Cumulative Inflation

2 min read

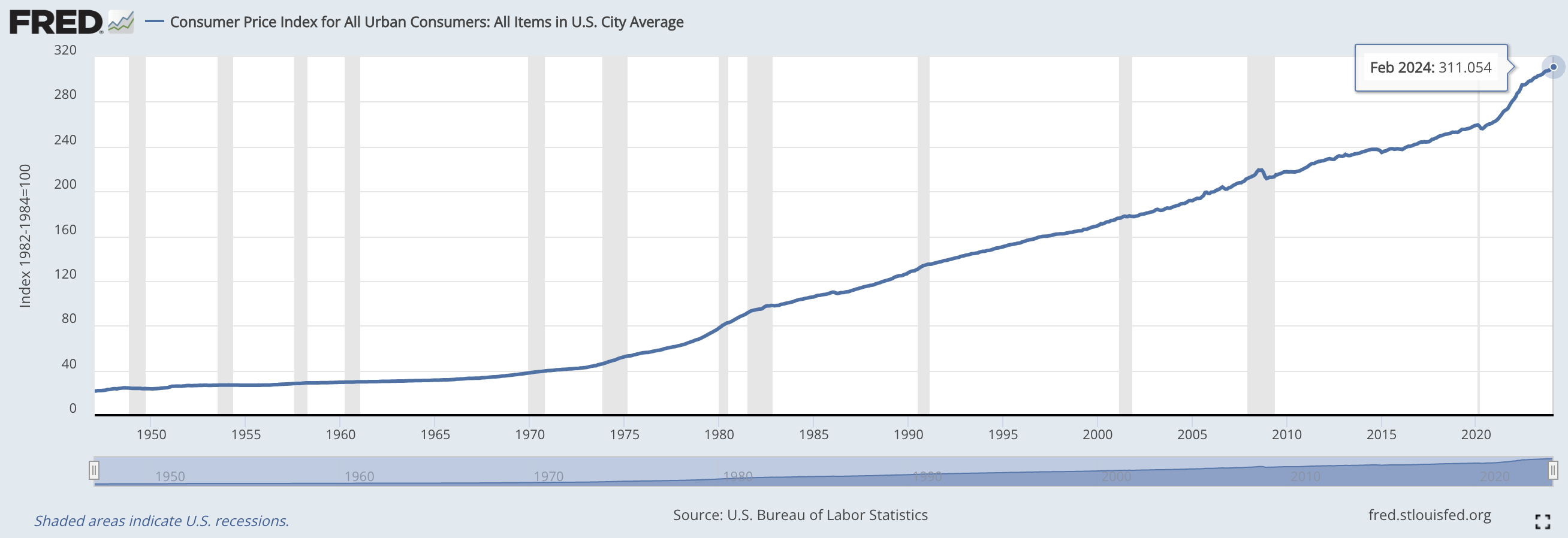

Cumulative inflation is the total increase in the price of goods and services over a period of time. It represents the decline in purchasing power of fiat money over a period longer than the yearly inflation. Cumulative inflation adds all the yearly inflations to see the total increase in prices over a period.

In 2021 alone, inflation has risen to its highest levels since the 2008 financial crisis. Many economists claim that a moderate inflation rate each year is healthy for the economy; however, a review of cumulative inflation exposes that fiat currencies are a poor store of value over years or decades.

The Consumer Price Index (CPI) reports annual and monthly inflation rates, but realized inflation often exceeds target inflation rates, demonstrating the importance of cumulative inflation rates.

By only reporting yearly and monthly inflation levels, the U.S. Bureau of Labor Statistics drastically underrepresents the impact that inflation has on the currency value over long periods of time.

How To Calculate Cumulative Inflation

Cumulative inflation is calculated by first choosing a good or basket of goods, and then dividing today’s price by the price at the start of the period. Then subtract 1. If the resulting number is greater than 0, the price of that good has inflated. For example, in 1990, an item was priced at $100, and in 2021 that same item is priced at $208. ($208/$100) - 1 = 1.08. Accordingly, the cumulative inflation rate since 1990 is 108%.