Billions of dollars worth of bitcoin and other cryptocurrencies are mined each year by a wide range of miners, ranging from home miners, to large publicly traded companies. In 2021, $15 billion in revenue was made by Bitcoin miners according to research by The Block.

Mining can be a very profitable endeavor, even for (non-technical) individuals if they figure out how to run a mining operation. In this article we cover everything you need to know about mining rigs and how you can get started in this lucrative industry.

What Is a Mining Rig?

A mining rig is a specialized computer system designed specifically for mining cryptocurrencies. For example, a miner uses a mining rig to process transactions and secure the network of a cryptocurrency that uses a Proof-of-Work (POW) algorithm. A mining rig constantly performs hash functions to be the first to create a new block of transactions that can be added to the blockchain.

Mining rigs are most commonly used to mine Bitcoin, which has over 99% of the market share in computing power backing it, out of all Proof of Work-based cryptocurrencies. It’s important to note that some of these cryptocurrencies use a different hashing algorithm, so the hash rate is not directly transferable between all coins.

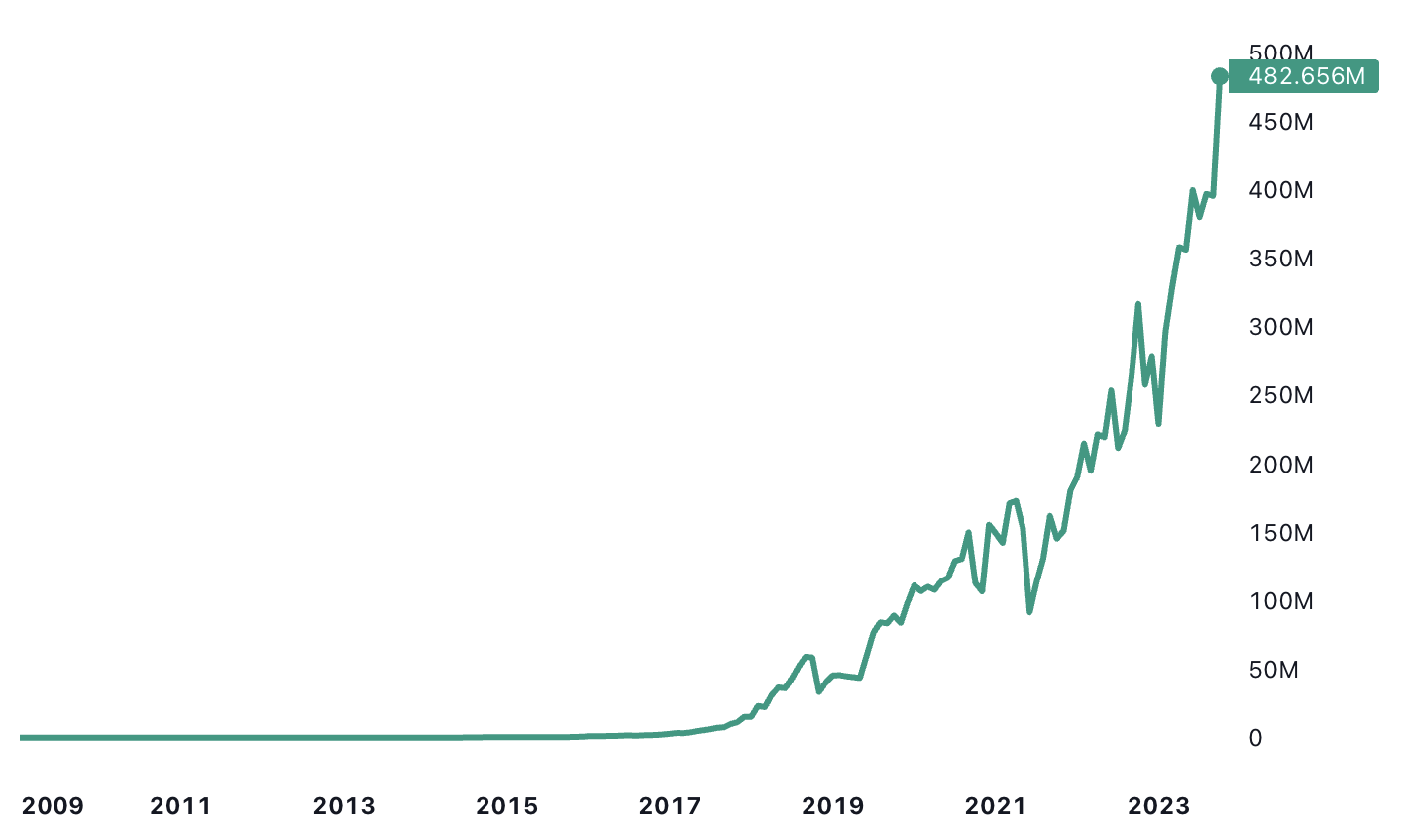

Bitcoin's hashrate over time in millions of Terahashes per second (tradingview)

➤ Learn more about Bitcoin mining.

Mining rigs can range from simple setups using standard computer components to highly specialized systems. The choice of mining rig depends on factors such as the type of cryptocurrency being mined, the miner’s budget, technical expertise, and the desired balance between performance and energy efficiency.

Building a Mining Rig

When building a Bitcoin mining rig, several critical hardware components must be considered to ensure optimal performance. These components include the motherboard, which determines compatibility with other parts and is crucial for connecting multiple GPUs. Second, the GPUs provide the necessary processing power for mining. Third, the power supply must match the rig’s power requirements. Forth, a robust cooling system is required to prevent overheating. Proper selection and integration of these parts are vital for creating an efficient and effective mining rig.

A mining rig typically consists of dozens of components and hundreds of chips. These are all arranged to perform cryptocurrency mining at the highest possible energy efficiency.

A Bitmain Antminer S19 Pro

ASIC mining rigs usually have a weight of around 11-39 pounds (5-18 kg), a length of around 11.8-15.7 inches (30-40cm), a width of around 5.9-7.8 inches (15-20cm), and a height of around 9.8-11.8 inches (25-30cm).

Types of Mining Rigs

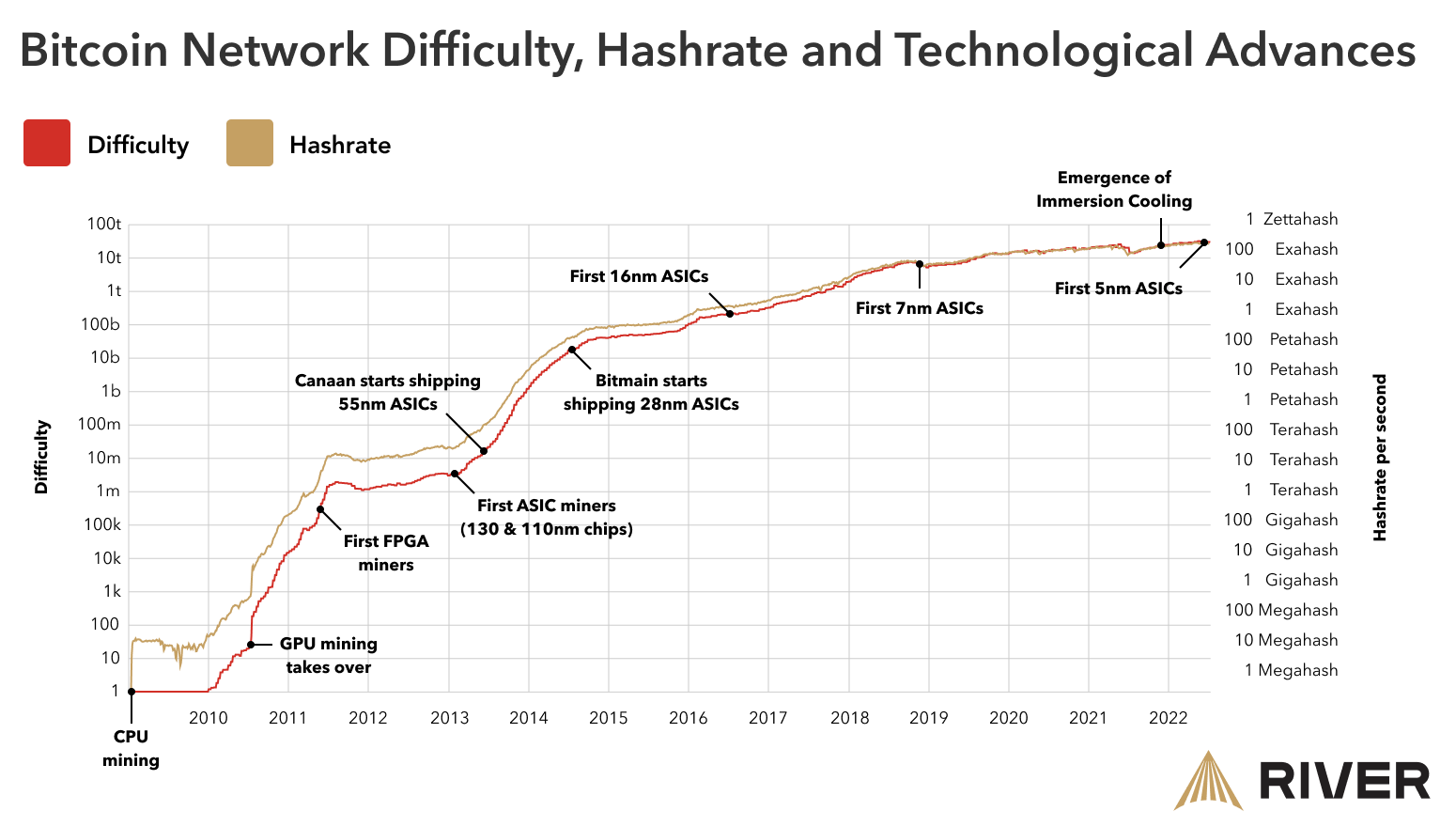

There are several types of mining rigs that have been popular such as a CPU miner, GPU miner, ASIC miner, and FPGA miner. Due to the historical profitability of mining, manufacturers keep pushing the limits of what is possible to achieve a higher efficiency and thus profitability. We look into the different types of mining rigs below and how they have changed the mining industry over the years.

What Is a CPU Miner?

A CPU miner is a type of mining rig that uses the central processing unit (CPU) of a computer to perform the computational work required in mining. While CPU mining was popular in the early days of Bitcoin and other cryptocurrencies due to its low initial cost and simplicity, it has become less common as more powerful and efficient mining methods, such as GPU and ASIC mining, have emerged.

As mining competition increased, CPUs quickly became outclassed, which is why it is often mentioned that mining from a personal computer is no longer profitable.

Today, CPU mining is typically used for mining newer or less resource-intensive cryptocurrencies, and it remains a feasible option for beginners or those interested in experimenting with mining without significant financial investment.

What Is a GPU Miner?

A GPU miner is a type of mining rig that uses graphics processing units (GPUs) to mine cryptocurrencies. GPUs are powerful processors originally designed for rendering graphics in video games, machine learning, and other applications. However, their high computational power and efficiency make them well-suited for mining.

A GPU mining rig can look like a regular personal computer, but it typically has several GPUs (Graphics Processing Units) connected to its motherboard. These rigs require a compatible motherboard, sufficient power supply, cooling systems, and often specialized software to manage and optimize the mining process. GPU mining is popular because it offers a good balance between cost, flexibility, and performance, making it accessible for both amateur and professional miners.

As a result, it has significantly more mining power than a CPU. The first GPU mining rigs in 2009 introduced a ~332% efficiency improvement over CPU miners.

The most popular manufacturers of GPUs are companies such as Nvidia, Asus, MSI, and AMD. Some of their most popular GPUs for mining are Nvidia’s GeForce RTX 3060 Ti and GeForce 3090, as well as AMD’s RX 6700 XT and Radeon RX 580.

What Is a FPGA Miner?

An FPGA miner is a type of mining rig that uses Field-Programmable Gate Arrays (FPGAs) to mine cryptocurrencies. FPGAs are integrated circuits that can be configured by the user after manufacturing, allowing them to be programmed to perform specific tasks, including mining different cryptocurrencies.

It can therefore be used to mine a specific cryptocurrency, and then reprogrammed to mine a different one. While this sounds great in theory, in practice this process is difficult, and FPGAs have a lower energy-efficiency than ASIC miners. This also explains why they are not used much for mining anymore. The first FPGA mining rigs in 2011 were 615% more energy efficient than GPU miners.

FPGAs offer a middle ground between the flexibility of GPU miners and the efficiency of ASIC miners. They are more efficient than GPUs in terms of power consumption and mining performance but are not as specialized or as powerful as ASICs. This makes FPGAs a versatile option for miners who want to switch between mining different cryptocurrencies without the need to invest in new hardware.

What Is an ASIC Miner?

An ASIC miner is a type of mining rig that uses Application-Specific Integrated Circuits (ASICs) to mine cryptocurrencies. ASICs are specially designed chips that are optimized for a single task: mining a specific cryptocurrency. This makes them extremely powerful and efficient for this purpose.

The most popular mining rig today is the ASIC. Unlike the other processing units, this is a chip that is customized and manufactured for a particular use, rather than a general-purpose use. When an ASIC is optimized for mining, it will far outclass the power efficiency of other computers. This makes trying to compete with ASIC mining rigs impossible without using ASICs.

The first ASIC mining rigs in 2013 were 460% more energy efficient than FPGA miners.

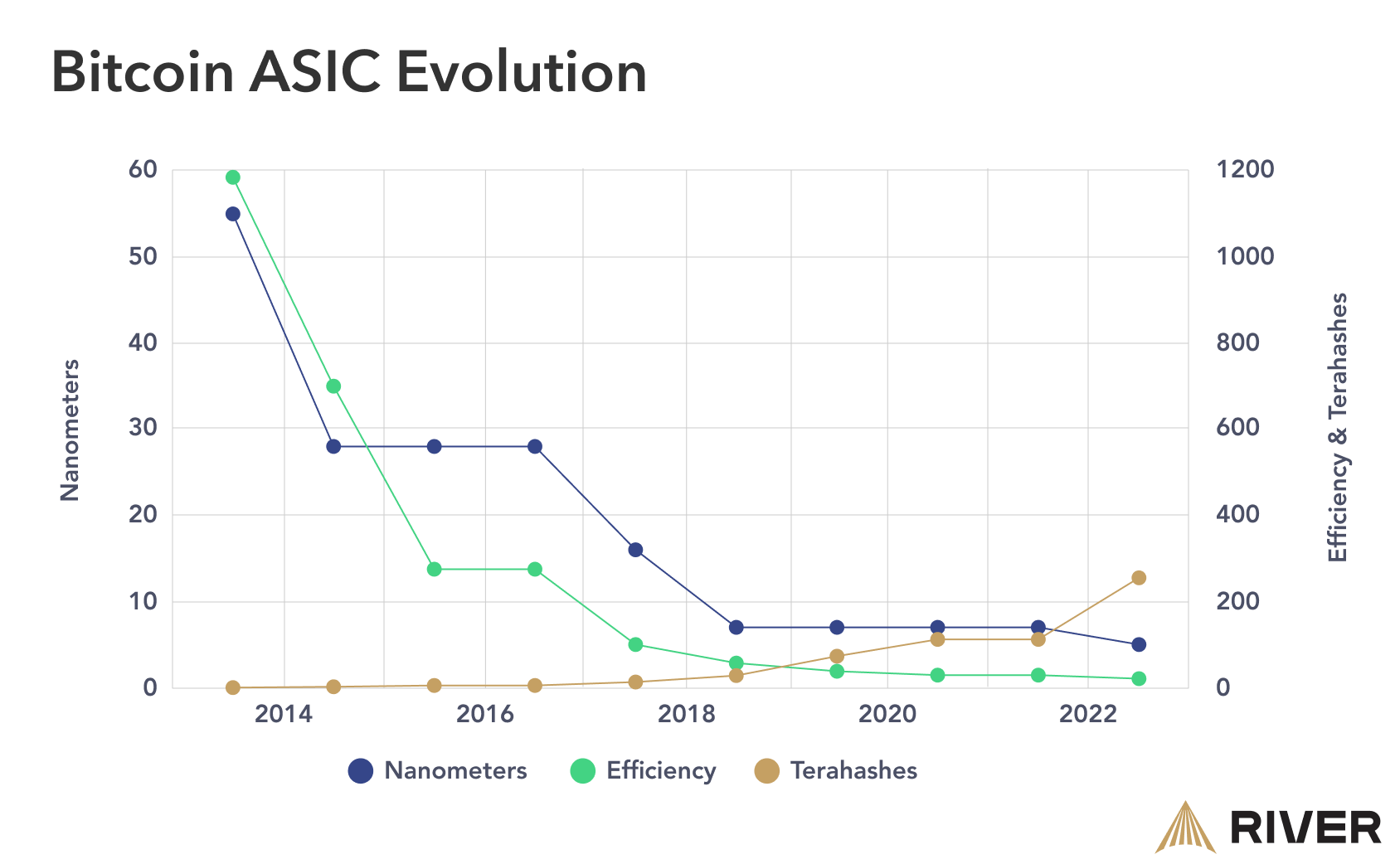

Advancements in Mining Technology

Over the years, there have been significant advancements in mining technology, driven by the financial incentive to mine more efficiently and effectively than the competition. These advancements encompass various aspects of mining hardware and software, aiming to maximize hash rates, reduce energy consumption, and improve overall mining efficiency.

| Type | Miner model | Date | J/TH* | Efficiency gain | Cumulative gain |

|---|---|---|---|---|---|

| CPU | ARM Cortex A9 | 3 Jan 2009 | 877193 | ||

| GPU | ATI 5870M | 23 Sep 2009 | 264550 | 232% | |

| FPGA | X6500 FPGA Miner | 29 Aug 2011 | 43000 | 515% | |

| ASIC | Canaan AvalonMiner | 1 Jan 2013 | 9351 | 360% | |

| ASIC | Antminer U1 | 1 Dec 2013 | 1250 | 648% | 648% |

| ASIC | Bitfury BF864C55 | 3 Mar 2014 | 500 | 150% | 1,770% |

| ASIC | PickAxe | 23 Sep 2015 | 140 | 257% | 6,579% |

| ASIC | Antminer S9 | 1 Jun 2016 | 98 | 43% | 9,442% |

| ASIC | 8 Nano Compact | 1 May 2018 | 51 | 92% | 18,235% |

| ASIC | Antminer S17 | 9 Apr 2019 | 36 | 42% | 25,875% |

| ASIC | Antminer S19 Pro | 23 Mar 2020 | 30 | 20% | 31,070% |

| ASIC | Antminer S19 XP | 12 Nov 2021 | 21.5 | 40% | 43,393% |

Measuring Mining Efficiency

Efficiency in mining refers to the energy expenditure required to perform a trillion hash functions, measured in joules per terahash (J/TH). The lower this number, the higher the efficiency of a mining rig, meaning less energy is used to achieve the same computational work.

Firstly, one of the key technological advancements has been the reduction in the size of transistors, measured in nanometers (nm). Smaller transistors allow more to be placed on the same chip surface area, increasing the chip’s overall processing power and efficiency. This miniaturization has enabled the development of more powerful and energy-efficient ASIC miners.

Secondly, as mining rigs become more powerful, they generate more heat. Advances in cooling technologies, such as liquid cooling and advanced air cooling systems, have been crucial in maintaining optimal operating temperatures. Efficient cooling solutions help prevent overheating, reduce downtime, and prolong the lifespan of mining hardware.

Thirdly, software advancements have also played a significant role in mining technology. Optimization algorithms have been developed to improve the efficiency of mining operations. These algorithms help in better managing power consumption, balancing workloads across multiple rigs, and optimizing mining strategies based on real-time data. For example, some of the most popular optimization algorithms and protocols in Bitcoin mining include the Stratum protocol and P2Pool.

Which Mining Rig for Which Cryptocurrency?

The different types of mining rigs are typically used to mine different Proof-of-Work cryptocurrencies. This match depends on the algorithm used to secure the blockchain of each respective cryptocurrency. Some of these algorithms make it unprofitable to use certain types of mining rigs.

Some cryptocurrencies are ideal for ASICs, which means CPUs and GPUs can not profitably compete to solve blocks. Due to the higher price point of ASICs, this makes it difficult for people without capital to mine profitably.

Other cryptocurrencies try to be ASIC-resistant to keep mining accessible at lower price points for more people. There are some drawbacks to this approach as well:

- When GPUs are the optimal mining rigs to mine a cryptocurrency, such as in the case of Zcash, it puts heavy pressure on the GPU market. It becomes difficult for people to acquire GPUs at accessible prices for other uses, such as the previously described machine learning applications.

- When CPUs are the optimal mining rigs, such as in the case of Monero, there is a new incentive for hackers to infect as many computers as possible to make them mine cryptocurrency at no cost for the hacker. Before cryptocurrency mining with a CPU emerged, monetizing large amounts of hacked computers was a more complex task.

How Much Does a Bitcoin Mining Rig Cost?

A typical ASIC mining rig can cost anywhere between $500 and $10,000. That is a broad range and it does not tell the full story of the quality of the product.

It is important to understand that the price of a mining rig is not the only factor when buying a miner. An operator wants to run miners that have the highest possible efficiency for the amount of money they invest.

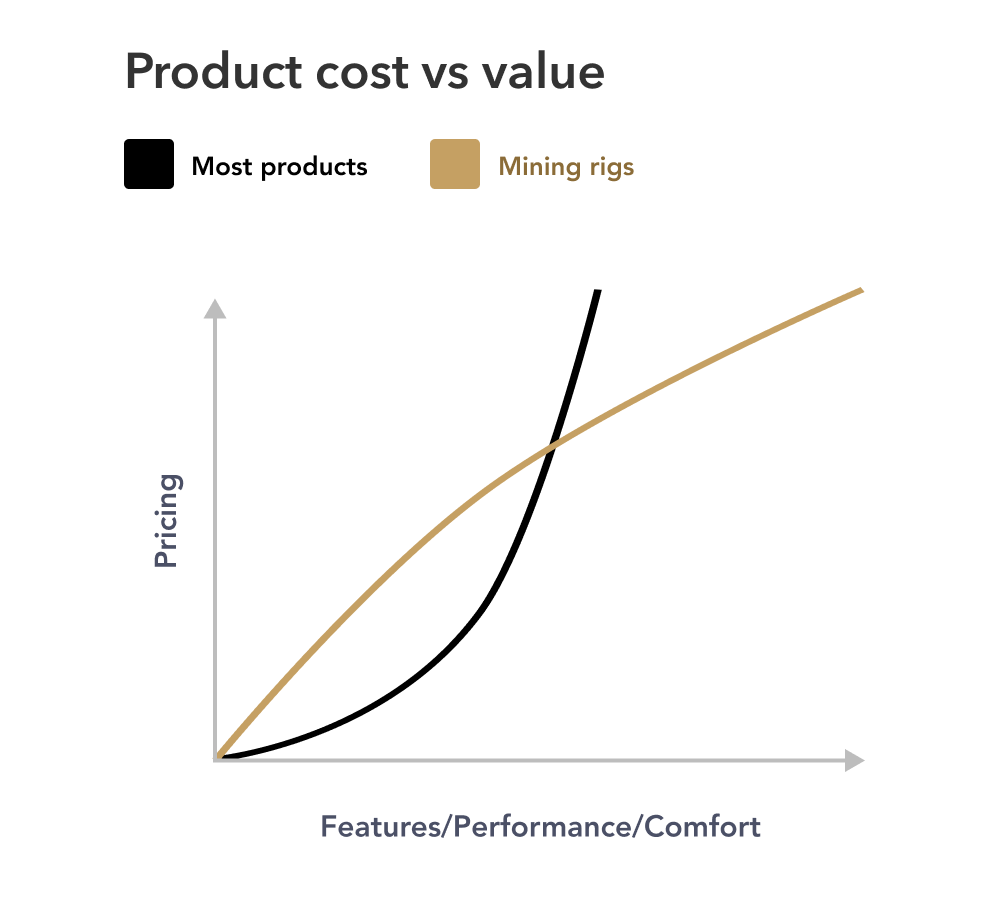

Cost vs Energy-Efficiency

The cost vs energy-efficiency tradeoff is different for cryptocurrency mining than it is for other devices, equipment or machines, where a premium is often paid for a disproportionately low improvement in performance or features. Consider a laptop for example, at a 20% higher price point it does not become 20% better at everything.

For a miner, if the price is 10% higher than another rig, then the efficiency should be 10% higher too, or it may make more sense to spend that capital on a different mining rig with a higher efficiency per dollar.

Older generations of miners typically do not offer the same level of efficiency as newer models. Depending on the price of a cryptocurrency compared to the difficulty to mine it, it can still be profitable to mine with older miners. Another factor here is the abundance of cheap energy in local areas, as this allows operators to purchase less efficient machines while making up the difference with the energy price.

How Much Can You Earn With One Bitcoin Mining Rig?

The profitability of a mining rig depends on a number of factors, which makes it difficult to give a simple answer like $5-10 per day. Mining profitability comes down to the revenue of a miner less the costs to run the machine.

In the mining industry, the costs are typically divided into two categories: Capital Expenditures and Operating Expenditures.

CapEx in mining:

- Cost of the mining rigs, infrastructure, cabling and accessory equipment, and delivery costs.

- Cost of the facility if the operator owns it, otherwise this is OPEX.

OpEx in mining:

- Electricity to keep the mining operation running.

- Maintenance of mining rigs, such as replacement parts and tools.

- Costs of the facility if it is rented.

- Staff wages.

- Business administration.

- Security and/or insurance costs.

- Potential licensing and regulatory requirements.

- The fee charged by the mining pool the operator chooses to participate in.

In addition to costs, there are also factors that can potentially decrease mining revenue:

- Miner delivery time.

- Installation delays.

- Miner downtime.

- An increase in mining difficulty.

- A decrease in the value of the cryptocurrency that is mined, as OPEX costs are typically paid in fiat currency.

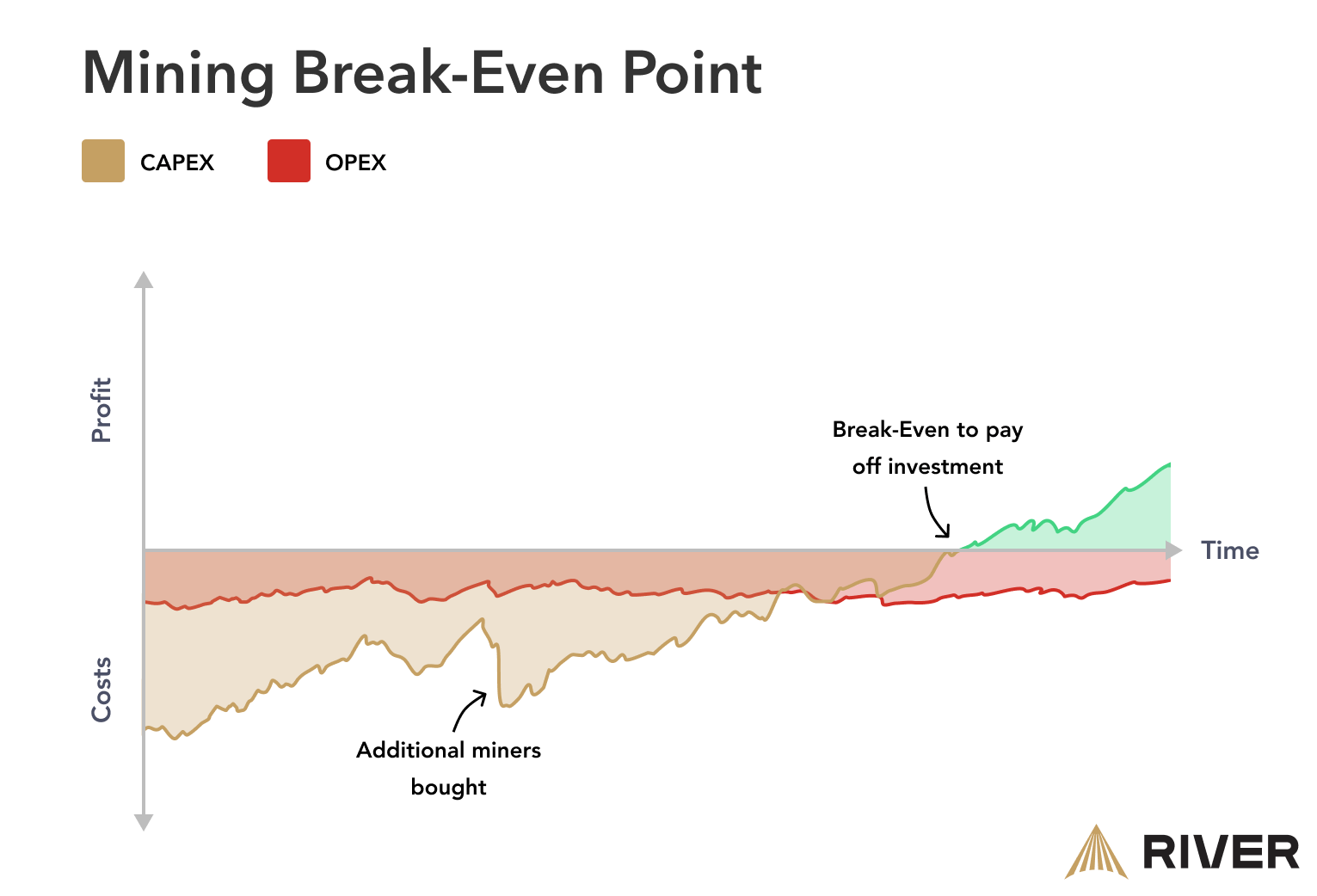

Calculating Break-Even for Mining

Ideally, when a mining rig is purchased, the seller provides statistics that allow the operator to calculate their break-even point on the investment. After this point in time, anything left after the operational expenses would be profit.

The reason why this is a broad range and not a specific number, is that mining rig manufacturers cannot predict beforehand what the difficulty will be to mine new blocks in months or years from now, so they have to use estimations.

If there is no calculator, but there is an estimation of when a return on investment can be expected, it is still wise to validate this estimation in multiple places. Electricity costs vary wildly around the world. It may be possible for someone in one location to earn back the cost of their miner in a year, while the same miner in an area with high electricity costs may never see a profit. The electricity cost in the estimation must always be updatable, rather than using a predetermined value.

➤ Learn more about Bitcoin mining profitability.

The Best Mining Rigs

A quick way to determine the best current mining rig is by looking at the highest efficiency, compared to the cost.

In practice, the efficiency per dollar is not always the best indicator, as not every mining rig is ideally suited for each location. Some models require different transformers, panels, breakers, and wiring on site which would increase your overall costs. Other models have a higher hash rate for their size and may allow you to get the most out of your available energy source.

How Long Does a Mining Rig Last?

Some miners are historically more prone to breaking down than others. The Antminer S17 and T17 for example were having 20-30% failure rates within a month. Some models from the same manufacturer, such as the Antminer S9, have been reliably running for over 6 years. The durability of a machine is an important factor to consider when looking into different models.

Beyond durability, the reliability and ease of use are not to be overlooked either. Whatsminer is often praised as a miner that is very reliable and easy to work with, which is especially important for large scale mining operations.

It is good for a buyer to do their research, keeping in mind that the most vocal people online tend to be negative reviews.

Using a Mining Profitability Calculator

As the prices of mining equipment frequently changes, it is wise to use a mining profitability calculator to make an informed decision on which miners to buy. To use such a calculator, relevant data on some modern miners is required.

Mining Rigs Compared

Below we have created an overview of some of the more popular mining rigs that have been manufactured since 2020. Note that some of the hashrate values may vary by a few percent in practice.

The most efficient mining rig is determined by dividing the power consumption in watts by the hashrate. The lower the outcome of this calculation, the higher the efficiency. Note that prices vary for each machine. While one machine may be the most efficient, it also likely comes at a premium price point per Terahash. This is an important factor that must be evaluated.

Legend:

- Hashrate (TH/s): Refers to how many trillions of hash functions a miner can perform per second.

- Watts (W): Refers to the amount of Watts of electricity a miner needs to perform that many hashes per second.

- Efficiency (J/TH): Refers to the energy expenditure to perform a trillion hash functions. The lower this number, the higher the efficiency of a mining rig. (In this equation, the “per second” portion cancels out, and Joules can be considered 1 to 1 with Watts).

| Model | Manufacturer | Release date | Hashrate | Watts | Efficiency |

|---|---|---|---|---|---|

| Antminer T21 | Bitmain | Oct 2023 | 190 TH/s | 3610 W | 19 J/TH |

| Whatsminer M66S Immersion | MicroBT | Oct 2023 | 298 TH/s | 5513 W | 18.5 J/TH |

| Whatsminer M63S Hydro | MicroBT | Oct 2023 | 390TH/s | 7215 W | 18.5 J/TH |

| Whatsminer M60s | MicroBT | Oct 2023 | 186 TH/s | 3441 W | 18.5 J/TH |

| Whatsminer M60 | MicroBT | Oct 2023 | 162 TH/s | 3104 W | 19.2 J/TH |

| Antminer S21 | Bitmain | Aug 2023 | 210 TH/s | 3150 W | 14.2 J/TH |

| Whatsminer M50 | MicroBT | Apr 2022 | 114 TH/s | 3306 W | 29.0 J/TH |

| Bonanza Mine 2 | Intel | Feb 2022 | 135 TH/s | 3510 W | 26.0 J/TH |

| Antminer S19 Pro Hydro | Bitmain | Jan 2022 | 198 TH/s | 5445 W | 27.5 J/TH |

| Antminer S19j Pro | Bitmain | Aug 2021 | 104 TH/s | 3068 W | 29.5 J/TH |

| Antminer S19j Pro | Bitmain | Jun 2021 | 100 TH/s | 3050 W | 30.5 J/TH |

| Avalonminer 1246 | Canaan | Jan 2021 | 90 TH/s | 3420 W | 38.0 J/TH |

| Whatsminer M30s++ | MicroBT | Oct 2020 | 106 TH/s | 3286 W | 31.0 J/TH |

Buying a Bitcoin Mining Rig

Given that a good mining rig costs thousands of dollars at minimum, it is important to understand the key characteristics to be evaluated before a purchase.

Power Efficiency

A mining rig should be efficient at turning electricity into hashes. This means not only the price point needs to be considered, but also the power efficiency of a mining rig. The efficiency is represented by the wattage needed to compute a trillion hashes.

Efficiency = watt / terahash

For example, the Antminer S19 XP has a power consumption of 3010W and a hashrate of 140TH/s. Its efficiency is therefore 3010W / 140 TH/s = 21.5J/TH. The lower this number, the better the efficiency, as less energy is spent to compute a trillion hash functions.

Efficiency is a crucial metric, because if 5% less is paid for a miner but the hashrate is 10% lower, the rig is less efficient than competing models. This means over time, less efficient models may temporarily or permanently get pushed out of the market when profit margins go negative, while more efficient mining rigs can remain operational for a longer time.

Note that a lower efficiency number is better and indicates less energy used per Trillion hashes.

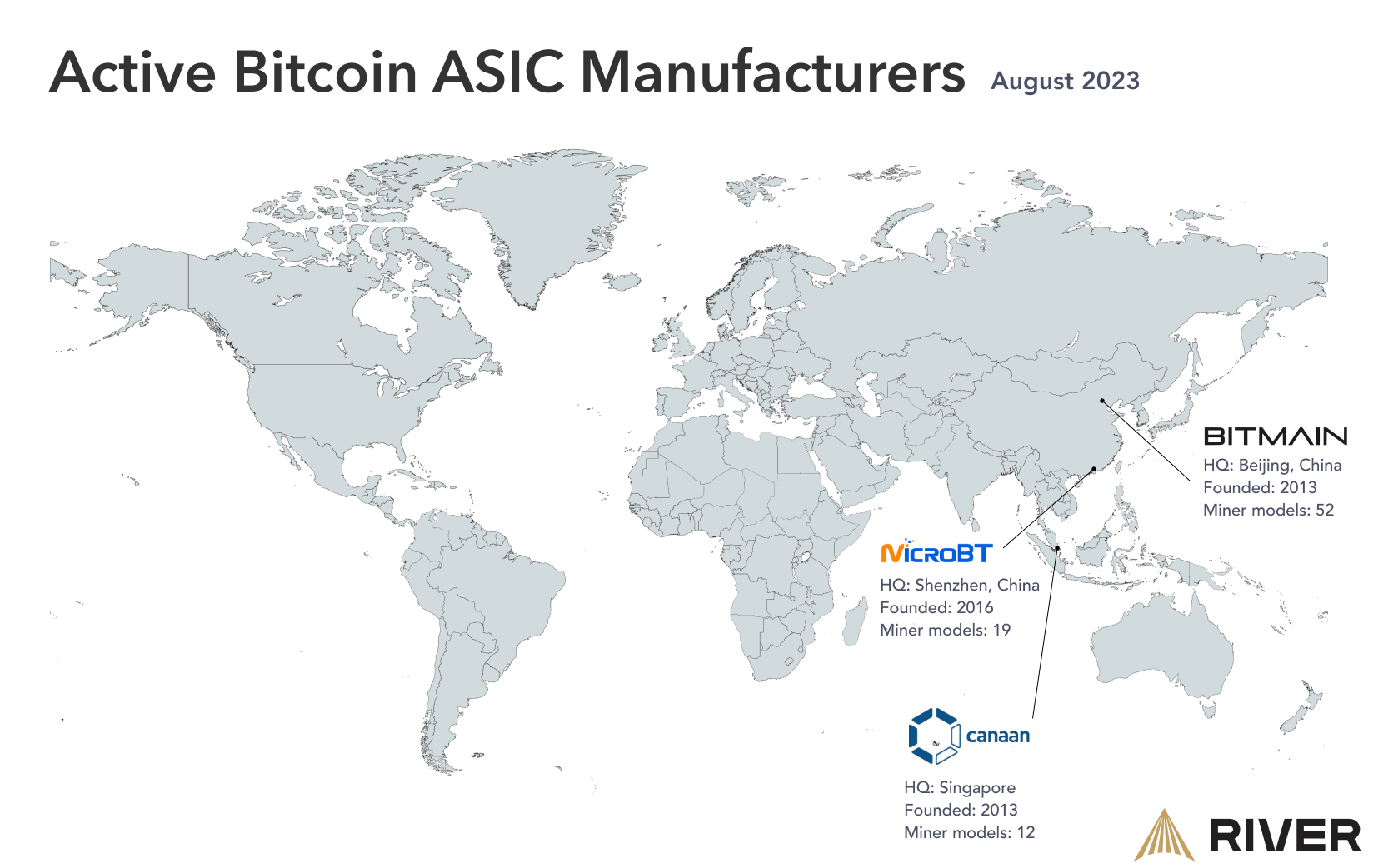

Manufacturer Reputation

When someone is interested in buying a mining rig, they should make sure it was produced by a reputable manufacturer with a solid track record.

Since the emergence of ASICs, there have been companies that claimed to produce mining rigs that could achieve a certain hashrate, but the rigs either never materialized, or they underperformed what was promised.

List of Bitcoin ASIC manufacturers

This is not an exhaustive list. It only contains manufacturers that have produced a new model in the last 2 years.

- Bitmain

- MicroBT

- Canaan

As can be seen in the image, the majority of the active ASIC manufacturers are based in Asia. This can make it more appealing for people in other continents to purchase their mining rigs from brokers or service providers, to avoid long shipping times and potentially unexpected delays.

Timing the Mining Market

As with any technology, there is constant ongoing research, development and innovation happening. New generations of miners get to market every year, with higher energy efficiency than the older generations. These new miners influence the long term viability of older generations of mining rigs, and thus their price. It is important to note that newer miners do not immediately or quickly push old ones out of the market.

If an operator is interested in buying a large number of mining rigs, it would be wise for them to do some research and anticipate when a new generation of miners may arrive. The use of new miners will not immediately be widespread and acquiring them can be difficult, but for a large-scale mining operation, the impact can be significant.

In addition to the manufacturing market, another factor is the price of the cryptocurrency that the mining rig can mine. The value of mining rigs can move alongside this price. There is typically more profit to be made from mining when the cryptocurrency price rises significantly, as the price of mining rigs doesn’t move as fast. Predicting the price is a notoriously difficult activity, and should be considered over the long term, rather than the short term.

Where to Buy a Bitcoin Mining Rig?

There are four places to buy a mining rig:

- From a manufacturer, note that these sometimes have large order minimums and potentially long shipping times due to geographical location.

- From a broker, which buys and sells miners as a business model. Brokers typically source from the manufacturer or a large-scale wholesaler.

- From a full-service provider, which can help to host/co-locate miners to reduce all of the operational challenges that come with running a mining operation.

- From a secondary marketplace where second-hand mining equipment can be bought from peers.

Buying a Second Hand Bitcoin Mining Rig

It is particularly important to be careful when buying second-hand mining equipment. While the lower price points of second-hand miners can be appealing, it is important to verify that the machines are in the advertised conditions.

In general, buying second-hand mining equipment is relatively safe. While mining rigs usually run 24/7, it is in the best interest of the seller (the original miner) to be careful with this equipment to maintain its resale value. Miners are focused on efficiency, and abusing equipment to then try to get rid of it before it breaks carries far too much risk.

Due to the size of the investment of buying mining equipment, caution is still advised. Here are some of the aspects to look out for when buying second-hand mining equipment:

- Reputation of the reseller - As with buying any second-hand equipment, this is an important factor. To help protect against dishonest sellers, a marketplace with some form of buyer protection can also be considered.

- Did the miners ever break down and get repaired? - Miners break down from time to time. Proper repairs require domain expertise, just like repairing any other electronic equipment. If done poorly due to human error, it can harm the longevity of a mining rig and thus the investment.

- What is the historical performance? - Savvy customers may ask for pictures and insights in hashrate performance history, to see if the numbers match what is advertised. This is not yet an industry standard, but pushing for it greatly improves transparency in the industry, and getting accurate data points can make the difference between profit or loss.

Buy or Build a Bitcoin Mining Rig?

The process of building a mining rig mostly applies to GPU mining rigs, which require various components to be purchased, put together and configured. This requires more technical knowledge. Even for someone with a great depth of knowledge in the field, setting up one GPU mining rig can take around 3 hours. For someone new to mining, the duration would likely be many times that.

On the other hand, most ASIC miners will come out of the box, as the purpose-built machine is already put together in the most optimal way. There is no assembly necessary, but that does not mean there is no work involved in getting a mining operation up and running.

How to Set Up a Bitcoin Mining Rig

In this section we will describe what it takes to set up a mining rig, and more broadly, a mining operation. If this looks like too much work, remember that there are alternative options where you only provide the capital for the miners, and other parties take care of setup and maintenance. This gives you access to the returns of Bitcoin mining (often at a scale individuals would not be able to obtain on their own), without the hassle or complexity.

Setting Up a Bitcoin Mining Operation

When it comes to getting a mining operation up and running, there are more steps involved than simply plugging in a device, pressing a button and entering a few parameters in an interface. The bigger an operation gets, the more considerations there are. This is why it helps to zoom out first and look at the overall business plan.

Location for a Bitcoin Mining Operation

The location is a critical decision, here are a few reasons why it is not an afterthought:

Noise - If the plan is to run a small-scale operation with just one or a few mining rigs at home, then it is important to consider that mining rigs are very loud. A single mining rig will typically produce between 40 and 85 decibels of noise, which is not suitable for a living area.

Cooling - Additionally, mining rigs get very hot from constantly running at high performance. This means they require cooling, so insulating a mining rig to mitigate noise is not a simple solution. The heat also means that running an operation in a space that is already naturally hot may increase the costs to cool the mining rigs.

Energy - Mining rigs themselves use a lot of energy beyond the costs to cool them. No matter where a mining rig is running, it should never blow out the fuses. At the same time, a mining rig does need to get enough energy to run at maximum efficiency, or it will not be able to earn a profit over time.

Some miners have taken their operations to the next level in terms of creativity, using the heat generated by their rigs to support other business activities.

To conclude, a good location for a mining operation needs to:

- Support significant power consumption.

- Have access to a fast and stable internet connection.

- Have enough space for the mining rigs, cooling equipment and people to move around.

These factors need to be calculated and properly planned, in such a way that it allows growth of the operation if this is desired.

Beyond these basic requirements, there may be additional factors that influence a mining operation.

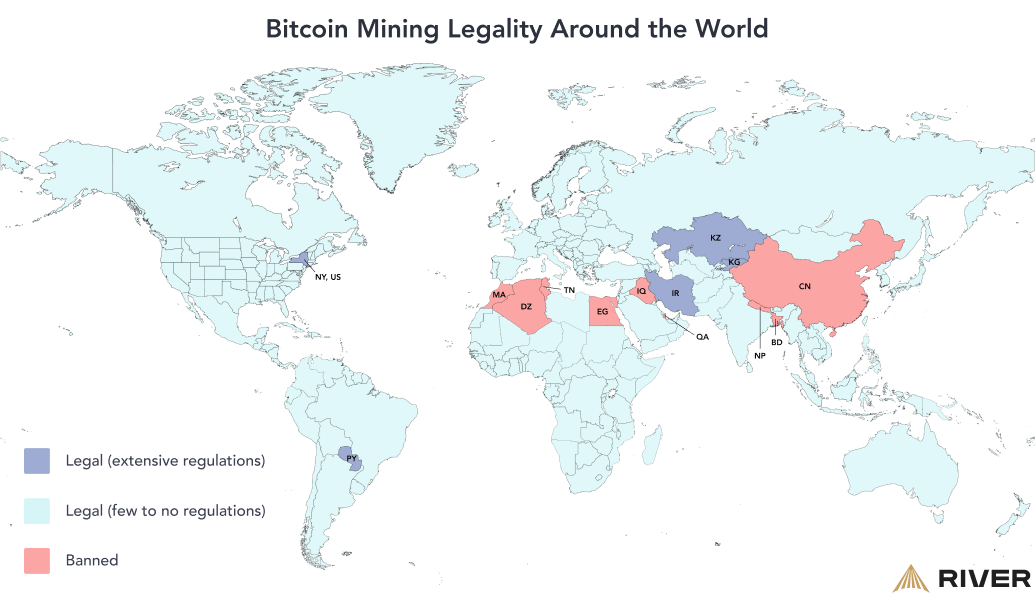

Legality, Licensing, and Regulations

Depending on the jurisdiction of a miner, different rules and regulations around mining may apply. As of 2022, only a handful of countries have specific laws around mining, and some require miners to get a license.

➤ Learn more about Bitcoin mining legality.

Insurance and Security

Due to the value of mining rigs, it is wise for an operator to get insurance to protect against theft and potentially against natural disasters.

Only getting insurance is not enough. If mining rigs would get stolen, it would not just be the machines that are gone, but also the potential income they should be earning until they would be replaced. Sometimes delivery times for mining rigs can be long, which could significantly increase the time to get a return on investment on the operation. It is therefore important to ensure that the location where the miners are located has thorough security, which goes back to the importance of picking a good location.

Once the bigger challenges around the operating location have been worked out, the focus moves to setting up the hardware and software.

Setting Up Bitcoin Mining Hardware

Like with any electronic equipment, ASIC miners come with an instruction manual on how to set them up. These offer extensive documentation on how to set up a mining rig.

Before the mining rigs are delivered, there are already several things related to the physical hardware that can be prepared for.

Placement of Mining Rigs An important consideration is how to place the miners so they are easily accessible for potential repairs, as well as positioning them optimally for cooling. It is best practice in the industry to use a frame, rack or case for this. Large scale operations go as far as using containerized solutions, so they can rapidly relocate hundreds of mining rigs at once.

Cable Management Power cables are a critical component. The reason is that many manufacturers do not include a power cable with the rig, due to the large variety of plug standards worldwide and the global phenomenon of mining. This means power cords will need to be purchased ahead of time. Manufacturers do provide documentation around what kind of cables should be purchased.

Additionally, as a general rule across electrical appliances, it is critical to respect the 80% rule. This means that circuit breakers can only handle about 80% of their total amperage. Going beyond this number carries risk of damage to the equipment.

Beyond power cables, also keep in mind that mining rigs use Ethernet/LAN cables, as this has a higher reliability than WiFi. One ethernet cable is required per mining rig, and in general it would be wise for an operator to have some spare cables for the mining rigs to reduce possible downtime.

Setting Up Mining Software

Many ASICs come with pre-installed mining software, also called firmware. This firmware is closed-source and internally developed by the manufacturer. It tends to have limited functionality compared to what can be unlocked and achieved with open-source mining software.

In general, it is recommended to look into using different mining software, as sometimes the efficiency of a miner is scaled back by the default mining software to ensure inexperienced users cannot break their device and blame the manufacturer.

Fortunately there is a wide range of open-source mining software available in the market, often at no cost to the user.

List of Bitcoin mining software:

- ASICSeer

- Awesome Miner

- BFGMiner

- Braiins OS

- CGMiner

- EasyMiner

- ECOS

- Foreman

- Kryptex Miner

- Minder

- MSKMiner

- MultiMiner

- Vnish

Firmware can be downloaded on the respective website of the provider, and then installed on a mining rig through the settings.

Once the mining software is set up, several settings must be configured, related to the stratum mining communication protocol, port number, a potential username and which mining pool the rig should join. More on that below.

Connecting a Wallet to a Bitcoin Mining Rig

Coins can be mined into any wallet or address that the operator has access to. Both custodial and non-custodial setups work. Since practically all miners will join an existing mining pool, this pool will ask the operator to which address it should pay their share of the revenue.

Joining a Bitcoin Mining Pool

As a reminder, mining pools exist to ensure a steady income stream for miners. Mining without a pool means an operator only has a tiny chance to find a block and earn back their investment. By joining together with other miners in a sufficiently large pool, smaller but more frequent returns can be earned.

Before deciding which mining pool to join, it is wise to look into your options. Pools may pay out to members in different time intervals, and charge a fee varying between 0-4%. When the fee is 0%, there is usually a reason so it is important to read the details on this. A pool may also provide operators with different services such as better monitoring, a mobile application, an API, the ability to customize payouts to individual needs, and more.

The 10 biggest Bitcoin mining pools as of August 2023 are:

- Foundry USA

- AntPool

- F2Pool

- ViaBTC

- Binance Pool

- MARA Pool

- BTC.com

- EMDCPool

- Braiins Pool

- Luxor

At River, our mining operations use Foundry USA as the mining pool. Many of the operators of these mining pools also offer pools for other cryptocurrencies.

Once a mining pool is chosen, the pool’s website will provide all the information needed to join the pool. These steps will involve entering the Stratum URL into the mining software to set up the communication protocol, connecting a wallet and configuring the miners to work for the chosen pool.

Hosted Mining: Mining With a Low Time Investment

Setting up your own successful mining operation requires a significant time investment, financial investment, and a broad set of skills. It is a serious commitment, as not seeing it through entirely still comes with costs.

That should not discourage people from getting involved in mining. There are options that lower the threshold to get started, such as through hosted mining.

What Is Hosted Mining?

In hosted mining, one party buys the mining rigs, and another party takes care of the technical and operational challenges to keep the miners running as much as possible. This makes it easy and significantly less stressful for anyone to get started with mining and get a first idea if they want to be involved in it.

Key Takeaways

- Mining rigs are specialized computers, customized for cryptocurrency mining

- A miner is used to help process transactions and secure the network of a cryptocurrency that uses a Proof-of-Work algorithm

- There are different types of mining rigs such as CPU miners, GPU miners and ASICs. These are best suited for different cryptocurrencies