If someone tries to submit false information, the network instantly rejects it. Since each node checks the data itself, there is no need to trust anyone else. This makes Bitcoin a fully trustless system where the entire network always agrees on the state of the blockchain.

Can Byzantine Fault-Tolerant Systems Be Attacked?

One major concern in any Byzantine Fault Tolerant system is the possibility of a 51% attack where a single entity gains control over the majority of the network’s computational power.

In Bitcoin, such an attack would be extremely costly due to difficulty adjustment, a mechanism that ensures mining remains competitive. If an attacker tried to alter past transactions, they would need to outpace the honest network’s mining power, which is economically impractical.

This makes Bitcoin the most secure decentralized monetary system ever created, reinforcing its role as a trustless global currency.

History of The Byzantine Generals Problem

The Byzantine Generals Problem was first introduced in 1982 the paper The Byzantine Generals Problem. The problem was inspired by the challenges faced by the Byzantine army, where generals had to coordinate an attack without secure communication. This concept was later applied to computer networks, highlighting the difficulty of achieving reliable consensus in distributed systems.

Before this, earlier work on interactive consistency problems and reputation scores laid the foundation for Byzantine consensus. The General’s Problem evolved into variations like the Weak Byzantine Generals Problem, which explored scenarios with partial reliability. Over time, these ideas led to modern Byzantine consensus mechanisms, shaping solutions for secure, trustless systems like Bitcoin.

Key Takeaways

- The Byzantine Generals Problem describes the difficulty decentralized systems have in agreeing on a single truth.

- The Byzantine Generals Problem plagued money for millennia, until the invention of Bitcoin.

- Bitcoin uses a Proof-of-Work mechanism and a blockchain to solve the Byzantine Generals Problem.

- Bitcoin’s ruleset is objective, so there is no disagreement about which blocks or transactions are valid, allowing all members to agree on a single truth.