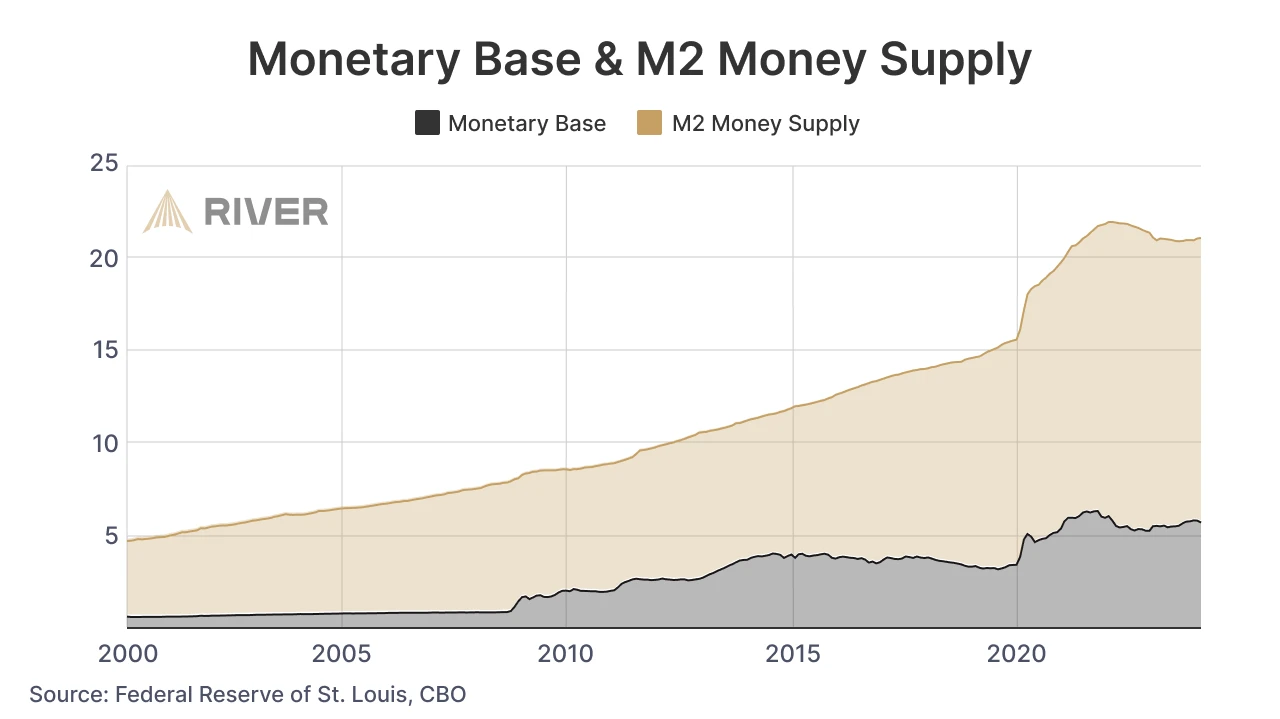

More than 80% of the US dollars in circulation today were created after the year 2000. Were these dollars “printed” or simply generated digitally? This article covers the basics of money creation and identifies the key players involved.

Understanding Money Supply

To understand how money printing works, it’s essential to grasp two key measures of the money supply.

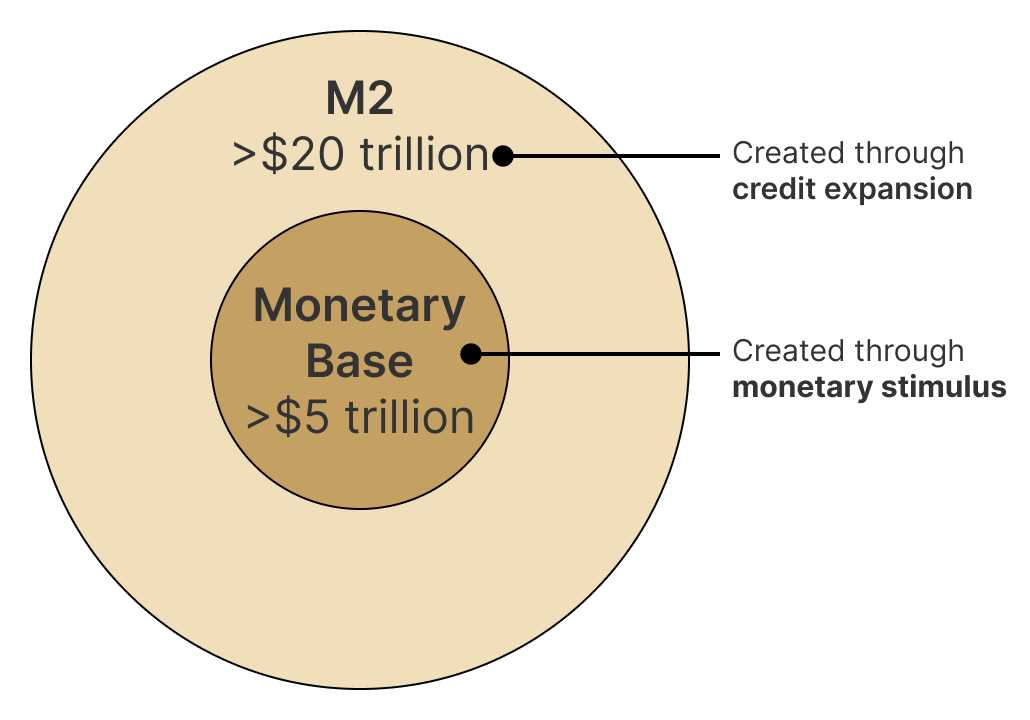

- M2 Money Supply is the most commonly used measure, encompassing all cash in circulation, bank deposits, and money market funds. This metric provides a broad view of how many dollars are available in the economy for spending and saving.

- The Monetary Base is a more strict, yet equally important way of measuring the money supply. This metric focuses on the foundational elements of the money supply directly controlled by the Federal Reserve, such as cash and bank reserves.

Credit expansion and monetary stimulus will be explained in the next section.

Methods of Money Creation

Money can be created in a few ways. This section focuses on the specifics of the U.S. dollar, but similar concepts apply to currencies around the world.

Monetary stimulus is the process of expanding the monetary base, which can only be done by the Federal Reserve. Among the four methods of monetary stimulus listed below, the first three are purely digital, enabled by the Fed’s unlimited capacity to adjust bank reserves on its balance sheet.

-

Open market operations: This involves the buying and selling of government securities in the open market. When the Federal Reserve buys securities, it must create new money to purchase these assets from banks, thereby increasing the monetary base. Conversely, when the Fed sells securities, it receives dollars from banks, thereby reducing the monetary base. The Federal Reserve conducts open market operations to set short-term interest rates. Policy measures such as Quantitative Easing (QE) and Yield Curve Control (YCC) have also been used in the past to expand the money supply.

-

Loans to financial institutions: The Federal Reserve can provide loans to banks and other financial institutions. The discount window is one such way banks can access money directly from the Fed to meet short-term liquidity needs. When the Fed lends to banks, it creates new money, thereby injecting additional reserves into the banking system and increasing the monetary base.

-

Foreign exchange intervention: The Federal Reserve can engage in foreign exchange interventions by buying or selling foreign currencies. This can influence the exchange rate and also impact the domestic monetary base depending on the transactions involved. The Plaza Accord stands as a notable example, where in 1985 finance officials from the U.S., U.K., France, Japan, and West Germany agreed to depreciate the dollar against foreign currencies.

-

Printing currency: Unlike the aforementioned methods of monetary stimulus, which occur on a purely digital basis, the printing of physical currency is done by the Bureau of Engraving and Printing (BEP), a division of the U.S. Department of the Treasury. Printing of currency occurs on a regular basis, based upon demand forecasts from the Federal Reserve. Once the BEP prints new bills, they are transferred to the Federal Reserve, which then distributes the new currency to banks in exchange for their existing reserves held at the Fed.

➤ Learn more about Seigniorage

Credit expansion is the process of increasing the amount of debt within an economy, and occurs through the lending activities of the private sector and the fiscal policies of the government:

-

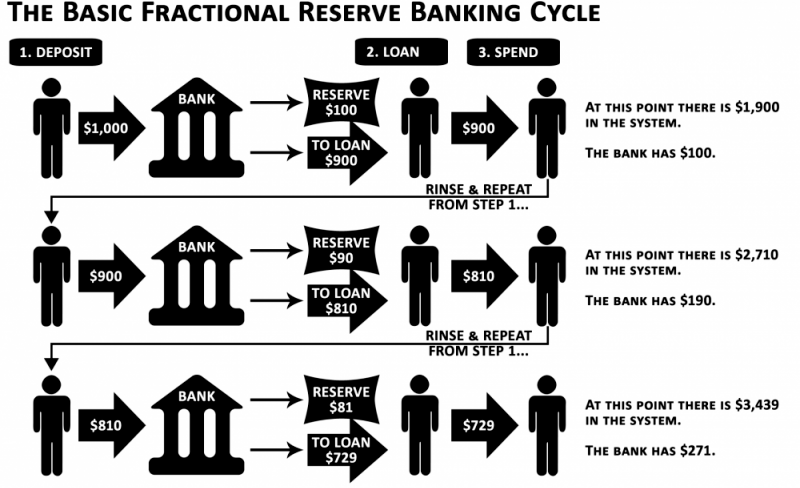

Private sector lending: Commercial banks and other financial institutions create money when they issue loans. When a bank extends a loan, it credits the borrower’s account with a deposit, thus creating new money. This process multiplies the monetary base through the money multiplier effect, where the initial deposit leads to a series of further loans and deposits. The graphic below depicts this process, known as fractional reserve banking.

-

Government deficits: When the government spends more than it collects in taxes, it runs a deficit. This deficit can be financed by borrowing from the public through the issuance of government bonds. If purchased by private entities, it leads to credit expansion as these entities convert other assets into government securities, potentially freeing up more funds for lending and investment. If there is not enough from the public to buy government bonds, the central bank will typically step in. When a central bank purchases government bonds, it creates new money, directly increasing the monetary base. As of May 2024, the Federal Reserve holds roughly $4.5 trillion in government bonds, representing the total amount of money that was created by the Fed to help pay for government deficits.

➤ Learn more about the Cantillon Effect

Can The Government Print Money?

In our current financial system, the federal government does not have the direct ability to create, or “print” money. This is because our central bank, the Federal Reserve, is not technically part of the U.S. Government, despite the fact that they operate under Congressional mandates and are run by members appointed by the President. Essentially, the Federal Reserve often has few options except to create money as desired by the federal government. Nonetheless, the Federal Reserve has full independence to carry out its mandate at its own discretion.

While the federal government cannot directly create money, its actions do affect our money supply. When the government runs fiscal deficits and accumulates large amounts of debt, the Federal Reserve historically has played a role in purchasing the government’s bonds through QE and YCC. Additionally, the government can influence the amount of bank lending through its policy, and influence monetary stimulus in its ability to appoint Federal Reserve board members.

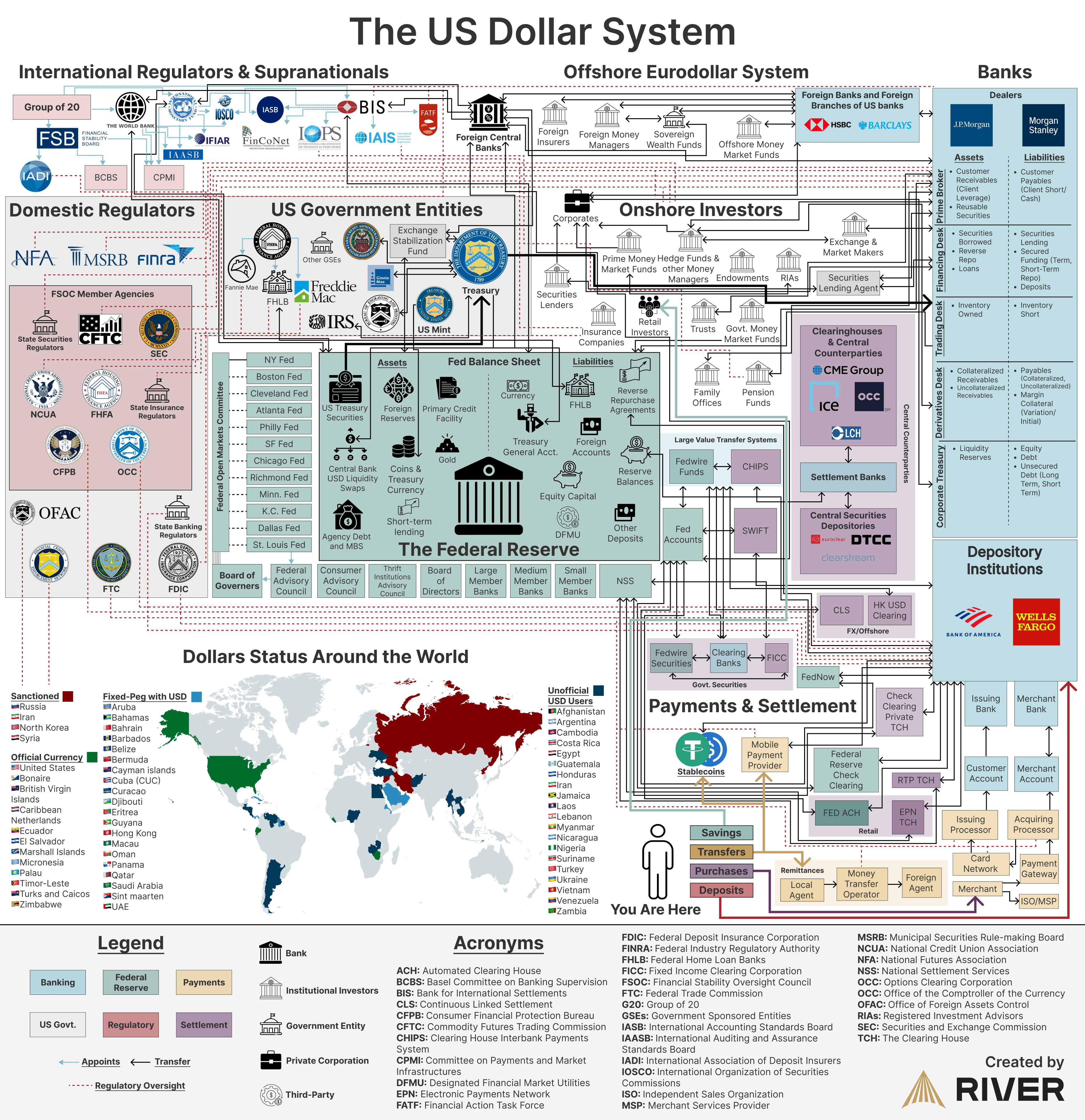

Ultimately, the U.S. dollar system is highly complex and intricate, with dozens of independent actors that all carry a level of influence over the money supply.

Historical Context of Money Printing

Money printing has occurred repeatedly throughout history, often tied to periods of economic turmoil or war. In ancient Rome, excessive coin debasement—where silver and gold content was gradually reduced—led to severe inflation and economic decline. Roman emperors frequently devalued the currency to finance military campaigns and public spending, ultimately destabilizing the empire’s economy.

During the American Revolution, the Continental Congress issued “Continental Currency” to fund the war effort. With no solid backing in gold or silver and excessive printing, the value of these notes rapidly declined, giving rise to the phrase “not worth a Continental.”

Today, over 90% of all currency is digital, making it easier to create money instantly by updated ledgers at central banks. In the future, physical currency will likely continue to decline in circulation or be phased out entirely. In this context, Bitcoin serves as the only digital currency that is immune to debasement and inflation.