In recent years, bitcoin has emerged as a treasury asset for businesses across all industries. While most companies choose to hold a small amount of bitcoin as part of their broader business model, others take a more aggressive approach. These companies allocate a majority of their assets to bitcoin with the stated goal of accumulating as much bitcoin as possible. Businesses that follow this strategy are known as bitcoin treasury companies.

In this article, we’ll explore what defines a bitcoin treasury company, the benefits and risks for investors, and how investing in bitcoin treasury company stocks compares to owning actual bitcoin.

Defining a Bitcoin Treasury Company

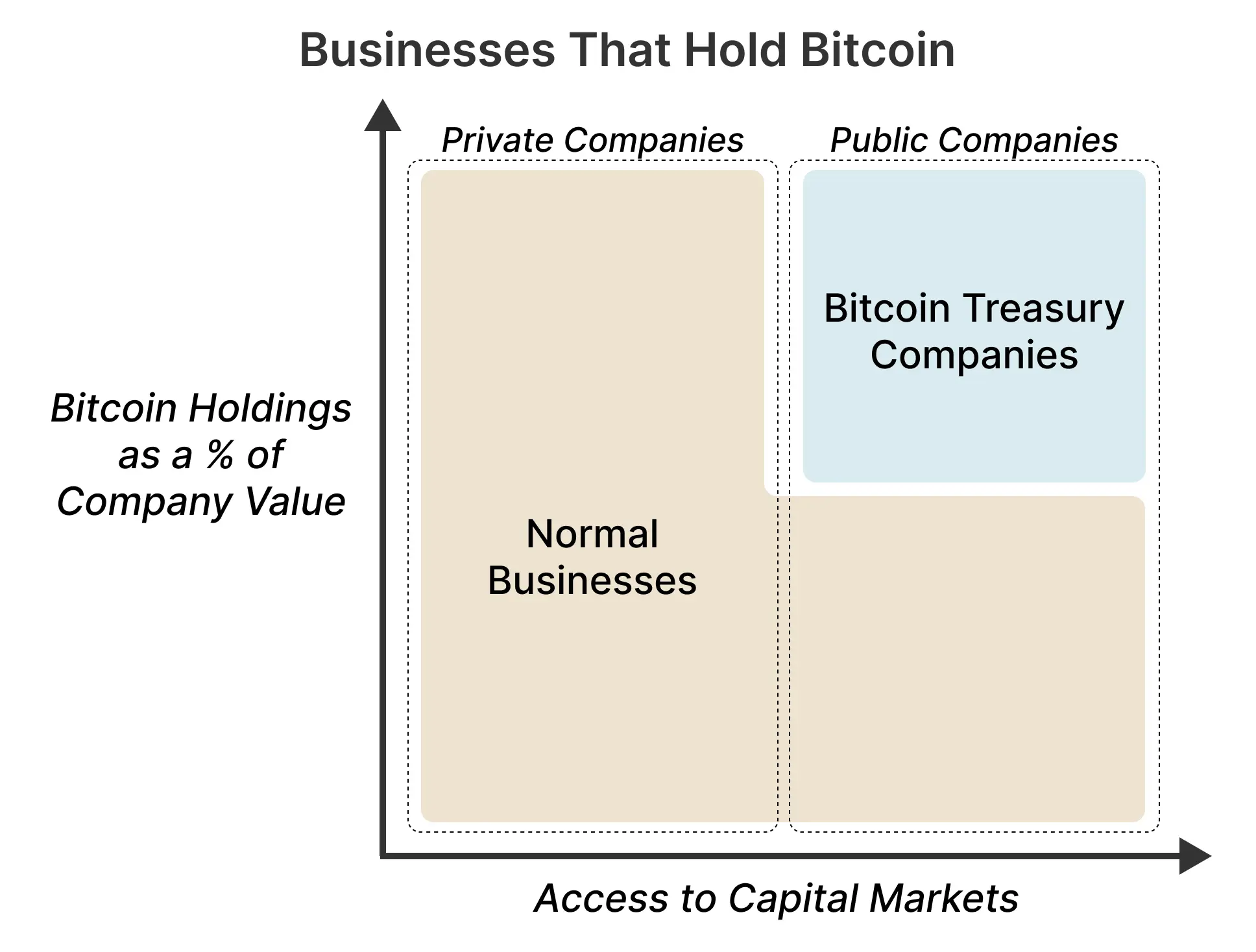

Bitcoin treasury companies are publicly traded firms whose main purpose is to provide investors with price exposure to bitcoin. Not all companies that hold bitcoin are bitcoin treasury companies. Instead, these businesses have two unique qualities:

- High bitcoin allocation: Bitcoin treasury companies take an “all-in” approach, where bitcoin holdings represent a majority of company assets. This significant bitcoin exposure sets them apart from traditional businesses and positions primarily as investment vehicles for those seeking exposure to bitcoin’s price performance and growth.

- Access to capital markets: Bitcoin treasury companies regularly raise funds to acquire more bitcoin. They accomplish this by issuing shares of stock, taking on debt through bonds, and offering other sophisticated securities. These companies must be publicly traded to allow investors to purchase their shares.

How Bitcoin Treasury Companies Differ from Traditional Businesses

Most traditional businesses that hold bitcoin do so to help preserve earnings, hedge against inflation, and manage financial uncertainty. For these companies, bitcoin represents a small fraction of their total assets, serving as a strategic tool within a broader business model. In contrast, bitcoin treasury companies are specifically designed to provide investors with price exposure to bitcoin. The central pillar of their business model is their bitcoin holdings.

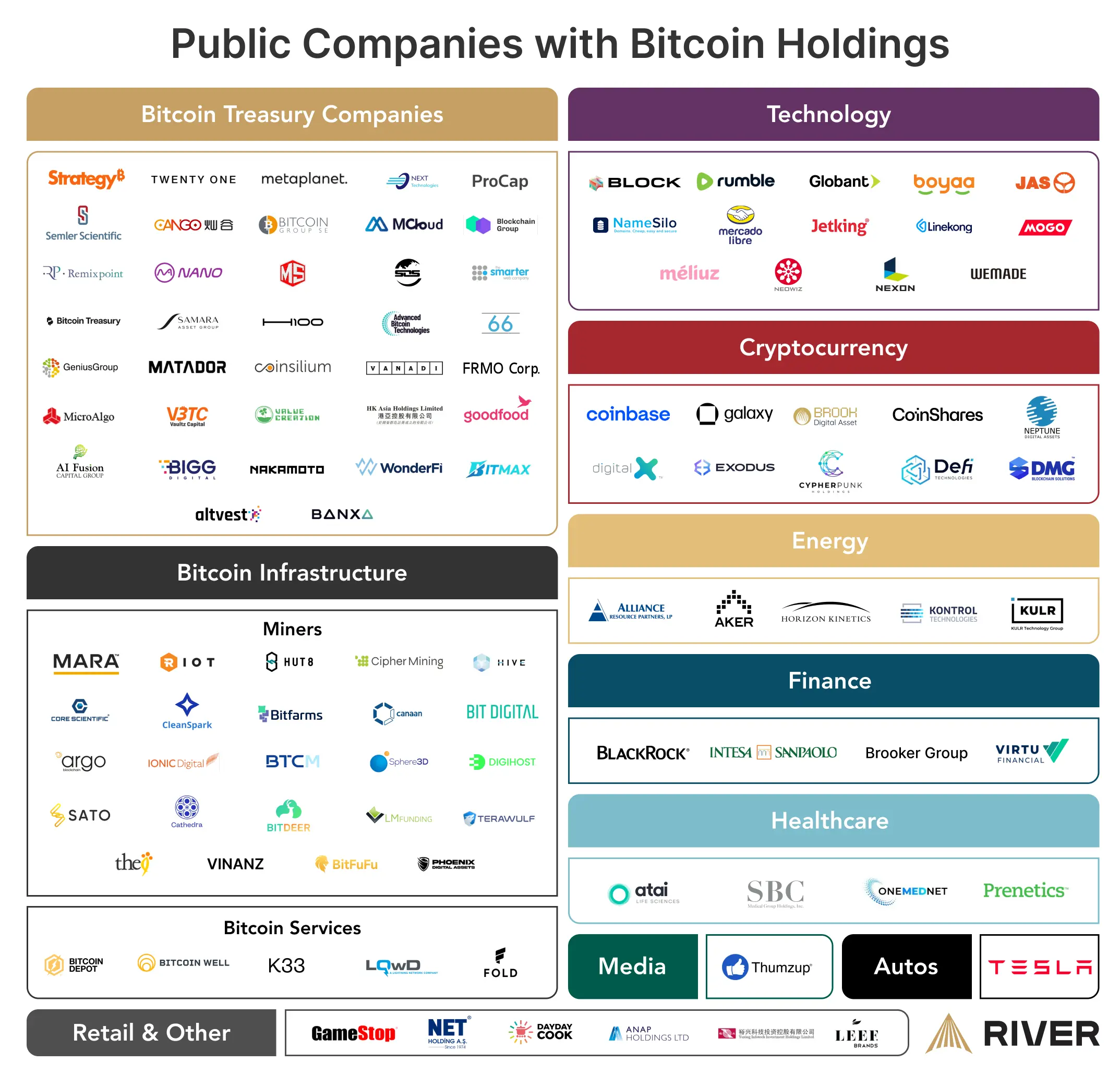

Bitcoin adoption by businesses is growing rapidly across nearly every industry. To learn more about this trend, please read our recent report.

➤ Learn more about Learn how to invest in bitcoin with your business

Why Do Bitcoin Treasury Companies Exist?

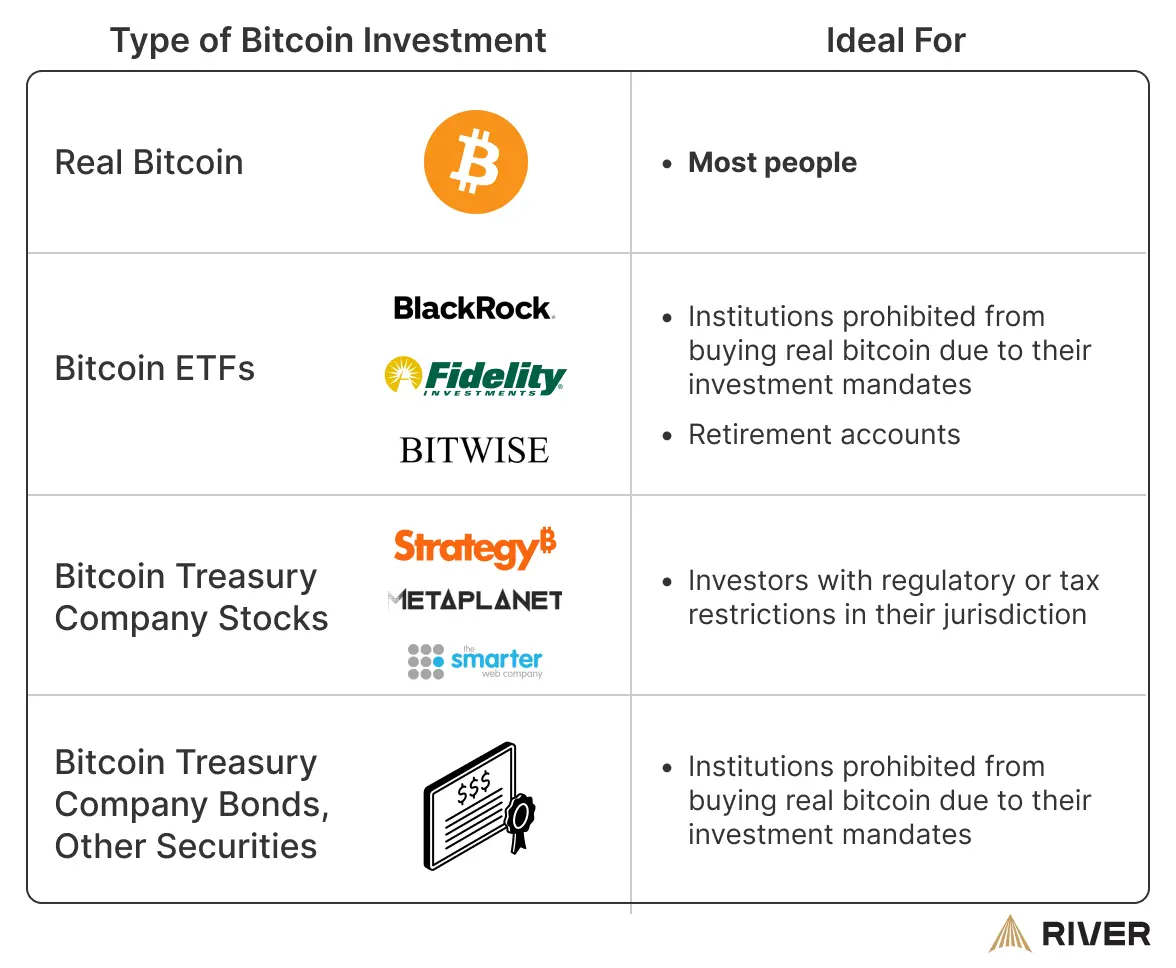

Investors hold more than $112 billion worth of stocks in bitcoin treasury companies as of July 2025. These investors typically choose to own bitcoin treasury companies instead of (or in addition to) real bitcoin for the following reasons:

Jurisdictional Considerations

Regulatory barriers in certain countries make direct investment in bitcoin difficult or costly for investors:

- In regions where spot bitcoin ETFs or similar regulated funds are not available, like the United Kingdom, a bitcoin treasury company may be one of the ways for some investors to gain price exposure.

- In Japan, high capital gains taxes on direct bitcoin holdings can discourage individual investment, while taxes on stocks are comparatively low. In Japan’s case, investing in bitcoin treasury companies can offer a more cost-effective and accessible way for investors to benefit from bitcoin price movements.

Investor Mandate Restrictions

Many institutional investors face strict limitations on the types of assets they can hold. Even if these investors view bitcoin favorably, their investment mandates may prevent them from purchasing bitcoin directly. Bitcoin treasury companies can provide a compliant way for institutions to gain indirect price exposure to bitcoin while still meeting their investment mandates.

For example, a fund restricted to investing solely in bonds cannot buy bitcoin outright. However, by purchasing the corporate bonds of a bitcoin treasury company, the fund can take a bullish position on bitcoin and participate in its potential upside.

Similarly, retirement funds often have a low risk tolerance, prohibiting direct investment in volatile assets like bitcoin or technology stocks. However, these funds may invest in the bonds or preferred shares of a bitcoin treasury company. This approach allows them to benefit from bitcoin’s price appreciation, while mitigating volatility and remaining within their risk parameters.

Exposure Optimization

Investors with a high risk tolerance may try to leverage their exposure to bitcoin. This typically involves borrowing money to invest in bitcoin. However, borrowing as an individual generally comes with high interest rates and collateral requirements, making leveraged bitcoin investing both costly and risky.

Bitcoin treasury companies typically have access to capital at much lower costs than individual investors. Because these companies can borrow funds at favorable rates, they can employ leverage more effectively, maximizing their bitcoin price exposure at a reduced cost. By purchasing shares in bitcoin treasury companies, investors can indirectly access this leverage, gaining the potential for amplified returns linked to bitcoin’s performance without personally borrowing or incurring individual debt. While this method still carries significant risk, it offers investors a simpler and more cost-effective way to enhance their returns.

The amount of leverage and borrowing costs can vary significantly between bitcoin treasury companies. As a result, investors often gravitate toward well-established companies with stronger track records. One of the most prominent examples is MicroStrategy, a pioneer whose innovative approaches have substantially influenced the bitcoin treasury space.

What Is MicroStrategy?

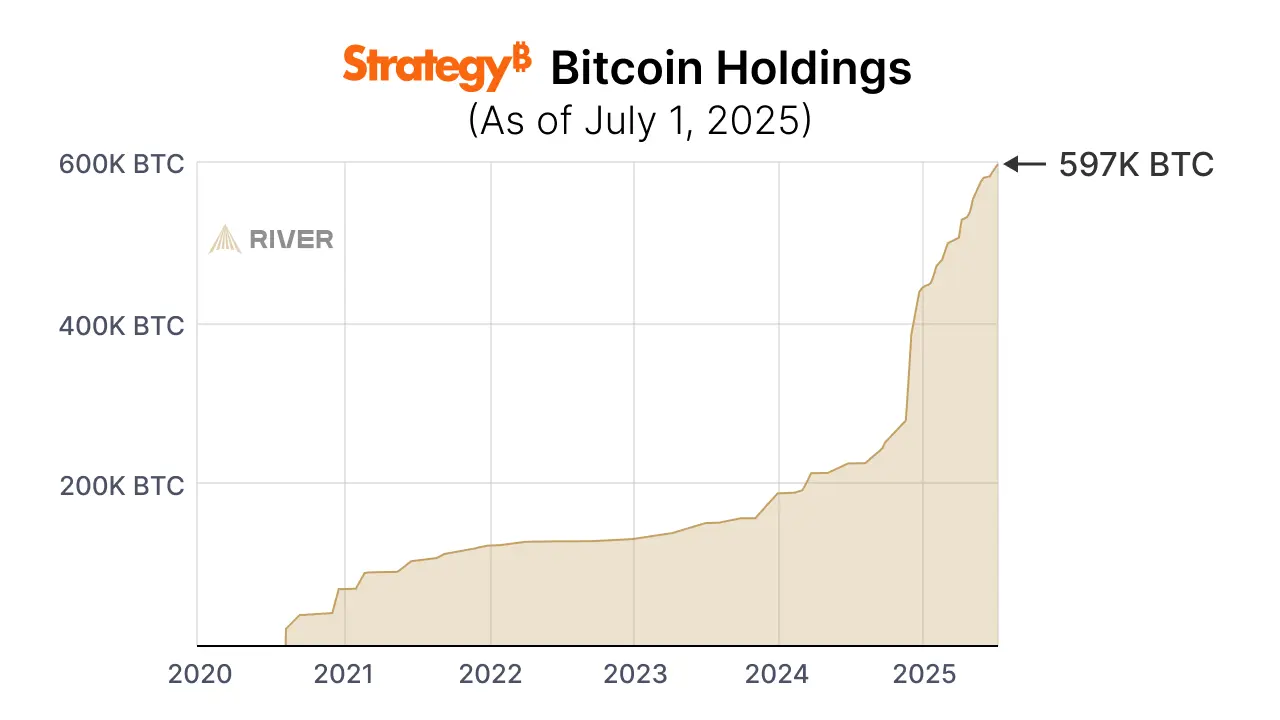

MicroStrategy, now known as Strategy, is an enterprise software company that pioneered the bitcoin treasury company movement under the leadership of Michael Saylor. In August 2020, the company converted its entire treasury to bitcoin, purchasing 21,454 bitcoin for $250 million.

Since this initial purchase, Strategy has continued aggressively acquiring bitcoin through a series of strategic fundraising initiatives, including issuing convertible bonds, senior secured notes, and equity offerings.

The company’s strategy has enabled it to invest over $42 billion into bitcoin, making it the largest corporate bitcoin holder globally. Investors have responded positively, as the company’s stock has become a popular vehicle for indirect bitcoin exposure. Strategy’s stock returns have closely mirrored bitcoin’s price movements, often outperforming direct bitcoin investments during bull market phases due to the embedded leverage in their strategy.

However, Strategy’s leverage also amplifies risks. During bear markets, Strategy’s stock price typically declines more sharply than bitcoin’s price. This heightened volatility can result in significant losses for investors during periods of market downturns. As a result, investing in Strategy is riskier than direct bitcoin holdings, especially for risk-averse investors.

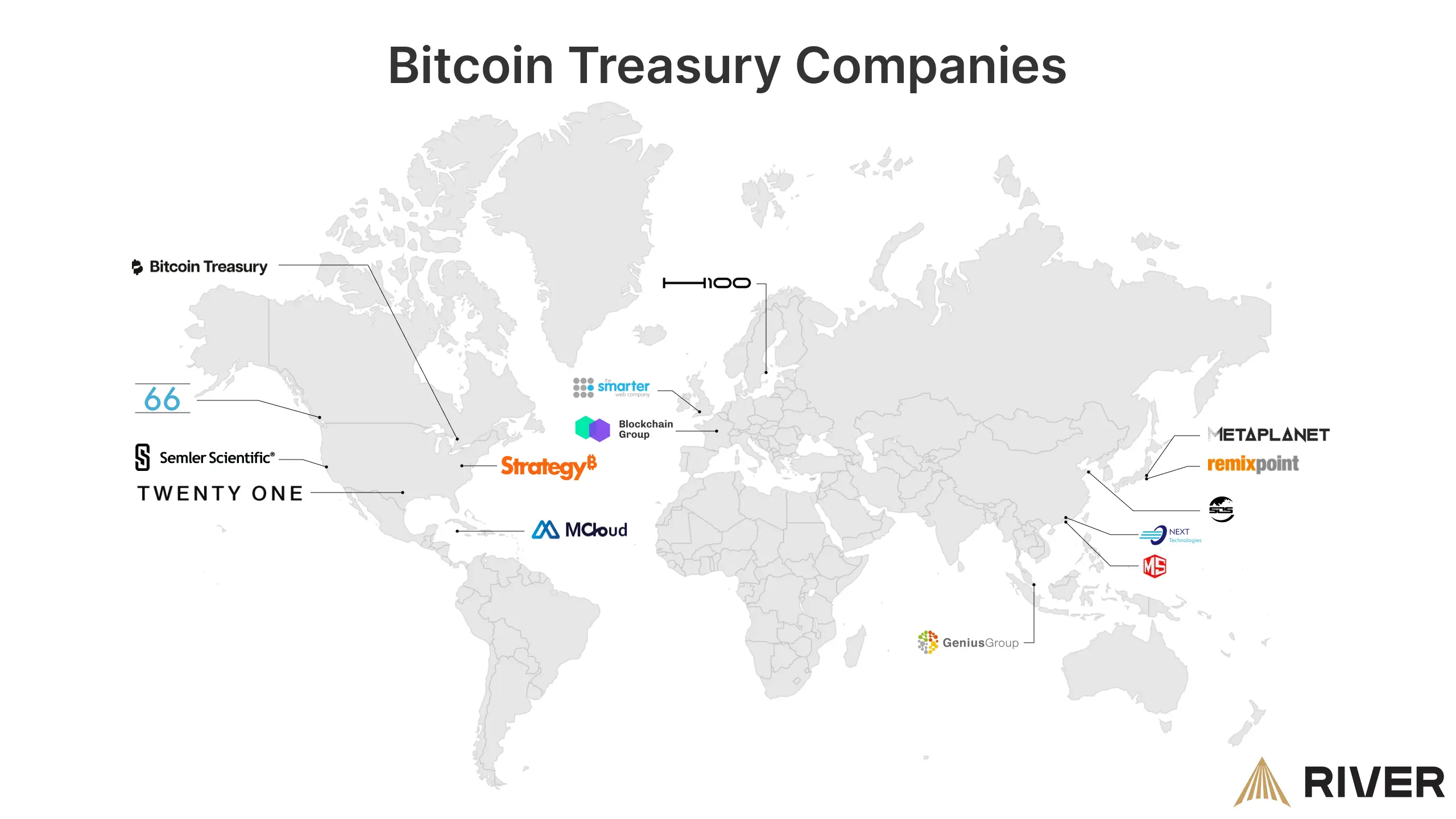

The Rise of Bitcoin Treasury Companies

The success of Strategy has spawned dozens of similar bitcoin treasury companies, with notable examples emerging in various jurisdictions. For instance, Metaplanet in Japan has successfully established itself by offering investors simplified, regulated price exposure to bitcoin for investors who face higher taxes on direct bitcoin holdings. Similarly, in the UK, the Smarter Web Company has implemented a comparable model in a region that lacks a spot bitcoin ETF.

Currently, bitcoin treasury companies account for one-fourth of all public companies with bitcoin holdings. They own over half of all publicly known corporate bitcoin holdings.

Should I Buy Bitcoin Treasury Stocks or Real Bitcoin?

While bitcoin treasury companies can improve access to bitcoin and sometimes offer higher returns, they are not a replacement for owning bitcoin directly. Investors who opt for shares in bitcoin treasury companies make a few key sacrifices:

- Lack of Self-Custody: Investors in these stocks do not have direct ownership or control over their bitcoin. Self-custody provides complete autonomy and eliminates counterparty risk, while bitcoin treasury stocks rely on the third-party management of both the company’s management and their bitcoin custodian.

- Inability to Transact Permissionlessly: Owning bitcoin directly allows investors to transact freely and independently, without requiring approval or intervention from intermediaries. In contrast, shares of bitcoin treasury companies cannot be used as a medium of exchange.

- Limited Proof of Reserves: Bitcoin holders on many exchanges can independently verify their holdings through transparent and cryptographically secure proof-of-reserve protocols. Conversely, investors in treasury companies typically depend on periodic financial disclosures and audits, which may lack transparency or frequency.

- Exposure to Corporate Risks: Investing in bitcoin treasury stocks introduces risks unrelated to bitcoin’s performance, such as company management decisions, operational risks, corporate governance issues, and potential insolvency risks.

- Potential Premiums or Discounts: Treasury stocks might trade at prices that deviate significantly from the underlying value of their bitcoin holdings, which can lead to investors paying premiums or incurring discounts that impact their returns unpredictably.

Ultimately, while bitcoin treasury stocks offer convenience, leverage, and accessibility, investors must weigh these benefits against the trade-offs involved in foregoing direct bitcoin ownership.

If you are new to bitcoin, we encourage you to begin with investing in real bitcoin before deciding to buy bitcoin treasury stocks and similar products. To familiarize yourself with bitcoin, we invite you to explore a few articles to help you get started:

- Bitcoin in 21 Minutes: A bite-sized intro course for getting started with bitcoin investing

- How to Get Started with Bitcoin Self Custody: A complete guide for securing your own bitcoin

- How to Buy Bitcoin: A guide for buying real bitcoin on various platforms