Taproot Assets is heralded as a new protocol that will bring assets to Bitcoin in a scalable way and enable new use cases. It has the potential to transform Bitcoin into a multi-asset network, on which users can have instant, global, and final settlement for low fees, with the stability of their preferred currency.

What exactly are Taproot Assets? How do they work? And when can users expect to see it live on the Bitcoin and Lightning network?

What Is Taproot Assets?

Taproot assets is a proposed protocol that will allow people to issue digital assets on the Bitcoin blockchain. These digital assets can be fungible currencies such as stablecoins, or non-fungible, unique tokens such as NFTs or collectibles. Today such assets largely reside on other blockchains due to easier implementation, lower transaction costs, or higher scalability, but Taproot assets could shift this balance.

Taproot assets can be transferred over the Bitcoin network through an on-chain transaction. Additionally, fungible Taproot assets can also be transferred instantly, at low cost, and more privately over the Lightning Network when deposited into a channel. The latter is expected to be the main network for Taproot asset transfers, due to the overwhelming practical advantages.

If adopted, Taproot assets could increase the activity and use cases of both networks without requiring a change in the user experience. Taproot assets would increase Bitcoin’s network effects and thus also benefit users who are not interested in additional assets beyond bitcoin.

The first proposal for Taproot assets was announced by Lightning Labs in April 2022. It is not the first project that attempts to enable different assets on top of Bitcoin, but it is the first to make use of Bitcoin’s Taproot upgrade to make the implementation more elegant and scalable. Another project attempting to achieve similar goals is the RGB protocol.

How Does Taproot Assets Work?

Before diving into how Taproot assets work on a technical level, it is useful to take a moment to think about what properties are desirable in a system that allows you to transfer (non-)fungible assets:

- The ability to use any type of asset on the same network.

- Cheap asset transfers that work 24/7.

- Assets that are not controlled by a centralized entity.

- An easily auditable supply.

- A very high degree of security, both for the individual asset as well as the network it is transferred on.

- User-controlled privacy.

- Global accessibility for everyone.

Below we look into what technologies the Taproot assets protocol uses to address these desired properties.

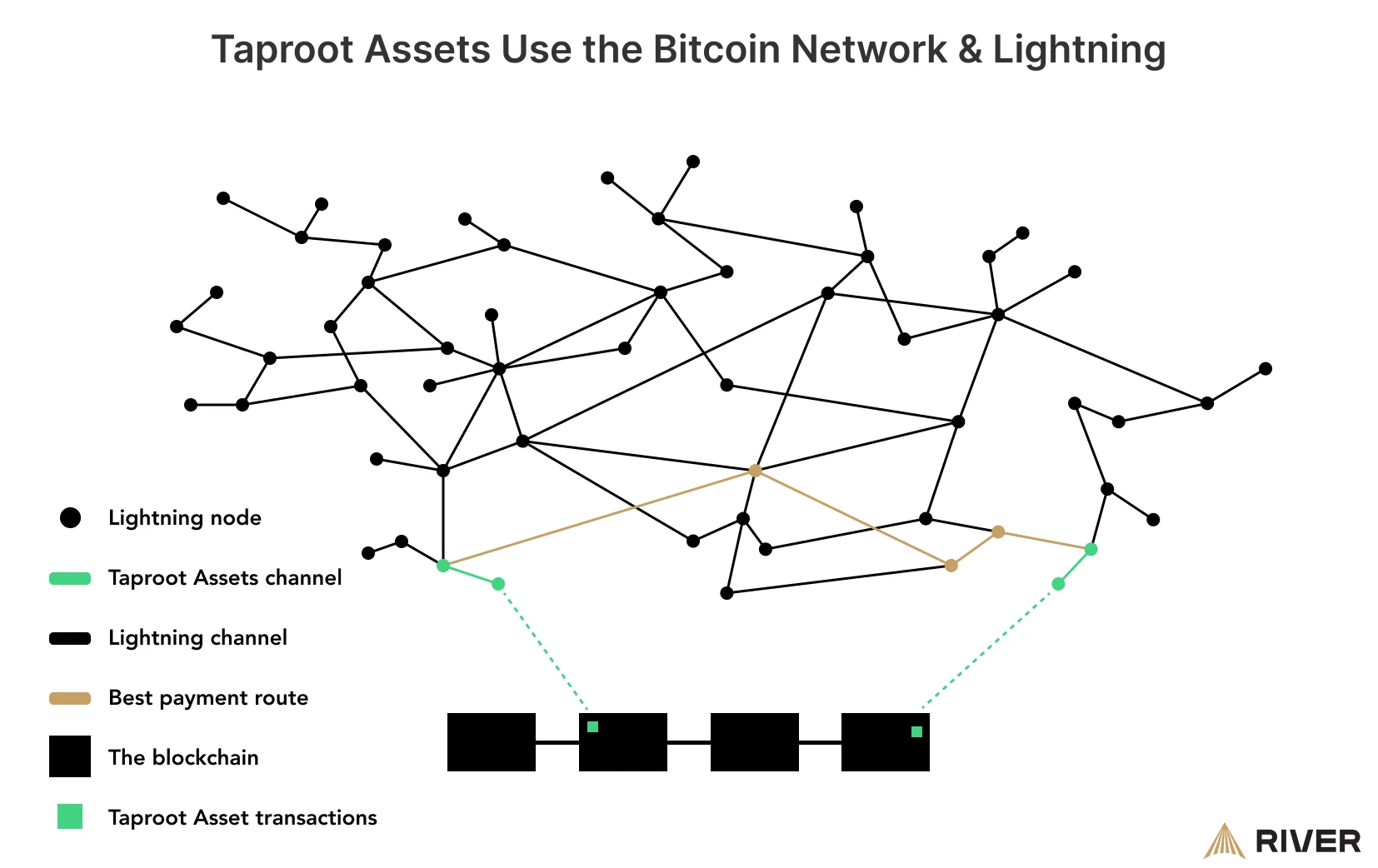

Taproot Assets Uses the Bitcoin Network

Taproot assets are registered on the Bitcoin blockchain in the form of hashed metadata attached to a transaction. Storing all of the metadata directly on the blockchain would take up more space and would thus be more expensive. This cost is avoided by using a hash, a one-way transformation of data that cannot be forged and is easy to verify.

Since there is no limitation to the amount of data that can be represented by a hash, one transaction on the blockchain can represent millions of transactions. This holds true for Taproot asset transfers as well, and will be elaborated upon further in the Merkle tree section.

A transaction containing a Taproot asset can be transferred over the Bitcoin network like any other Bitcoin transaction. Given Bitcoin’s 99.98% uptime since its inception in 2009, and no downtime since 2013, it is an exceptionally reliable network to transfer assets, which gives Taproot asset users a high degree of certainty that their assets are always safe and transferable. The Bitcoin network also ensures that a Taproot asset cannot be double spent, just like bitcoin itself.

Taproot Assets Use the Lightning Network

Taproot Assets uses the Lightning Network for fungible assets (such as stablecoins) to achieve higher transaction speeds, better scalability and lower fees than if it were to only use the Bitcoin base layer. This is similar to how transferring bitcoin itself is faster, cheaper, and more scalable over the Lightning Network.

Non-fungible Taproot assets (such as NFTs) would not work on the Lightning Network, as these cannot be split up and get partially transferred across a Lightning channel.

It is important for Taproot assets to be compatible with the Lightning Network for fungible assets, as Bitcoin itself cannot scale to billions of users on the base layer. Bitcoin’s base layer has a built-in limitation in transaction throughput that ensures the network can be joined by nodes on average computers. This ensures the network remains decentralized. If each Taproot asset transfer would require an individual on-chain transaction, there would in turn be major limitations to the scalability of Taproot assets.

With the proposed implementation of Taproot assets, the Lightning Network itself would not need to be changed. To route a payment denominated in a Taproot asset, only the participants in the first and last payment channels would need to be aware of the Taproot asset transfer. For any routing nodes in between, the transfer would look like any lightning transfer as they would be moving bitcoin.

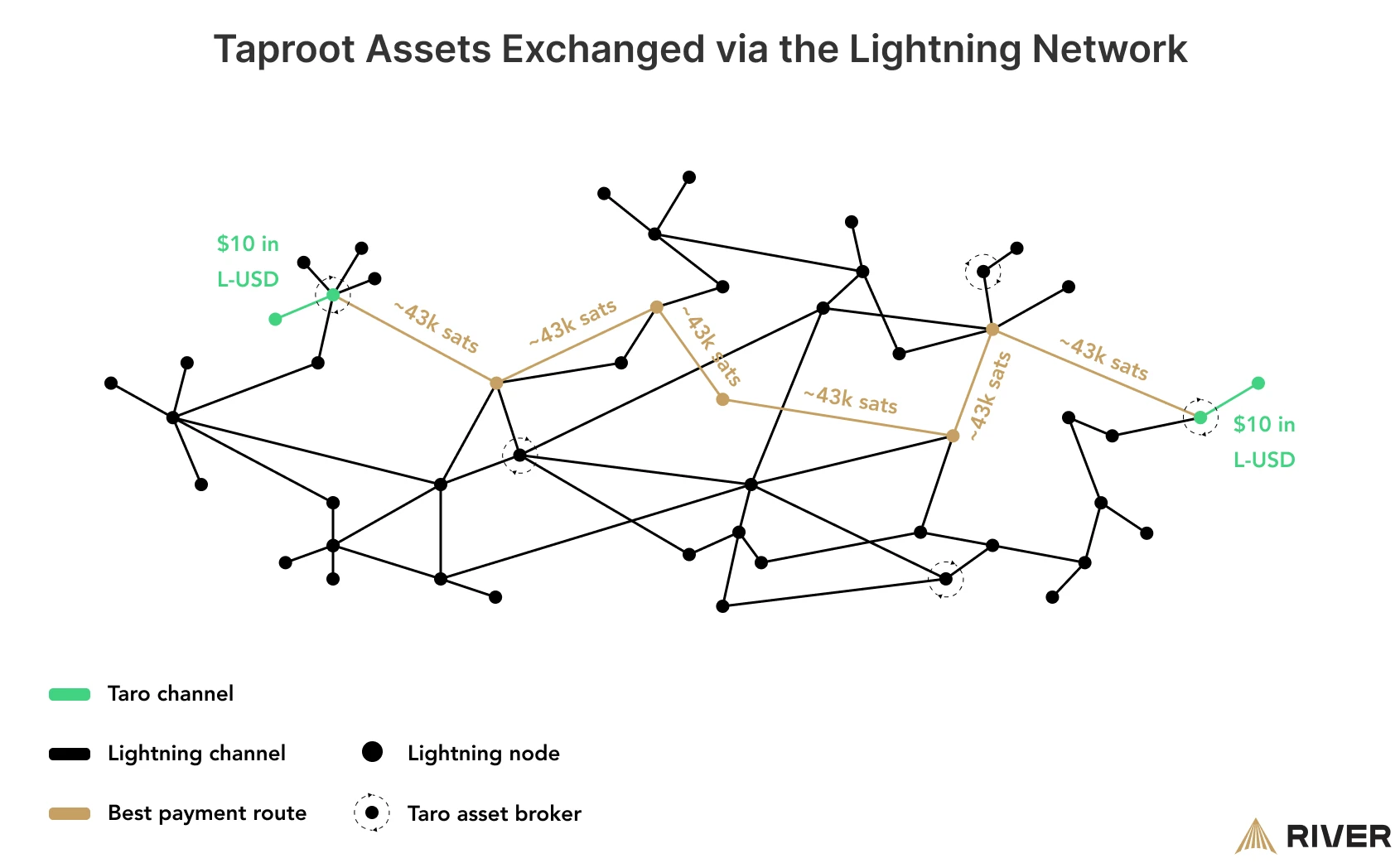

Taproot assets would most frequently be exchanged for other assets at the edges of the network, similar to how in the traditional financial world, not everyone engages in asset swaps. They are mostly facilitated by specialized services such as foreign exchange offices.

Taproot Assets Introduces Brokerage on the Lightning Network

The fact that only senders and receivers of the first and last hop would need to be aware of the existence of the asset is a major game-changer for anyone looking to issue new assets.

Before Taproot assets, when a new asset would be created, a marketplace must be found to list it, and enough users need to be interested in exchanging the asset on that specific marketplace.

After Taproot assets is released, this marketplace can be entirely decentralized and many nodes in the Lightning Network may choose to operate as a brokerage, taking in one form of asset and exchanging it for another as a market maker. When a user is looking to exchange a Taproot asset, their wallet may simply find the fastest and cheapest place near them in the network to exchange it, for the best possible price.

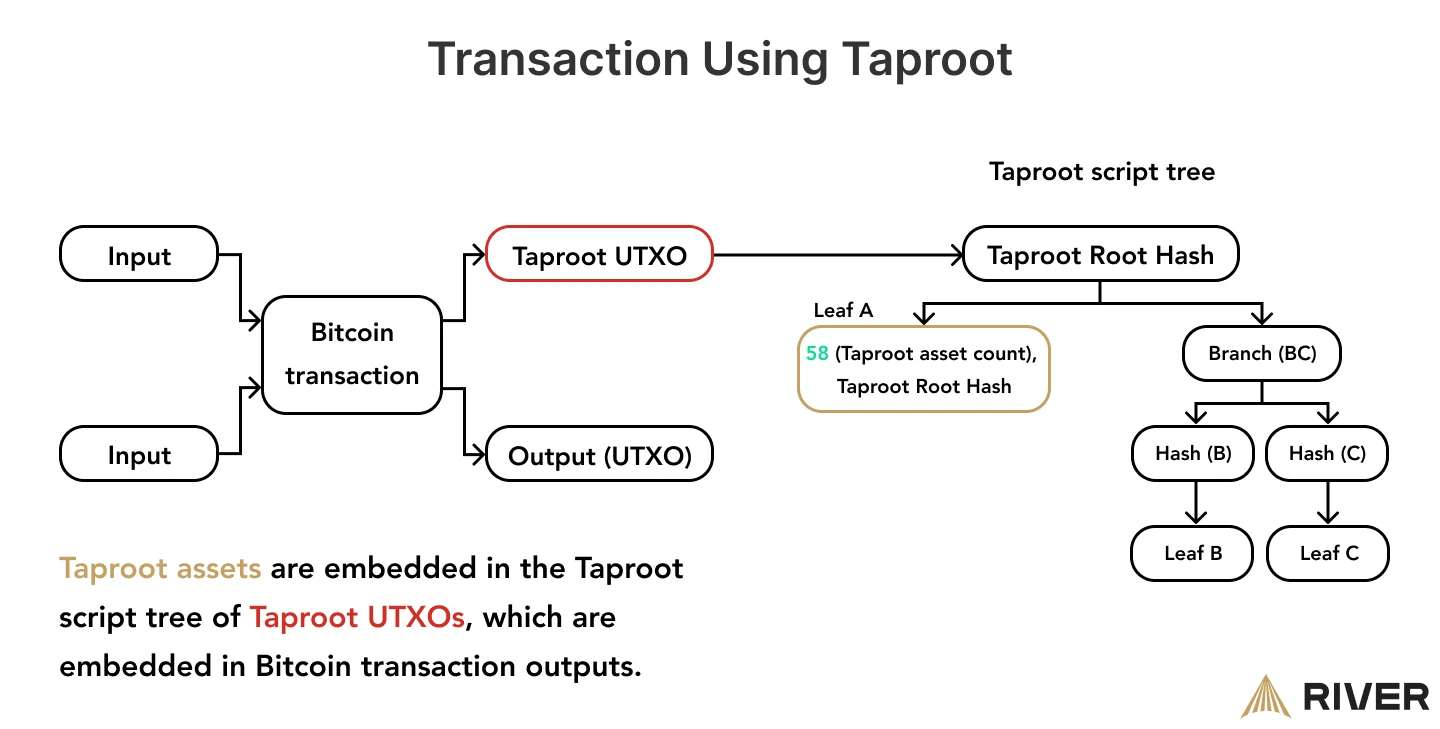

Taproot Assets Uses Taproot

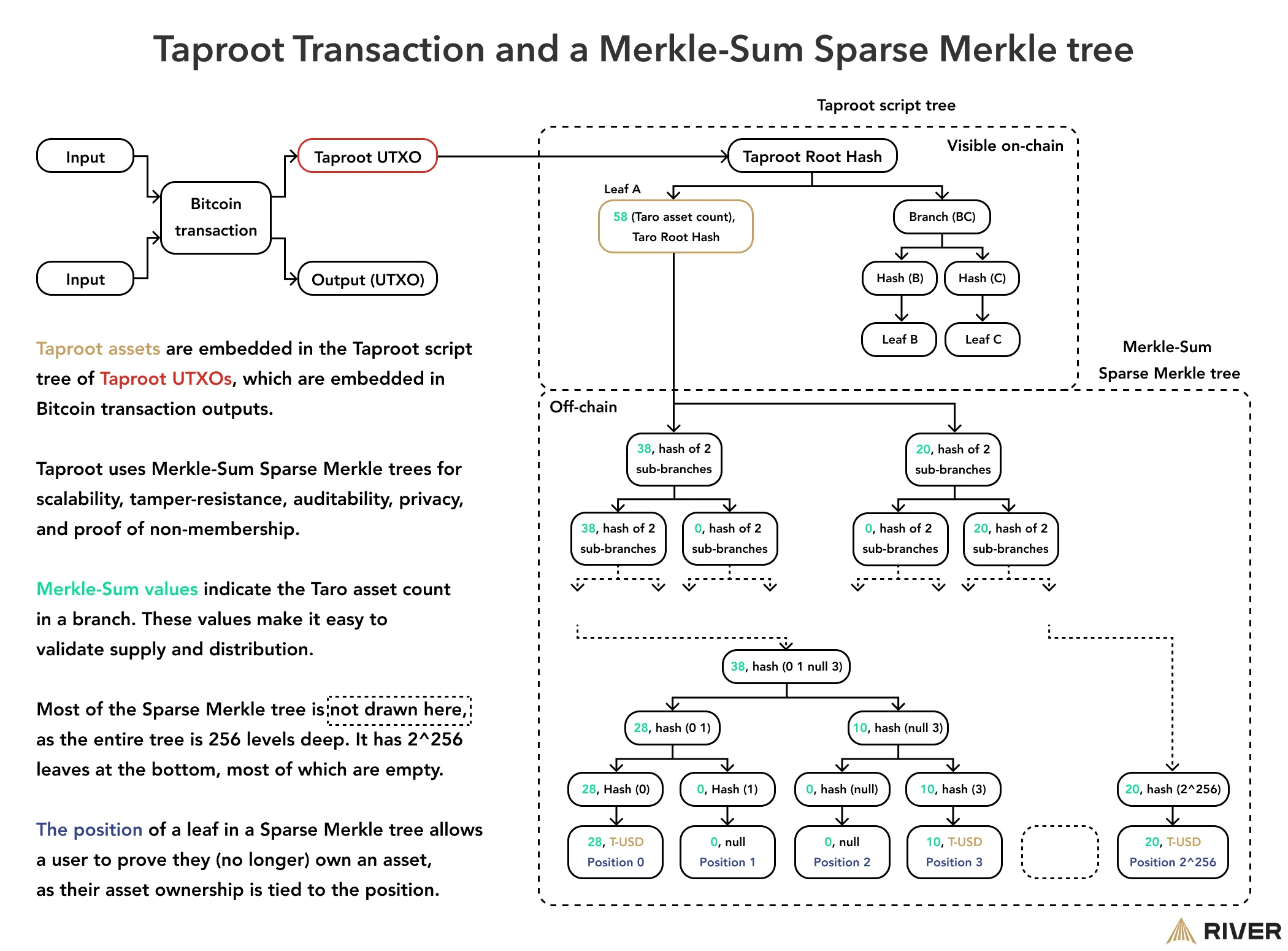

Taproot is an upgrade made to Bitcoin in 2021. It allows users to create spending conditions for a transaction output (UTXO) in such a way that only the condition that is actually met is revealed on-chain to all observers. This makes a Taproot transaction look similar to any regular bitcoin transaction, which is great for privacy, and ensures that nodes don’t even need to know that Taproot assets exist.

The conditions that are created to send a Taproot transaction are organized in a tree structure called a Taproot script tree. This structure minimizes the amount of data needed to validate the transaction, which reduces the burden on nodes. The tree also ensures that observers can’t tell if there were other conditions to spend this transaction, as only the hash of the tree is included in the transaction output.

Taproot assets use Taproot to embed asset metadata into a transaction output and to set specific rules on how to interact with and validate this new asset data. Because the root hash of the Taproot asset script is all that is included in the Taproot transaction, no observer can tell if it was a Taproot asset transaction, as the hash could represent anything.

The use of Taproot makes Taproot assets quite different from asset solutions built on other blockchains. In many cases these blockchains use account models rather than UTXOs, which means information about balances is usually revealed.

Taproot Assets Use Merkle Trees

A Merkle tree is a structure that can store a lot of data, while making it easy to prove that specific data exists in the tree. It is also easy to verify if data in the tree has been tampered with, and exactly where the changes happened.

If you’re not familiar with Merkle trees yet, we recommend to read up on them quickly to understand the next part.

Taproot assets uses a specific variant of a Merkle tree, called a Merkle-Sum Sparse Merkle tree (MS-SMT). This is a combination of a Merkle Sum tree and a Sparse Merkle tree.

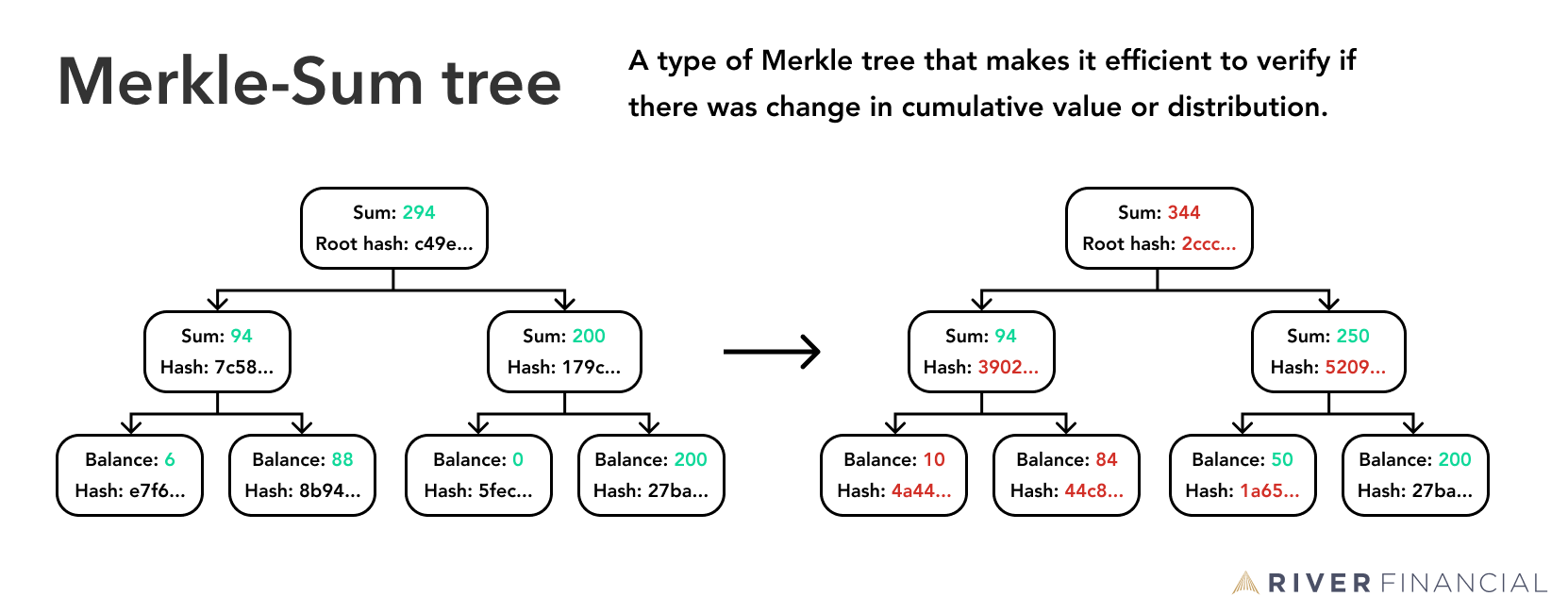

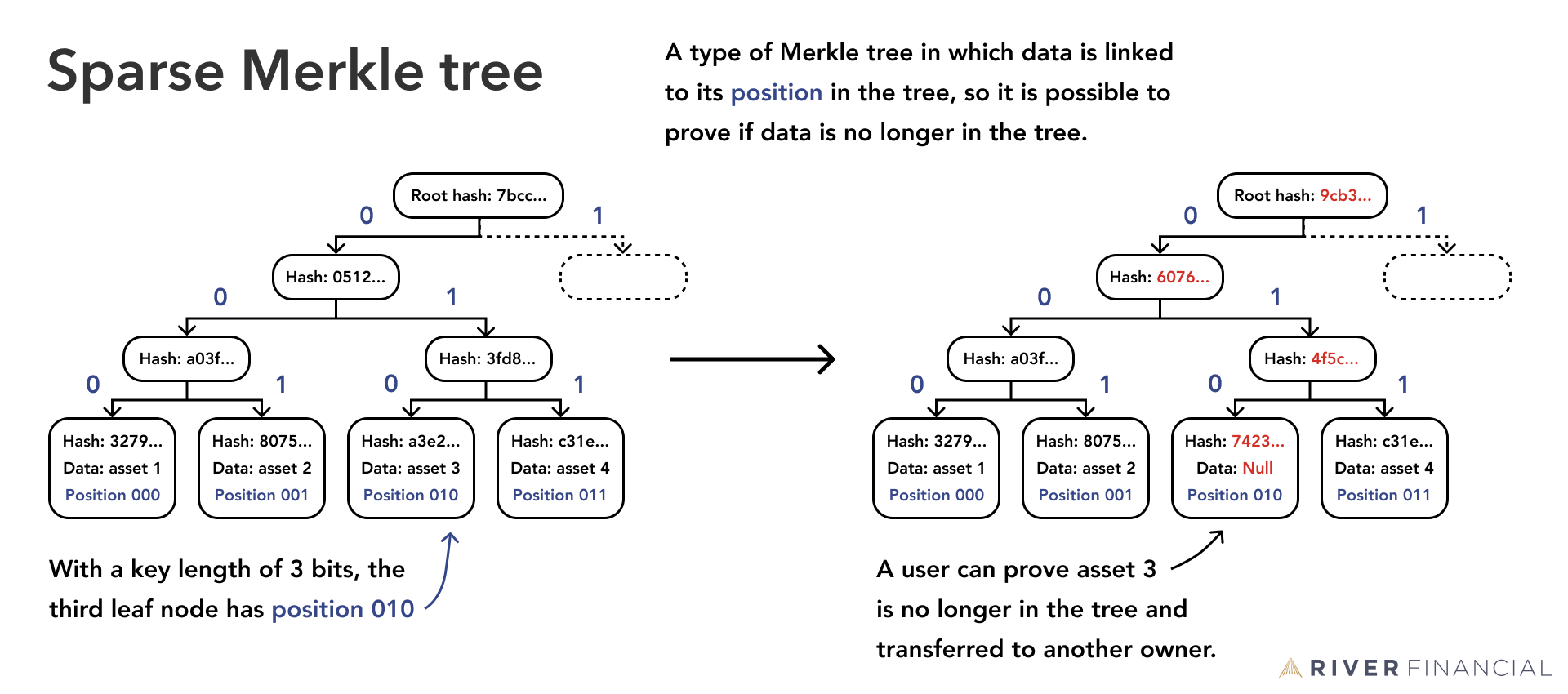

A Merkle-Sum tree is used to make it efficient to verify that there is no change in the value or distribution of the leaves of a Merkle tree, by assigning a numeric value to each leaf. If Taproot assets are stored in a Merkle tree, then a Merkle Sum tree makes it much quicker to verify that the assets still add up to the same amount and are in the same places as before.

A Sparse Merkle tree is used to make it efficient to verify if any data is not in the tree. In this particular Merkle tree, all of the leaves are indexed. If a Taproot asset transfer is done, the specific leaf where the asset used to be becomes empty, which makes it possible to prove that a Taproot asset was transferred or it would still be in this position.

Combining all of the above properties, a Merkle-Sum Sparse Merkle tree has the following properties:

- Scalable for a high number of assets.

- Allows a user to prove a certain asset is stored in a Merkle tree, of which the root is metadata in a bitcoin transaction.

- Tamper-resistant or the Merkle Root would change.

- An easily auditable supply without having to reveal all the information.

- Makes it possible to split and merge fungible Taproot assets, as long as they continue to add up to the total supply.

- Allows a user to prove a certain asset is no longer stored in a Merkle tree and has been transferred. This is also called proof of non-membership.

How Taproot Assets Will Be Issued and Transferred

Taproot assets can be transferred over the Bitcoin blockchain or the Lightning Network. For a user, there will be little practical difference besides additional assets being displayed in their wallet, and an off-chain place to store data that proves the Taproot asset is authentic.

On a technical level, Taproot asset transfers are more complicated, as can be identified by the usage of asset scripts, Taproot and Merkle-Sum Sparse Merkle trees.

Beyond those technical components that construct a Taproot asset transaction, there is also a difference between how non-fungible assets such as NFTs or collectibles are transferred, and how this works for fungible assets such as stablecoins.

NFTs on Taproot Assets

Non-fungible assets are issued in a single, limited edition batch in an on-chain transaction. These assets cannot be split or merged, they can only change ownership, which will happen off-chain by transferring the unique identifier of the asset and its verification file of historical transaction data that proves the authenticity. This information is stored in Taproot Asset Universes, which fulfill a similar role to a block explorer, and can be run by anyone with an interest in the assets.

The new owner of a Taproot asset can examine the data in a Taproot Asset Universe and use it to reconstruct the metadata in the blockchain to verify their ownership. They can also amend the metadata with their own proofs before passing on the asset.

Stablecoins on Taproot Assets

A fungible asset on Taproot such as a stablecoin can be split and merged. This means that if a user has an asset, it can change ownership inside an existing group of users that all have assets within that same Merkle tree, or the assets could be transferred to a user in a different Merkle tree. An updated version of the Merkle tree would simply show that the total supply of the asset hasn’t changed, but the balances of the different owners have updated.

Transfer a Taproot Asset, Transfer its Rules

We previously mentioned in the Taproot section that Taproot assets have specific rules on how to interact with them and validate them. These rules are stored in the asset script, a set of rules created by a developer that define how this specific asset can be transferred. This asset script becomes part of the Merkle-Sum Sparse Merkle tree.

The knowledge of how to handle Taproot assets needs to be transferred to the new owner, so that this person knows how to transfer the asset after receiving it and can prove to the next owner that they have this knowledge. To make this possible, Taproot Assets use an address format based on bech32 that will include the asset script hash. The owner can then prove that they have the knowledge on how to spend this Taproot asset, by providing the next owner with the asset script, who can hash it to verify that it matches the asset script hash that is attached.

When Will Taproot Assets Be Usable?

The first version of the Taproot Assets daemon was released on 28 September 2022. Developers can mint, send and receive Taproot assets on the test network of the Bitcoin blockchain.

Developers have also been sending these assets over the Lightning Network for the first time as of 2024.

There is still a ways to go until Taproot Assets will be usable by the average user. During this period any issues or feedback can be processed and implemented.

We’ve seen a similar process for the Lightning Network itself, which was first proposed in early 2016, became usable in 2018 for users willing to accept the risks of novel software, and has been rapidly growing and maturing since. We expect the rollout of Taproot Assets to follow a similar path, but perhaps accelerated given that no new network needs to be created.

Key Takeaways

- Taproot assets is a protocol that will allow the issuance of digital assets on the Bitcoin blockchain.

- Taproot assets can be fungible currencies such as stablecoins, or non-fungible, unique tokens such as NFTs or collectibles.

- Taproot assets can be transferred over the Bitcoin network, or instantly, at low cost and more privately over the Lightning Network.