Cantillon Effect

2 min read

The Cantillon Effect describes the uneven effect inflation has on goods and assets in an economy. Since new fiat money is injected into an economy at specific points, its effects are felt by different people and industries at different times. This distorts relative prices and benefits certain parties while disadvantaging others. Watch the short video below to understand how the Cantillon Effect works.

When new money is added to the economy, it will naturally raise the price of goods and assets. However, not all prices will rise by the same amount or at the same time. The Cantillon Effect asserts that the first recipient of the new supply of money has an arbitrage opportunity of being able to spend money before prices have increased.

This is partially due to the fact that new fiat money is created at almost zero cost and given to specific parties, usually banks. These banks have an opportunity to spend this money on goods and assets whose price has not yet reflected the increase in money supply. Banks can thus buy goods at a discounted rate.

As the new money flows from central banks to private banks to investors to ordinary citizens, prices gradually begin to reflect the increase in the money supply. By the time ordinary citizens experience the increased money supply, they will be buying goods at higher prices.

Thus, the flow of new money through the economy is beneficial to parties that receive the funds first, and less beneficial to those that receive it later on. The individuals and institutions closest to the central bank – banks and asset owners – are granted financial advantages at the cost of those least connected to the financial system.

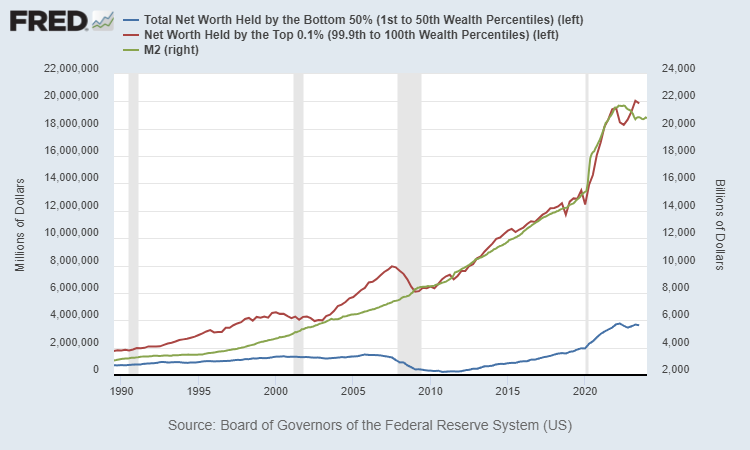

This evolution is evident when comparing the wealth increase of the top 0.1% individuals to the M2 money supply growth.

This increase is fully correlated, while wealth held by the bottom 50% of the population has completely fallen behind this growth.

As a result of the Cantillon Effect, inflation can be seen as a non-legislative and regressive tax on the purchasing power of citizens by the government.