Bitcoin’s hard cap, also known as the supply limit, can theoretically be changed, however, such a change would be very unlikely to occur. There are incentive and governance models in the bitcoin protocol that protect the hard cap of 21 million coins.

What Is the Bitcoin Hard Cap?

The Bitcoin hard cap is the maximum number of bitcoin that can ever be created, which is set at 21 million BTC. This hard limit on the total supply of Bitcoin is a key feature of Bitcoin’s monetary policy, designed to create scarcity and prevent inflation. Satoshi Nakamoto encoded this limit into Bitcoin’s source code, which is enforced by network nodes.

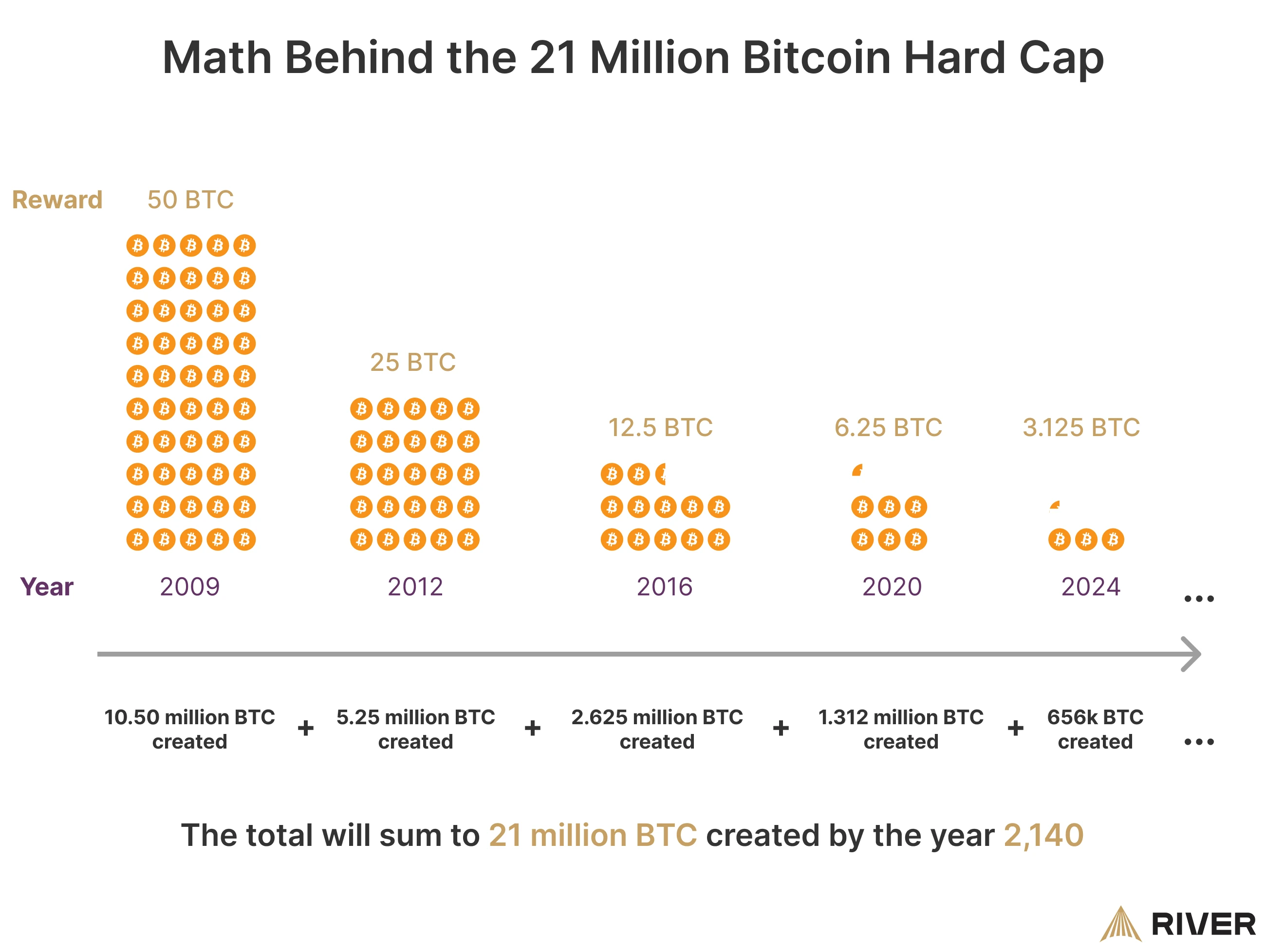

The hard cap is reached through the process of halving, where the reward for mining new blocks is cut in half approximately every four years, gradually reducing the rate at which new bitcoin are created until the hard cap or limit is reached. It’s estimated that the last bitcoin will be mined around 2140, bringing the supply to a total of 21 million.

➤ Learn more about Bitcoin’s emission schedule.

Importance of the Hard Cap

Bitcoin’s hard cap is central to its value proposition, both as a money and an investment. Like gold and real estate, Bitcoin is a successful store of value because it’s difficult to increase its supply. Thanks to the halving process, bitcoin becomes more difficult to produce about every four years, and eventually, it will become impossible to create new bitcoin. This scarcity is one of the reasons why many investors value Bitcoin highly.

➤ Learn more about why Bitcoin has value.

Why Did Satoshi Choose 21 Million?

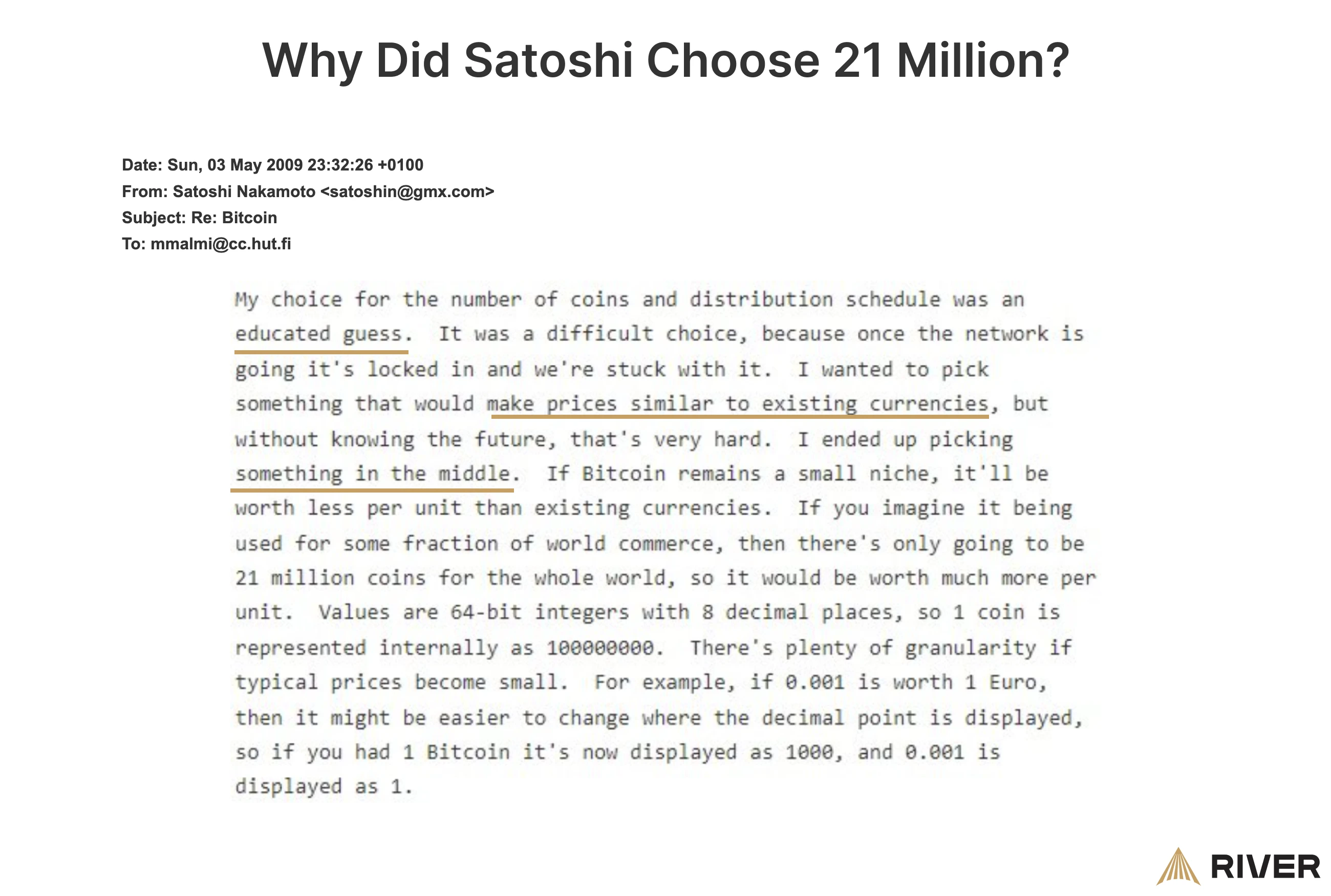

While initially, Satoshi did not disclose the specific reasons, an email exchange with Martti Malmi, an early Bitcoin contributor, sheds light on the rationale behind this decision. Satoshi explained that the decision to cap Bitcoin’s supply at 21 million was an “educated guess,” since it needed to be decided in advance without knowing how the future of Bitcoin would unfold.

Satoshi aimed at a number that would eventually make prices denominated in Bitcoin comparable to existing currencies. It was further explained that Bitcoin offers a high degree of divisibility, which allows for flexibility in pricing. A bitcoin is divisible into 100 million units called satoshis.

Bitcoin’s divisibility ensures that despite a seemingly low supply, it can serve as a medium of exchange. This high level of divisibility allows for flexibility in payments accommodating a wide range of values. Even if the value of one bitcoin becomes very high, transactions of very small amounts are still possible, making Bitcoin practical for everyday use and ensuring its utility across various economic scales.

Why Bitcoin’s Hard Cap Will Not Change?

There will never be more than 21 million bitcoin because Bitcoin’s hard cap is protected by its incentive and governance model. A few critics claim that since Bitcoin is nothing more than open-source software, the rules of the Bitcoin network can be changed easily.

Thanks to Bitcoin’s architecture, the entities who maintain Bitcoin’s rule set have strong incentives to resist a change to the hard cap, while those who may desire to change it have no ability to control the network.

Miners are the actors who may have the strongest motivation to change Bitcoin’s hard cap as it may temporarily increase their revenue.

However, for several reasons outlined below, this change will not occur.

Bitcoin’s Incentive Model Protects the Hard Cap

There is a lack of an incentive to increase the bitcoin supply because it would result in inflation and destroy the core investment thesis for Bitcoin – its scarcity. For many investors, the allure of Bitcoin is the predictable, fixed supply. Wealth managers such as Paul Tudor Jones and institutions such as BlackRock have credited Bitcoin’s scarcity as a significant driver for its growing value.

Removing the fundamental driver behind Bitcoin’s value proposition is not in the miners’ best interest. Although the change would increase miner revenue in bitcoin terms, the loss of faith in the Bitcoin network would result in a catastrophic and irreversible price collapse, leading to a net loss of miner revenue in fiat terms.

Since almost all miners pay their costs such as equipment costs, salaries, and energy bills in fiat currency, miners are more concerned with their fiat-denominated revenue rather than their bitcoin-denominated revenue. Thus, if bitcoin’s price crashes, miners will face large financial setbacks.

Bitcoin’s Governance Model Protects the Hard Cap

Bitcoin’s governance model is decentralized, meaning that changes to the protocol require widespread consensus. Any change to the hard cap would require the majority of nodes to adopt the new rule, which is unlikely.

Speculation that Bitcoin’s hard cap could change is rooted in two deeper misunderstandings about Bitcoin as a distributed, consensus-based network. Firstly, there is not one, but dozens or hundreds of versions of the Bitcoin source code. Every node in the Bitcoin network runs independent software that will reject any invalid blocks, such as blocks that reward a higher amount of BTC.

While many nodes run the latest version of Bitcoin Core, a significant number of nodes continue to run older versions and different implementations. Thus, while Bitcoin Core’s source code can be changed trivially, it is far more difficult to convince tens of thousands of nodes to adopt these changes.

➤ Learn more about what is Bitcoin Core.

Secondly, miners do not control the network or its rules. Miners follow rules enforced by the full nodes to be rewarded with bitcoin. When miners submit a new block to the network, tens of thousands of nodes each independently verify this block, making sure it produces an appropriate amount of new bitcoin, includes a valid Proof-of-Work, and all transactions within the block are valid. Nodes will reject all blocks that violate these rules, meaning miners have no control over Bitcoin’s ruleset.

This theory was validated by reality during the Blocksize War in 2017 when 95% of miners agreed to raise the block size limit in an attempt to allow Bitcoin to scale. Nodes and users, however, refused this change and successfully forced miners to adopt an alternative scaling solution.

How Can Bitcoin’s Hard Cap Be Changed?

Despite the countervailing incentives and governance models, changing Bitcoin’s hard cap is possible, but several groups would have to collaborate from the developers, community members, and nodes.

First, developers must propose and then write the code to implement this change. There would be community discussion, which would likely be controversial. If developers agreed upon these changes, the changes would be integrated into Bitcoin Core.

Next, the community would have to agree to an activation path, to ensure that the network transitioned to the new ruleset collectively. Changing the supply cap would necessitate a hard fork, which means that all nodes on the network would have to adopt the changes or be forced off the network.

As part of the activation path, both miners and nodes would signal their support for the change, and once a dominant portion of the network signaled support, the change would be activated. Nodes and miners who refused the change would now operate a minority fork, preserving the original Bitcoin network, and the two networks would compete for market share and hash rate. Thus, the 21 million supply of the original bitcoin can never be changed.

Key Takeaways

- Bitcoin critics claim that Bitcoin’s rules can be easily changed by altering Bitcoin’s source code.

- However, Bitcoin is governed by the software run by nodes, not by the source code.

- Removing the strict limit on the number of bitcoin would destroy the value of Bitcoin as a system and alienate investors and long-time believers.