Bitcoin is increasingly becoming a part of business treasuries nationwide. But how much bitcoin should a business hold?

In personal finance, determining an asset allocation is straightforward based on age and risk tolerance, but businesses face greater complexity. Their optimal allocation to bitcoin depends on factors like size, industry, and operating model.

In this article, we’ll explore how various types of businesses can approach their bitcoin allocation.

How Much Bitcoin Should a Business Hold?

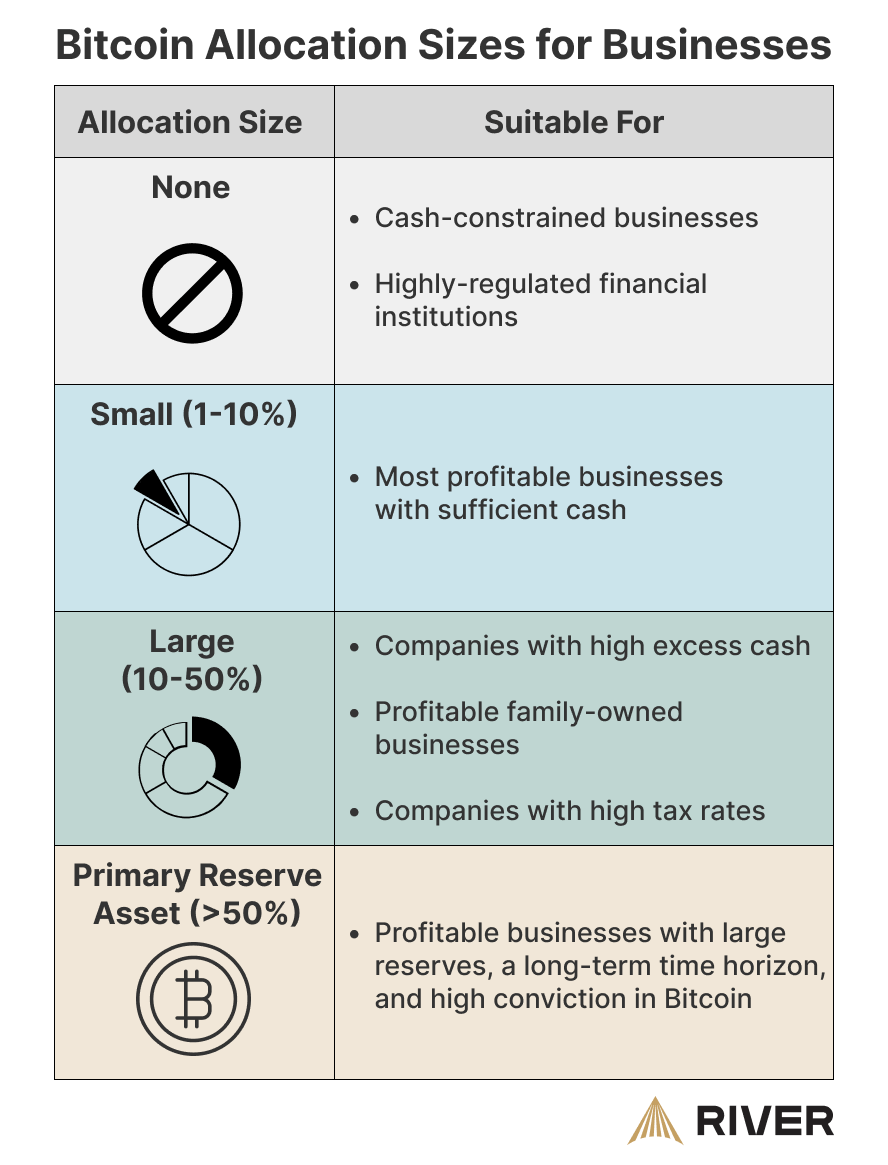

There is no one-size-fits-all approach for business treasuries. The management of cash, short-term investments, and bitcoin varies greatly depending on a business’s profitability, size, and operating model. Below, we outline different bitcoin allocation sizes that businesses might consider and the circumstances that would justify each allocation.

No Bitcoin Allocation

As a general rule of thumb, businesses should maintain at least 3-6 months of cash on hand to cover expenses. Companies with slim margins and low cash reserves should avoid holding volatile assets like bitcoin to ensure their survival.

- Restaurants usually retain low cash balances and lack the capacity to build a substantial treasury. That being said, some restaurants such as Tahini’s have been successfully using bitcoin as a treasury asset for years.

- Businesses that distribute net income to equity owners rather than retaining earnings on the balance sheet may find a bitcoin allocation inappropriate.

- Highly-regulated banks are conservative by nature and face regulatory challenges when holding bitcoin and other digital assets. Until there is more regulatory clarity regarding the treatment of bitcoin in banking, many financial institutions are unlikely to hold bitcoin.

Small Bitcoin Allocation

Mature, profitable businesses typically maintain a treasury well in excess of 3-6 months of cash, and are well-suited to have a small allocation to bitcoin. While many businesses distribute a portion of their profits to investors, some earnings are retained to ensure the company’s future resiliency.

A standard corporate treasury for these companies may consist of 6 months of cash, with excess treasury holdings diversified into short-term investments and long-term assets. For these businesses, a small allocation to bitcoin of less than 10% can provide significant value in the following ways:

- Access to liquidity: Many businesses operate with constraints on their cash liquidity. Standard banking hours limit the ability to quickly raise or transfer dollars during non-business hours, such as weekends. This poses a risk for businesses that rapidly turn over their capital or rely on short-term credit to fund operations. Banks are only available less than 25% of the year due to standard banking hours, while Bitcoin confirms new transactions every 10 minutes, 365 days a year.

- Improved international transactions: Multinational businesses dealing with illiquid currencies face liquidity risks and high transaction costs. Bitcoin offers a cost-effective, highly transactable bridge for international transactions.

- Hedge against bank failures: The Silicon Valley Bank collapse in March 2023 highlighted the risk of businesses losing their deposits at banks. Bitcoin allows businesses to self-custody assets, providing protection during financial crises or in high-risk geopolitical environments.

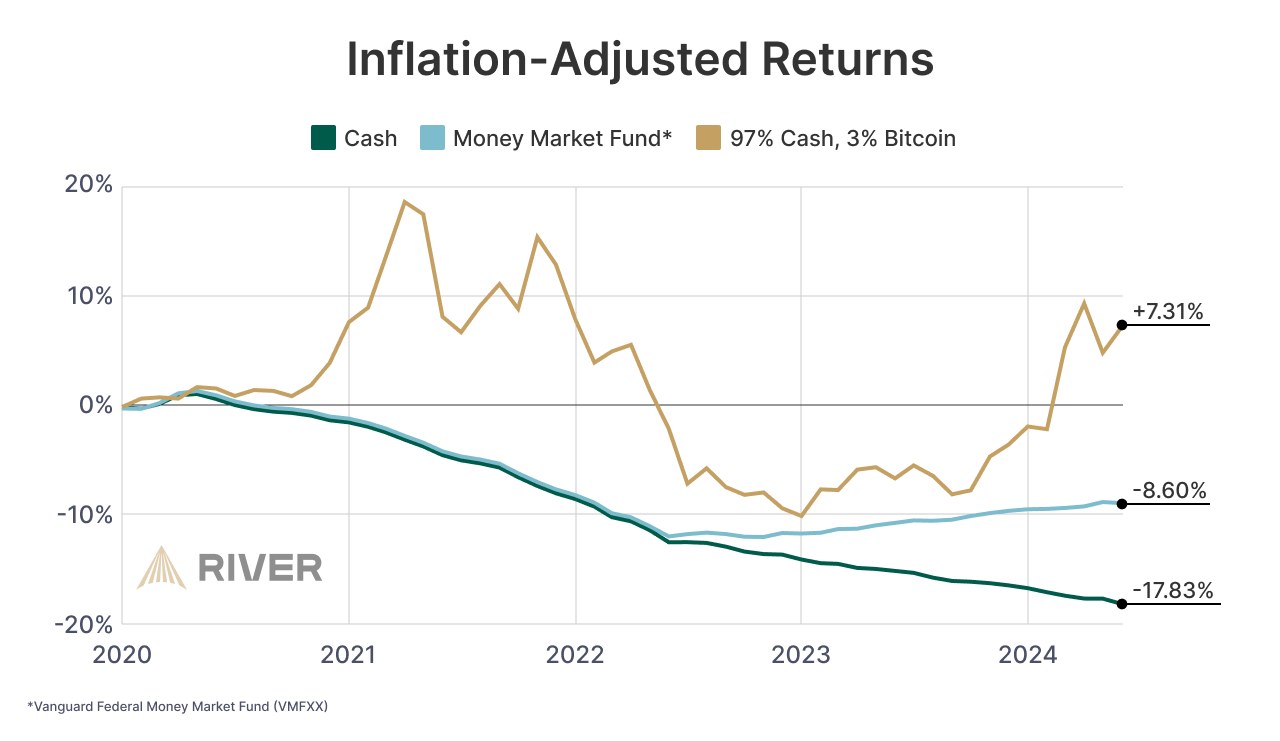

- Resistance to inflation: Inflation erodes the value of large cash reserves. Bitcoin’s fixed supply of 21 million units and transparent monetary policy shield it from inflation, and makes it a valuable addition to a diversified treasury. As shown in the chart below, an all-cash treasury supplemented with a small, 3% allocation to bitcoin would have protected against the inflationary effects since 2020.

Large Bitcoin Allocation

Over time, profitable business that choose to retain a majority of their earnings tend to build up a large treasury. There are many reasons to retain all earnings within a business. Companies can lower their immediate tax burdens by delaying the distribution of profits to shareholders. Additionally, family-owned companies may retain profits within the business to pass down generational wealth. Lastly, businesses in highly-cyclical industries such as real estate and commodities can improve their resiliency during economic downturns by maintaining a large treasury.

For these companies, while a large treasury is appropriate, holding too much cash can be disadvantageous, as its value erodes over time due to inflation. Instead, diversifying assets across long-term investments can help preserve a treasury’s value. In this context, bitcoin is well-suited as a larger allocation in a corporate treasury, so long as it is intended as a long-term investment to be held for multiple years.

Bitcoin as a Primary Reserve Asset

Companies with high conviction in bitcoin as a store of value may choose to use bitcoin as a primary reserve asset. This approach involves allocating a company’s entire treasury to bitcoin, except for the cash needed to meet short-term expenses.

These are known as Bitcoin Treasury Companies, including MicroStrategy, Semler Scientific, and Metaplanet.

Using bitcoin as a primary reserve asset introduces a significant risk to a company’s financial performance. Additionally, this strategy may lead to a company’s success being more dependent on bitcoin’s performance than its underlying business model.

Therefore, this approach should only be taken by profitable businesses that have a high conviction in bitcoin, long-term time horizon, high alignment among stakeholders, and a full understanding of the risks involved.

How to Start a Bitcoin Allocation as a Business

If your businesses is considering a bitcoin allocation, make sure you have a good understanding of the right allocation size, and how to buy, store, and account for bitcoin. We have a separate article to help businesses understand how to choose the right bitcoin custody solution.

River allows over 1,000 businesses to easily buy, sell, and store bitcoin on our platform. River employs a 100% full reserve custody model, meaning we don’t use or lend your bitcoin. River is also thoroughly licensed, audited, and regulated in the U.S. We maintain our clients’ bitcoin offline in geographically-dispersed cold storage locations that require multiple signatures.

Our business page is a good resource to learn more about how we serve corporate clients. If you have any questions about River’s offerings, we offer live support whenever you need assistance.

River does not provide investment, financial, tax, legal or other professional advice. We encourage you to consult with appropriate professionals if you have specific questions about the implications of buying, selling, or holding Bitcoin for your business.

Key Takeaways

- There is no one-size-fits-all approach for business treasuries. The management of cash, short-term investments, and bitcoin varies greatly depending on a business’s profitability, size, and operating model.

- As a general rule of thumb, businesses should maintain at least 3-6 months of cash on hand to cover expenses.

- An all-cash treasury supplemented with a small, 3% allocation to bitcoin would have protected against the inflationary effects since 2020.