After a decade and a half of the zero interest rate regime, the financial sector is again showing signs of instability. What does this mean for business owners, organizations, and depositors? It means that it is time to seriously assess counterparty risk assumptions made when dealing with banks.

In this article, we’ll make the case for why more institutions ought to consider a bitcoin treasury allocation to derisk their business operations.

Operational Risks of Relying on Banks

Fractional reserve banking—where banks lend out a portion of the deposits on their balance sheets—is standard practice. In fact, official guidance in the U.S. as of March 2020 is that banks do not have to keep any deposits on reserve.

Banking is a confidence game, and in the absence of deposit reserves, organizations must have confidence that withdrawal requests will be honored no matter the circumstances.

Bank runs happen quickly, often too quickly for treasurers to recover funds stored at struggling banks. This can have serious knock-on effects on businesses. Following the multiday collapse of Silicon Valley Bank in March 2023, business owners were unable to access their funds for a period of time.

Why rely on FDIC insurance policies, or the goodwill of the Federal Reserve to meet your firm’s financial obligations, when you could maintain a bitcoin allocation for just such a circumstance? With a market cap of over $550 billion as of June 2023 and a market that never closes, bitcoin holders can always source liquidity in a timely manner.

Bitcoin liquidity is abundant thanks to globally distributed markets, and the permissionless nature of transacting on the network.

Suppose that a firm maintains a bitcoin treasury, but for whatever reason, was short on cash to cover an operating expense on a Friday evening. In this case, the treasurer would be able to liquidate a portion of the bitcoin immediately after they realized they were short on cash. Since there is no one centralized marketplace, the treasurer would have sufficient optionality to strike a deal that led to the best possible outcome.

The continuing contractions of the U.S. banking industry should raise red flags in the minds of corporate treasurers. Businesses of all sizes risk being unable to meet their financial obligations because they do not fully understand the balance sheet(s) of their custodians.

River clients can leverage our built-from-scratch, secure custody solution where all bitcoin held on the platform is backed 1:1. Client bitcoin is never rehypothecated, and we do not rely on third parties. We have built a premier bitcoin brokerage that provides a pathway for institutions to add bitcoin to their treasuries.

If you are ready to get your treasury on a Bitcoin Standard, get in touch with our Private Client Services team who can answer any questions you may have.

Bitcoin Reduces Business Risks

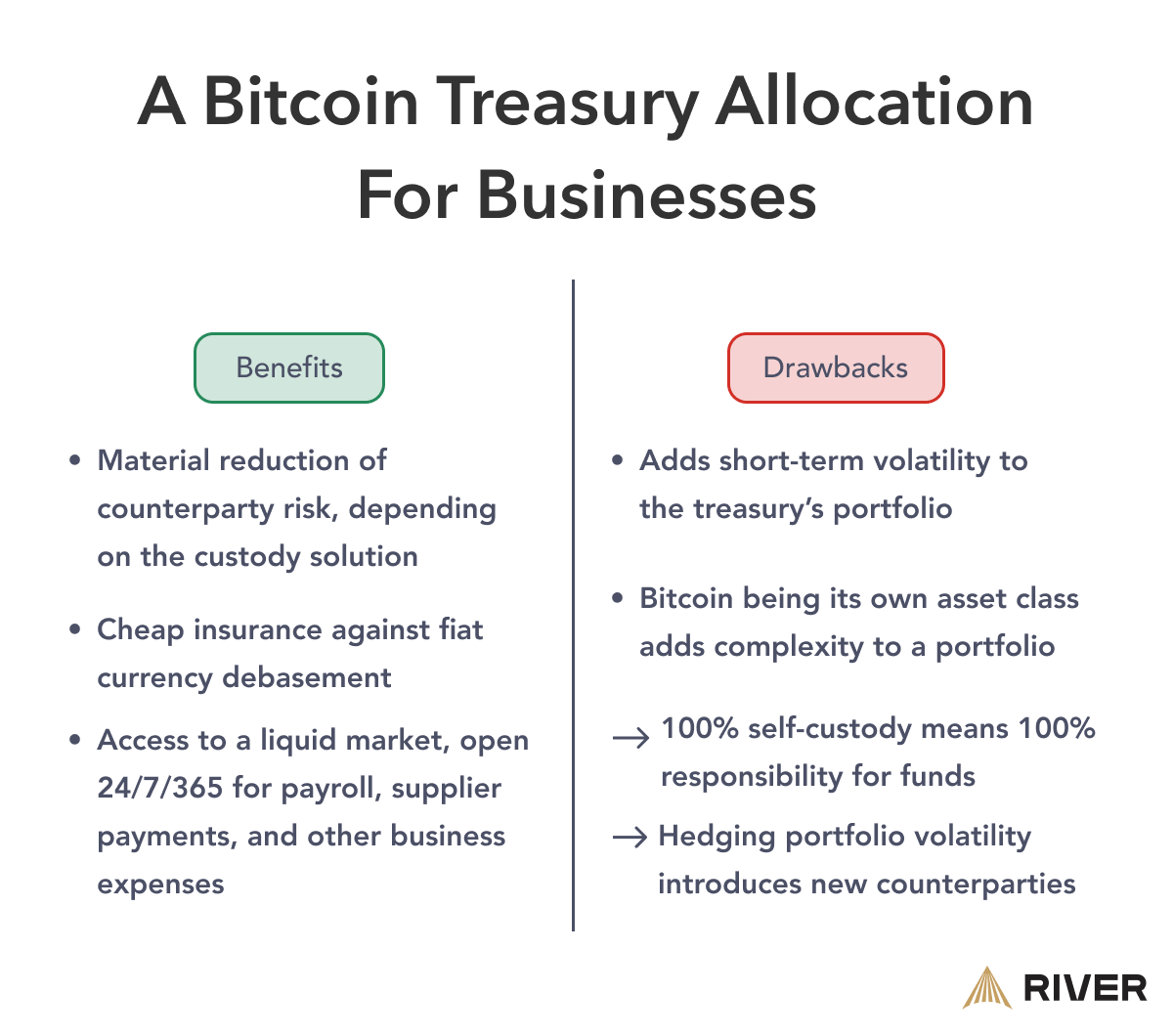

Reducing your firm’s counterparty risk is a compelling reason to consider a bitcoin treasury allocation. The risk reduction can come via self-custody, by using custodial service providers who don’t lend deposits, or custodians that offer loans on a strictly overcollateralized basis.

In addition to reducing counterparty risk, if an entity does business in multiple countries and uses different currencies, a bitcoin treasury can serve as a currency bridge between positions. Utilizing bitcoin in this way can reduce the latency and costs associated with international transactions.

During periods of prolonged zero (or negative) interest rates, treasurers are forced to creatively monetize the cash on a company’s balance sheet. Yield-chasing has disastrous consequences if interest rates rise, especially if they rise quickly. Maintaining a bitcoin allocation can work to reduce that tendency, as bitcoin’s asymmetric upside potential can compensate for the lack of short-term yield.

Annual inflation is effectively a moving starting line where treasurers are at an immediate disadvantage. Bitcoin’s supply inelasticity—via the 21 million unit hard-cap—combined with the rigid, transparent monetary policy, insulates it from the effects of fiat money supply growth. This allows entities with bitcoin treasuries to preserve their future purchasing power. A bitcoin position functions as an insurance policy against fiat currency debasement, with the added bonus of not needing to pay monthly insurance premiums!

When institutions store their money in banks, they implicitly or explicitly trust that they will be made whole whenever they choose. The combination of near-zero reserve requirements and deposit rehypothecation in banking means that institutions must trust their banks.

Counterparty risk can be meaningfully reduced by allocating a portion of treasury funds to bitcoin, leveraging either self-custody or a number of custody solutions.

➤ Learn more about Bitcoin custody.

Firms like Microstrategy, Marathon Digital, Tesla, and Block are among the high-profile institutions to hold bitcoin in their treasuries—and this is only publicly available data. These firms are leveraging bitcoin in their treasuries to mitigate or completely eliminate the risks described in this section.

Microstrategy Executive Chairman and Founder Michael Saylor explains how adding bitcoin to the corporate treasury in 2020 has affected the firm:

Bitcoin Custody Options for Institutions

Trust is the central factor to determine an appropriate custody solution, and each organization needs to decide where they want to place that trust. In the case of self-custody, all of the organization’s trust would be placed in the designated group of signers (Executives who possess the private keys needed to authorize transactions). The group of signers is typically organized as a threshold—e.g. 2-of-3—and is sometimes geographically distributed to mitigate the risk of physical coercion.

Another option is to leverage a multisig vault service like what is offered at Unchained. In this case, the organization/treasury would maintain control of two of the three signing keys and the vault service provider would maintain one key. As a result, the entity that established the multisig vault maintains majority control over the vaulted funds, with the assurance that a trusted third party will maintain a backup. If desired, an organization can coordinate and manage its own multisig vault via the open-source Caravan project.

Institutional exchange accounts are another feasible custody option—provided that the establishing entity has a high degree of trust in the exchange or brokerage. At River, we do not advertise ourselves as a bitcoin custodian, but we have built from scratch and maintain all of our cold storage infrastructure. This is important because it means that an organization need only trust River, as opposed to additional external dependencies via software or service providers.

Bitcoin is a network that enables trust-minimized financial transactions, but humans are social creatures, and we rely on trust to make our lives easier. In order for bitcoin to scale to institutions, they need trusted options—River aims to be the premier bitcoin onramp for firms, families, and individuals alike!

Additional Upsides of a Bitcoin Allocation for Treasuries

The concept of duration mismatch (or maturity mismatch) has been gaining popularity due to the public nature of Silicon Valley Bank’s March 2023 collapse.

As an example, suppose a treasury owns a large position in 10-year government bonds—that company still has short-term financial obligations like supplier payments or payroll. Also suppose that the position of government bonds was acquired in a ZIRP environment, and that over the past year, interest rates were increased to 4.5%. If that company needed to access its treasury funds stored in bonds, it would have to sell the position at a massive loss (bond prices are inversely correlated with interest rates).

The scenario above tracks against SVB’s meltdown; many banks (and other organizations) are likely in similar positions. Bitcoin dissolves duration mismatch risk—bitcoin’s price is as close to a free market as exists and can be bought or sold on the global market anytime.

Utilizing Bitcoin for risk reduction in other financial applications is also possible. In the context of a loan underwriter (or similar), bitcoin is a pristine collateral asset. And because of the trust-minimized nature of bitcoin transactions, should the borrower on a loan be unable or unwilling to repay, their bitcoin collateral can be easily liquidated within minutes.

Another potential benefit to using bitcoin in financial operations is that all transactions are listed on a global public ledger. Instead of your reconciliation team chasing down counterparties and waiting for trades to settle over several days, they have all the information they need to settle in a much shorter timeframe. Bitcoin’s programmable nature could be leveraged to automate cash management processes so that it functions seamlessly 24/7/365—even on bank holidays.

Conclusion

Signs of structural instability are becoming more evident in the incumbent financial system. It is unclear what the Fed will do about interest rates in the future, but in the meantime, it might be prudent to consider derisking business operation by allocating a portion of your firm’s treasury to bitcoin.

In conjunction with bitcoin’s asymmetric upside potential as a store of value, the litany of business risks are compelling reasons to consider a bitcoin allocation for your treasury.

The most important thing to consider is this: are you confident that if you or your treasurer needed to withdraw a large amount of capital, it would be honored?

If there is any doubt in your mind, a great first step would be to get in touch with our Private Client Services team who can help to assess your firm’s situation and guide you along the path to financial sovereignty.

Key Takeaways

- Bitcoin's global market trades 24/7/365 and this liquidity profile is quite useful in a business context.

- Bitcoin held in treasuries works to mitigate counterparty risk, and provide asymmetric upside potential on firms’ balance sheets.

- Bitcoin allocations can serve as cheap insurance against fiat currency debasement, and can potentially preserve future purchasing power