Many people hold their bitcoin for the long term, hoping to increase their wealth over time. Nobody likes to think about this dream unexpectedly being shattered by catastrophe, but unfortunately, it does happen.

Setting up Bitcoin inheritance is a tricky subject. We go over the various options to ensure you can pass on your Bitcoin wealth to your loved ones.

Why Bitcoin Inheritance Is Important

If bitcoin is held in self-custody, there is nobody who can move the funds without access to the private keys. This is how Bitcoin works by design, so if inheritance is not set up properly, there is a very high chance that nobody will ever be able to access the bitcoin, and it will be lost.

➤ Learn more about What Happens To Your Bitcoin When You Die

Even if relatives come across a seed phrase when going through the deceased’s belongings, will they recognize it for what it is and know what to do with it without putting the funds at risk?

It is dangerous to leave bitcoin inheritance up to chance, but it can be equally risky to simply tell relatives exactly how to access bitcoin holdings.

Risks of Sharing Access to Bitcoin Before Death

When more people have access to private keys, more things can go wrong.

- If people know how to access funds, their physical and digital safety can be put at risk as others may try to get this information from them. The beneficiary could also share with their closest relations that they have access to the bitcoin, without seeing the potential harm in doing so.

- Inexperience can be a problem. Even with the best documentation, a family member could enter a seed phrase into compromised software and lose access to the bitcoin. They could feel intimidated when the moment arrives and make a critical mistake, or ask for someone’s help who then defrauds them.

- If the owner does not have a will, then the beneficiary could take the bitcoin for themselves without sharing it with other relatives, or pretend that the bitcoin has been lost. These may sound like unlikely scenarios in your family, but it would be wise to prevent even the smallest probabilities of these outcomes in the first place.

- Premature access can be a risk for both parties. While the owner is alive and well, beneficiaries could take a curious look to see how much bitcoin there is, or if that amount has changed over time. They could then make one of the mistakes mentioned above. In a bad situation, they could take some or all of the bitcoin, and there may not be a way to prove it was them.

- Who is to blame for theft? If a third party steals the bitcoin, the beneficiary could be a suspect. Not necessarily for taking the bitcoin, but perhaps for poorly securing it, all while they may be innocent.

In an ideal setup, access to the bitcoin should be provided after the owner has truly passed away, in a fair and legally enforceable way. This is more complicated than it looks.

How to Set Up Your Bitcoin Inheritance Plan

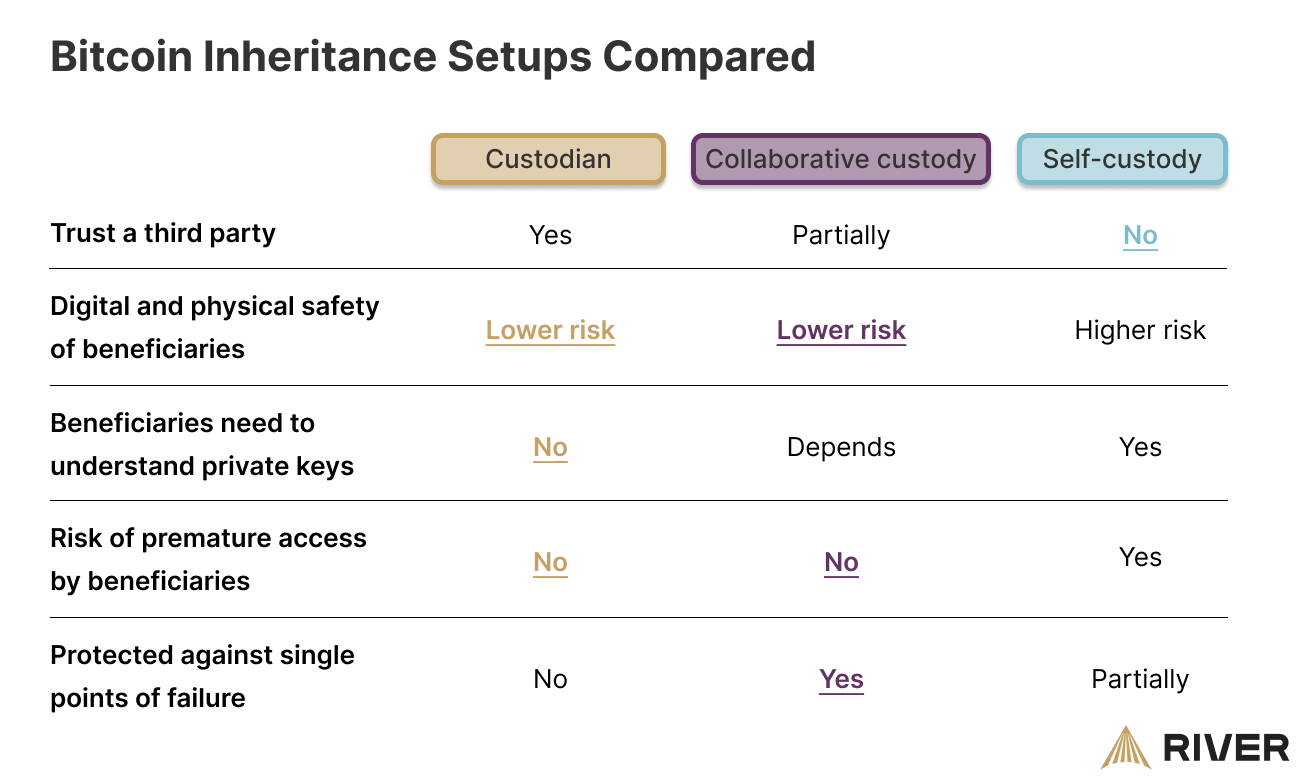

There are three different options to set up Bitcoin inheritance, we compare them in the table below and then elaborate on this comparison.

Option 1: Hold the Bitcoin at a custodian with beneficiaries set up

For this option, a company must be trusted to hold the bitcoin, which is an aspect many bitcoin owners are understandably apprehensive about. If the company makes a critical mistake with its cold storage funds and loses access, all the funds may be lost forever. Similar to banks and investment funds, it can take years or decades to build a reputation as a company where people feel comfortable to store their funds.

One of the main appeals of this setup is that it does not involve any responsibility on behalf of beneficiaries to protect a private key. They can simply contact the company, prove the person was deceased, and inherit the bitcoin.

River offers such a Bitcoin Beneficiary plan. It is important to understand that it only applies to bitcoin that is held on the platform. There is no way for River or any other company or individual to gain access to someone’s specific funds. In addition, such a custodial service cannot hold back the bitcoin from legally agreed-upon beneficiaries. They are required to transfer ownership.

Option 2: Hold the Bitcoin in a multisig in collaboration with a third-party service

The second option is closer to self-custody. Multisig enables bitcoin to be secured in a setup that requires a specific number of keys to move it, for example, 2 out of 3 keys must sign a transaction.

In this setup, the owner holds one key, the beneficiary holds another key, and the service provider holds the third key. If the owner were to pass away, the beneficiary and the service provider would together be able to move the bitcoin to a new address.

This multi-signature inheritance setup protects:

- the safety of the beneficiary as they are unable to move the bitcoin alone.

- the bitcoin from premature access, as the service provider wouldn’t agree to move it in collaboration with the beneficiary if the owner was still alive.

- the bitcoin from theft or mistakes with the security of one of the three keys, due to the other two keys still being able to move the funds. This is not unique to inheritance plans and is simply a part of how multisig works.

Many service providers have made it user-friendly to set these types of constructions up, and in turn, charge a fee for doing so, protecting access to one of the keys, and helping to guide a beneficiary through the process of claiming the funds.

Option 3: Pass on the Bitcoin without trusted third parties

This option may seem appealing to many due to there being fewer costs involved and less trust in people who are not family or friends. In practice, this option has the highest risk of loss of funds, as many things can go wrong.

We refer back to the section above on “risks of sharing access to your bitcoin before death”. All of these risks apply in this setup.

In an attempt to prevent some of these risks, some people try to create a multisig setup themselves, in which the other keys are held by several beneficiaries. Sometimes these setups rely on a specific piece of software that may not continue to function or be supported. To be safe, the beneficiaries will need to have the understanding to go through the same procedure using different software. They may end up asking for external help, and run into some of the same risks we outlined earlier.

Improving Self-Custodial Bitcoin Inheritance Options

Attempts have been made to reduce the risks of a self-custodial setup.

For example, to avoid premature access risk, people have restricted the ability to move their bitcoin through Bitcoin’s built-in timelock feature. This script ensures a transaction with the funds is only sent once a certain number of blocks have been mined, but the approach carries numerous risks. If the timelock is misconfigured, the bitcoin could be lost forever. There is no way of knowing what future fees will be, and this transaction cannot easily be reversed once it is pending.

Technical proposals have been made for Bitcoin Vaults to be added to the Bitcoin protocol, which would allow users to create additional protections for their bitcoin on the blockchain itself. This however does not solve most of the challenges we listed for the self-custody option, such as the technical knowledge required for a beneficiary to claim the bitcoin.

Bitcoin Inheritance Tax

It is important to consider inheritance tax implications. This varies per jurisdiction, depending on whether bitcoin is considered property and what kind of thresholds are put in place to determine if there is a tax, and how much it is.

In the U.S., there could be taxes at both the federal and state levels, so it would be wise to consult an expert locally to avoid unexpectedly high taxes for beneficiaries.

Conclusion

There are many ways for Bitcoin inheritance to go wrong, so it is important to choose the setup carefully, as each has its pros and cons.

It is important to consider how and when beneficiaries will gain access, and if this is legally enforceable. Procedures need to be put in place so that the beneficiaries always know what to do, especially if the initial agreed-upon setup does not end up working.

No matter which approach is chosen, setting up a will in addition would be wise to avoid disagreements.

River provides you with the option to set up beneficiaries in just a few minutes. We would also advise you to do your own research and weigh the options of what setup works best for you.

Key Takeaways

- It is important for Bitcoin holders to take inheritance seriously. Without a proper process, their bitcoin may be lost forever.

- Sharing access to your bitcoin before you pass comes with a variety of risks that need to be carefully considered.

- There are several popular options for Bitcoin inheritance, each with their own benefits and risks.

Notice: River does not provide investment, financial, tax, or legal advice. The information provided is general and illustrative in nature and therefore is not intended to provide, and should not be relied on for, tax advice. We encourage you to consult the appropriate tax professional to understand your personal tax circumstances.