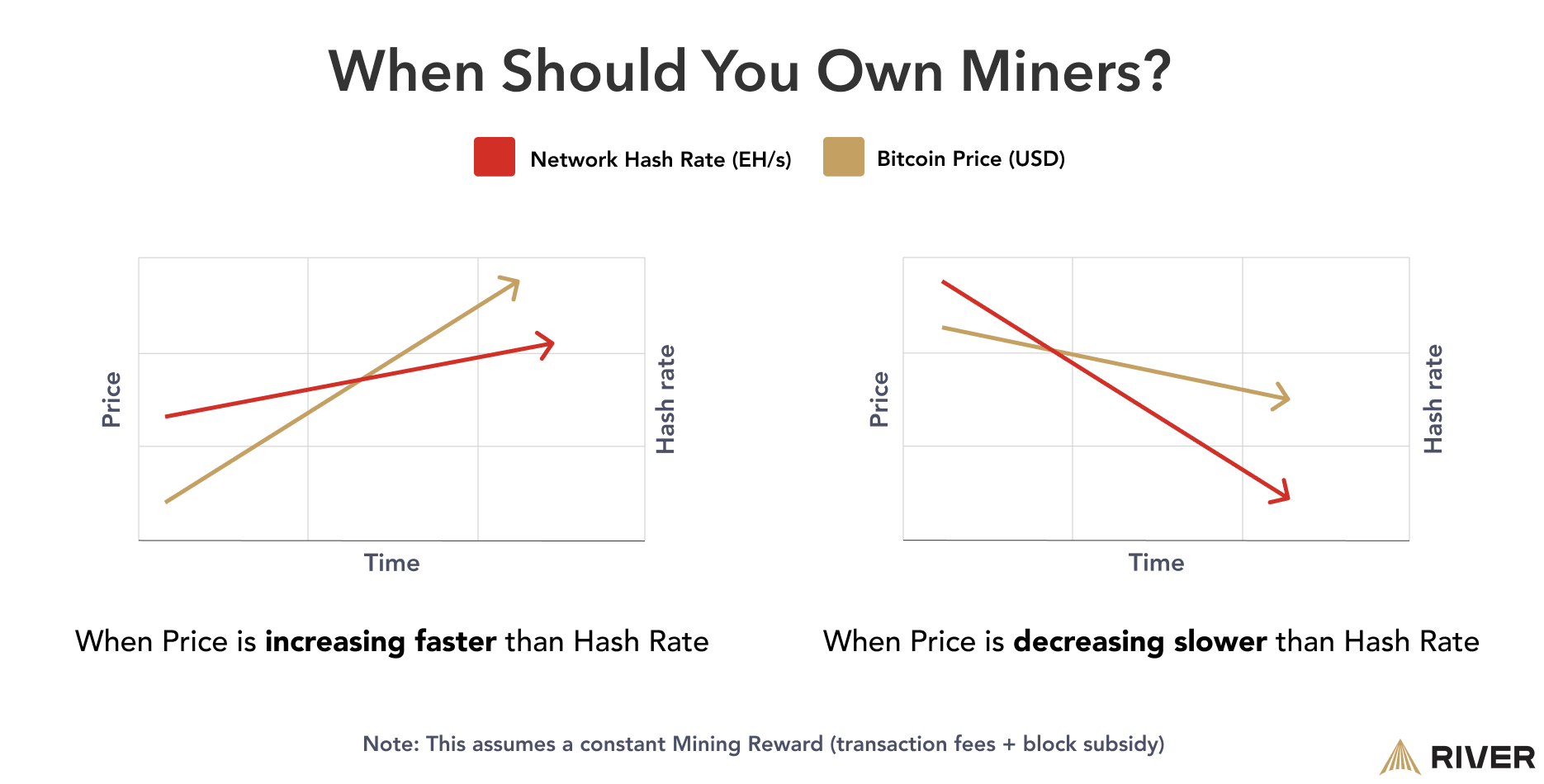

Choosing between investing in Bitcoin miners or purchasing bitcoin directly is a decision that depends on several key factors: your investment objectives, risk tolerance, technical knowledge, and available resources. You should buy and invest in Bitcoin miners rather than only buying bitcoin if you believe that over time, bitcon’s price will increase faster than the network’s hash rate increases. If you do not believe that to be the case, you might be better off using your River account to buy bitcoin in the near term.

This article will explore the benefits of investing in miners, the drawbacks of investing in miners, and provide you with resources and contacts to help you make the best decision for your particular circumstances.

➤ Learn more about Bitcoin Mining basics

Benefits of Investing in Bitcoin Miners

Investing in miners over bitcoin is effectively betting on bitcoin’s price to appreciate faster than the network’s hash rate increases. Assuming that price remains relatively constant, or increases in the short-run, you would accumulate more bitcoin by mining than by making a lump sum purchase at present.

In this sense, you can think of owning a miner as a form of dollar cost averaging with a higher upside if bitcoin’s price moves dramatically upward. In addition to maintaining consistent exposure to bitcoin through mining rewards, by participating in bitcoin mining, you are contributing to the security and decentralization of the network.

In the event that price rises quickly, or even steadily over time, those who invested in hardware would be able to recoup their initial investment, generate a profit, and potentially be able to re-sell your miner for a gain, depending on market conditions.

It could be the case that bitcoin’s price appreciation happens slowly and with periods of depreciation, or that there is no price increase at all. However, even if the price of bitcoin falls over your investment period, if hash rate falls too, and the rate that hash rate declines is greater than the rate that bitcoin price declines, you would still accumulate more bitcoin by mining than by purchasing a lump sum of bitcoin.

As a general rule, you are better off mining if you believe that bitcoin’s price will increase faster than the network’s hash rate increases over time—or that price will decrease slower than the network’s hash rate decreases.

Drawbacks of Investing in Bitcoin Miners

When you make an investment in bitcoin, your profit and loss depend on the bitcoin price. But when you are invested in miners, your position is affected by more factors.

At a high level, mining profitability depends on how difficult it is to mine a new block, bitcoin’s price, the block subsidy, and transaction fees. Miners also have to consider their power costs, the uptime of their machines, and the cost of the physical infrastructure (hosted or owned outright). The confluence of all these factors complicates the decision-making process for miners: it is simply harder to assess the value of a mining operation in the short term as opposed to a bitcoin position.

As a result of this uncertainty, it is best to consider an investment in miners as illiquid—ASIC miners are specifically designed to produce as many hashes as possible. Therefore, a miner’s incentive is to maximize their operations’ uptime, as downtime reduces profitability.

Finally, liquidating a position in physical miners is less convenient than bitcoin the asset. You would need to first take delivery of the machine, and either find another hosting partner or get in contact with an ASIC brokerage desk (like Kaboomracks) to resell your machine.

Periods When Buying Miners Was Preferable to Buying Bitcoin

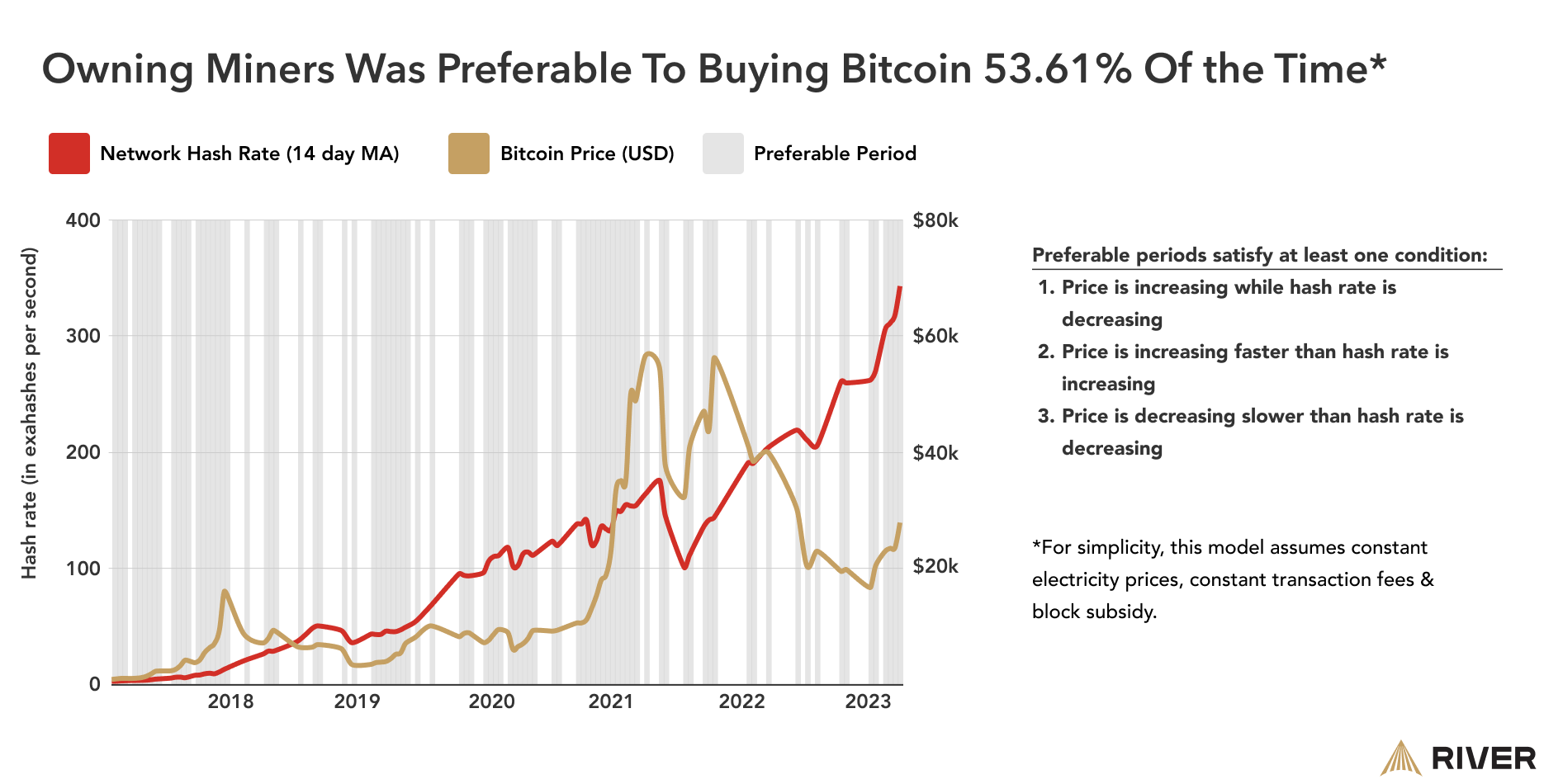

In the process of coming up with generalized parameters to determine when investing in miners made more sense than buying bitcoin, we became curious about how frequently such periods occurred. However, as discussed in the previous section, costs associated with mining vary greatly depending on external circumstances and this makes a general analysis difficult.

Therefore, to produce the model below, we made the following assumptions:

- Electricity costs are held constant (this does not occur in reality, but it simplifies the model).

- Transaction fees and block rewards are also held constant (for the same reasons).

- Hash rate and price are below illustrated as 14-day moving averages.

What we found is that from the beginning of 2018 to the present, owning miners was preferable to owning bitcoin approximately 53% of the time.

How to Get Started Mining

Ultimately, there is no one-size-fits-all answer when it comes to mining bitcoin. Each investor needs to consider their own circumstances: available capital, desired amount of bitcoin to accumulate over their investment term, as well as their tolerance for market volatility.

A great first step in assessing the feasibility of making a mining investment is to tinker with mining profitability calculators:

- ASICMinerValue is a fairly straightforward representation of profitability estimates broken down by the model of the machine.

- Luxor’s profitability calculator allows users to plug in their specific inputs.

- Braiins’ calculator offers even more inputs than Luxor and has graphical representations of monthly revenue, cash flows, PnL, and hardware value.

It might be useful to compare the results of all three calculators against each other during your diligence process—don’t trust; verify.

Conclusion

The choice between investing in bitcoin or bitcoin miners is something that each individual or organization must make for themselves.

It is important to take all of your circumstances into account: consider all your input costs, run the numbers as you understand them for yourself, and cross-reference the results against other tools.

It could be said that those who have invested in bitcoin miners have the highest degrees of conviction in Bitcoin’s success.

Key Takeaways

- Consider investing in miners if you believe price will appreciate faster than hash rate, or that price will decrease slower than hash rate.

- General answers to this question are challenging because of the amount of inputs, and person-to-person differences.

- Based on our analysis, exposure to miners has been preferable to owning only BTC 53% of the time since January 2017.