Cloud mining can be a contentious topic in the cryptocurrency community. Cloud mining can be trusted if you choose a reputable and transparent provider. However, due to the high risk of scams and the often lower profitability compared to traditional mining, it requires careful research and consideration. Always be cautious and avoid investing more than you can afford to lose.

Cloud mining can look like an interesting way to start earning cryptocurrency rather than buying it. There’s no need to install or run hardware or software, and no other technical issues to deal with, so it sounds easy!

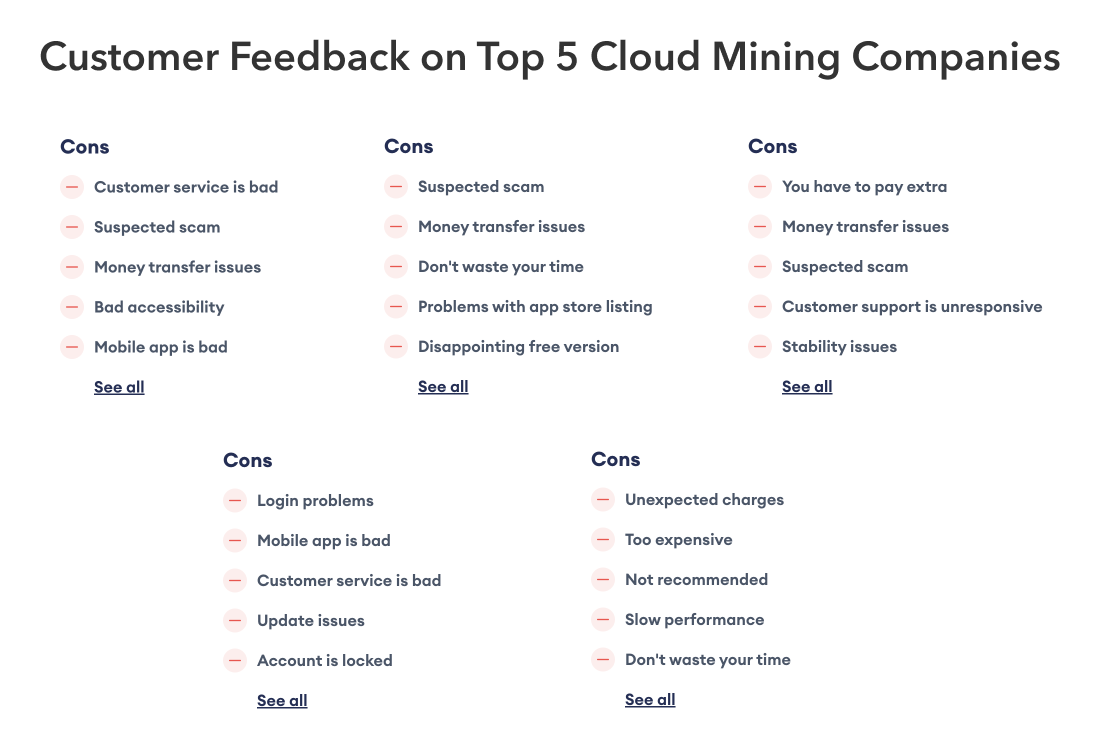

However, when digging deeper into the top 5 rated cloud mining companies, their customer reviews tell a different story:

Every business has negative reviews, but phrases like “suspected scam” or “customer support is unresponsive” are definite red flags. When these types of reviews frequently pop up for all the top companies in an industry, it should serve as a warning to anyone and warrant further investigation. It’s important for anyone considering cloud mining to thoroughly research the cloud mining service provider to ensure they are reputable and to carefully consider the potential risks and returns.

We are not trying to name and shame cloud mining businesses, nor do we want to write off an entire industry. We want to provide a different perspective on cloud mining—no spin, no marketing talk—to help clients make informed decisions.

What Is Bitcoin Cloud Mining?

Cloud mining is a way to earn cryptocurrency, such as bitcoin, without having to directly manage the hardware and software typically required for mining. Instead of setting up and maintaining their own mining rigs, individuals rent processing power from third-party sources such as a cloud mining service provider. Just like hosted mining, it is a way to start mining cryptocurrency that does not require the individual to set up and maintain a physical mining operation. This makes mining more accessible to those without technical skills. However, unlike hosted mining, a cloud mining customer does not own the mining rigs.

Similarly, software businesses used to maintain their own servers to run their infrastructure 24/7. Over the past decade, many of them have outsourced these activities to professional cloud computing/hosting companies that specialize in running infrastructure.

When a customer rents computing power from a cloud mining provider, the customer usually pays a fee on a monthly basis for the electricity costs and maintenance to keep the ASIC mining as much as possible. These terms are typically defined in a long-term contract. Due to the volatile nature of cryptocurrency mining profitability, the upside of such a long-term contract can be difficult to assess. Terms may look favorable upon signing the contract, but as market conditions change, so can the profitability.

Cloud Mining Bitcoin

In the early days of Bitcoin mining, everyone did their mining at home. Eventually, professional businesses started emerging. These miners specialize in finding the cheapest energy available (often stranded or otherwise wasted energy) to drive their costs lower. These low costs make it hard for the vast majority of the global population to compete from home with their local energy prices, as they get outcompeted.

Cloud mining businesses have existed for years in Bitcoin and gained a lot of traction in general when other cryptocurrencies started seeing increased trading volumes in 2017. The cloud mining business owns the ASICs and is responsible for paying out customers according to the terms of their contracts.

The customer does not own anything and only has a contract to ensure payouts. Without more recourse, it can be easy for an illegitimate company to scam people. Many of these operations temporarily paid out customers, and then took off with the money either when bills came due or when they had “made enough.”

Is Cloud Mining Bitcoin Profitable?

It is possible for cloud mining to be profitable, depending on the provider and the state of mining profitability. Cloud mining involves various costs that can significantly impact your profitability. Key fees include setup fees for configuring hardware, ongoing maintenance fees for electricity and equipment upkeep, and potential hidden fees like withdrawal charges or scaling costs. Contracts also vary in duration and may include clauses for early termination if mining becomes unprofitable. It’s crucial to review these details thoroughly to avoid unexpected expenses and ensure you understand the full cost implications before committing to a cloud mining contract.

Consistent profitability can be difficult, as mining is a very competitive business where operators aim to pay minimal energy prices. If a cloud mining business adds its own fee on top of the energy price, then it becomes harder to be competitive with miners that only pay for the electricity.

Some cloud mining providers may promise advanced features that reportedly lead to higher profitability, such as switching between which coins are mined based on profitability, or mining several coins at once. In general, we would advise caution when mining anything other than Bitcoin, as many cryptocurrencies have low trading liquidity and high price volatility. Their profitability can quickly evaporate, which is costly when locking into a longer term contract.

Is Cloud Mining Safe and Trustworthy?

The cloud mining business model raises serious questions. Let us reason through this logically:

The costs to run a Bitcoin mining operation include buying ASIC mining rigs, building out or renting a facility, purchasing additional equipment (cooling systems, cables, and racks), paying staff for setup and maintenance, and electricity costs.

The biggest upfront cost is the ASIC mining rigs. These could be financed over a longer period of time, but this is a significant investment nonetheless.

So if a company already owns all of the mining equipment, why would they need your capital to run it? If mining is profitable, then the operator would earn more money in mining rewards than they are paying in electricity.

A common business argument is that they need your capital “to grow faster,” but this means that the business is constantly spending all of its capital to squeeze out a few extra percent in a volatile and unpredictable market. This involves significant risk to the business and its customers, so is it wise to trust such a company with your money?

The biggest problem with cloud mining is that as a customer, there is no guarantee that your money is actually being used for mining. The business takes capital from its customers and needs to pay them returns. This can, however, also be done by investing the customer money in other activities that may have significantly more risk.

We would argue the risks of cloud mining outweigh the rewards, which is also why River does not offer cloud mining. We have a hosted mining product instead, which has a key difference.

Cloud Mining Compared to Hosted Mining

The main difference between cloud mining and hosted mining is that with hosted mining, the client owns the mining hardware and can get it physically delivered to them in case something goes wrong at the hosting site.

This may not seem like a significant difference at first, but the critical advantage is that the business can share the costs of purchasing miners with its customers. This means that a hosted mining business only needs to ensure that it has space to operate the ASICs, and can ensure a high level of uptime on the miners as agreed in the contract. From a business perspective, this is simpler to run and finance, which reduces the risks for both the business and the customer.

Modern ASICs can be profitable for years, so a client with a stable and reliable partner can mine for the long-term.

The downside of hosted mining for the customer is a higher upfront cost, as they have to purchase mining rigs. However, this does provide more peace of mind for the customer that there is actually a machine out there that is mining for them. The client also owns the equipment, which can provide an additional claim against a partner that is not paying out mined Bitcoin. Clients may also be able to depreciate their miner(s) over time, depending on the tax advice of their accountant.

How To Choose a Cloud Mining Provider?

Finding the right cloud mining service is key to avoiding the potential risks of cloud mining. It’s important to choose services that are transparent about their practices. Look for ones that share detailed information about their mining locations, the equipment they use, and updates on mining progress. You should opt for a provider with a proven track record. Reviews and feedback from other users can give insight into the service’s reliability and trustworthiness.

Key Takeaways

- Cloud mining is a way to earn cryptocurrency by renting computing power from third-party sources.

- The cloud mining business model raises questions about why these companies need client funds to pay for electricity when they have budgeted for everything else.

- Cloud mining has historically been a troubled industry with customer funds frequently being used for other, more risky activities.