As Bitcoin continues to grow in popularity as both a digital currency and an investment asset, more people are exploring different ways to get bitcoin. Whether you’re new to cryptocurrency or an experienced investor, there are several methods to obtain Bitcoin. In this guide, we’ll walk you through the different ways to get Bitcoin. Most often, bitcoin is purchased with fiat currency. Bitcoin can also be earned, inherited, or gifted.

How to Buy Bitcoin

Buying bitcoin with fiat money is the most common method of acquisition. There are many exchanges and brokerages on which you can do this, but not all of them are equal in reputation or cost.

We strongly recommend sticking with platforms with long and proven track records and being wary of anything that sounds too good to be true.

1. Bitcoin Exchanges, Brokerages, and OTC Desks

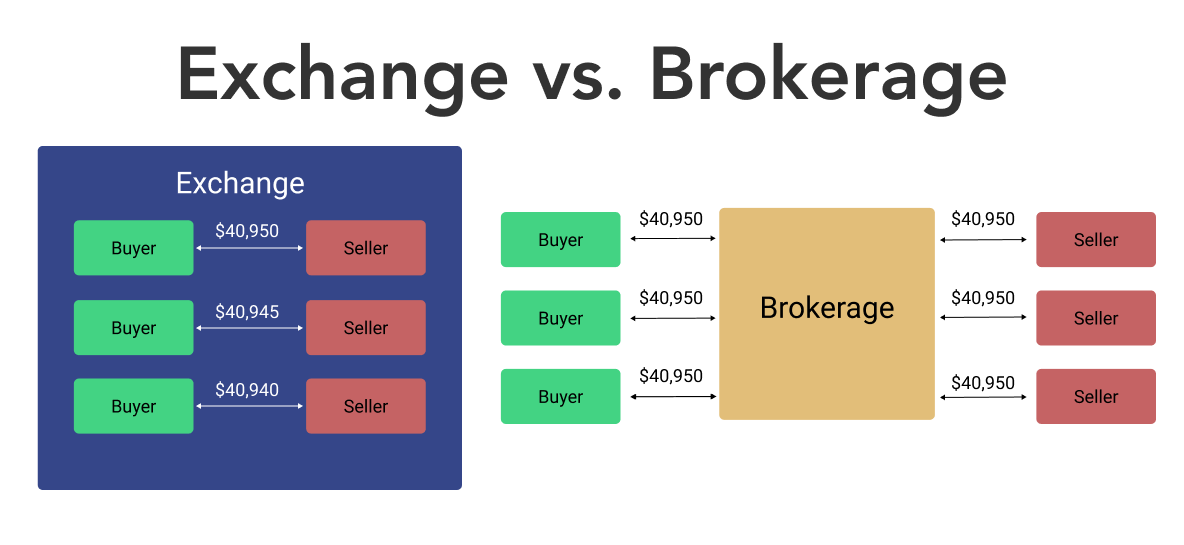

Exchanges, brokerages, and OTC desks are the most prominent market makers that facilitate bitcoin trades and investments.

Most brokerages and exchanges make it possible for an investor to buy bitcoin within a matter of minutes. To buy bitcoin through a brokerage, exchange, or OTC desk, the investor would create an account, complete KYC requirements, connect a payment method, and then purchase bitcoin.

An exchange does not provide liquidity because it does not hold any assets. Conversely, a brokerage is actively involved in the trade and thus provides liquidity.

An OTC desk acts as a direct dealer or supplier, and is generally restricted to institutional clients and time-sensitive purchase orders. Brokerages typically purchase bitcoin from an OTC desk on behalf of their clients.

➤ Learn more about how River purchases its bitcoin.

2. Bitcoin ATMs

An individual can buy bitcoin from a Bitcoin ATM, which accepts fiat currency in exchange for bitcoin.

Some Bitcoin ATMs have more lenient KYC standards in comparison to exchanges, brokerages, or OTC desks. However, bitcoin ATMs often charge a higher fee than other purchase options.

3. Payment Applications

Bitcoin can be bought through a payment application, such as PayPal, CashApp, and Venmo. However, these applications aggregate coins from many users into large institutional wallets. This means that an individual who holds bitcoin on these platforms is not the true owner of the bitcoin itself, as they are not holding it in self-custody.

Know Your Customer (KYC) Requirements to Buy Bitcoin

When buying bitcoin from an exchange or brokerage for the first time, such a platform is required by law to collect certain information about the buyer through a Know Your Customer (KYC) process.

By Bitcoin’s design, these rules do not apply to peer-to-peer transactions on the network. A user can transact with anyone without having to collect and protect their personal identity information.

There are several steps in the KYC process. First, a bitcoin brokerage or exchange must collect the investor’s legal name, date of birth, physical address, email address, and social security number. This initial KYC is typically automated, meaning that computers review the information provided by the investor. The financial institution’s client services team will then verify the name, date of birth, and physical address. If the investor wishes to withdraw bitcoin to self-custody, the financial institution may also require them to submit photo identification, such as a driver’s license or passport.

➤ Learn more about privacy, anonymity, and KYC.

How to Fund a Bitcoin Purchase

Bitcoin is typically purchased by wire transfer, ACH payment, direct deposit, or through a payment application.

Wire transfers and ACH payments have longer settlement times but lower fees, which may be preferable for larger bitcoin purchases.

Buying Bitcoin Through a Bank Wire

Bitcoin can be bought by wiring funds directly to a bitcoin financial institution. Bank wires relay information between connected banks at the request of a client, allowing an investor to send money from their bank account to the institution through which bitcoin will be purchased. Bank wire transfers are typically used for large bitcoin buy orders, and excess funds are kept on the platform as a cash balance.

ACH Payment to Buy Bitcoin

An individual can also buy bitcoin with a bank transfer that is facilitated by an automated clearing house (ACH). ACH systems settle transactions in batches and can take three to four days to complete a transfer. After placing a buy order, funds are typically debited from the linked bank account between 1 to 3 business days.

Note that a holding period will often apply to transfer the bitcoin off the platform since ACH payments are subject to long chargeback periods.

How to Earn Bitcoin

An individual can earn bitcoin in many different ways.

Get Paid in Bitcoin

Anyone can request their employer or clients to pay them in bitcoin rather than fiat currency. For an increasing number of people around the world, this is a preferred option.

A discount can even be offered since the settlement is faster and there is no large fee being taken by a payment processor.

Many different wallets and payment providers can be used to accept bitcoin payments.

Note that earned bitcoin is taxed differently than bitcoin purchases and sales.

➤ Learn more about bitcoin mining taxes and regulation.

Earn Bitcoin Through Mining

The best-known method for earning bitcoin is mining it. This is a highly competitive market that requires proper investigation and real dedication to make it worthwhile. For the vast majority of people, earning bitcoin or buying it is the preferred way.

➤ Learn more about mining, transaction confirmation, and the blockchain.

Other Ways to Get Bitcoin

Sometimes an individual can obtain bitcoin at little or no cost. In these scenarios, bitcoin is either gifted to promote the network or inherited by a beneficiary.

Bitcoin Airdrops and Faucets

A bitcoin airdrop distributes free bitcoin. A bitcoin faucet releases small amounts of free bitcoin in sporadic intervals to users through a connected wallet. Airdrops and faucets are no longer common. Accordingly, users should be skeptical about any service offering to send them free bitcoin. Bitcoin received from an airdrop or faucet is taxed at the individual’s income tax rate.

Airdrops and faucets were popular in the first few years of Bitcoin’s existence, when bitcoin was cheap and demand was relatively low. Airdrops and faucets were a method for increasing bitcoin adoption, and essentially gave free bitcoin to anyone willing to provide an address. One prominent and early example of a bitcoin airdrop occurred in 2010, when Gavin Andresen, one of the earliest Bitcoin developers, created a faucet to periodically give out free bitcoin.

Airdrops have become less frequent in recent years because the value of bitcoin has increased significantly, and it is no longer economical for Bitcoin evangelists to give away free bitcoin. One recent airdrop occurred in 2021, when the El Salvadoran government airdropped $30 in bitcoin to its citizens shortly after adopting the currency as legal tender.

➤ Learn more about Bitcoin's network effect.

Bitcoin Inheritance

As the population ages, bitcoin inheritance and estate planning will become increasingly important. Depending on the storage method and purchasing activity, there are several options for ensuring that the appropriate beneficiary will inherit your bitcoin. If a beneficiary has not been established through a service or tool of the custodian, then decisions about Bitcoin accounts defer to estate planning documents or Power of Attorney.

➤ Learn more about set up Bitcoin inheritance.

How To Store Bitcoin Safely

Once you’ve purchased Bitcoin, it’s crucial to store it securely. Bitcoin can be stored in two main types of wallets:

Hot Wallets: These are connected to the internet and allow for quick access to your Bitcoin. They are convenient for frequent transactions but are more vulnerable to hacking.

Cold Wallets: These are offline and provide the highest level of security. Cold wallets can be hardware devices, paper wallets, or USB drives. They are best suited for long-term storage.

➤ Learn more about types of different bitcoin wallets

Notice: River does not provide investment, financial, tax, or legal advice. The information provided is general and illustrative in nature and therefore is not intended to provide, and should not be relied on for, tax advice. We encourage you to consult the appropriate tax professional to understand your personal tax circumstances.

Key Takeaways

- An individual can buy bitcoin with fiat currency or other tokens.

- A bitcoin mining machine earns bitcoin by working to build the blockchain.

- Anyone with internet connection and a Bitcoin wallet can be paid in bitcoin.

- Cash, credit card, debit card, bank wire, automated clearinghouse, or payment application can be used to buy bitcoin.