Glossary

Dollar Cost Averaging (DCA)

1 min read

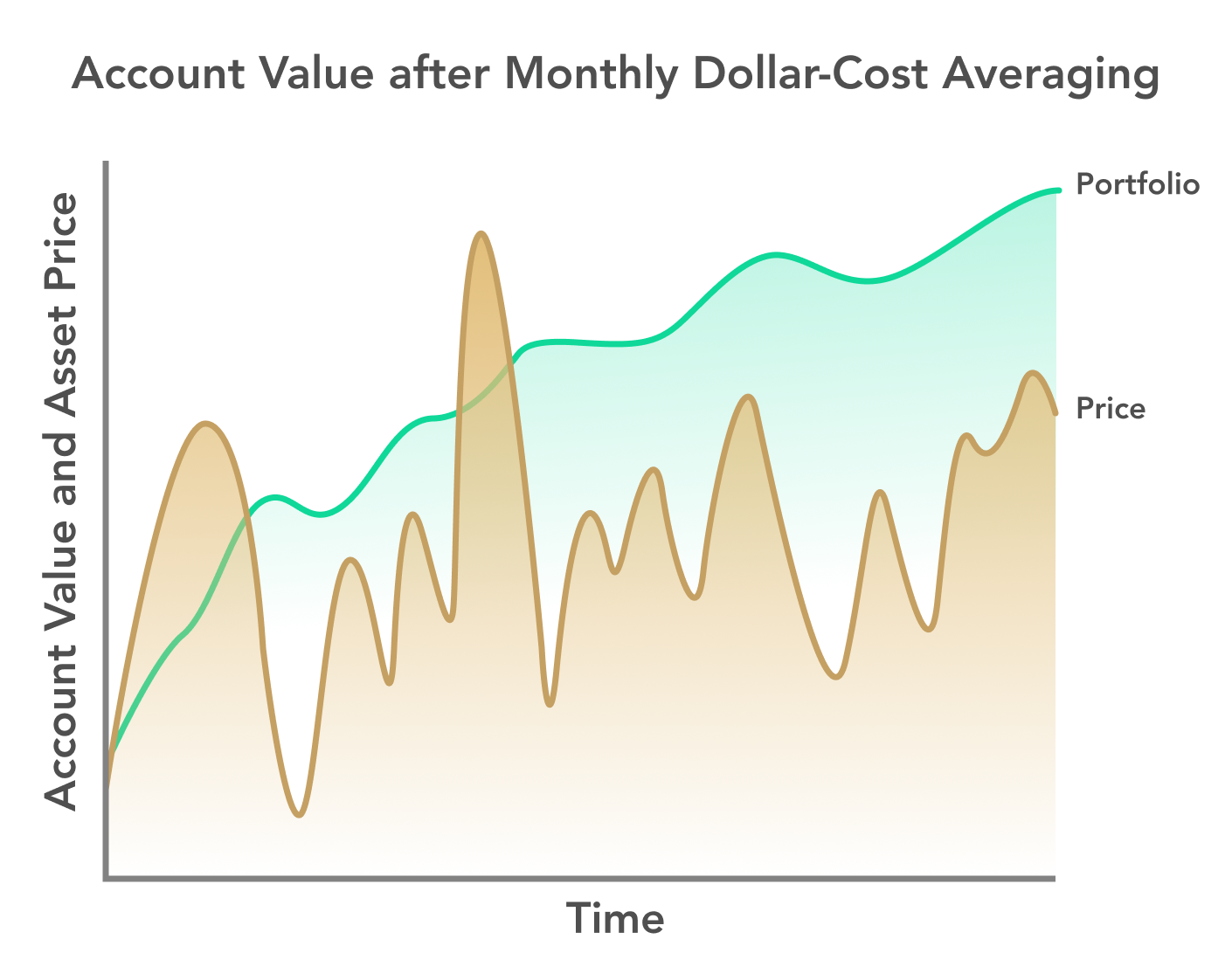

Dollar-cost averaging is an investment strategy where an investor purchases an asset over several trades which are spaced across time. The purchases are generally evenly spaced and deploy a constant amount of dollars.

The primary purchase of dollar-cost averaging is to lower the impact of volatility on the average purchase price of the asset. Investors who use dollar-cost averaging don’t have to worry about timing the market correctly as they will be making many different purchases with different prices.