Bitcoin and gold have been compared as investments for years. Both assets are known for their ability to preserve wealth and serve as hedges against inflation. In this article, we take a closer look at bitcoin and gold, comparing their strengths and weaknesses across key characteristics and functions of money.

Bitcoin and Gold as an Investment

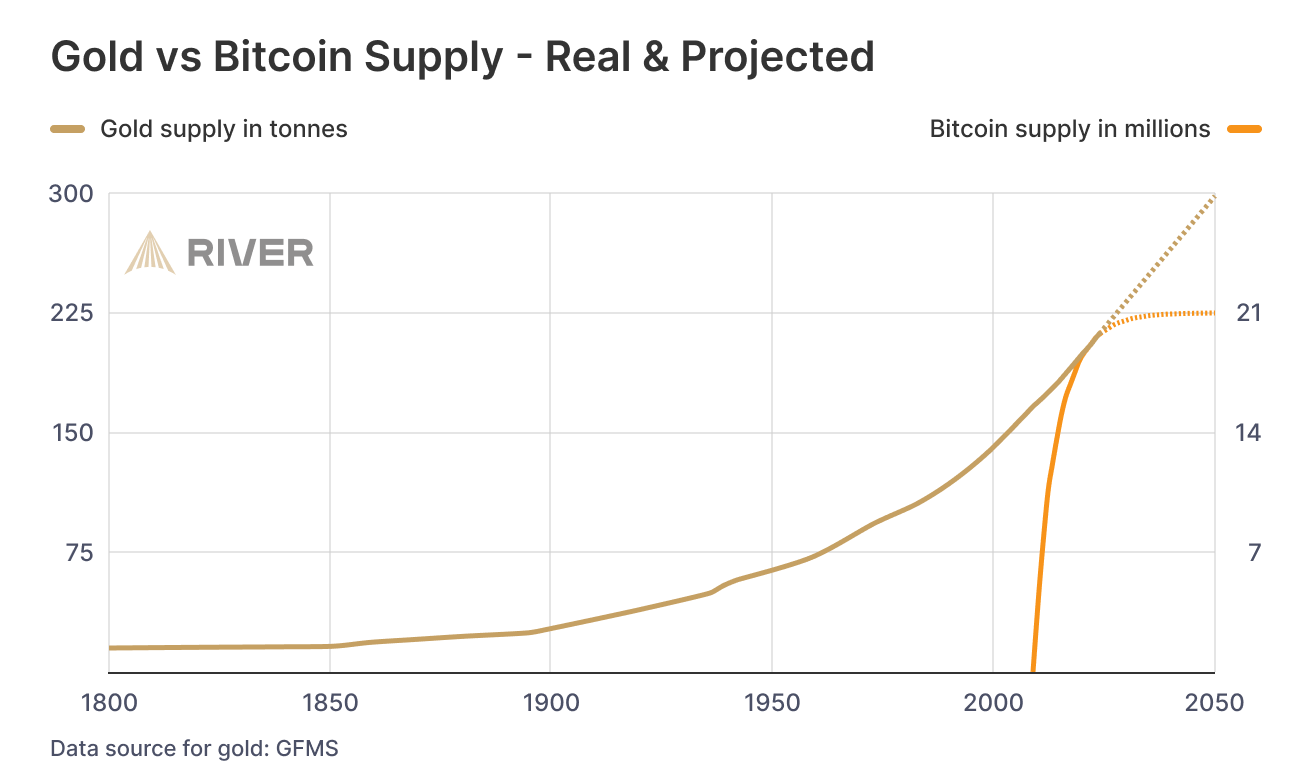

The absolute and relative scarcity of both bitcoin and gold plays a major role in how investors compare them as long-term stores of value.

Bitcoin’s appeal lies in its fixed supply cap of 21 million coins, ensuring absolute scarcity. It’s easy to buy and sell in precise amounts, and anyone can independently verify its authenticity using a Bitcoin node. As a digital asset, bitcoin’s utility continues to expand, and when held in proper self-custody, it cannot be confiscated.

Gold’s appeal, on the other hand, stems from its thousands of years of history as a store of value and its limited industrial applications. However, verifying gold’s authenticity is costly, and auditing the total global supply is impossible.

Both bitcoin and gold face unique challenges when it comes to secure storage. Many investors choose to hold these assets through third-party custodians, which introduces counterparty risk—the possibility that a trusted intermediary could default, mismanage funds, or restrict access. On the other hand, self-custody allows for complete ownership and control but comes with its own trade-offs, including technical complexity, potential loss of access, and higher responsibility for security.

Bitcoin and Gold as an Inflation Hedge

One of Bitcoin’s defining features is its absolute scarcity. With a fixed supply of 21 million coins, Bitcoin’s value proposition is rooted in the fact that no more can ever be created without the overwhelming consensus of the network through a hard fork. This strict supply limit gives Bitcoin unique resistance to monetary inflation.

Bitcoin’s effectiveness as an inflation hedge was most clearly demonstrated during the COVID-19 lockdowns of 2020–2021. As governments around the world printed unprecedented amounts of money to fund stimulus programs, bitcoin’s price surged, reflecting investors’ search for assets that could preserve purchasing power.

Gold, by contrast, is only relatively scarce. New gold is mined every day, additional reserves are discovered each year, and future sources—such as potential space mining—could expand the total supply. This ongoing increase dilutes gold’s scarcity over time and affects its performance as a long-term inflation hedge.

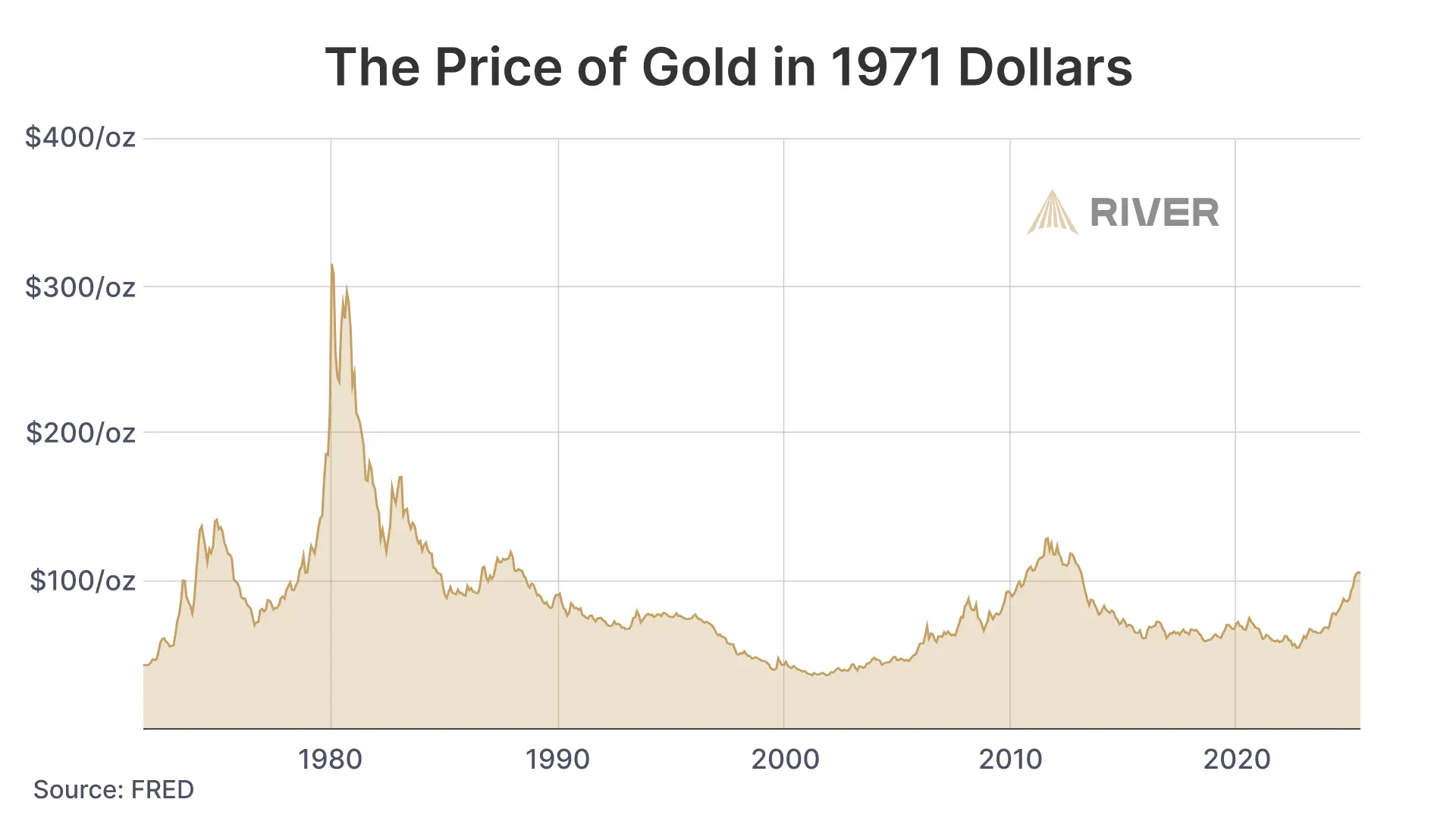

In practice, gold can still serve as a partial hedge against inflation, but it has historically failed to keep pace with rapid monetary expansion. Since the United States went off the gold standard in 1971, the price of gold has not meaningfully increased when adjusted for monetary inflation.

This does not mean that gold is a bad investment, but comparing its current perceived value to its real historical value is important. Decades of monetary inflation have distorted this perspective.

Investment Potential of Gold and Bitcoin

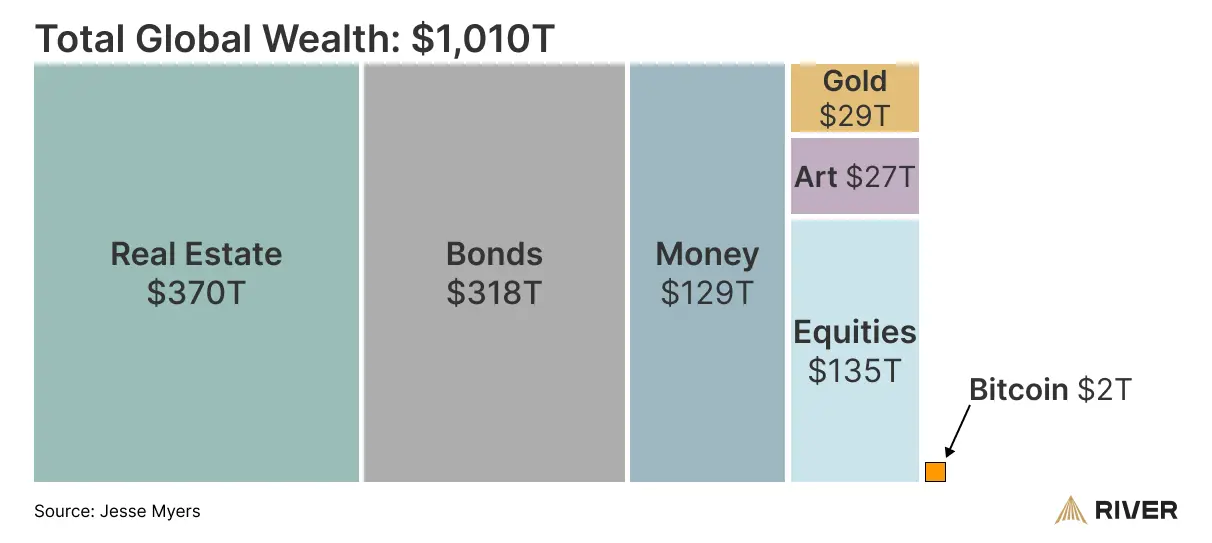

Gold is considered a mature asset, having served as a store of value for thousands of years. Its total addressable market (TAM) represents a significant share of global store-of-value assets. Some argue that gold could capture an even larger portion of this market as investors seek alternatives to fiat currencies, reinforcing its investment appeal.

Gold’s current market capitalization stands at approximately $29 trillion—over ten times that of bitcoin. Despite this, bitcoin’s TAM may be even greater than gold’s due to its superior properties as both a store of value and a medium of exchange. If bitcoin were to capture 50% of the total store-of-value market, its TAM would be roughly 100 times its current valuation, suggesting a significantly higher investment potential.

Volatility and Stability

Because bitcoin is a newer and smaller asset than gold, its volatility has historically been much higher. In the short term, its price can fluctuate significantly due to uncertainty about its future and relatively low global adoption. As a result, many investors favor gold for its greater short-term price stability.

Bitcoin and Gold as a Medium of Exchange

Bitcoin’s verifiability, portability, and divisibility have made it an efficient transaction alternative to fiat currencies. Its network effects are strong and its liquidity continues to spread around the world.

Gold is impractical as a medium of exchange; it lacks the divisibility, portability, and network effects to be effective for transaction purposes. Crossing borders with large quantities of gold is unfeasible and leads to confiscation.

The Risks of Centralization and Confiscation

The Bitcoin network is decentralized. No government, entity, or individual can control the supply of bitcoin or ban anyone from transacting or buying bitcoin. The decentralized nature of bitcoin also eliminates the potential for a single point of failure in the network. Several national governments, including India, China, Turkey, and Nigeria, have attempted to ban Bitcoin. However, no government has been successful, and in most cases government attempts to ban or confiscate bitcoin have led to increased use of the currency within their borders.

➤ Learn more about banning Bitcoin.

The mining and sale of gold is nearly monopolized by several large multinational corporations. Gold supply can be interrupted by internal corporate disputes, labor rights protests, and national or international conflicts. In addition, there have been many documented labor rights and environmental regulation violations associated with gold mining operations.

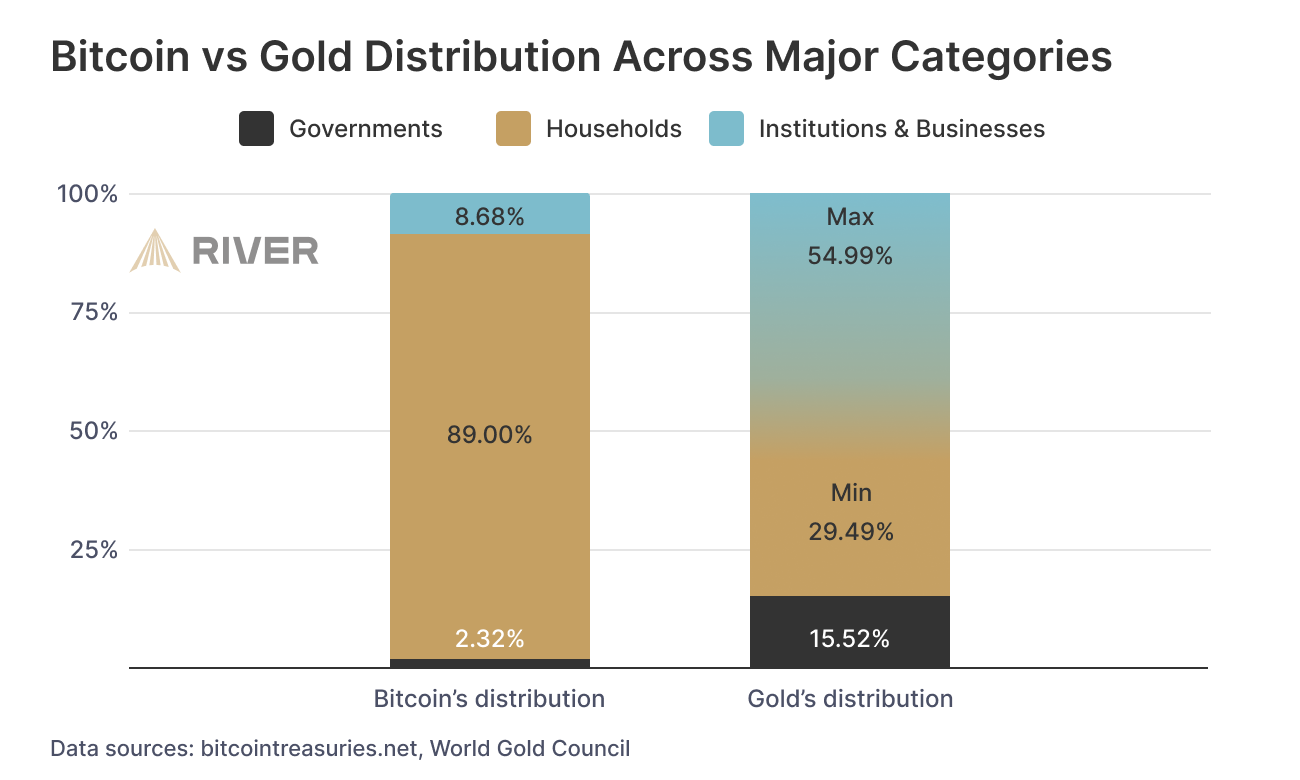

There is a historical precedent for national governments to successfully confiscate privately held gold. The US government confiscated privately owned gold in 1933 to eliminate the gold standard and artificially prop up the value of the dollar during the Great Depression. Gold has been confiscated en masse in many countries across the world, including Communist China, the United Kingdom, and Soviet Russia.

Gold is inherently more susceptible to confiscation due to its physical nature. Gold is heavy and visible, making it more difficult to secure, transport, and hide from would-be expropriators. Thus, a vast majority of gold is held with custodians such as banks. These banks are subject to regulations and legal action, making them easy to coerce.

On the other hand, bitcoin is not physical—proving that an individual owns bitcoin is rather difficult. Bitcoin can be easily self-custodied, making mass confiscation extremely inefficient. Bitcoin can only be moved with the correct private key, which a bitcoin owner can hide or deny knowledge of more easily than with gold.

As a result of these differences, and in part due to how long gold has been around, a far larger share of all the gold is being held by governments than is the case for their bitcoin holdings through confiscations from various companies.

Divisibility and Portability of Bitcoin vs Gold

A single bitcoin is divisible into 100 million satoshis, similar to how a dollar can be broken down into 100 pennies. The divisibility of bitcoin allows it to be used to transact in small amounts at a low value, even as the price of one bitcoin grows. By contrast, gold is difficult to divide into small, spendable amounts. Gold is often stored as a bullion worth anywhere between $2,000 and $600,000. To spend gold, an individual would have to melt the bar down, incurring further costs before transacting.

One of bitcoin’s most successful improvements upon gold is its portability. Because of its digital nature, bitcoin can be stored in a software wallet or on a flash drive. Using the Lightning Network, a layer built on top of the blockchain, transactions can occur almost instantaneously, at any time, without delays or fees associated with third-party-mediated transactions.

Gold is extremely difficult to move. Its weight and lack of divisibility significantly impact its portability. Gold is most often stored in a personal safe or a safety deposit box at a bank, which comes with non-negligible counterparty risk and costs.

Liquidity of Bitcoin and Gold

Both gold and bitcoin are among the most liquid assets in the world, meaning they can be bought and sold easily without impacting their price.

Gold has a deep and established market spanning global exchanges, central banks, and private investors. It is actively traded in the form of bullion, coins, ETFs, and futures contracts. However, the process of buying and selling physical gold can be slow, requiring authentication, transportation, and secure storage. Selling large amounts of gold in physical form may also introduce logistical hurdles and additional costs, such as dealer premiums and assay fees. In contrast, paper gold, such as ETFs and gold futures, offers greater liquidity but introduces counterparty risks.

Bitcoin, on the other hand, is traded 24/7 on global cryptocurrency exchanges, offering instant settlement and high liquidity, even for large investors. Unlike gold, bitcoin does not require physical handling, making it easier to transfer across borders and trade in real time. However, liquidity can vary across exchanges, and market depth may fluctuate during periods of extreme volatility.

Accessibility of Bitcoin and Gold

Gold’s accessibility is largely dependent on physical availability and infrastructure. While gold can be purchased from banks, dealers, and online marketplaces, owning and storing it requires secure facilities, insurance, and in some cases, transportation. Many individuals rely on third parties, such as vault storage services or ETFs, to hold gold on their behalf, which can introduce counterparty risk. Additionally, moving gold across borders can be challenging due to customs regulations and transportation security concerns.

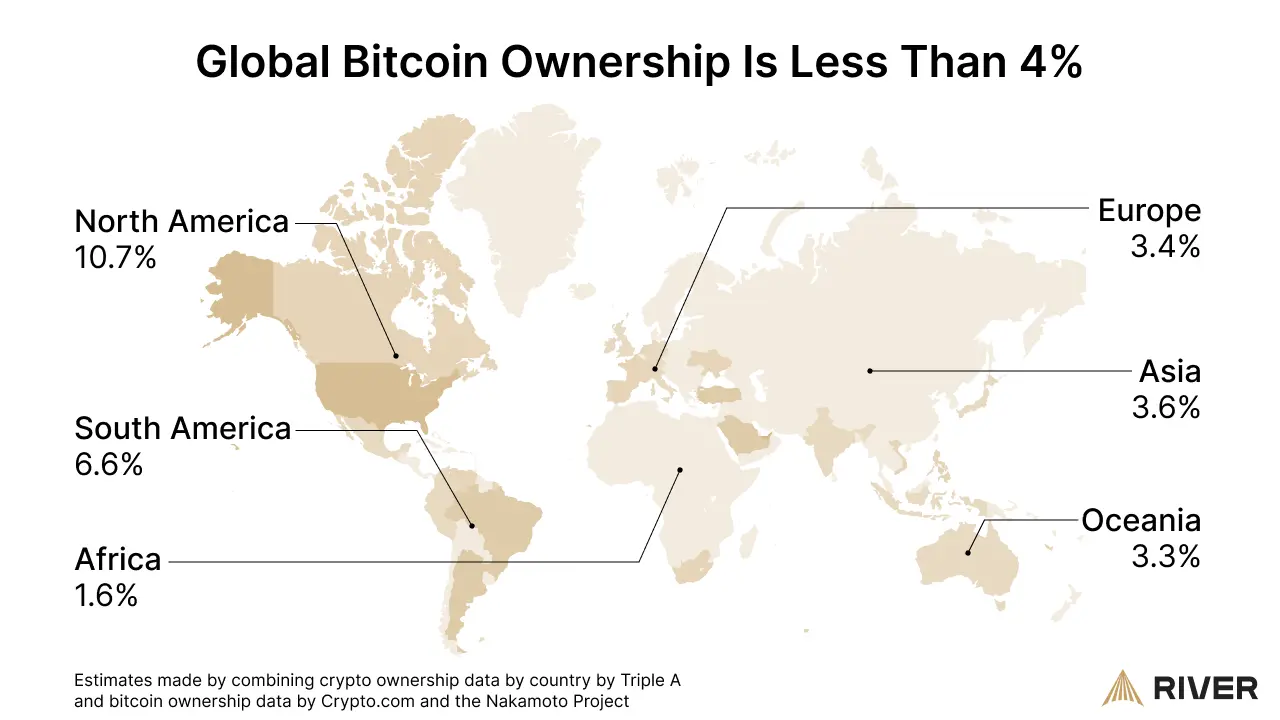

Bitcoin, by contrast, is highly accessible to anyone with an internet connection. It can be acquired instantly on exchanges, brokerages, and via ETFs. Unlike gold, bitcoin does not require physical storage, and ownership is secured through private keys rather than a vault. However, accessibility can be limited by factors such as government regulations, internet restrictions, or technical barriers related to self-custody and security best practices. As of 2025, it is estimated that less than 4% of people worldwide own any amount of bitcoin.

Regulation of Bitcoin and Gold

In the United States, both bitcoin and gold are regulated as commodities, primarily under the oversight of the Commodity Futures Trading Commission (CFTC). This classification means that both assets are subject to trading rules and anti-fraud regulations in futures and derivatives markets. However, their regulatory treatment diverges significantly in other aspects, particularly regarding taxation, financial reporting, and market accessibility.

Gold has long been recognized as a physical commodity, with a well-established regulatory framework. Bitcoin, while also classified as a commodity, operates in a more fragmented regulatory environment. As Bitcoin adoption increases, regulatory clarity will continue to evolve, potentially leading to a more standardized framework similar to gold.

Utility and Practical Use

Gold has several applications beyond its role as a store of value. Approximately 47% of all gold is used in jewelry, while around 12% is allocated for industrial purposes, including electronics, dental fillings, and aerospace technology.

In contrast, bitcoin, being purely digital, has no utility beyond its function as money. While this may seem to limit its value potential, many consider bitcoin’s singular purpose an advantage, as its price is driven solely by its monetary properties, without influence from external industrial demand.

Environmental Impact of Bitcoin vs Gold

Bitcoin has received criticism for its perceived environmental impact. In practice, Bitcoin mostly uses stranded energy that would otherwise go to waste by being load-shedded. This in turn lowers the cost of electricity for consumers as more revenue is generated by electricity companies. At the same time, Bitcoin mining incentivizes the rollout of renewable energy generation in places that lack consistent demand to make these models feasible.

Meanwhile, gold mining is highly destructive to physical environments. This can lead to mass-scale pollution of both land and water, affecting anyone or anything that inhabits those areas.

Conclusion

Bitcoin and gold are commonly compared, but bitcoin has improved upon gold as a hedge against inflation and as a medium of exchange in many ways. The bitcoin supply is absolutely finite, while gold is only relatively scarce. The authenticity and transaction history of bitcoin is easily verifiable by any individual while auditing the gold supply and authenticating any gold is cost-prohibitive and time-consuming, if at all possible.

No government has successfully mass confiscated or banned bitcoin, while the US and many other governments have historically seized privately owned gold. Finally, bitcoin offers superior divisibility and portability to any currency, but especially gold.

Key Takeaways

- The bitcoin supply is absolutely finite at 21 million bitcoin. Gold is scarce but its supply is growing.

- Bitcoin supply and transactions are easily verifiable by anyone. Gold production and authenticity is difficult and expensive to verify.

- No one can be prevented from mining bitcoin or transacting on the Bitcoin network. Gold production and sale has been monopolized.