Proof of Reserves (PoR) is a way for companies to show that they hold the money or assets they claim they do, ensuring their clients’ deposits are safe.

In this article, we will explain what reserves are, and how Proof of Reserves can help ensure your funds are safe. Proof of Reserves works especially well for Bitcoin since the Bitcoin blockchain is public and transparent.

What Is Proof of Reserves (PoR)?

Proof of Reserves (PoR) is a process that proves an exchange or brokerage holds sufficient reserves, or assets, to cover all customer deposits. It provides transparency and assurance to clients. A PoR is specific to bitcoin and cryptocurrency companies, as it involves the publication of wallet addresses that hold bitcoin or other digital assets, which can be identified by any user on the blockchain.

By selecting platforms that operate on a full-reserve, you can mitigate risks and ensure your assets remain secure.

Importance of Proof of Reserves in the Cryptocurrency Industry

Proof of Reserves is a crucial transparency mechanism in the cryptocurrency industry. By providing cryptographic proof of their on-chain holdings, these institutions can demonstrate solvency and reassure users that their funds are backed one-to-one by actual reserves. This practice is especially vital in an industry prone to security risks, financial mismanagement, and potential insolvency.

The significance of PoR became increasingly apparent following high-profile exchange collapses, such as the FTX bankruptcy in 2022, where customer funds were misused and insufficient reserves were discovered. Without clear proof of reserves, users risk exposure to fraudulent practices, fractional reserves, or insolvency. By adopting PoR, exchanges can foster greater trust, mitigate counterparty risk, and improve overall market transparency.

Understanding Reserves

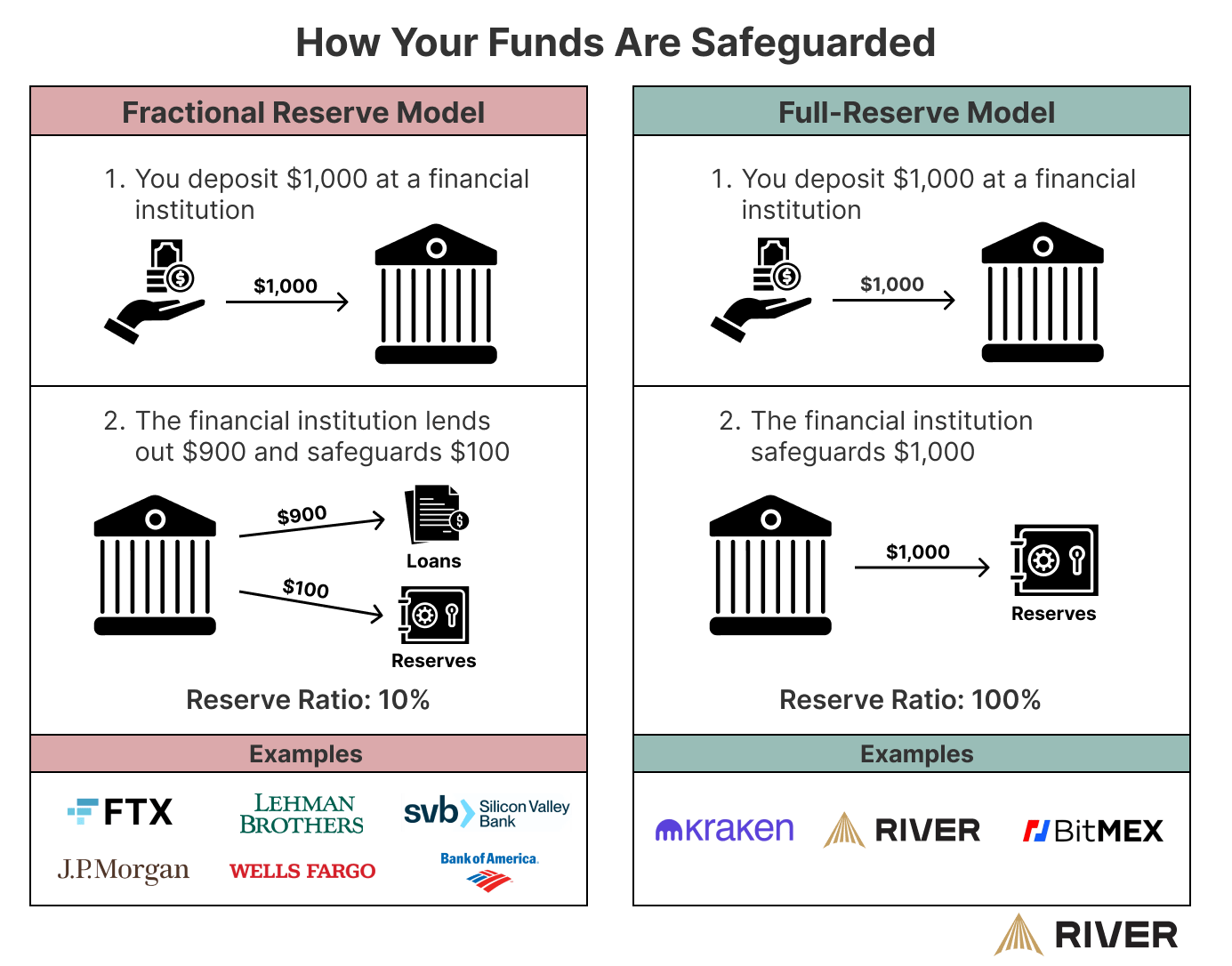

Whenever you deposit money at a bank, the bank stores a portion of your deposits in cash and other stable assets to ensure you can reliably withdraw your money. These assets are known as reserves.

Most banks today operate under a fractional reserve system, meaning that for every dollar deposited, the bank only keeps a small percentage of that dollar as reserves. All money not held as reserves is lent to borrowers or otherwise used to generate profits.

A bank’s reserve ratio is the percentage of reserves held for each dollar deposited. When a bank’s reserve ratio is less than 100%, it holds less money than its depositors have entrusted it with. All banks today use this model, called a fractional reserve. If all of its clients were to withdraw at once, this would result in a bank run and some clients would be unable to withdraw their money.

A full-reserve bank has a reserve ratio of 100% or higher, meaning that for every dollar deposited, they hold at least that much cash as reserves. As a consequence, a full-reserve bank can return all deposits to all of its clients at any time. While River is not officially a bank, we do use this full-reserve model for the bitcoin we custody for our clients.,

Here are two examples of bank runs that have occurred this decade:

- FTX: In November 2022, concerns arose about the health of cryptocurrency exchange FTX. FTX operated under a fractional reserve model, and therefore was unable to pay back customer funds when users rushed to withdraw their assets. The exchange is currently in bankruptcy, and most customers have been unable to get all of their money back.

- Silicon Valley Bank (SVB): In March 2023, customers of SVB, which mainly consisted of startups and venture capital firms, began rapidly withdrawing their deposits after the bank announced a large loss on their assets. The bank’s collapse was one of the largest in U.S. history, and while customers were ultimately made whole due to government intervention, many were unable to access their money for multiple days. This harmed many startups that were unable to pay their employees or meet expenses.

Today, people mainly interact with their bank and finances online, eliminating the need to physically withdraw money at a bank branch. While bank runs are unlikely to happen on any given day, they can now occur more easily and rapidly. Therefore, it is important to stay up to date on the health of the institutions where you entrust your money.

How Does Proof of Reserves Work?

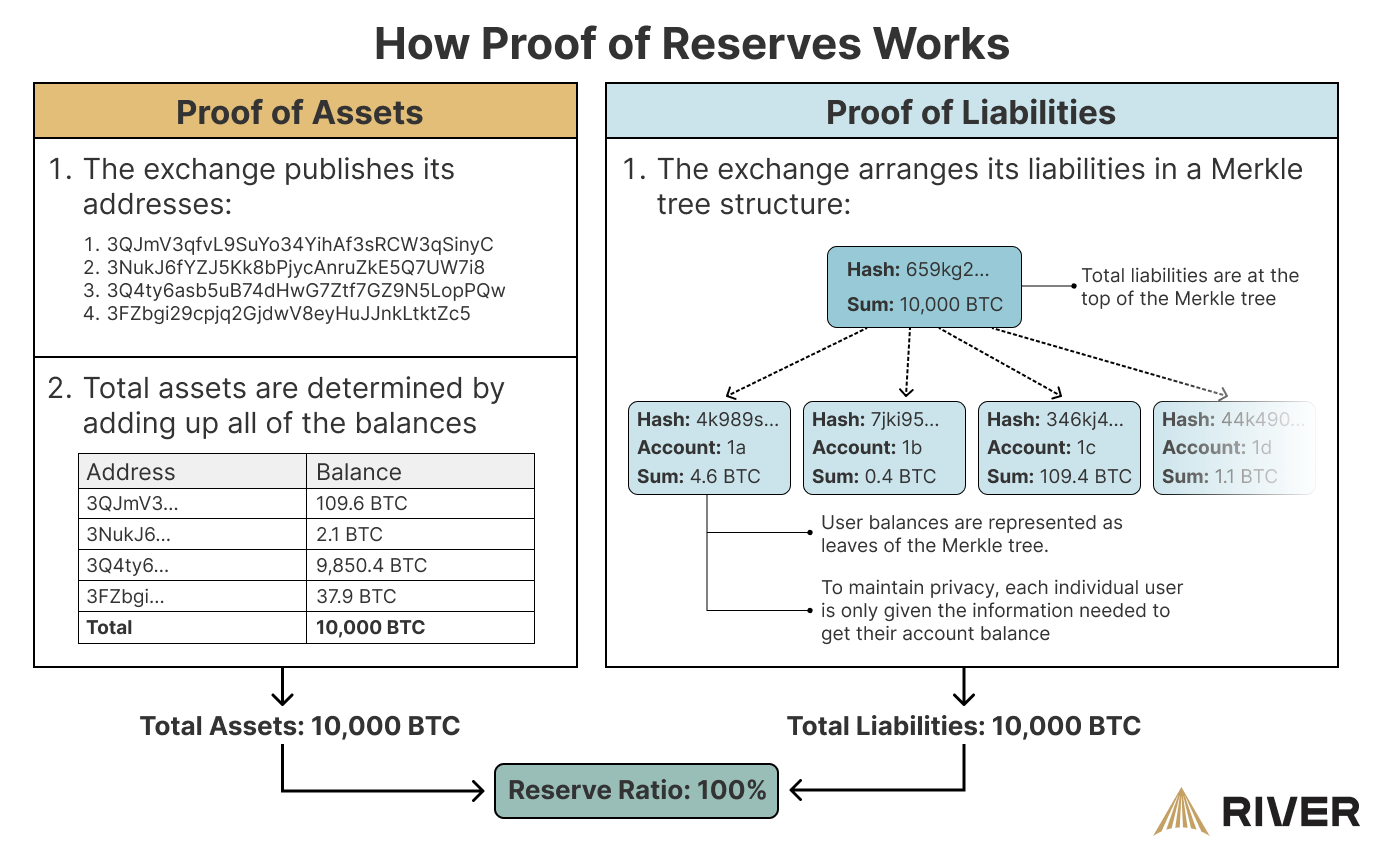

When performed successfully, a Proof of Reserves will accurately show an institution’s reserve ratio. In order to do this, two pieces of information are required:

Proof of Assets

Assets consist of all the reserves an institution holds. For a proof of assets, an institution simply publishes a full list of all the addresses they control. As Bitcoin is an open, public ledger, anyone can view the bitcoin balances in these addresses and determine the total amount of assets held.

To prove that an exchange is the true owner of the addresses it publishes, it may provide an attestation, such as a transaction from its address that follows a predefined formula. As a simple example, an exchange may announce it will send a transaction for its published address to another wallet with an amount of 12,345 sats. Once this transaction has been executed, it has proven it is the owner of that address.

Proof of Liabilities

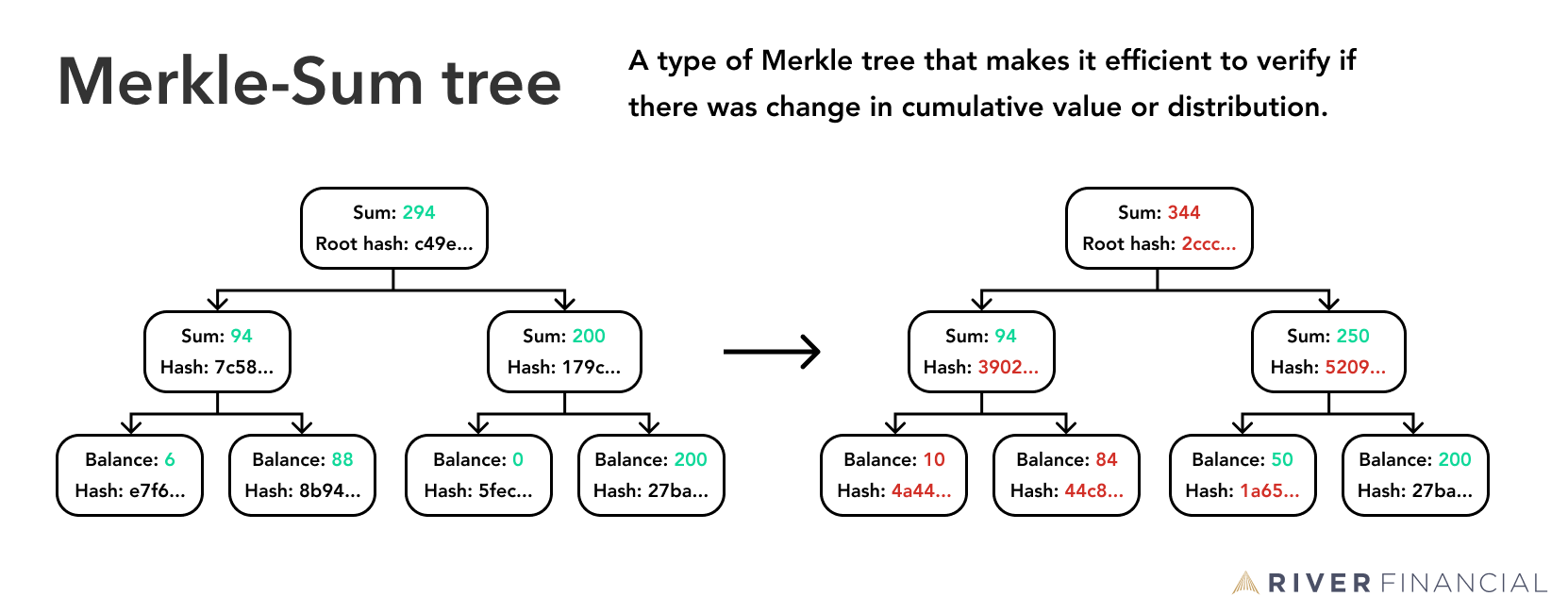

Liabilities consist of all the deposits that are owed to customers. For a proof of liabilities, an institution publishes a list of all liabilities owed to customers. However, to protect user privacy, data structures known as Merkle Sum trees are used.

In a Merkle Sum tree structure, the exchange publishes its total liabilities at the top of the tree, representing the sum of all user balances which are represented as individual leaves of the tree. Each user is given the necessary information to derive their own balance and verify that it is included in the sum of liabilities. While individual account balances are not shared with anyone besides the account owner, the Merkle tree structure is an effective way to prove an exchange’s liabilities. This is because if the exchange were to understate its liabilities by excluding certain accounts, the account owners could individually see that their information was excluded, and report this to the broader public.

An institution’s reserve ratio can be determined by dividing its proven assets by its liabilities. If an institution’s proof of assets is equal to or greater than its proof of liabilities, it has a reserve ratio of at least 100% and is considered full-reserve.

Some institutions may have a reserve ratio of over 100%. This simply means that they hold more assets than liabilities, and is a good sign of their ability to meet the demands of their depositors.

Limitations of Proof of Reserves

While a Proof of Reserves is a great way for users to ensure their funds are safe, there are a few limitations to be aware of:

- PoRs only represent a snapshot in time: PoRs are typically done on a periodic basis, such as once a month. While users can verify that their exchange had full reserves, they are only basing this information on the last snapshot in time.

- Proof of liabilities relies on user participation: To ensure that an exchange’s published liabilities are accurate, users must verify that their account balances are included. However, not all users can be relied upon to check their balances. Instead of anonymizing user balances in a Merkle tree, an exchange could publish a simple list of all its liabilities. However, this would compromise the privacy of its users, who may not want their balances to be made public.

- Proof of liabilities only covers user balances: While a proof of liabilities can show the total amount of deposits owed to customers, an exchange may have additional liabilities not included in the proof, such as debt and outstanding contracts. In most cases, user accounts have seniority over other liabilities held by an exchange. In the event of bankruptcy, the users get paid back their deposits before other debt holders. However, this is not always the case and depends on the particular exchange.

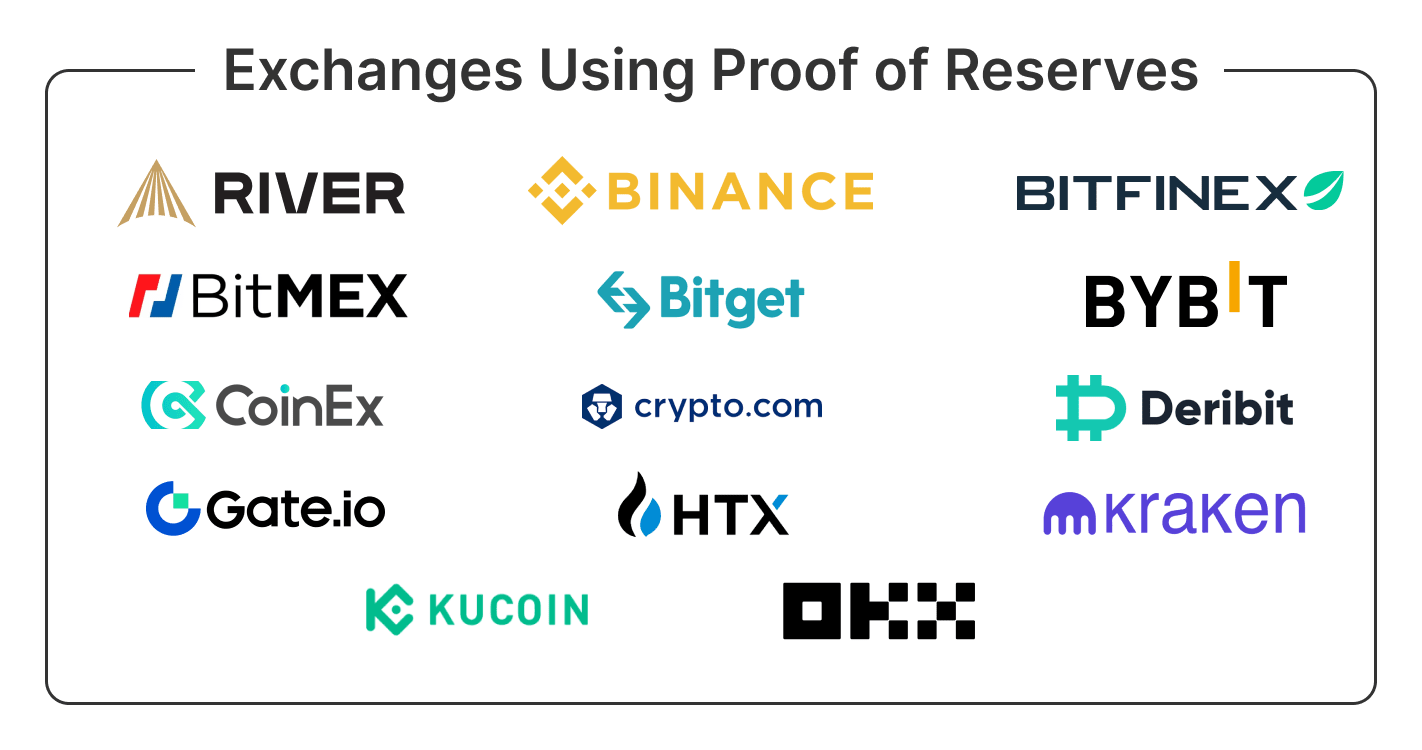

What Exchanges Use Proof of Reserves?

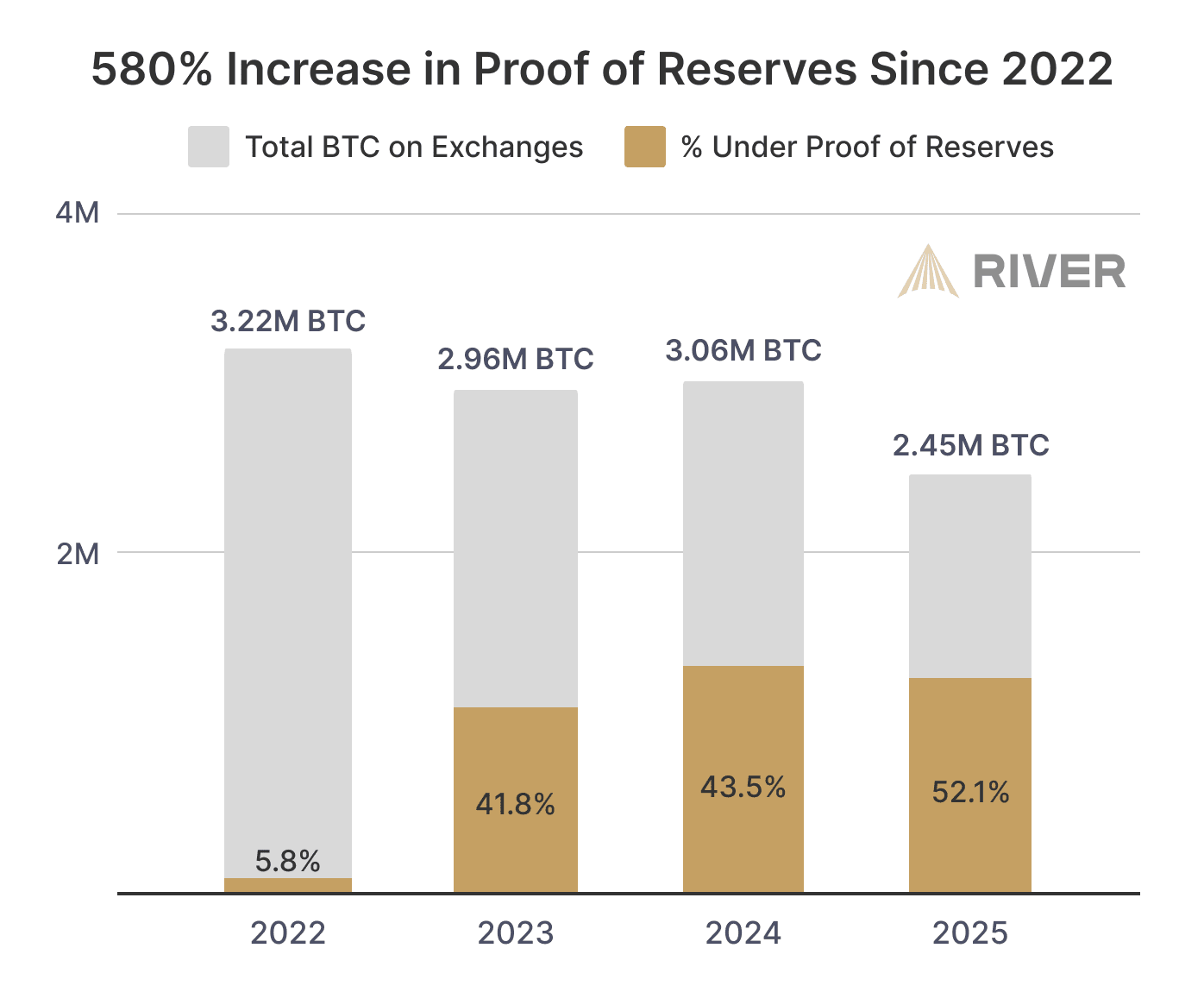

Over a dozen of the world’s largest exchanges now implement proof of reserves. The majority of these began offering this transparency in the wake of the FTX collapse in 2022.

The Future of Proof of Reserves

Today, over half of all bitcoin on exchanges is verified by Proof of Reserves. As such, Proof of Reserves is becoming a gold standard for the bitcoin and cryptocurrency industry. As the industry matures, exchanges that implement verifiable PoR audits are likely to gain a competitive edge by demonstrating their financial integrity. Furthermore, regulatory bodies are exploring frameworks that could make PoR a mandatory requirement for centralized platforms, reinforcing its role as a baseline standard for responsible custodianship. Over time, PoR may become as fundamental to crypto exchanges as regular financial audits are to traditional banks — a necessary safeguard to protect investors and strengthen the industry’s credibility.

Does River Provide Proof of Reserves?

River provides a Proof of Reserves both to clients and the general public, and is one of the few Bitcoin-only exchanges in the U.S. that holds all client funds in cold storage and in full-reserve. River’s custody systems were built in-house to maximize security and reduce dependencies on third parties.

Key Takeaways

- A bank’s reserve ratio is the percentage of reserves held for each dollar deposited. When a bank’s reserve ratio is less than 100%, it holds less money than its depositors have entrusted it with.

- Reserves ensure a bank’s customers can reliably access their money when needed. Without ample reserves, depositors who have entrusted a bank with their savings could risk losing their funds.

- Proof of Reserves (PoR) is a way for companies to show that they hold the money or assets they claim they do, ensuring they can make their clients whole.