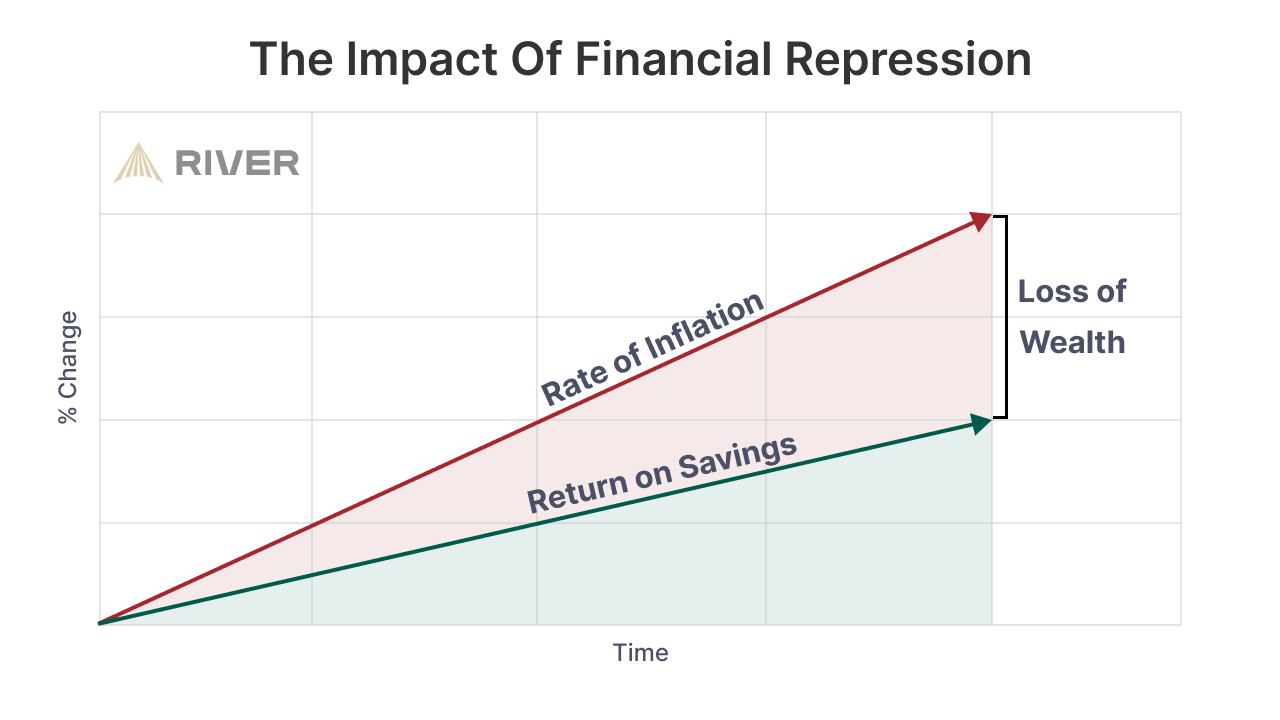

Financial repression describes a set of government policies that direct funds from the private sector to the public sector to help reduce national debt. In periods of financial repression, savers lose wealth, while those with high debt levels benefit from the erosion of their debt burdens. This is because the rate of inflation typically exceeds the rate of return on savings.

Just as with businesses and individuals, governments sometimes use debt to fund their expenditures. When a government’s debt is too high to repay by raising taxes or cutting spending, it often resorts to policy measures that move funds from the broader economy to the public sector. These measures allow governments to finance their spending and manage debt repayment more effectively, without defaulting.

Methods of Financial Repression

There are several indirect policies that direct funds from the private sector to the public sector to help reduce national debt. At a high level, these policies disadvantage savers and enrich the government. These include:

- Interest Rate Caps: The Federal Reserve influences interest rates across the economy. Keeping nominal interest rates low, often below the inflation rate, reduces the real return on savings and makes borrowing cheaper for the government. Quantitative Easing is one way to suppress interest rates. More direct policies such as Yield Curve Control artificially prevent interest rates from rising above a set level.

- Regulatory Requirements: Financial institutions may be required to hold government bonds or other approved assets, suppressing interest rates and subsidizing government spending.

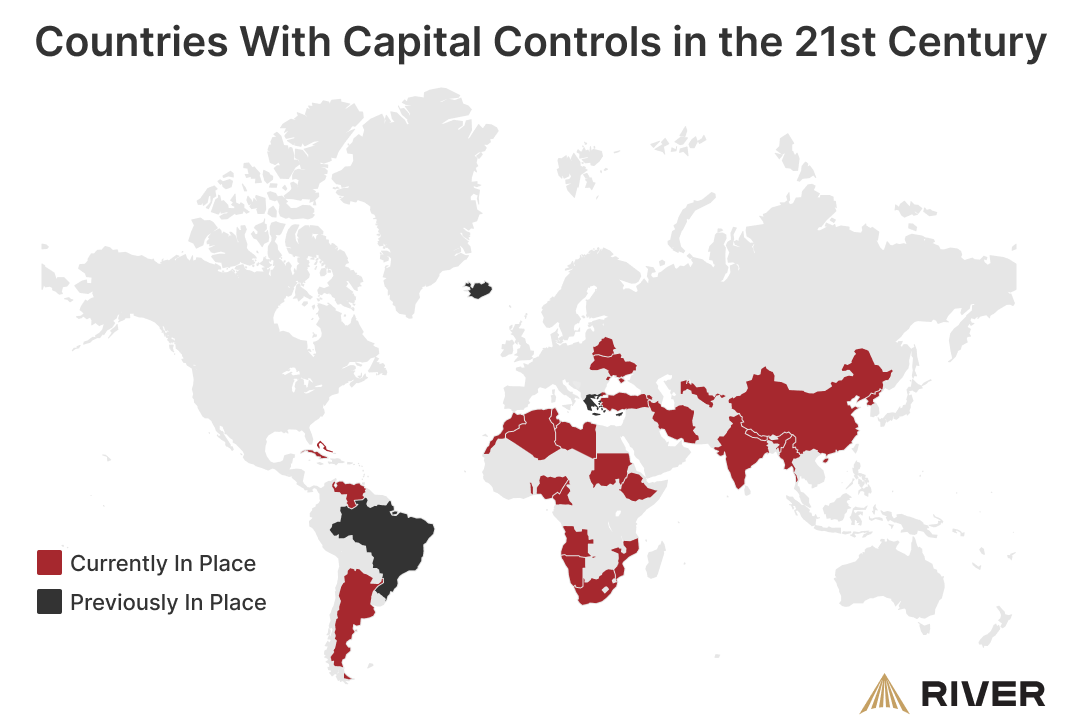

- Capital Controls: In extreme cases, governments may restrict the flow of wealth across borders, preventing citizens from investing in better-returning assets abroad and limiting their ability to avoid financial repression. As shown in the chart below, thirty-one countries accounting for over 40% of the world’s population have implemented capital controls since the year 2000.

- Directing Credit: Governments may steer savings towards preferred sectors through directives or incentives.

Impacts of Financial Repression

Financial repression can have far-reaching consequences for both society and the wider economy. By artificially suppressing interest rates, restricting capital flows, and directing savings towards government debt, financial repression creates an environment where the allocation of resources becomes inefficient, and the burden of debt is shifted across different sectors of the economy.

What does financial repression mean for you and the economy? Here are some effects to consider:

- Reduced Real Returns: During financial repression, savers receive lower returns on their investments, which might discourage saving and drive investors to seek higher yields through riskier assets. This results in numerous negative consequences for the average person; retirement and large purchases become more difficult to achieve, certainty about one’s financial future is reduced, and quality of life is diminished.

- Debt Reduction: Inflation and low interest rates can reduce government debt levels, which might also lower debt for businesses and individuals. Taken in isolation, debt reduction may be a good thing. However, financial repression does not improve a government’s fiscal responsibility. Only budget reform can improve a country’s long-term ability to reliably pay back its debt.

- Wealth Redistribution: Financial repression acts as a transfer of wealth from savers to borrowers, including the government, by reducing the real value of savings. Those who stay out of debt by building up savings are harmed, as the value of their savings diminishes with inflation. Meanwhile, those with large amounts of debt benefit, as the value of their debt burden diminishes with inflation.

- Low Economic Growth: By distorting interest rates, economic growth can be hindered by diverting funds from potentially more productive private investments to government debt.

Macroeconomic Implications of Financial Repression

Financial repression not only impacts individual wealth and investment behavior but also has broader macroeconomic implications that influence the stability and growth of an economy.

One of the primary macroeconomic consequences of financial repression is the reduction of consumer spending. When inflation outpaces interest rates, the real value of savings erodes, reducing household wealth and lowering disposable income. As savers earn returns below inflation, they have less to spend on goods and services. This can stifle economic demand, reducing overall consumption, which is a significant driver of economic growth in most developed economies.

Another critical implication of financial repression is the crowding out of private-sector investment. By redirecting savings toward government debt, financial repression limits the capital available for private businesses to invest in productive ventures. Capital that could have fueled innovation, infrastructure development, and business expansion is instead channeled into government bonds or other low-yielding assets. This leads to underinvestment in the private sector and stunted economic development. Over time, the lack of investment in capital goods and savings-financed investments can hinder long-term productivity growth.

Financial repression also plays a significant role in the expansion of government debt. By keeping interest rates artificially low, governments can finance their spending at a lower cost, making it easier to run deficits without facing immediate financial pressure. However, this creates a cycle of expanding debt-to-GDP ratios, as governments become reliant on perpetual borrowing to meet budgetary needs. While this might seem sustainable in the short term, it can lead to a debt trap where the economy becomes increasingly dependent on low-interest government debt, making fiscal reforms and adjustments difficult to implement.

Criticisms and Challenges of Financial Repression

Financial repression is often criticized for its long-term negative effects on the economy and society. By keeping interest rates artificially low, it erodes the wealth of savers, as their returns fail to keep up with inflation, diminishing their purchasing power over time. This policy also crowds out private-sector investment, as capital that could have been used for productive investments is instead directed towards government debt.

This misallocation of capital stifles economic growth, as businesses struggle to secure financing and capital goods investments are underfunded.

Financial Repression After World War II

At the end of World War II, the United States faced high debt levels from wartime spending. At the war’s conclusion, public debt to GDP was 112%.

In 1942, the Federal Reserve helped the U.S. Treasury reduce the government’s debt burden by placing a cap on interest rates across the yield curve. As a result, between 1945 and 1980 real returns were less than 1% for two-thirds of the time. By 1980, federal government debt as a percentage of GDP fell to 30%.

While it may provide temporary relief for government debt, financial repression often exacerbates fiscal challenges in the long run. The policy creates a debt-to-GDP cycle that can fuel inflation, raise interest rates, and create economic instability.

Do We Have Financial Repression in the US Today?

The US Government faces an increasingly high debt burden, now exceeding 120% of GDP. It has become increasingly unlikely that the federal government will be able to pay back its debt without relying on various forms of financial repression.

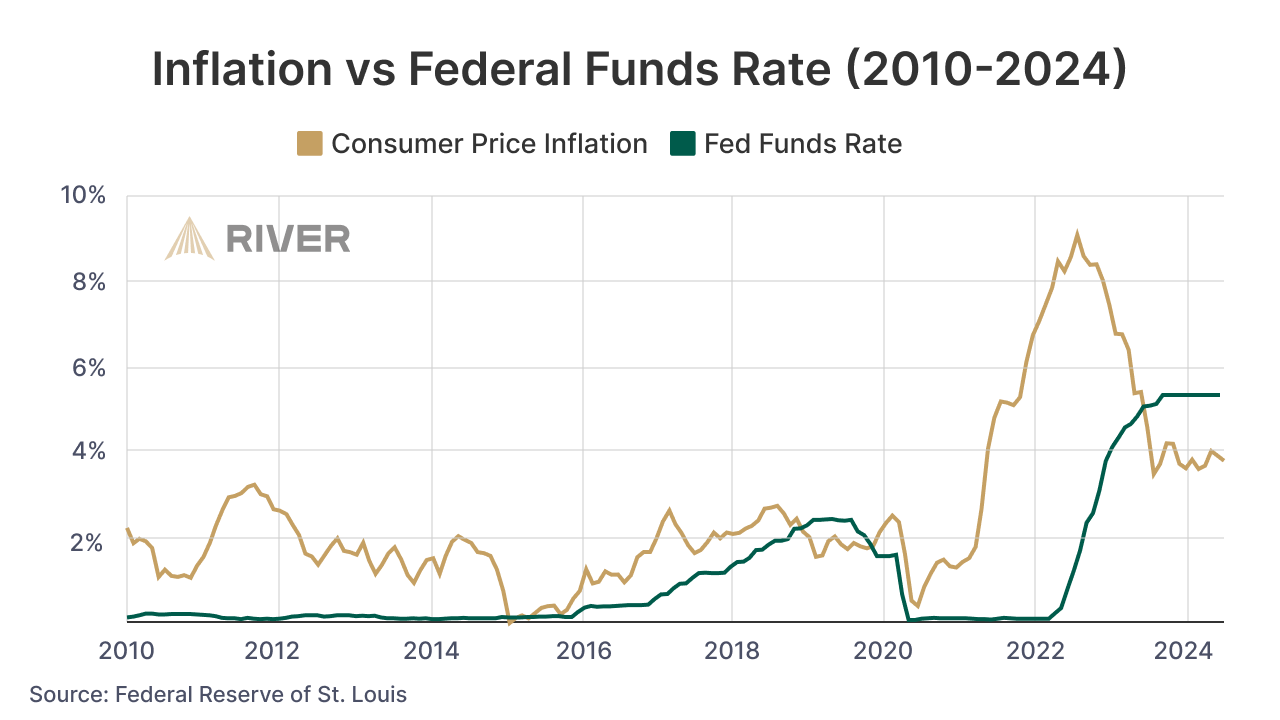

Since 2010, the Federal Funds Rate, which is set by the Federal Reserve, has been below the rate of inflation more than 80% of the time, as shown in the chart below.

Key Takeaways

- Financial repression refers to a set of government policies that direct funds from the private sector to the public sector to help reduce national debt.

- Methods of financial repression include interest rate caps, capital controls, and regulating the financial sector.

- Financial repression transfers wealth from savers to borrowers by reducing the real value of both savings and debt.