Introduction

Brokerages and exchanges are organizations which allow investors to convert one asset into another. Normally a government-issued currency such as the U.S. dollar is one of the assets involved in the trade, but it doesn’t need to be. For example, when you buy bitcoin with dollars you are converting your dollars into bitcoin. Both brokerages and exchanges can offer any type of asset pair and can operate during whatever hours they choose. However, these two models operate quite differently behind the scenes, and this leads to some important differences for what a trader can accomplish in either type of market.

Functional Structures

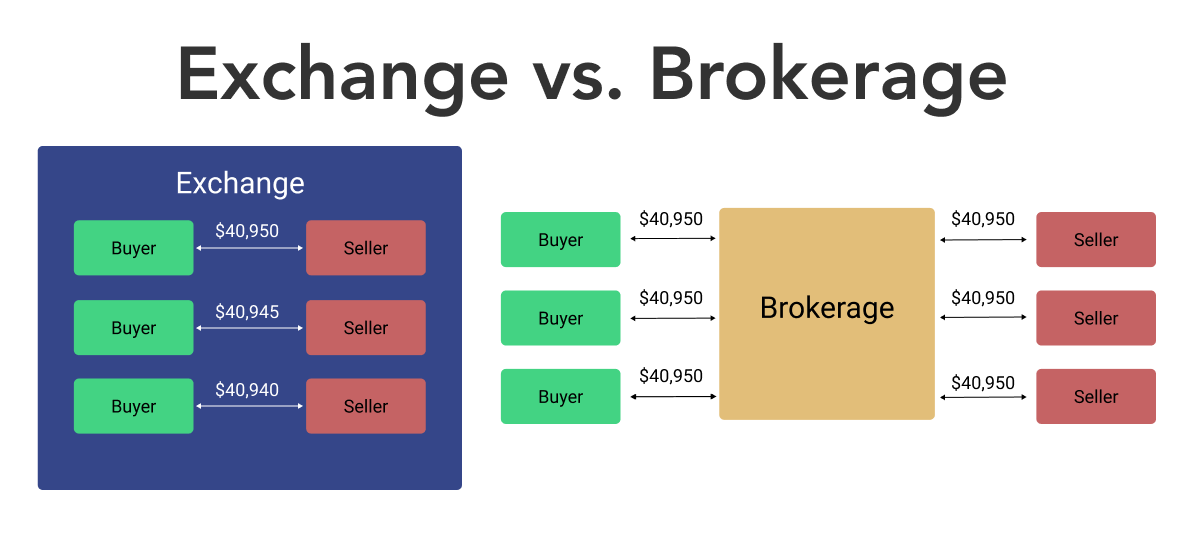

An exchange is a market that facilitates the matching of buyers and sellers for any given asset pair. This type of platform makes it easy for traders to find counterparties who are willing to take the other side of their trade. When transacting on an exchange there are many potential counterparties you could be trading with. The exchange is not participating in the trade in any way. It never buys or sells the assets that trade on its platform. Instead, it matches corresponding traders together, allowing them to trade with each other.

When a trader transacts with a brokerage, the brokerage is always taking the other side of their trade. A trader buys the asset from the brokerage or sells it to the brokerage. The brokerage does not match traders nor does it require a corresponding trader to execute an order. Since the brokerage’s portfolio changes with every trade, they are technically trading as well.

The brokerage has two primary ways of managing its internal position. Firstly, the brokerage can trade with a principal model, meaning their exposure to assets changes as trades occur. A brokerage using a principal model may still conduct some proprietary trading to balance their portfolio. Alternatively, the brokerage can operate with an agency model, meaning they simply place the order for the client on another platform. For example, under an agency model, a brokerage could sell 10 bitcoin to a trader by purchasing 10 bitcoin on another platform on their behalf.

Exchange Characteristics

This structural difference between the two models leads to tangible differences in the functionality of exchanges and brokerages.

Since exchanges are matching traders, there must be at least two traders willing to take opposite sides of the same deal in order to execute an order. Additionally, both parties must have their assets on the exchange at the time of the trade.

Normally this isn’t an issue, but for less liquid assets or large transactions, it is possible that an exchange could lack sufficient liquidity to fill an order. On an exchange, the price of an asset is determined by the actors who are trading it. An exchange makes money by charging a fee to the traders once they are matched and the order executes.

As a consequence of this model, trades can be settled instantly, with both parties receiving the asset they purchased.

Exchanges

Asset Price

Determined by the market

Security

Security Varies

Fees

Low to Medium Fees

Users

Short-term traders

Brokerage Characteristics

A brokerage is always taking the other side of the trade, so they can be more flexible with the settlement of assets. Many brokerages will allow traders to lock in a trade at a certain price even if they are unable to pay for the asset immediately. This is useful for traders who decide to trade an asset on short notice or would prefer to keep their assets elsewhere until they are traded. With brokerages, liquidity is determined by the brokerage itself, not other traders in the market. As long as the brokerage is willing to accept an order the trader will be able to execute their transaction. A brokerage sets their own price for assets, but this price is influenced by the price of the asset on other markets. A brokerage makes money by charging a spread, meaning the price at which they are willing to sell is higher than the price at which they are willing to buy.

Brokerages

Asset Price

Determined by the brokerage

Security

Strictly regulated with minimum requirements

Fees

Medium Fees

Users

Long-term investors

Which Model Should I Use?

It depends. Exchanges require some planning ahead because you need your assets to be on the platform before you can trade them and moving financial assets can take several days or even weeks. Additionally, many people are uncomfortable leaving assets on an exchange due to the risk of them being lost or stolen. Traders on exchanges are more at risk of slippage because they lack the price guarantee that a brokerage offers.

However, exchanges will give you ownership of an asset as soon as a trade occurs whereas brokerages may take longer for everything to settle. A brokerage is also likely to charge a higher spread or fee than an exchange meaning the end price may be less favorable.

Notice: River does not provide investment, financial, tax, or legal advice. The information provided is general and illustrative in nature and therefore is not intended to provide, and should not be relied on for, tax advice. We encourage you to consult the appropriate tax professional to understand your personal tax circumstances.Key Takeaways

- Exchanges and brokerages are different types of markets with unique functionality.

- Exchanges match traders, allowing them to execute orders with each other.

- Brokerages transact with their clients directly.