Confused about Bitcoin taxes or unsure how to report them? Our 2026 guide breaks down IRS rules to help you navigate capital gains and income taxes.

In the US, bitcoin is treated as property, not currency, meaning your transactions could have tax implications whether you’re selling, earning, or even spending your bitcoin. It might sound complicated, but understanding the basics is key to optimizing your financial strategy to ensure you keep as much bitcoin as possible, without any unnecessary setbacks.

Before we dive in, it’s important to note that River is not a tax advisor, and this article is not intended as tax advice. Our goal is to help you understand the basics of navigating the bitcoin tax landscape, so you can make informed decisions. This article is for information purposes only. For personalized advice, please consult a tax professional.

What Triggers Tax on Bitcoin?

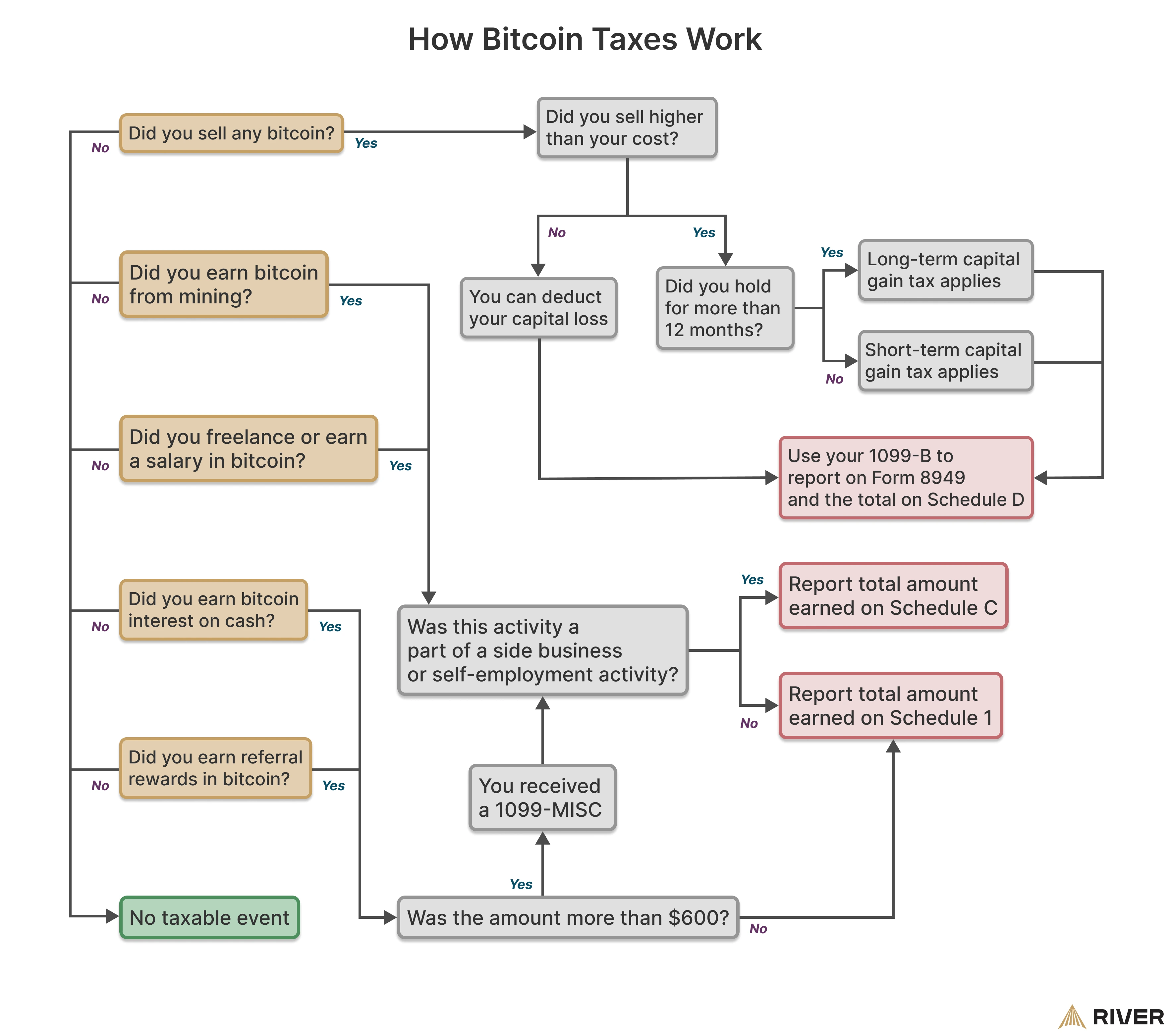

In the US, bitcoin is subject to either capital gains tax or income tax. A taxable event, which triggers bitcoin tax, occurs when you earn or dispose of bitcoin. Disposing of bitcoin can include actions like selling, spending, or using it in a way that transfers ownership.

How Capital Gains Tax Applies to Bitcoin Transactions

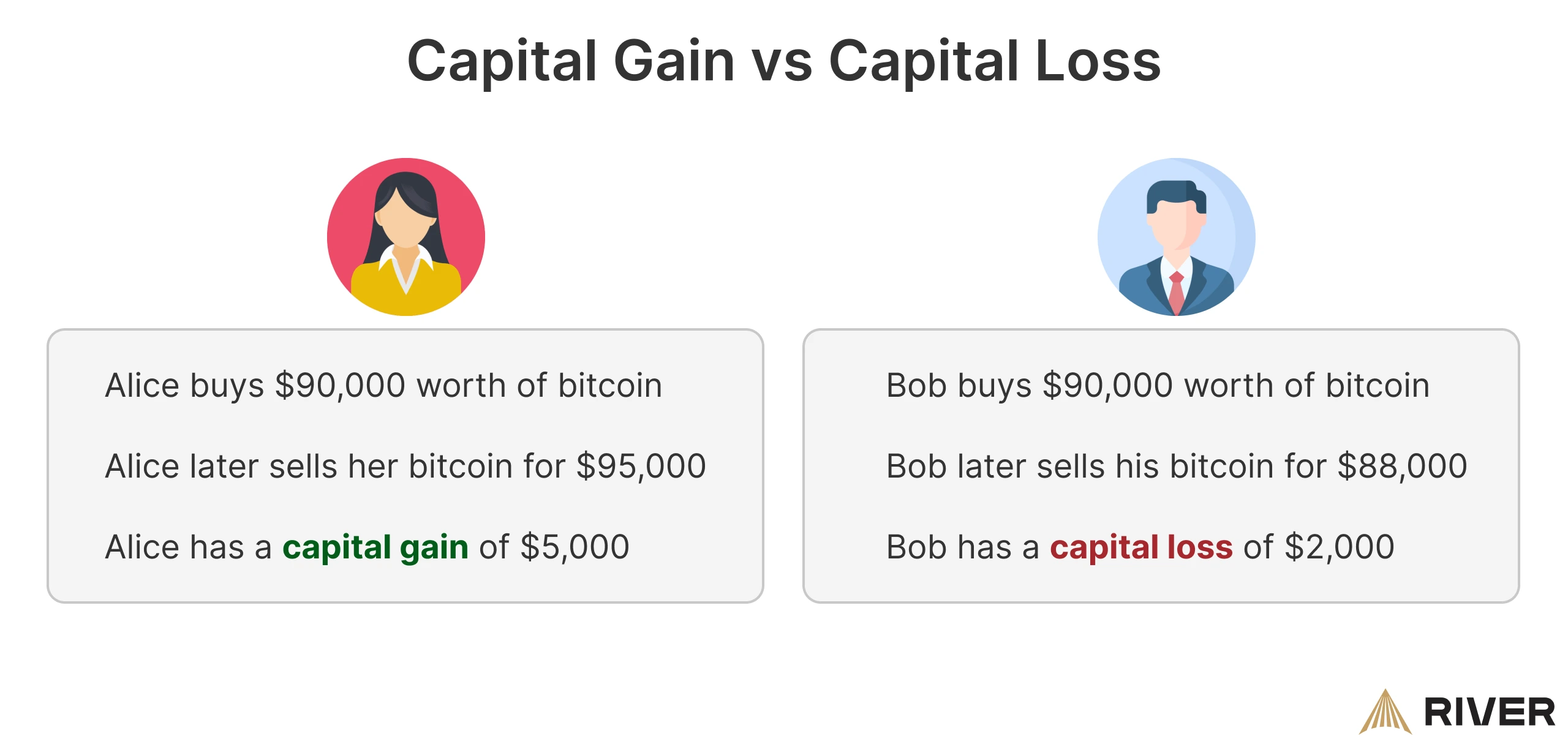

You will owe capital gains tax when you dispose of bitcoin depending on how the price of bitcoin has changed since you originally acquired it. If you sell bitcoin for a profit, capital gains tax applies. Even spending bitcoin to purchase goods or services counts as a disposal, triggering the need to report any gain or loss.

However, not all disposals result in gains. If you sell or spend bitcoin for less than your purchase price, this creates a capital loss. While no one enjoys losing money, capital losses can be used to offset gains on other assets, reducing your overall tax liability.

When Do I Owe Income Tax on Bitcoin?

You owe income tax on bitcoin when you earn it, as it is treated as income and taxed based on its value in USD at the time you receive it. For example, income tax is due when you earn bitcoin as payment for your job or receive bitcoin as a reward for referrals on an exchange.

When to Report Bitcoin Taxes

You need to report your bitcoin taxes by April 15, 2026. Americans living abroad have until June 15, 2026 to file. If you need more time, you can request an extension, which moves the deadline to October 15, 2026, but the extension request must be submitted by April 15.

How Bitcoin Taxes Are Calculated

The taxes you owe on bitcoin depend on two key factors:

- How much you earned during the year

- How long you held your bitcoin

Understanding these factors is crucial for determining your Bitcoin tax liability.

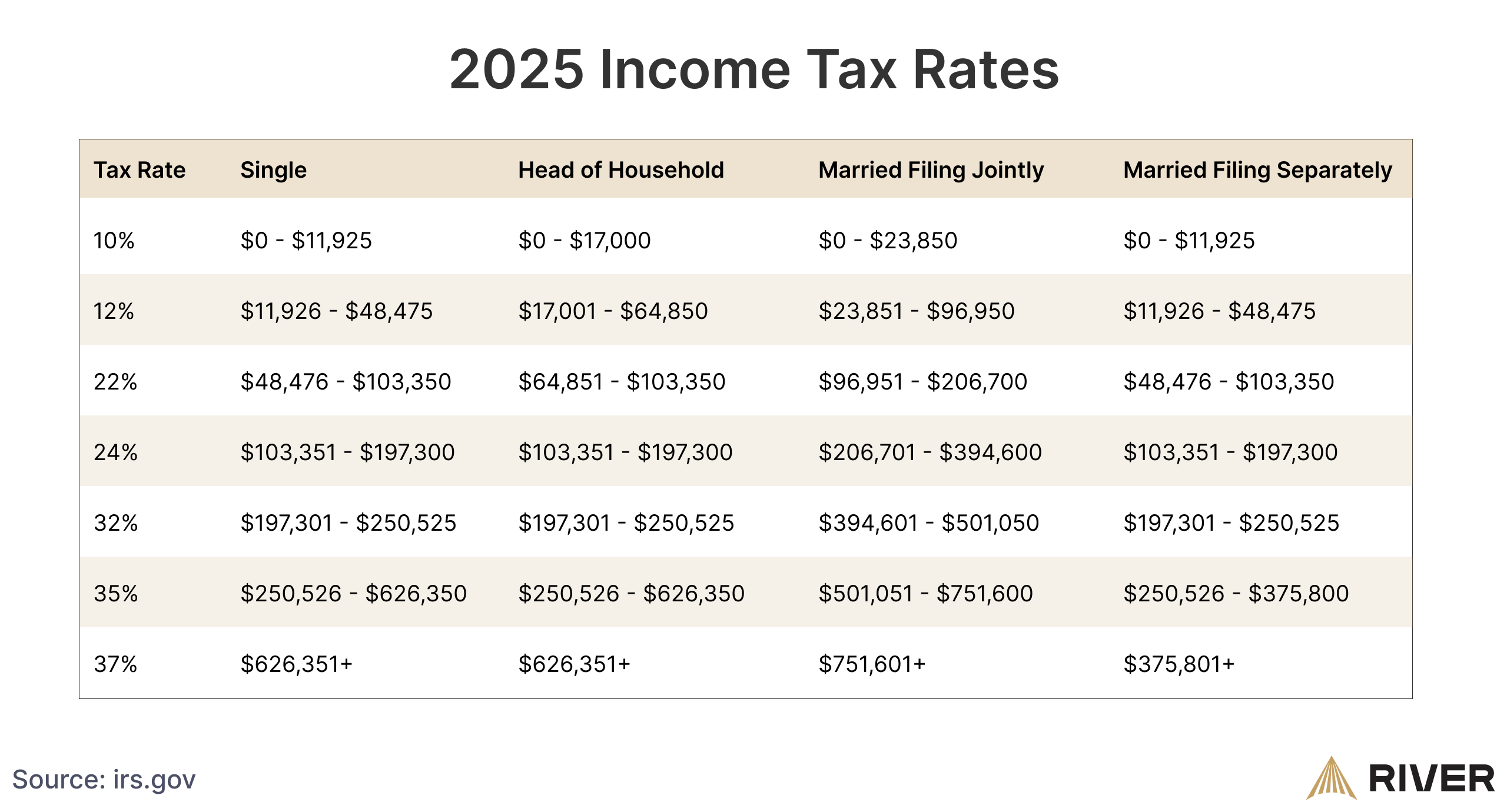

Bitcoin Tax Rates: Short-Term vs Long-Term

Bitcoin tax rates vary based on how long you hold your bitcoin before selling it. If you sell your bitcoin within 12 months of acquiring it, any profits are considered short-term capital gains and taxed as ordinary income.

For the 2025 tax year, ordinary income tax rates range from 10% to 37%, depending on your total income.

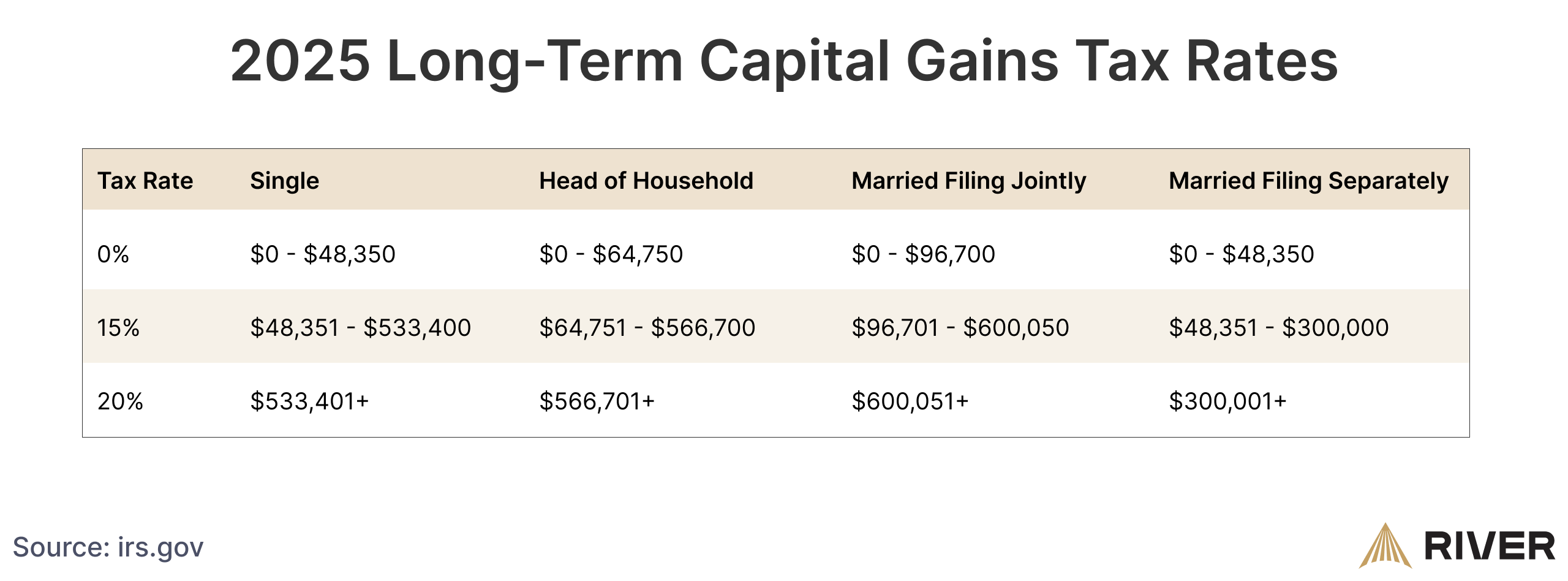

However, if you hold bitcoin for more than 12 months before selling, you qualify for long-term capital gains tax rates, which range from 0% to 20%, based on your income level.

Tax-Free Bitcoin Transactions

There are no taxable events when you buy bitcoin, hold bitcoin, or transfer bitcoin between your own wallets. These activities are generally not considered taxable events, meaning you do not owe taxes on them.

Taxation of Bitcoin Gifts

Gifting bitcoin is generally tax-free, because federal gift taxes only apply if the total value of gifts you give over your lifetime exceeds the $13.99 million lifetime gift and estate tax exemption. This is the maximum amount you can transfer during your lifetime without owing gift tax.

That said, there is an annual reporting threshold. If the fair market value of bitcoin you gift to any one person exceeds $19,000 in 2025, you must file a gift tax return (IRS Form 709). Filing this return is usually informational only—it does not mean you owe taxes—but it allows the IRS to track how much of your lifetime exemption you’ve used.

In short, for the 2025 tax year, the annual gift exclusion is $19,000 per recipient, and the lifetime exemption is $13.99 million.

Bitcoin Donations and Their Tax Implications

Bitcoin donations to registered charities offer several tax benefits since they are not considered a taxable disposal. You can deduct the value of your donation from your tax return. If your donation exceeds $500, you will need to report this on Form 8283.

The amount you can deduct depends on how long you’ve held the bitcoin:

- For bitcoin held for less than a year, you can only deduct whichever is lower: the bitcoin’s fair market value at the time of your donation or your cost basis.

- For bitcoin held more than a year, you can deduct the full market value at the time of donation.

Tax Implications of Lost or Stolen Bitcoin

If your bitcoin is lost or stolen, it is no longer tax-deductible due to the changes implemented by the Tax Cuts and Jobs Act of 2017. As a result, investors who lose bitcoin cannot claim these losses to offset their taxable income.

For example, here are some situations where the lost bitcoin is not deductible:

- Exchange Hacks - bitcoin lost due to the hacking of an exchange where it was stored.

- Wallet Hacks - bitcoin stolen from personal wallets due to unauthorized access.

- Mistake Transactions - bitcoin sent to the wrong address and irretrievably lost.

Can the IRS Track Bitcoin Transactions?

Some investors mistakenly believe that bitcoin transactions are anonymous, making it easy to avoid taxes. However, this is far from the truth. The IRS uses advanced methods to trace bitcoin activity and enforce tax compliance. By partnering with blockchain analysis firms like Chainalysis, the IRS can track transactions on the bitcoin blockchain. While bitcoin addresses do not directly reveal personal details, blockchain analysis can identify individuals by analyzing transaction patterns and data provided by exchanges.

➤ Learn more about bitcoin privacy and anonymity

Do Cryptocurrency Exchanges Report to the IRS?

Exchanges are required to report cryptocurrency activity to the IRS. They issue tax documents called 1099 forms, which contain your personal information and details of your bitcoin transactions. These forms help ensure tax compliance by reporting your cryptocurrency trades and holdings.

Consequences of Not Reporting Bitcoin Taxes

Failing to report bitcoin transactions can result in severe penalties. The IRS has intensified its efforts to crack down on bitcoin-related tax evasion in recent years. Penalties can include significant fines and/or criminal prosecution.

What to Do If You Forget to Report Bitcoin Taxes

Some bitcoin investors may not have been aware that bitcoin-related income needed to be reported on their taxes. If you find yourself in this situation, there is no need to panic. You can amend a prior year’s tax return to include your bitcoin-related income using IRS Form 1040-X.

It is typically better to amend your taxes in good faith rather than waiting for the IRS to identify the error. While amending your taxes doesn’t guarantee avoiding an audit, taking proactive steps to correct errors and pay what you owe shows good faith and may reduce the chance of closer scrutiny.

How to File Bitcoin Taxes

To file taxes on your bitcoin transactions, exchanges send you various 1099 forms that report the capital gains, losses, and income you earned. These forms help you accurately calculate your tax liability when filing. Here’s an overview of the common forms you may encounter:

IRS Tax Form 1099-B

For the taxes you file in April 2026 for the 2025 tax year, exchanges will send you Form 1099-B. This form reports capital gains and losses from all investment assets, including bitcoin. However, this form may not always be accurate if you have transferred bitcoin into or out of an exchange. Since exchanges may not have records of your cost basis or proceeds, and may not be positioned to correctly calculate your gains or losses.

IRS Form 1099-MISC

Form 1099-MISC reports miscellaneous income, including rewards earned through the River referral program or if you earned bitcoin interest on cash. If you have earned more than $600 in miscellaneous income during the tax year, most exchanges will send you this form. However, even if you do not receive a 1099-MISC, you are still required to report the income on your tax return, as all income, regardless of amount, is taxable under US law.

IRS Form 1099-K

Form 1099-K, which was previously used by exchanges, is a tax form for payment processors. It shows the total transaction volume rather than actual gains or losses. This created confusion in the past, as it could make it appear that clients owed taxes on the entire transaction volume, even if no taxable gains occurred. Due to this confusion, most exchanges no longer send Form 1099-K.

➤ Learn more about what tax forms you will receive from River

When Will I Receive My 1099 Tax Form?

1099 forms are typically issued by late January or early February of each year.

Where to Report Bitcoin on Your Tax Return

Once you receive a 1099 form from an exchange, review the form carefully to ensure the details match your own records, as exchanges may not have complete information. You will then use the information on the 1099 forms to report your taxes. Here are the next steps:

- Report any capital gains or losses on Form 8949 and summarize them on Schedule D.

- Report income on Schedule 1 or Schedule C, depending on whether it is personal or business income.

When it comes to reporting bitcoin taxes, you are required to declare both capital gains income and ordinary income.

How to Report Bitcoin Taxes on IRS Form 8949

Your capital gains and losses from bitcoin transactions are reported on IRS Form 8949. This form is used for the sales and disposals of all capital assets such as stocks, bonds, and bitcoin.

To complete Form 8949, you will need to:

- List all your bitcoin trades, sales, and disposals in the relevant columns.

- Include details such as the date you acquired the bitcoin, the date it was sold or traded, the gross proceeds, the cost basis, and the resulting gain or loss for each trade.

- Total all your transactions to calculate your net capital gain or loss for the year, which will be recorded at the bottom of the form.

Once completed, your totals from Form 8949 are used on Schedule D in your tax return, where your overall capital gains or losses are summarized.

How to Report Bitcoin Income Tax

Bitcoin income is reported on either Schedule 1 or Schedule C, depending on the nature of the income.

Bitcoin Income Tax on Schedule 1

Use the Schedule 1 form to report bitcoin income earned from activities such as referral rewards. This income is classified as “other income” and is not subject to self-employment tax.

Bitcoin Income Tax on Schedule C

Use Schedule C if you earned bitcoin as part of operating a business. For example, this can include receiving bitcoin payments for freelance work or profits from bitcoin mining operations at home.

Income reported on Schedule C is treated as self-employment income, which is subject to self-employment tax. Schedule C allows you to deduct business expenses such as electricity costs or operational costs.

New IRS Bitcoin Tax Rules for 2025

The IRS has introduced significant updates in 2025 regarding how investors track the cost basis of their bitcoin holdings. These changes include the switch to wallet-by-wallet accounting and the introduction of IRS Form 1099-DA. Both updates affect how investors report bitcoin transactions for tax purposes.

New Bitcoin Wallet-by-Wallet Accounting Method

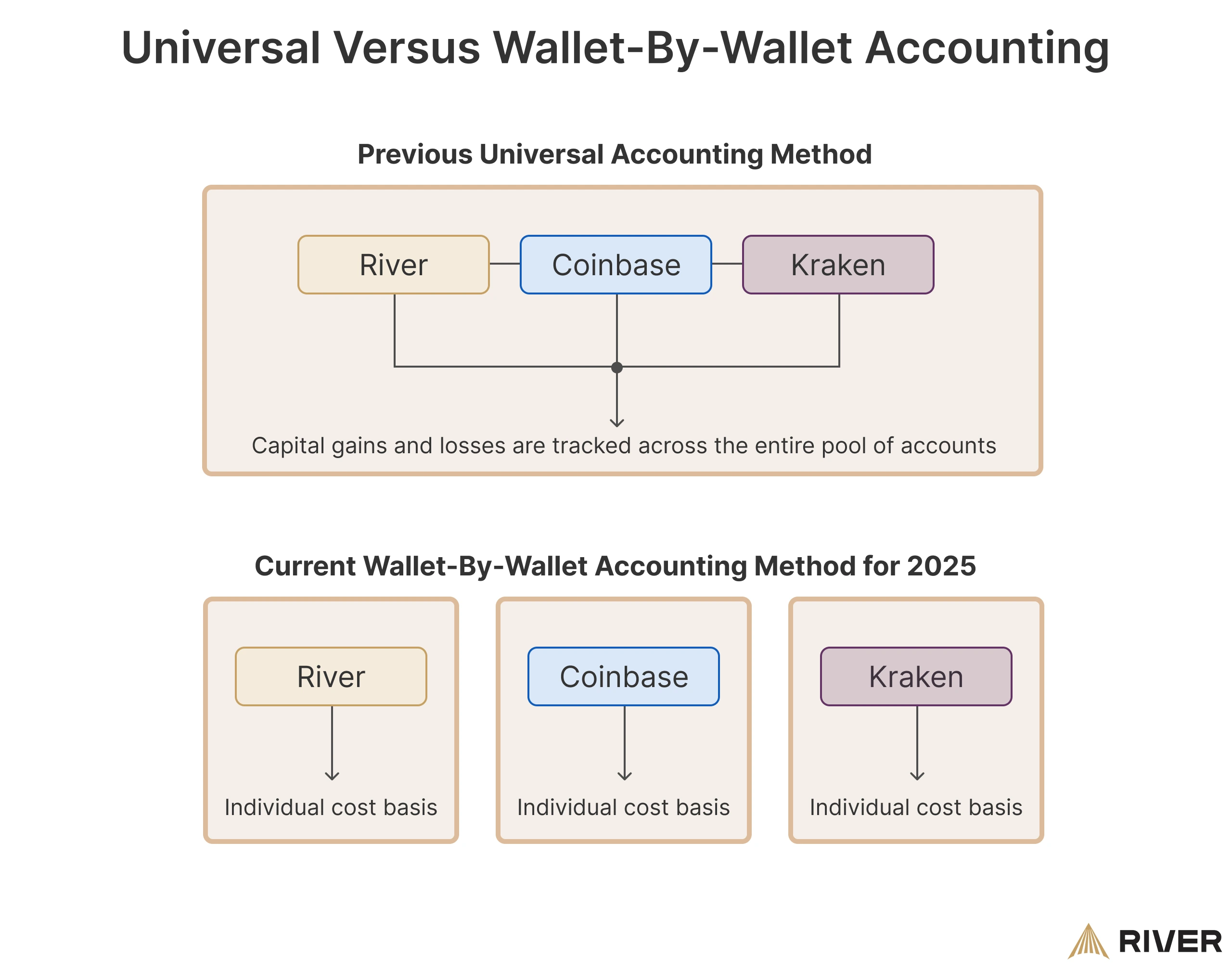

Starting January 1, 2025, the IRS rules apply specific identification and FIFO within a single wallet or account, rather than allowing a universal “all my bitcoin everywhere is one pool” approach.

Practically, this means you generally can’t treat bitcoin held across multiple wallets/exchanges as one combined inventory when determining which units were sold for basis/holding-period purposes. Instead, basis tracking is done separately for each wallet or account (wallet-by-wallet / account-by-account).

Because many taxpayers previously relied on a universal approach based on earlier IRS FAQs, the IRS issued a safe-harbor transition procedure that allows taxpayers to reasonably allocate their existing “unused basis” to wallets/accounts as of January 1, 2025 to help them move into the new regime.

How Does Transferring Bitcoin Between Wallets Affect Cost Basis?

When you transfer bitcoin between wallets, the cost basis travels with the asset. For example, if you purchase 1 bitcoin for $90,000 on River and transfer it to a hardware wallet, that bitcoin retains its $90,000 cost basis. The challenge arises if you’ve bought and transferred bitcoin at various prices.

What Is IRS Form 1099-DA and How Does It Impact Reporting?

For the tax year of 2025, many exchanges will issue a new, more detailed 1099 form called 1099-DA. Previously, 1099 forms such as the 1099-B only reported gross proceeds, which are the total amount you received from selling bitcoin without factoring in how much you paid for it. The new 1099-DA form includes your cost basis, making it easier for the IRS to track gains, losses, and ensure accurate tax reporting.

However, the IRS has indicated that for the 2025 tax year, Form 1099-DA will not be required to include cost basis details since it is the first year of implementing this new form.

- 2024 Transactions: River may report both cost basis (for tax lots acquired through River) using 1099-B.

- 2025 Transactions: River may report both cost basis (for tax lots acquired through River) using 1099-DA

- 2026 Transactions: River will report both cost basis and gross proceeds using 1099-DA.

Since the 1099-DA form for 2025 may not always mention a cost basis, you must report this yourself on your taxes.

Choosing a Cost Basis Method for Bitcoin Taxes in 2026

For the 2026 tax year, you can choose any accounting method that you prefer for each exchange you use. This flexibility allows you to select the method that fits your needs, whether it’s FIFO (First In, First Out), HIFO (Highest In, First Out), or LIFO (Last In, First Out).

➤ Learn more about the different cost basis methods like FIFO, HIFO, LIFO

However, it’s crucial that your records are accurate and match what is reported on Form 1099-DA. This means you should carefully track your bitcoin purchases and sales on a wallet-by-wallet basis to ensure consistency when filing your taxes.

Starting this year, exchanges will be required to report both cost basis and gross proceeds on Form 1099-DA. To ensure accurate reporting, taxpayers are expected to designate their preferred accounting method with each exchange, typically by the beginning of the tax year in which the method applies.

If you don’t notify your exchange, the default accounting method will be FIFO, and they will report the cost basis of your oldest bitcoin holdings.

Why Your Bitcoin 1099 Tax Form May Be Inaccurate

Exchanges sometimes cannot provide accurate tax reports for their users’ capital gains and losses. When you transfer bitcoin from one exchange to another, the new exchange may not automatically know the cost basis of the bitcoin you’ve transferred. In those cases, some exchanges assign a cost basis of $0 resulting in high taxable gains. Some other exchanges omit that deposited bitcoin from your tax forms resulting in inaccurate tax forms.

Exchanges typically only see the USD value of the bitcoin when it enters or exits their platform. Once bitcoin is transferred into or out of an exchange, the exchange loses access to the transaction history necessary to provide accurate tax reporting.

While many exchanges have this limitation, at River, you can enter the cost basis for the bitcoin you transfer to our platform. This enables you to correctly include this information on your tax forms.

➤ Learn more about how to add cost basis information for your bitcoin on River

What Is Cryptocurrency Tax Software?

Crypto tax software is designed to automate the bitcoin tax reporting process, making it easier to comply with IRS requirements. While you can manually aggregate your bitcoin transaction history from all your wallets and accounts on exchanges, this process can be time-consuming and complex.

Crypto tax software allows you to upload your transaction data as an Excel or CSV file from your exchange. Once uploaded, the software organizes your transaction history and generates accurate tax reports, including capital gains, losses, and income.

Key Takeaways

- Bitcoin transactions, such as selling, spending, or earning, are taxable events in the US, subject to either capital gains or income tax.

- Short-term capital gains are taxed as ordinary income, while long-term gains qualify for lower tax rates.

- Lost or stolen bitcoin is not tax-deductible under current IRS rules, even in cases of exchange or wallet hacks.