Countries have long held reserves of critical assets to protect their nation’s well-being. What would it mean for the United States to establish a Strategic Bitcoin Reserve? How might this impact the federal debt and shape the country’s future?

What Are Strategic National Reserves?

A strategic reserve is a stockpile of certain materials that are held back from normal use by governments for a particular strategy or to help deal with with unexpected events.

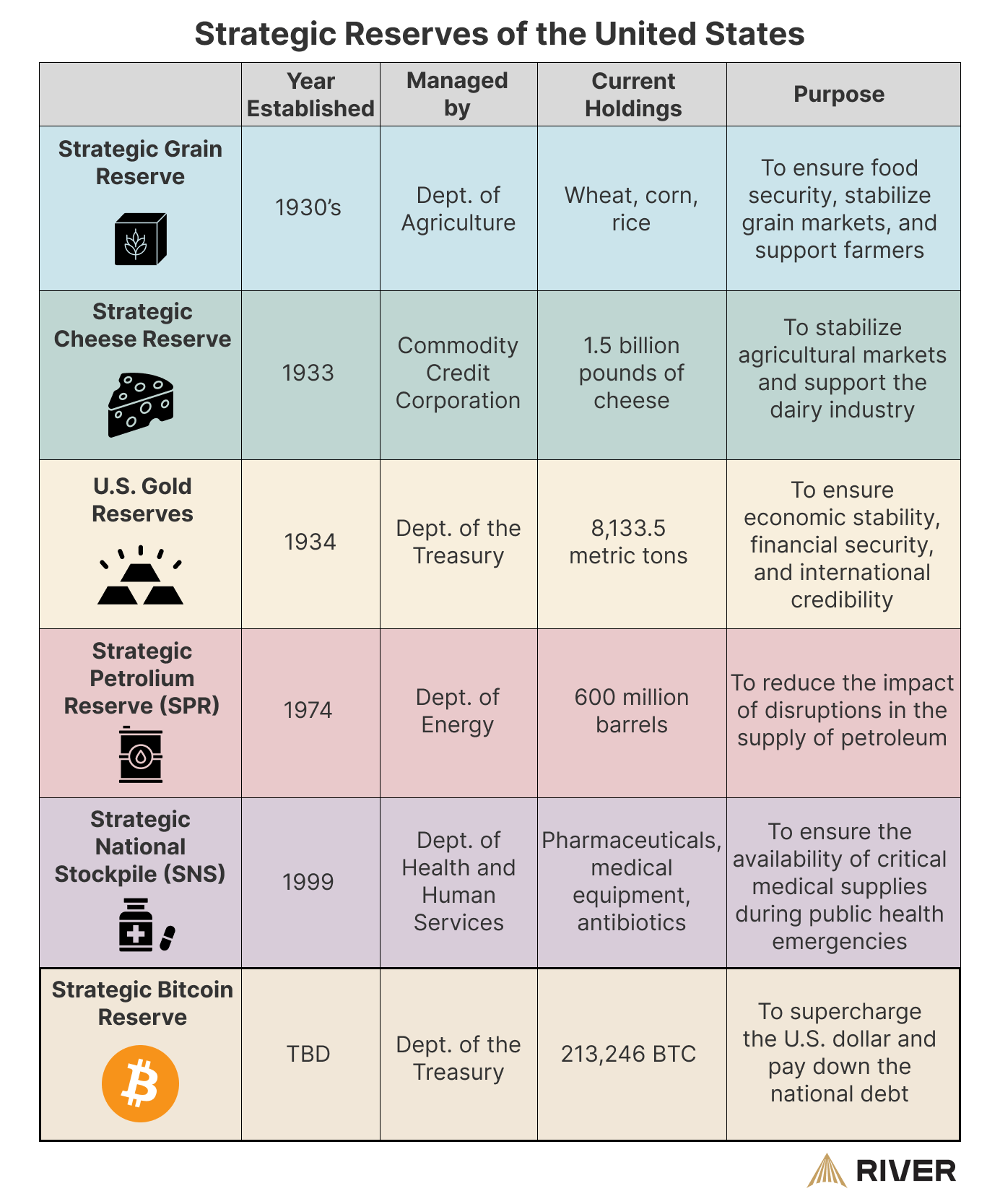

In the United States, the government has maintained a wide variety of reserves for decades. The table below lists just a few of these stockpiles:

Central Bank Reserves

The Federal Reserve also holds various assets as reserves, including gold certificates, foreign currencies, and U.S. Treasury securities. These reserves differ from strategic government reserves in a few ways:

- The Federal Reserve is independent from the U.S. Government. Its reserves are primarily used to conduct monetary policy and to balance its assets with its liabilities.

- The Federal Reserve operates under specific mandates from Congress, such as balancing maximum employment with price stability. Consequently, its reserve holdings are unlikely to be used for strategic purposes such as encouraging scientific research or paying down the national debt.

What Is a Strategic Bitcoin Reserve?

In July 2024, Senator Cynthia Lummis introduced the Boosting Innovation, Technology and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act in the U.S. Senate.

“The BITCOIN Act establishes a strategic Bitcoin reserve to serve as an additional store of value to bolster America’s balance sheet and ensure the transparent management of Bitcoin holdings of the federal government. Specifically, the legislation would:

- Establish a decentralized network of secure Bitcoin vaults operated by the United States Department of Treasury with statutory requirements ensuring the highest level of physical and cybersecurity for the nation’s Bitcoin holdings.

- Implement a 1-million-unit Bitcoin purchase program over a set period of time to acquire a total stake of approximately 5% of total Bitcoin supply, mirroring the size and scope of gold reserves held by the United States.

- Be paid for by diversifying existing funds within the Federal Reserve System and Treasury Department.

- Affirm self-custody rights of private Bitcoin holders and emphasize that the strategic Bitcoin reserve shall not infringe upon individual financial freedoms.”

According to the bill, the U.S. Government would manage its Strategic Bitcoin Reserves according to these rules:

-

Bitcoin purchases should not exceed 200,000 BTC per year

-

All bitcoin acquired through the program should be held for a minimum of 20 years

-

No bitcoin may be sold or disposed of for any purpose other than paying off the Federal debt.

How Would a Strategic Bitcoin Reserve Help the United States?

To understand how a Strategic Bitcoin Reserve could help the U.S., it first helps to have some context on the country’s unsustainable economic trajectory.

The U.S. federal debt has surpassed $35 trillion and is increasing at an accelerating pace. During the 2010s, the debt rose by approximately $1 trillion annually; in this decade, it’s grown at a rate of $2.6 trillion per year.

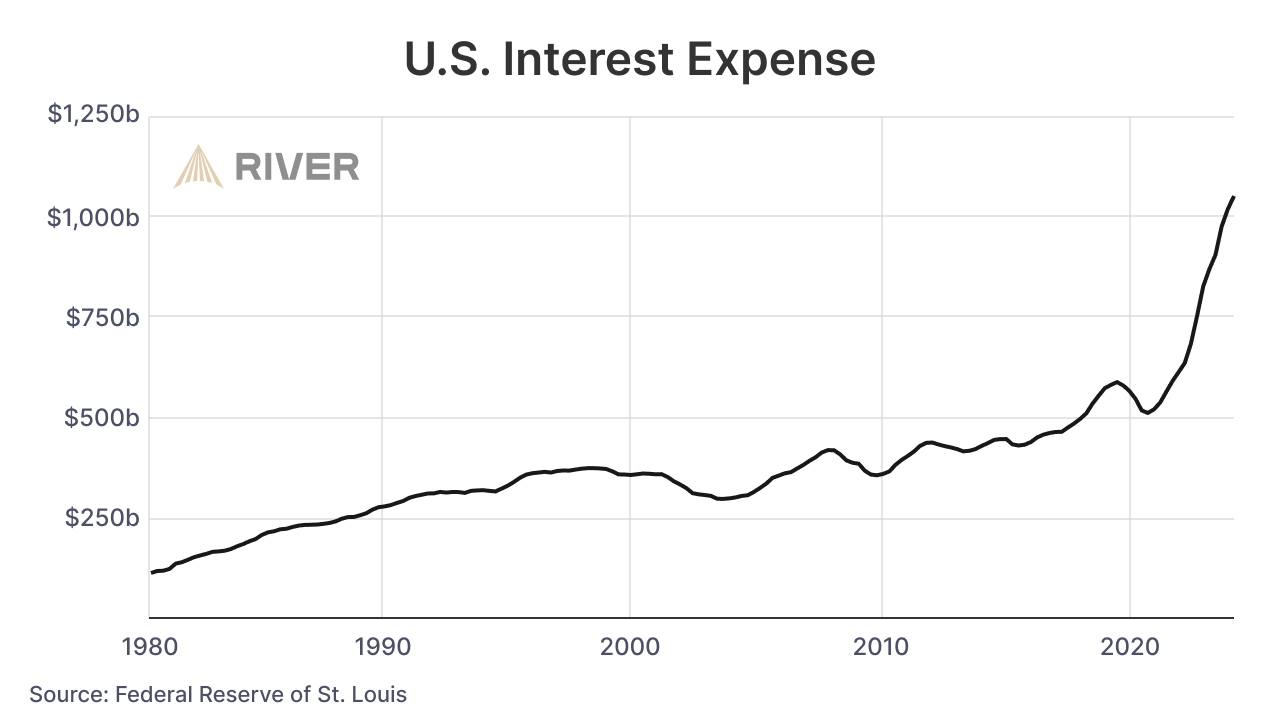

Last year alone, the interest expense on the federal debt exceeded $1 trillion, making it the second-largest budget item next to Social Security.

The U.S. government has consistently spent more than it has raised with taxes for over 20 years, a deficit that now stands at $1.6 trillion annually. The Congressional Budget Office estimates that the federal deficit will continue to grow over the coming decades, with no end in sight.

Can’t we solve the situation without using Bitcoin? Traditionally, there are a limited number of options to reduce the government’s debt burden:

Austerity

Austerity involves lowering expenditures and/or raising taxes to balance the budget. While this sounds great in theory, austerity is challenging to implement in the current environment for a few reasons:

- Unpopularity: Austerity measures are often unpopular and unlikely to be promoted by elected politicians.

- Mandatory Expenditures: A significant portion of the government’s budget consists of mandatory expenditures, such as Social Security and Medicare, which cannot be easily reduced.

- Inertia: Government budgets typically use the previous year’s budget as a starting point. This approach means that, for the sake of convenience, existing costs are rarely reduced, even if there may be opportunities for savings. At the same time, new expenditures can be added more easily, as they are built upon an already established financial framework. This practice makes it challenging to control or reduce the budget over time.

- Tax Increases: Rapid tax increases can lead to adverse effects, such as reduced economic activity and lower tax revenues.

Outright Default

An outright default occurs when a government fails to meet its debt repayments according to contract. While some countries have defaulted on their debt in the past, such a move is extremely unlikely by the United States. This is because a default would harm trust in U.S. institutions and likely undermine the value of the U.S. dollar. Additionally, the U.S. is not incentivized to default on its debt when it has an easy alternative available: printing money.

Inflation

Many governments rely on the effects of inflation to erode away the value of their debt. For example, if cumulative inflation over the next 20 years is 1,000%, but the U.S. debt load grows by only 100%, the real value of the federal debt would reduce by 80%. When the rate of inflation exceeds the rate at which the federal debt grows, the absolute size of the government’s debt decreases. Whether explicitly or implicitly, many governments across the world have implemented this strategy, and are likely to do so in the future. The downside of relying on inflation to reduce the national debt is that it destroys the value of the currency, and also may lead to social unrest, lack of trust in institutions, and wealth inequality.

As you can see, there are no perfect answers to the United States’ debt problem—this is where Bitcoin can play a role.

How Bitcoin Can Help Solve the U.S. Debt Crisis

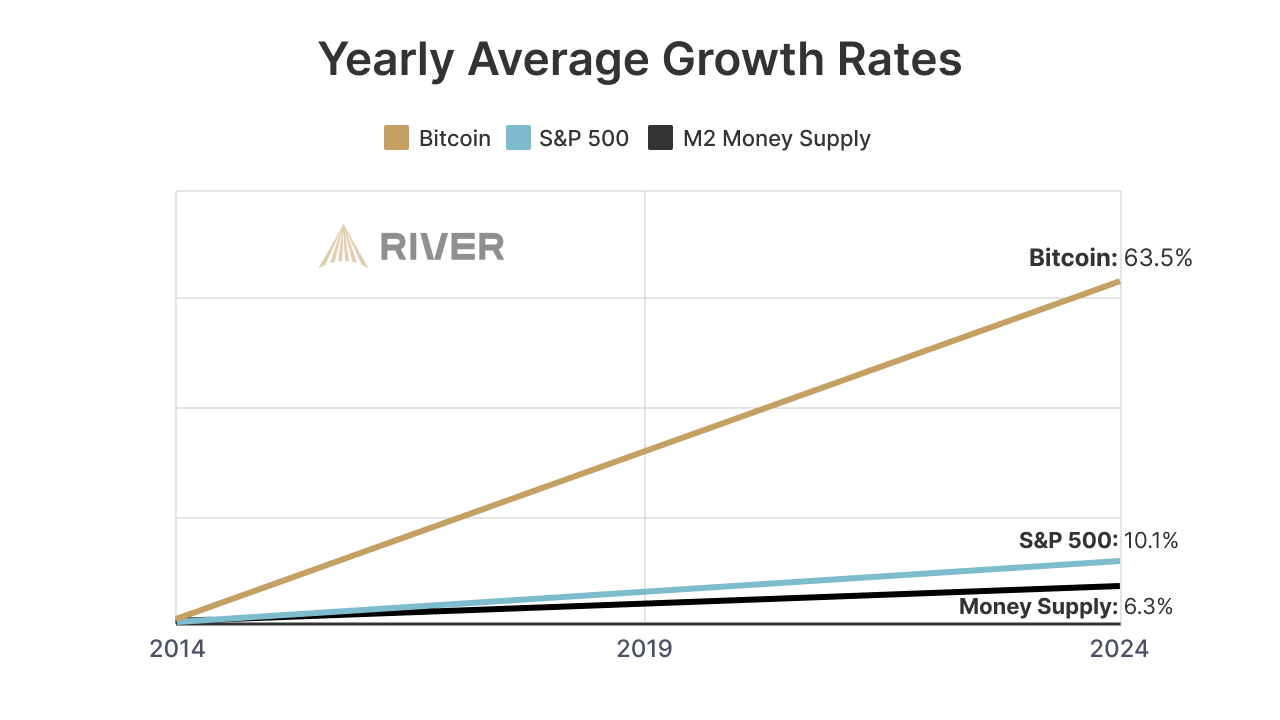

One strategy to strengthen America’s financial position is to invest in assets that appreciate faster than inflation or the growth of its debt. Since 2014, bitcoin’s annual price performance has significantly outpaced both inflation and the growth of other asset classes. Furthermore, bitcoin’s total market capitalization remains relatively small, at less than 1% of the value of traditional assets such as stocks, bonds, and real estate. This suggests that bitcoin’s value could continue to rapidly increase in the future as it catches up to other assets.

By being one of the first countries to strategically stockpile bitcoin, the United States would immediately place itself as the leader in bitcoin adoption, front-running all other countries that would follow suit. In doing so, the government’s Strategic Bitcoin Reserves would appreciate significantly in value. A large stockpile of bitcoin would help ensure trust in the government’s ability to meet debt obligations, which would encourage international investors to continue placing trust in U.S. government bonds, thereby reducing the interest rates paid on the debt.

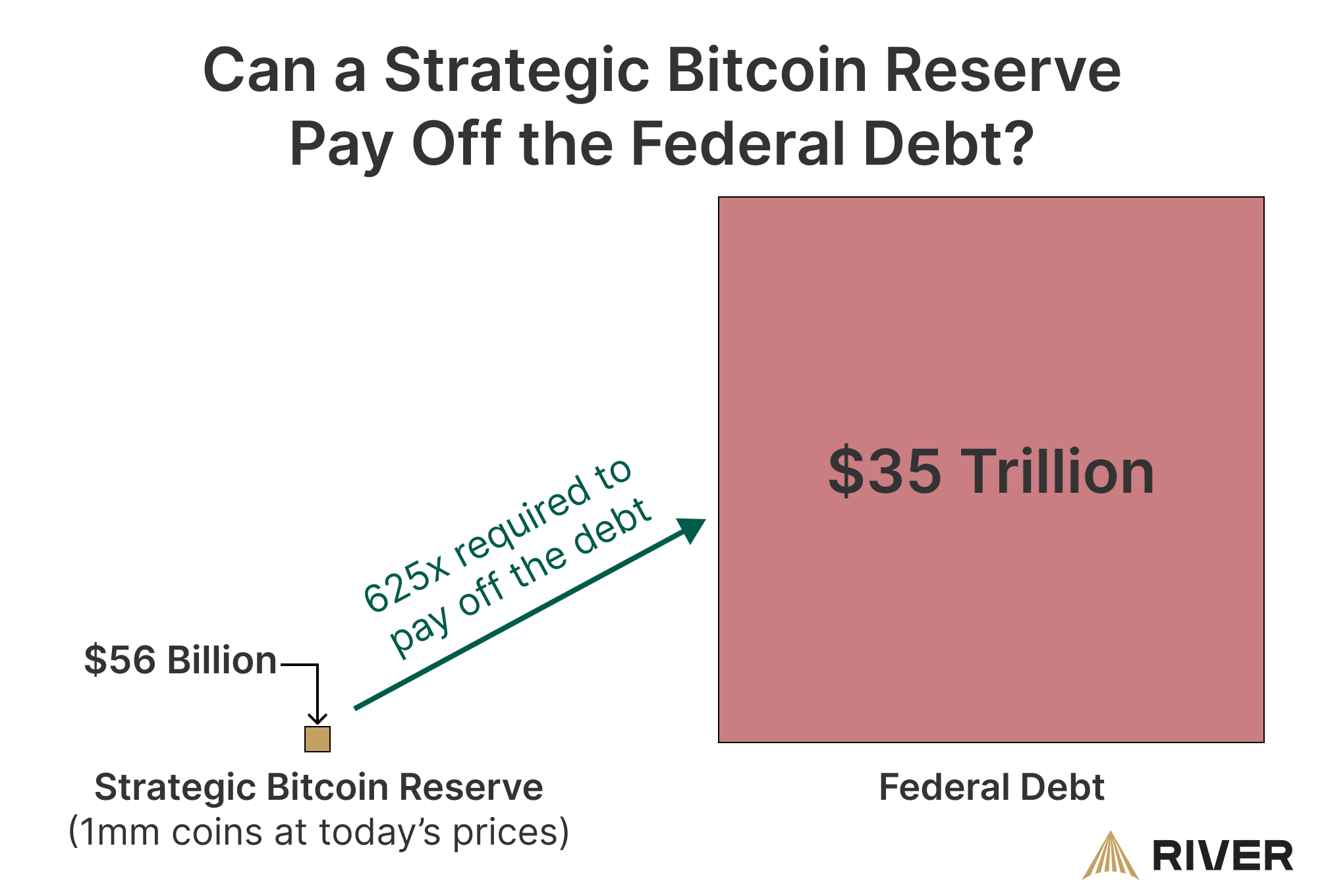

It is unlikely that a Strategic Bitcoin Reserve could single-handedly solve the federal debt problem. A $56 billion investment to acquire 1,000,000 BTC would have to appreciate by 62,500% in order to fully pay off our debt—this would imply a bitcoin market capitalization of over $700 trillion. However, it does not need to fully solve this problem to be a worthwhile strategy.

Nonetheless, there are several reasons why a Strategic Bitcoin Reserve would still be a worthwhile investment:

-

Low downside: The acquisition of 1,000,000 bitcoin for a strategic reserve would be a relatively small investment for the United States. At today’s prices, acquiring 200,000 BTC per year would amount to less than 0.2% of its annual federal budget.

-

Ensuring the future of the U.S. dollar: Regardless of one’s views on the U.S. dollar, it is in the best interest of the U.S. Government to ensure the dominance of the dollar as global reserve currency. A Strategic Bitcoin Reserve would serve as a hedge against potential dollar failure scenarios, such as the widespread adoption of bitcoin by other countries.

-

Significant long-term opportunity: It is highly likely that after establishing a Strategic Bitcoin Reserve in the U.S., many other developed countries would follow suit. This would place the United States in a long-term position of strength, holding the largest stockpile of bitcoin in the world. While its reserves may not be enough to pay off the entire debt load, U.S. politicians may find it to be in the best interest of the country to not sell any bitcoin and continue growing its reserves into the future.

-

Continuing U.S. innovative supremacy: The U.S. owes much of its success to the innovators and entrepreneurs that have improved many aspects of the world we live in. As Bitcoin represents the forefront of innovation and technology today, an endorsement of Bitcoin by the United States would help ensure it remains the best place for innovation to happen.

Do Other Countries Have Strategic Bitcoin Reserves?

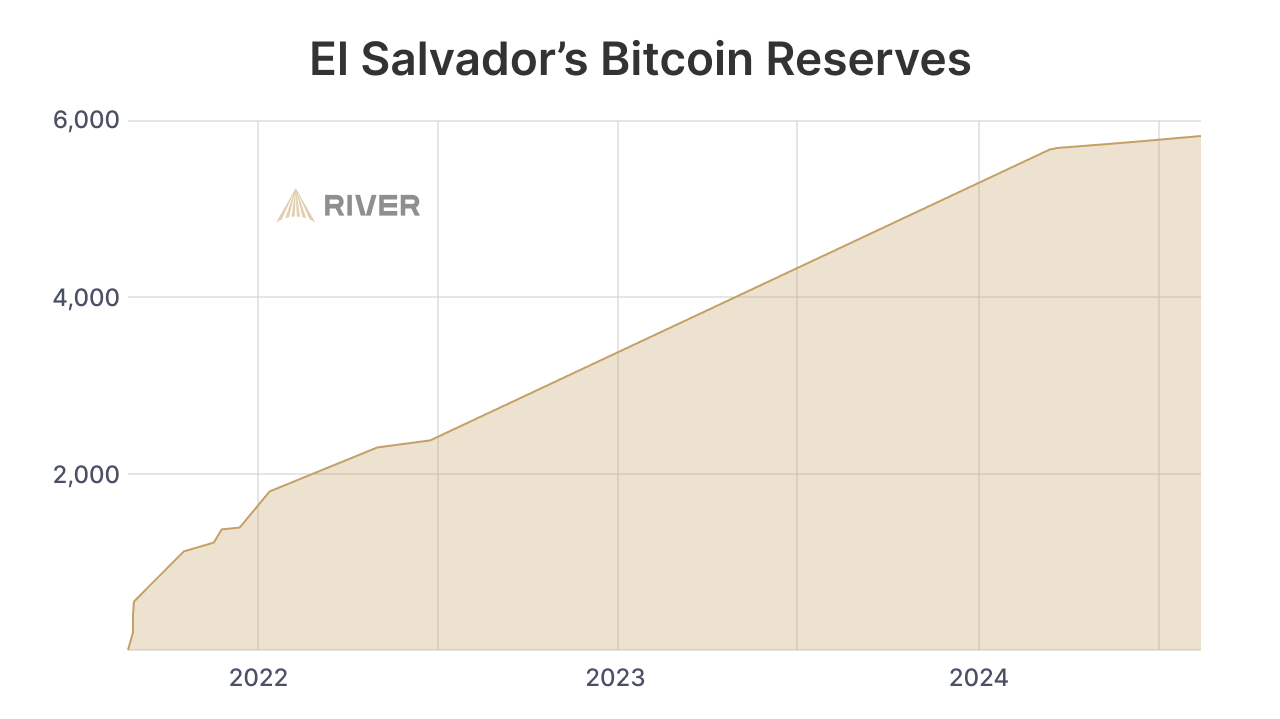

It is unknown how many other countries have begun accumulating bitcoin reserves. Currently, El Salvador is the only country to have publicly announced bitcoin as a strategic reserve asset. The country began stockpiling bitcoin in September 2021, when it declared bitcoin as legal tender. El Salvador has made a website where its reserves, now standing at nearly 6,000 BTC, can easily be tracked.

For El Salvador, this strategic has thus far proven successful, earning the country a 38% profit on its investment, or roughly $50 million so far.

How Would a Strategic Bitcoin Reserve Impact Bitcoin?

The most predictable immediate impact of a U.S. Strategic Bitcoin Reserve involves the price of bitcoin itself. A commitment by the U.S. to purchase large quantities of bitcoin would represent a sharp increase in demand for an asset that has a fixed supply. To match supply with demand, the price of bitcoin would most likely rise.

A Strategic Bitcoin Reserve would also have many long term impacts on Bitcoin which are more difficult to predict. However, it is almost certain that big changes would occur in a few key areas:

- Regulation: The regulatory treatment of Bitcoin remains in its infancy. For example, there is not much clarity over how banks can legally interact with bitcoin. A Strategic Bitcoin Reserve would likely encourage the establishment of a more complete and robust regulatory framework for Bitcoin.

- Strategic Alignment: Governments have historically held a neutral or negative stance towards bitcoin. If the United States were to establish a Strategic Bitcoin Reserve, it would likely have an incentive to take a more positive stance towards bitcoin. After all, the U.S. would be in a position to profit from the increased adoption of Bitcoin.

- Control: Today, Bitcoin is a highly decentralized network. The codebase is maintained by open-source developers and enforced by thousands of individual nodes. No single individual or entity has decisive control over how Bitcoin operates. It is difficult to say whether a Strategic Bitcoin Reserve would impact how Bitcoin is controlled. Nonetheless, it is possible that such a policy would lead the U.S. Government to attempt to seize control over the network. For example, the government could propose policies to blacklist certain addresses that are sanctioned from the U.S. dollar system.

Key Takeaways

- A strategic reserve is a stockpile of certain materials that are held back from normal use by governments for a particular strategy or to help deal with with unexpected events.

- The BITCOIN Act would establish a strategic Bitcoin reserve to serve as an additional store of value to bolster America’s balance sheet and ensure the transparent management of Bitcoin holdings of the federal government.

- It is unlikely that a Strategic Bitcoin Reserve could single-handedly solve the federal debt problem. A $56 billion investment to acquire 1,000,000 BTC would have to appreciate by 62,500% in order to fully pay off our debt.