Inflation is the rise in price of goods and services over time, which means your money doesn’t buy as much as it used to. It’s one of the most important economic measures and affects everyone.

But why does inflation happen? What types of inflation are there? Is inflation bad for the economy? This article will answer these questions.

What Is Inflation?

Most people have heard the term “inflation” in casual conversation. Generally, inflation means a rise in prices. However, inflation is a complex and often misunderstood concept.

Inflation affects everyone differently. For example, the rise in prices felt by a student may be quite different from the rise in prices experienced by a restaurant owner. Because of this, there are a variety of definitions or “types” of inflation that are more or less appropriate to use depending on the context.

How Is Inflation Measured?

Inflation is measured by the annual percentage increase in prices. For example, if a cup of coffee costs $5.50 now and $5 a year ago, the inflation rate for coffee is 10%.

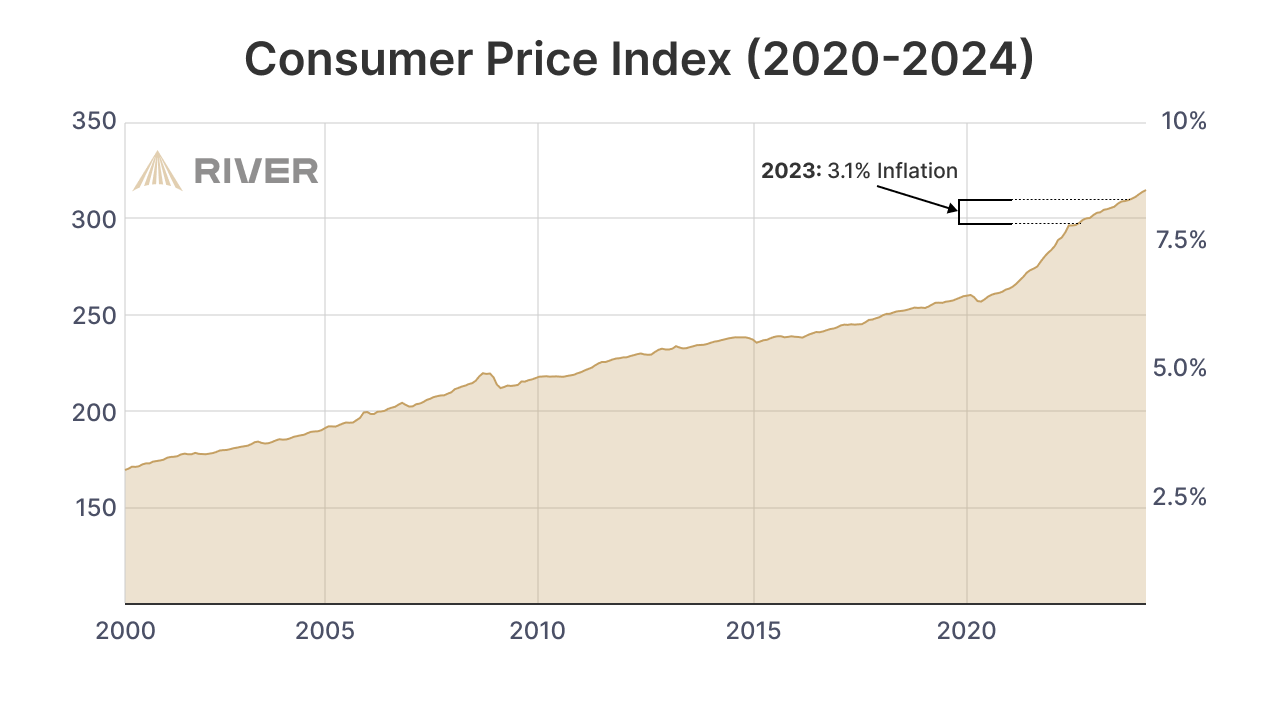

A common misconception is that when inflation decreases, prices also drop. In reality, inflation builds over time, causing prices to keep rising. For instance, consumer price inflation dropped from 7.6% in 2021 to 3.1% in 2023, but this still means that prices at the end of 2023 far exceed those in 2021. The concept of falling, yet positive inflation is known as disinflation. Between 2020 and 2023, the cumulative effect of positive yet falling inflation was a total price rise of nearly 20%.

What Are the Different Types of Inflation?

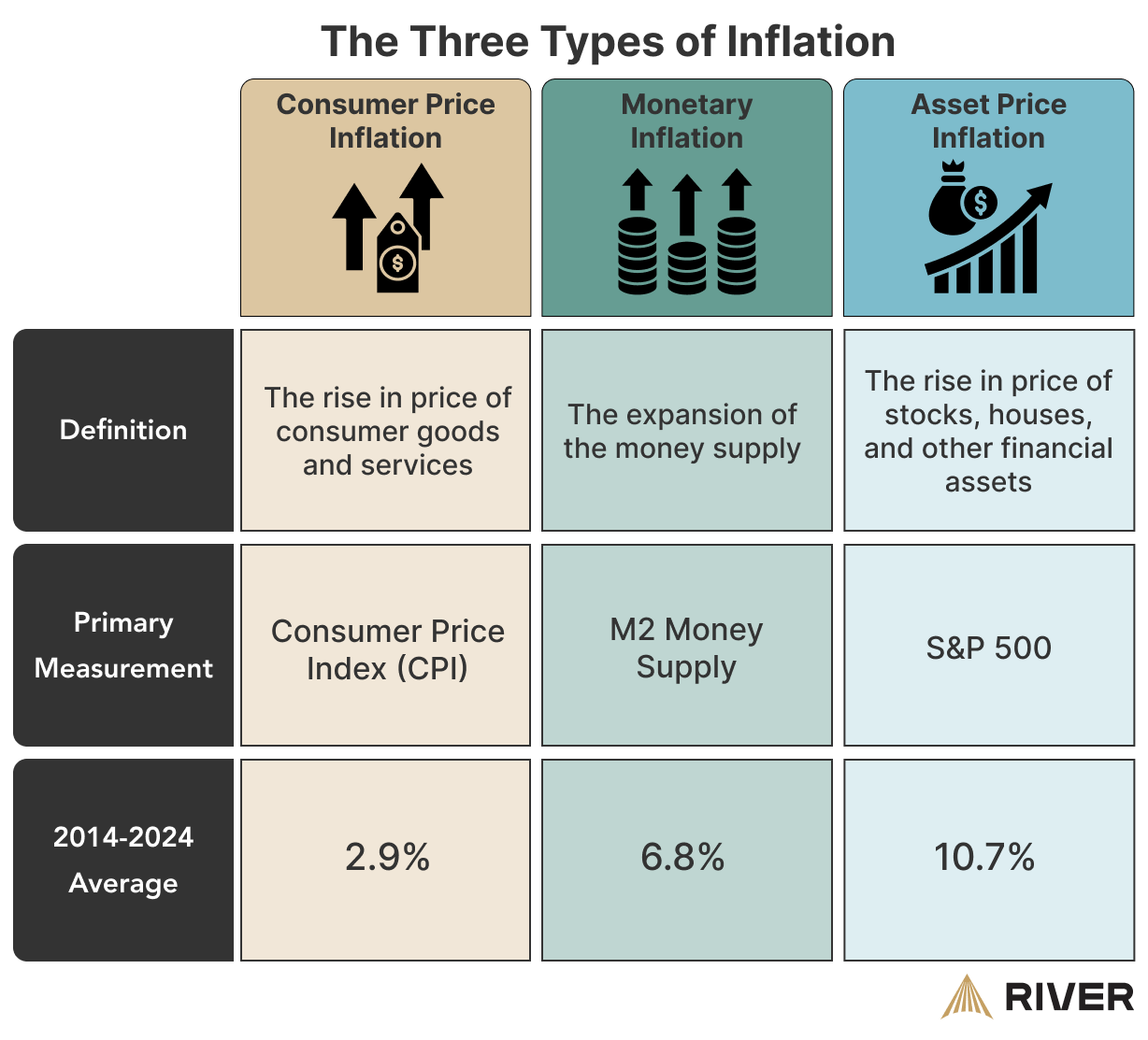

While there are many types of inflation, the three most commonly discussed are consumer price inflation, monetary inflation, and asset price inflation. These are illustrated in the graphic below.

Consumer Price Inflation

Consumer price inflation tracks the cost of everyday goods and services, making it the most widely recognized type of inflation. It is measured by the Consumer Price Index (CPI), which monitors the average price of a basket of consumer goods as defined by the U.S. Bureau of Labor Statistics.

The Federal Reserve uses consumer price inflation for its monetary policy, aiming to keep inflation rates around 2%. Instead of the CPI, the Fed uses a similar measure called the price index for personal consumption expenditures (PCE) to track inflation. The PCE index is more broad-based than the CPI, is updated more frequently, and includes additional factors such as employer-paid health insurance.

How Useful is the CPI?

The CPI will not reflect inflation perfectly. While it includes a variety of goods and services, it focuses on essentials like housing, transportation, and food, which might not capture individual spending habits. Additionally, the CPI basket’s contents remain static over time and do not account for changes in consumer behavior based on the cost of goods. Therefore, the CPI is a broad, aggregate, and imprecise way to understand price changes in the U.S. over time.

Monetary Inflation

Monetary inflation refers to the increase in the money supply within an economy. The most common measure is M2, which includes cash, checking deposits, and other easily accessible funds.

“Inflation is always and everywhere a monetary phenomenon.” Milton Friedman, 1963

Some economic theories, like that of the Austrian School, argue that all inflation is caused by increases in the money supply. According to this view, if the supply of money increases, the value of existing currency decreases. Governments can inflate prices by purchasing assets or taking on debt, thereby increasing the money supply.

Increasing the money supply is easier than ever. Most dollars are digital, and the U.S. Treasury no longer needs to print cash to increase the supply. The Federal Reserve can issue new digital dollars and use them to buy assets from banks and investors. Additionally, lowering bank reserve requirements and discount rates allows banks to lend more money.

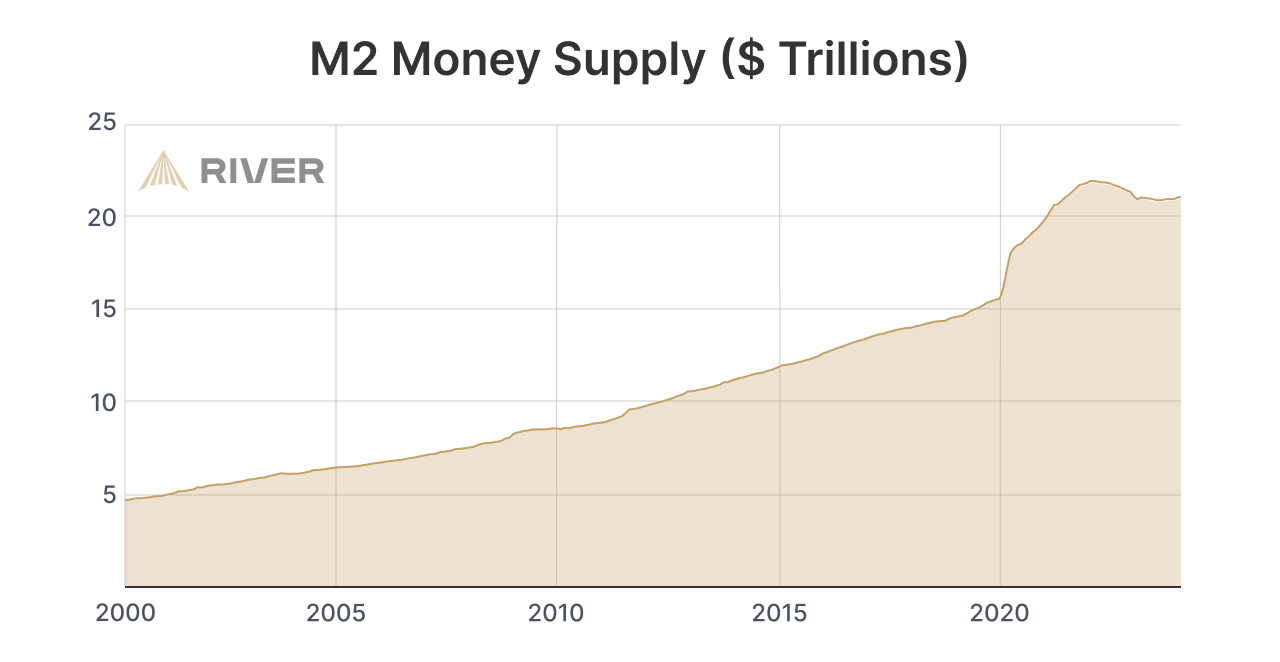

Monetary inflation in the 21st century has been higher than in previous years, largely driven by “easy” monetary policy from the Federal Reserve. Stimulatory policies such as “Quantitative Easing (QE)” directly increase the money supply. As shown in the chart below, the amount of dollars in circulation has increased more than four-fold since the year 2000.

➤ Learn more about how money printing works

Asset Price Inflation

Asset price inflation refers to the increase in the prices of financial assets, such as houses, 401ks, pensions, and stock portfolios. There is no broad measurement for asset price inflation, but it is commonly tracked using the S&P 500 and house prices.

Is Asset Price Inflation Good or Bad?

Asset price inflation affects people differently. Wealthy individuals with significant investments in stocks and real estate benefit as these assets become more valuable, increasing their wealth. Conversely, people with cash savings who lack assets such as a home are disadvantaged. They miss out on the gains from rising asset prices, making it harder to afford a home or save for the future.

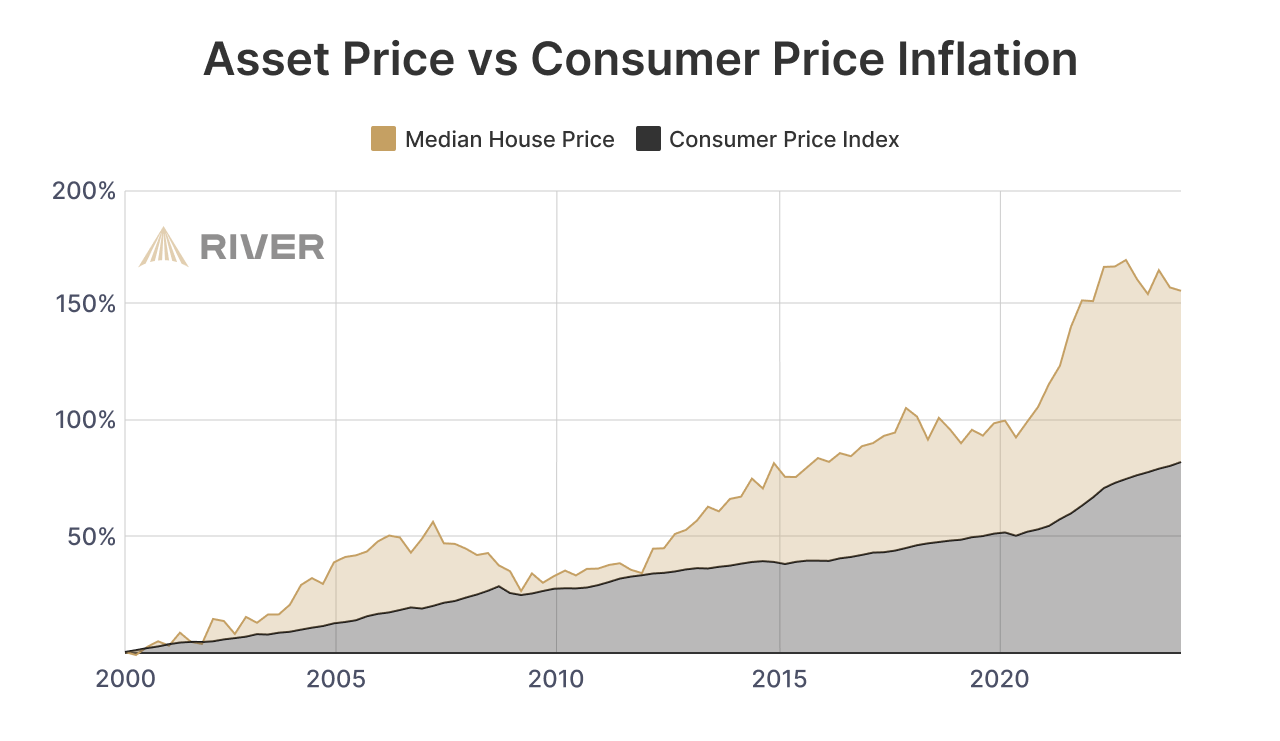

In recent years, asset price inflation has far outpaced consumer price inflation, as shown in the chart below. This disparity tends to widen wealth inequality because the wealthy, who earn primarily from asset gains, benefit more than the middle class and poor, who rely mainly on wages.

What Causes Inflation?

Economists often debate the causes of inflation. This is because the short-term fluctuations of prices are driven by many factors. These include:

- Higher Production Costs: “Cost-push inflation” occurs when increased costs for raw materials, labor, or other production inputs lead to higher prices for goods. For example, if oil prices rise due to production difficulties, manufacturers who use oil will pass those costs on to consumers.

- Higher demand: “Demand-pull inflation” describes how inflation can begin with periods of strong consumer demand or government spending. When aggregate demand exceeds supply during an economic expansion, goods and services become more expensive. Lower unemployment rates tend to be linked with higher demand and higher rates of inflation, as explained by the Phillips curve.

- Productivity: Economic productivity refers to how efficiently goods and services are produced. Increased productivity typically leads to lower prices and lower inflation. Conversely, decreased productivity can result in higher inflation. For instance, the U.S. healthcare system has seen declining productivity over the past 20 years, leading to higher medical costs for consumers.

Over time, the short-term effects of cost-push and demand-pull inflation tend to balance out. In the long run, the primary cause of inflation is an increase in the money supply. Monetary inflation is crucial to monitor because expanding the money supply eventually leads to asset price inflation and consumer price inflation, as more dollars chase a limited number of goods, services, and assets. However, the immediate effect of money printing is uneven, and is felt by different people and industries at different times, a concept known as the Cantillon Effect.

➤ Learn more about the Cantillon Effect

Does Inflation Hurt the Economy?

Central banks, depository institutions, and academics often claim that inflation is beneficial or even necessary for economic growth. The Federal Reserve considers moderate inflation to be healthy for the economy because it theoretically stimulates spending. However, inflation can have harmful effects on the economy that may outweigh these short-term benefits. These negative effects are often downplayed or ignored by those who benefit from inflationary policies.

Inflation Increases Economic Fragility

When inflation occurs, the entire economy consumes more and saves less, making the system more fragile. Savings act as a flexible hedge against an uncertain future. Without savings, people have a reduced ability to endure minor disruptions or economic downturns.

For consumers, even moderate inflation means the dollar consistently loses value over time. Since 2000, the dollar has lost more than 50% of its purchasing power, meaning consumers now pay twice as much for the same goods and services as they did two decades ago.

➤ Learn more about Bitcoin's fairness

Inflation Discourages Long-Term Investing

When money constantly loses value due to inflation, investors are forced to focus on short-term gains. Without inflation, investors can take their time to find suitable investments.

In an inflationary environment, delaying investment has a direct economic cost, as an investor’s cash loses value over time. This forces investors to constantly seek returns, even if the investments are risky or suboptimal, leading to inefficiencies in the economy.

Inflation Hides Economic Weakness

Inflation can artificially boost economic statistics like growth and profits, making the economy appear more successful and healthy than it truly is. This can lead to misguided policy decisions and spending allocations based on inflated data.

The Effects of Hyperinflation

Hyperinflation is an extreme form of inflation where prices for goods and services skyrocket rapidly over a short period. Economists typically define hyperinflation as an annual inflation rate of 1,000% or more.

Hyperinflation severely disrupts consumer spending and destroys the value of the native currency. For example, in 2018, Venezuela experienced inflation rates exceeding 900,000%, rendering its currency, the bolivar, virtually worthless.

Another instance of hyperinflation occurred in Zimbabwe from 1991 to 2008. This was triggered by the government’s faulty monetary policy to finance military operations in the Democratic Republic of the Congo. The Reserve Bank of Zimbabwe increased the money supply and declared inflation illegal. As a result, prices soared, and consumers sought better currency alternatives.

➤ Learn more about hyperinflation in Zimbabwe.

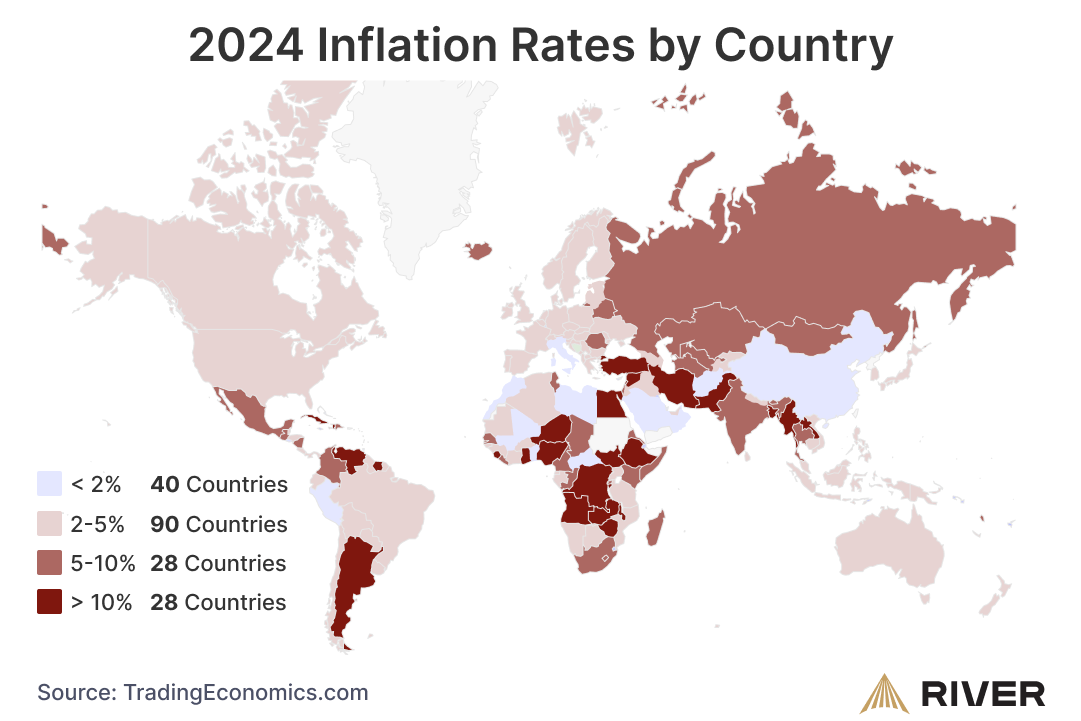

Today, over a dozen countries are experiencing inflation rates above 30%. Argentina, for example, saw the value of its currency fall by two-thirds in 2023 alone.

What Does Inflation Mean for Me?

The most obvious effect of inflation is higher prices, but it can also manifest in other ways. Producers may opt to maintain the same prices but use lower-quality materials to cut costs. Alternatively, they might reduce the quantity of the product while keeping the price the same, a phenomenon known as shrinkflation. For example, instead of increasing the price of a 12oz soda, a producer might sell a 10oz soda for the same price.

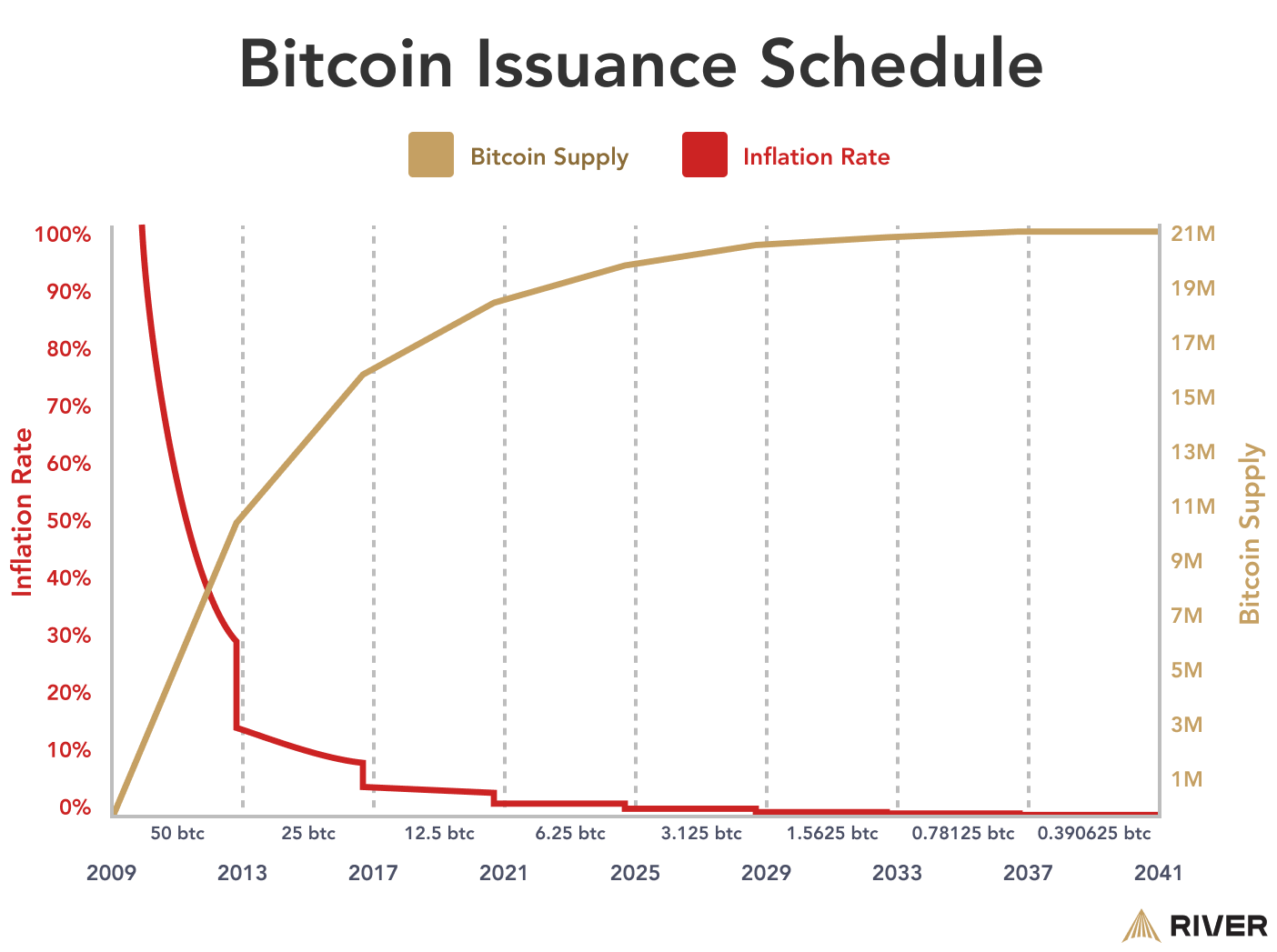

Inflation gradually decreases investor confidence in fiat currency. Those that hold their wealth in cash will see their savings erode away. As a result, inflation encourages consumers to spend or invest cash quickly before it loses value. Store-of-value assets, such as real estate, gold, and bitcoin, are known to be effective “hedges” against inflation due to their limited supply. Bitcoin, for example, was designed as a form of money with a mathematically fixed supply according to its software. Its monetary inflation rate is cut in half every four years, now below 1%.

Because of its wealth-eroding nature, inflation can be thought of as a hidden tax on your money. How can you protect yourself against inflation? The video below provides an overview:

Notice: River does not provide investment, financial, tax, or legal advice. The information provided is general and illustrative in nature and therefore is not intended to provide, and should not be relied on for, tax advice. We encourage you to consult the appropriate tax professional to understand your personal tax circumstances.

Key Takeaways

- Inflation affects everyone differently and is generally categorized into consumer price inflation, monetary inflation, and asset price inflation.

- The Federal Reserve aims for 2% annual inflation, but realized inflation typically exceeds that target.

- Inflation increases economic fragility and can lead to increased wealth inequality.