Bitcoiners don’t want to sell their holdings because they expect its value to grow; borrowing against bitcoin allows them to access dollars without having to sell. In some cases, it can also help avoid triggering taxes on a sale, depending on local laws. But borrowing against bitcoin isn’t without risks; price drops, high interest, and unsafe platforms can quickly turn it into a costly mistake. This guide explains how bitcoin-backed loans work, the important terms to know, the risks to watch out for, and how to choose a platform that helps you borrow safely.

What Are Bitcoin-Backed Loans?

A bitcoin-backed loan is a type of secured loan where you use your bitcoin as collateral to borrow dollars from a lender. Instead of selling your bitcoin to raise funds, you temporarily hand over your bitcoin to the lender, who holds it until you repay the loan.

Here’s how it works in simple terms: you deposit a certain amount of bitcoin with a lending platform, they determine how much you can borrow based on its value, and you agree to pay back the loan plus interest within a set time frame. If you make all your payments on time, you get your bitcoin back at the end. If the value of your bitcoin drops too much during the loan term or you miss interest payments, the lender may require you to add more collateral or risk having some or all of it sold to cover the loan.

The key point is that you still legally own the bitcoin while the loan is active; you’re just not able to move or sell it until you’ve paid off what you owe.

Why Borrow Against Bitcoin Instead of Selling?

Borrowing against your bitcoin holdings comes with risk, and should only be considered if you fully understand the implications and have ruled out better alternatives. With that in mind, there are three main reasons why people choose to borrow against their bitcoin:

- Maintain bitcoin price exposure: By borrowing against your bitcoin, you retain ownership and continue to participate in any potential price appreciation of your holdings, while still bearing the risk of price declines.

- Defer capital gains taxes: In the US, using bitcoin as collateral for a loan is not considered a taxable event. Bitcoin-backed loans allow you to access funds without triggering capital gains taxes that would apply if you sold your holdings.

- Access immediate liquidity without selling: Bitcoin-backed loans are usually much quicker to obtain than traditional loans. As a result, they can provide fast access to cash without liquidating your position, enabling you to meet expenses, seize investment opportunities, or cover short-term needs while preserving long-term holdings.

- Leverage: Some borrowers use bitcoin-backed loans to buy more bitcoin as a form of leverage. While this can amplify gains if prices rise, it also magnifies losses if prices fall, making it a high-risk strategy.

How Bitcoin-Backed Loans Work

In this section, we’ll explain how bitcoin-backed loans work using a simple example. As we go, we’ll introduce the key terms you need to understand.

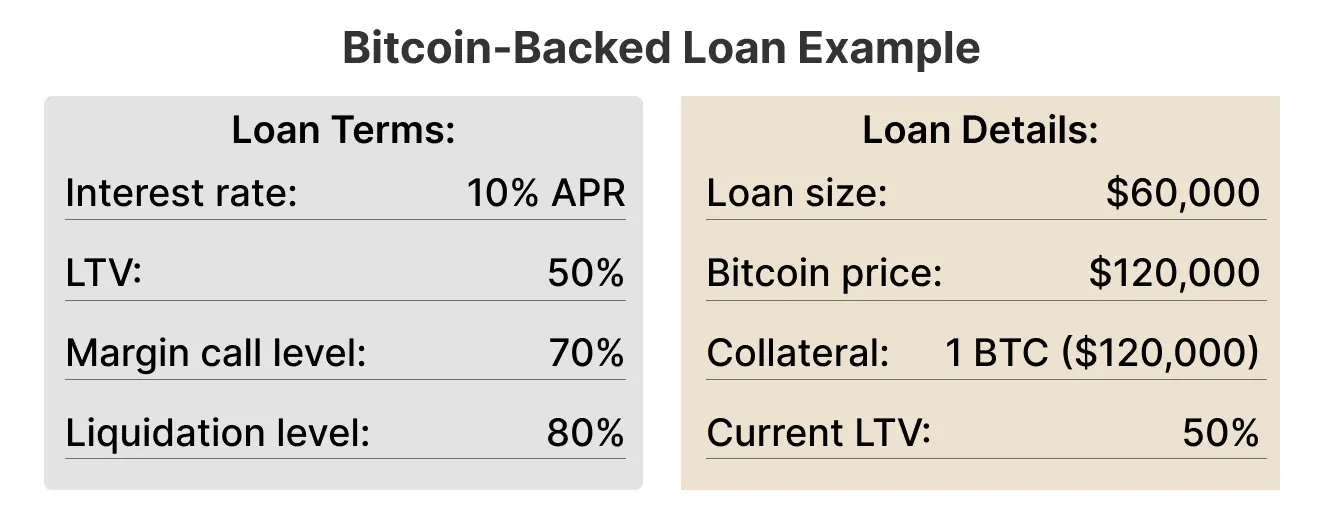

The image below shows the starting terms of an example $60,000 loan. In this scenario, the price of bitcoin is $120,000, and the borrower deposits 1 BTC (worth $120,000) as collateral.

Here are a few important starting terms to know:

Interest rate: Most lenders quote interest rates on an annual basis (expressed as an annual percentage rate, or APR). Interest payments can either be accrued on top of the existing loan or be paid by bank transfer, depending on the lender. Payments are usually made daily, weekly, or monthly. In this example, a 10% APR translates to about $500 in interest per month.

Maturity: In lending, maturity refers to the date by which the loan must be fully repaid. Some loans come with a fixed maturity date, such as six months or one year, after which repayment is due. However, most bitcoin-backed loans are open-ended, meaning they have no fixed maturity date. With an open-ended loan, you can repay at any time and keep the loan active as long as you continue making interest payments and maintain sufficient collateral. These loans do carry the risk that the lender may choose to close them at any time. If a lender does not specify a maturity date, it’s generally safe to assume the loan is open-ended.

Loan-to-value (LTV) ratio: The LTV ratio determines how much you can borrow relative to your collateral. It is calculated as the loan amount divided by the value of the collateral. In this case, the borrower has $120,000 worth of bitcoin as collateral, and the lender requires a 50% LTV ratio. This means the borrower can take out a loan of up to $60,000. A higher starting LTV allows you to borrow more cash for the same amount of bitcoin.

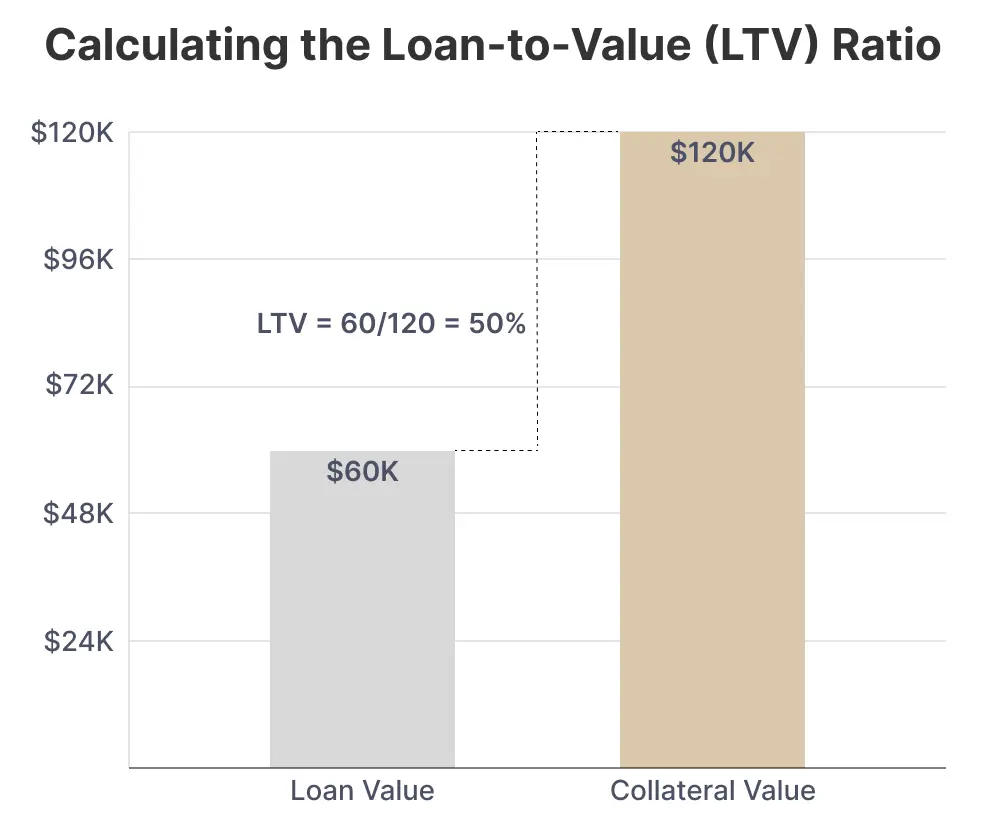

If the price of bitcoin rises, the loan’s current LTV decreases. A lower LTV means the borrower’s collateral has gained value, giving them a larger safety buffer to protect their loan. It also enables them to borrow additional funds against the same collateral, should they choose. For example, if bitcoin rises to $200,000, the loan’s LTV would drop to 30%.

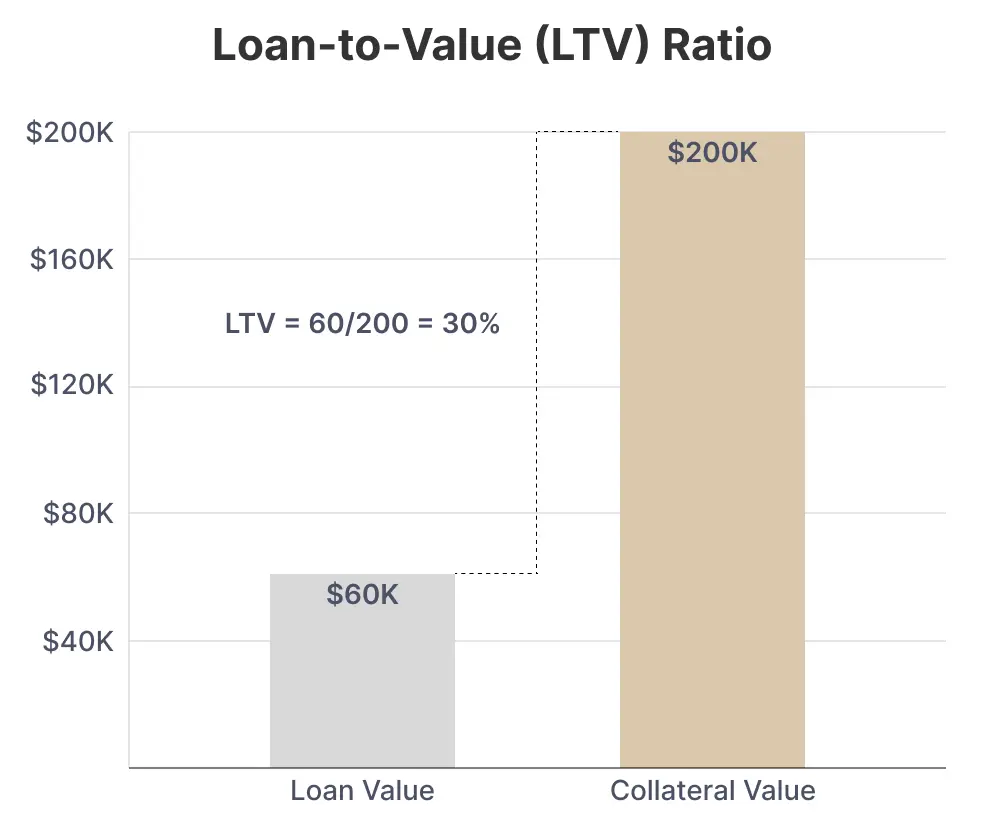

If the price of bitcoin falls, the loan’s current LTV increases. To protect against losses, lenders set a margin call level: a specific LTV ratio at which borrowers must add more collateral. A margin call typically requires enough collateral to bring the loan back to its original LTV, and borrowers are usually given a short window (e.g., 3 business days) to meet the requirement.

In this example, the margin call level is set at 70% LTV. For a $60,000 loan, this means the collateral value would need to drop to $85,714 before a margin call is triggered. Since the borrower posted 1 BTC as collateral, the price of bitcoin would have to fall from $120,000 to $85,714 for this to occur. To resolve the margin call, the borrower would need to deposit an additional $34,286 worth of bitcoin (about 0.4 BTC at $85.7K) with the lender.

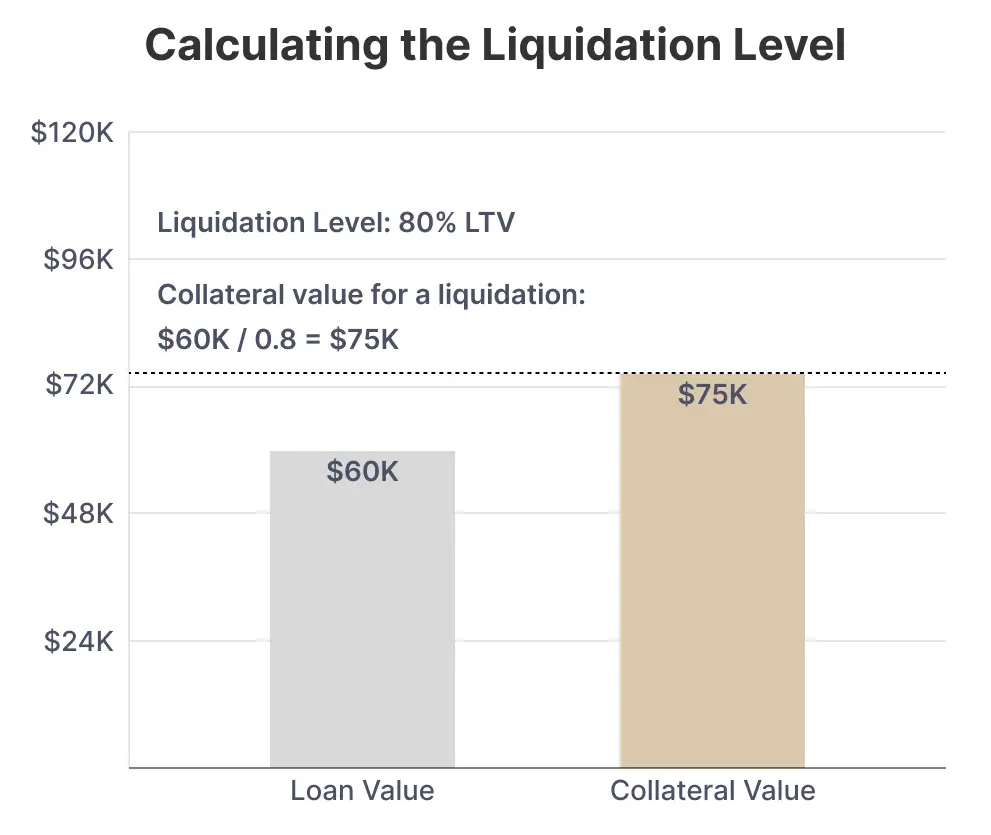

If a borrower fails to meet a margin call and the collateral value keeps falling, the lender will eventually sell the collateral to close out the loan. This point is known as the liquidation level.

In this example, the liquidation level is set at 80% LTV. For a $60,000 loan, that means the collateral value would need to drop to $75,000 before liquidation occurs. With 1 BTC posted as collateral, the price of bitcoin would have to fall from $120,000 to $75,000. At that point, the lender would sell $60,000 worth of bitcoin to repay the loan and return the remaining collateral (0.2 BTC) to the borrower.

It’s important to recognize the scale of this risk: liquidation would leave the borrower with only 20% of their original bitcoin collateral. Many borrowers are not fully prepared for such a dramatic decline, and while this safety buffer may seem large, the volatility of bitcoin means that scenarios like this are not impossible.

As long as borrowers stay on top of margin requirements, liquidations are unlikely to occur.

Closing a Loan

To close out a bitcoin-backed loan, the borrower must repay the original amount along with any outstanding interest. Once repaid, the lender returns the collateral. Alternatively, the loan can also be closed by selling a portion of the collateral equal to the principal amount owed.

What Is Bitcoin Rehypothecation?

With any bitcoin-backed loan, it is crucial to understand how your collateral is being managed and used. In some cases, lenders reserve the right to lend out a borrower’s collateral to earn additional interest: this process is known as rehypothecation.

Rehypothecation is not inherently good or bad, but it meaningfully changes both the risks and the potential benefits of a loan.

Rehypothecation can reduce interest rates: If a lender is able to generate income not only from the borrower’s payments but also by lending out the posted collateral, they may be willing to pass along some of those savings.

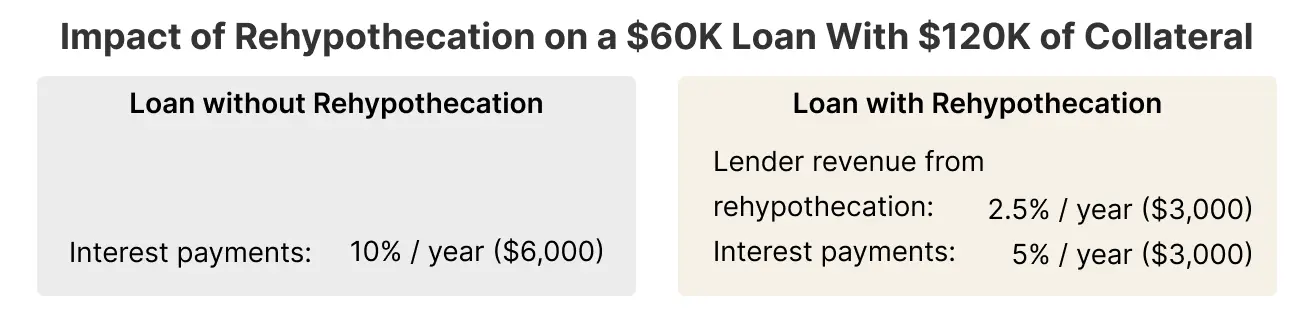

For example, consider our $60,000 loan scenario:

- Without rehypothecation: You would pay $6,000 per year at a 10% interest rate.

- With rehypothecation: If the lender earns 2.5% annually on your $120,000 collateral (about $3,000), they only need to collect $3,000 more to reach the same return. That means they could cut your interest rate in half (to 5%), reducing your annual cost to $3,000.

While rehypothecation can theoretically lower interest rates, in practice lenders may not pass those savings on to borrowers. More importantly, rehypothecation carries serious risks.

Rehypothecation puts your bitcoin at risk: By allowing a lender to rehypothecate your collateral, you greatly increase the likelihood of never recovering it. There have been numerous cases of bitcoin-focused lenders that offered bitcoin-backed loans, rehypothecated their clients’ collateral, and ultimately went bankrupt, leaving borrowers with substantial losses.

Although it may appear to be a harmless way to reduce fees, the risks of rehypothecation often outweigh the potential benefits. In the year 2022 alone, more than 100,000 BTC of rehypothecated bitcoin was lost by lending platforms.

If you are considering a bitcoin-backed loan, always ask your lender how your collateral will be managed, and whether it will be rehypothecated. If you cannot find a clear answer, it is safest to assume there is rehypothecation.

Risks of Borrowing Against Bitcoin

While bitcoin-backed loans can be a useful tool, they come with unique risks that every borrower should understand before committing:

Margin Calls & Liquidation

When you borrow against bitcoin, you are agreeing to maintain a certain loan-to-value (LTV) ratio. If the price of bitcoin falls and your LTV rises past the margin call threshold, the lender will require you to add more collateral or pay down part of the loan. If you fail to act in time, your collateral may be sold automatically in a process known as liquidation. This can mean losing bitcoin you intended to hold long-term, often at a much lower price than when you started the loan.

Using Loans for Leverage

Some borrowers use bitcoin-backed loans to buy even more bitcoin, hoping to multiply their gains if the price rises. While this strategy can amplify returns in a bull market, it also magnifies losses when prices fall. A leveraged position can easily lead to losing more bitcoin than you originally planned to risk. For most long-term investors, using loans purely as leverage is one of the riskiest strategies and should be approached with extreme caution, if at all.

Platform Security & Counterparty Risk

An overlooked risk is the platform you choose to work with. When you deposit your bitcoin as collateral, you are trusting that the lender will safeguard it. If the company is hacked, mismanages funds, or goes bankrupt, you may never get your bitcoin back, even if you make all your loan payments on time. This counterparty risk is especially high if the platform engages in rehypothecation. Next, we’ll cover how to evaluate your lending partner.

How to Choose the Right Bitcoin Lending Platform

Not all bitcoin-backed loan providers are created equal. Choosing the right platform can make the difference between safely accessing funds or losing your collateral. Before committing, take time to evaluate a lender across three critical areas: security, transparency, and loan terms.

Platform Security

The most important factor is how your bitcoin and personal data will be stored and protected. Look for platforms that use cold storage, undergo independent security audits, and provide Proof of Reserves (PoR) so you know your collateral is actually held on-chain. A reputable lender should be able to clearly explain their custody setup and risk controls.

To help you do your diligence on security and custody, we have a dedicated report sharing 11 questions you should be asking your bitcoin platform.

Transparency & Reputation

A platform’s track record matters. Do they disclose how collateral is managed? Have they survived previous market downturns without suspending withdrawals or going bankrupt? Search for reviews, past incidents, and whether the company’s leadership is public and accountable. Reputable platforms make their policies clear and don’t rely on vague promises. If you can’t easily find straightforward information about how they operate, that is a red flag. Make sure to read reviews and investigate beyond the platform’s website, which may only be telling you what you want to hear.

Lastly, knowing your platform’s financial position can help determine how much risk you are taking by handing them your collateral. Bitcoin lenders that provide public financial statements regularly are a good place to start.

Loan Terms

Even a secure, trustworthy lender may not be right for you if the loan terms don’t fit your needs. Pay attention to:

- Interest rates: Are they competitive, and fixed or variable?

- LTV ratios: Higher LTVs let you borrow more but increase the risk of margin calls.

- Maturity: Is the loan open-ended or fixed-term?

- Fees: Watch for origination, withdrawal, or hidden costs.

Compare platforms side by side to understand which offers the right balance of safety, cost, and flexibility for your situation.

Taxes for Bitcoin-Backed Loans

Borrowing against your bitcoin may help you unlock funds without triggering a taxable event, but it’s important to understand the rules. In the United States, using bitcoin as collateral for a loan is not considered a sale. That means you don’t owe capital gains tax simply because you have borrowed against your holdings. This is one of the main reasons many investors prefer loans over selling, especially if their bitcoin has appreciated significantly.

However, there are a few key points to keep in mind:

- Loan repayment vs. sale: As long as you repay the loan and recover your bitcoin, there is no taxable event. But if your collateral is liquidated to cover the loan, that counts as a sale, and you may owe capital gains tax based on your cost basis.

- Interest payments: The interest you pay on a bitcoin-backed loan is generally not tax-deductible for individuals, unless the borrowed funds are used for investment or business purposes.

- State laws: Some states may have additional rules around digital assets, lending, or consumer protection. Always check your local regulations.

Because tax treatment can vary depending on your situation, it is wise to consult a qualified tax advisor before taking out a bitcoin-backed loan. An upfront conversation can prevent costly surprises later.

Alternatives to Borrowing Against Bitcoin

Borrowing against bitcoin is not the only way to access funds. Depending on your financial goals, risk tolerance, and time horizon, you may find that other options are safer, cheaper, or simply easier to manage. Here are three of the most common alternatives:

Selling BTC Directly

The simplest option is to sell some of your bitcoin. This gives you immediate cash without the stress of ongoing interest payments or the risk of margin calls. While selling bitcoin means that you lose price exposure and often pay capital gains tax, it can provide the most peace of mind. For long-term holders with large unrealized gains, this can make selling less attractive, but for others, it may be the most straightforward solution.

Traditional Personal Loans

Bitcoin-backed loans carry relatively high interest rates, often above 10%. This is largely because bitcoin-backed loans are a recent and immature product.

In contrast, banks and credit unions have long histories of providing personal loans or lines of credit with much lower interest rates. These loans may come with lower risks since they don’t expose you to bitcoin price volatility or liquidation. However, approval typically depends on your credit score, income, and debt-to-income ratio, and the process may take longer than getting a bitcoin-backed loan.

Using Other Assets as Collateral

If you own other assets, such as stocks, real estate, or even a retirement account, you may be able to borrow against them instead. Securities-backed lines of credit and home equity loans are common examples. These alternatives may offer lower interest rates and more stable collateral compared to bitcoin, though they also come with their own risks, like the possibility of losing your home or stock holdings if you default.

Notice: River does not provide investment, financial, tax, or legal advice. The information provided is general and illustrative in nature and therefore is not intended to provide, and should not be relied on for, tax advice. We encourage you to consult the appropriate tax professional to understand your personal tax circumstances.