From a business perspective, the accounting and tax treatment of bitcoin is a relatively new and evolving subject. In this article, we will provide a brief overview of bitcoin’s accounting treatment and guide you in finding answers to any bitcoin accounting or tax questions you may have.

Business Bitcoin Accounting Basics

When a business purchases bitcoin, this has an immediate impact on its financial statements.

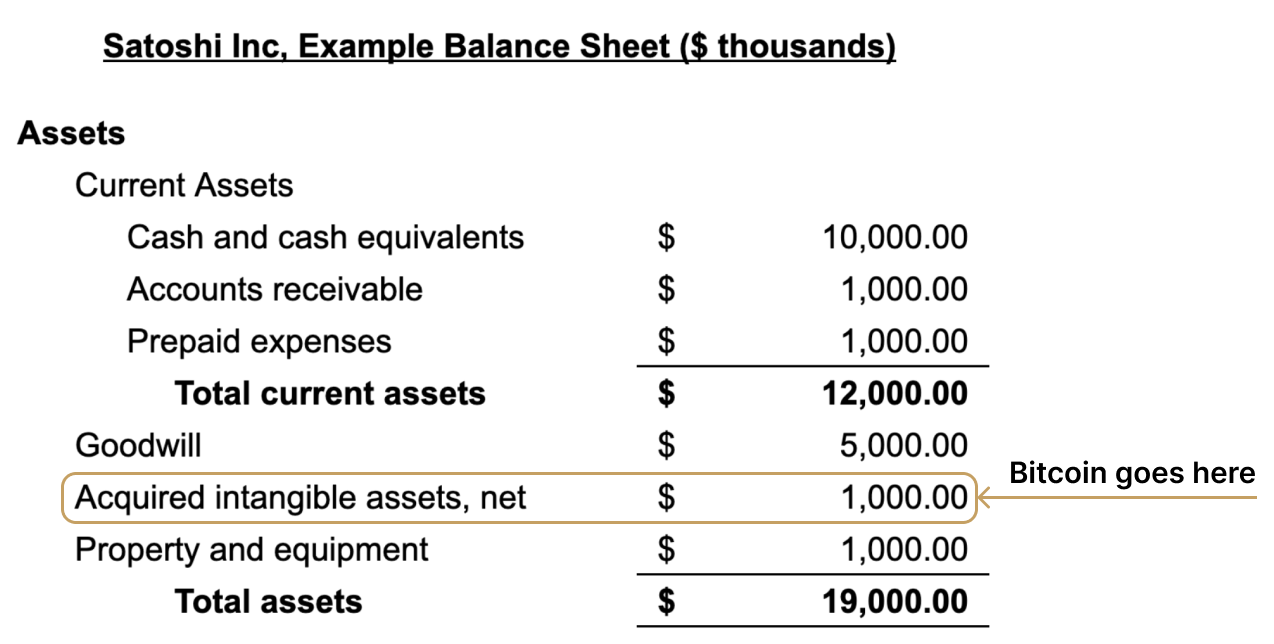

On the balance sheet, bitcoin holdings are shown as intangible assets—often listed as “Digital Assets” or “Acquired Intangible Assets”. The example below shows the assets side of a balance sheet for a company that holds $10,000 in bitcoin.

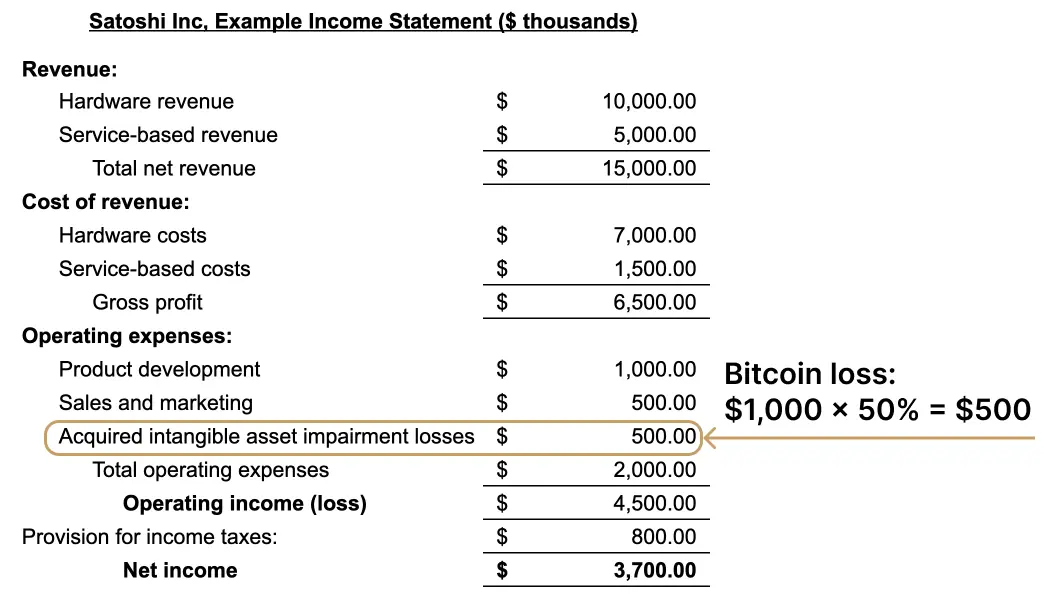

When a business holds bitcoin, it does not owe taxes on potential gains until bitcoin is sold. However, fluctuations in bitcoin’s price will impact the business’s net income, as the holdings must be regularly adjusted to fair value. The example below shows an income statement of “Satoshi Inc.” after a 50% loss of their original purchase.

In this example, no bitcoin was sold. Therefore, the 50% loss of Satoshi Inc’s bitcoin holdings is considered “unrealized”. This means that the loss has no impact on the business’s taxable income. Additionally, because no cash was received or lost by the company, its cash flows are unaffected.

Once a business makes a sale of bitcoin, it will incur a realized gain or loss based on the change in value of its holdings. A profitable sale is considered taxable income, while a loss can help offset other taxable income. Any sale of bitcoin will positively affect a company’s statement of cash flows, assuming they receive cash in return for the bitcoin.

Below is a list of comprehensive resources on the accounting and taxation of bitcoin. In the sections that follow, we will reference which resources you may consult for various topics.

- AICPA - Accounting for and auditing of Digital Assets practice aid: Published in June 2024, this document provides guidance on how to account for an audit digital assets.

- FASB - Intangibles—Goodwill and Other—Crypto Assets (Subtopic 350-60): Published in December 2023, this document is an overview of FASB’s amendment to Bitcoin’s accounting treatment, now allowing it to be measured at fair value.

- KPMG - Crypto Intangible Assets - Issues In-Depth, Accounting by investment companies: Published in June 2024, this guide assists investment companies in accounting for and reporting for “crypto intangible assets.”

How Has Bitcoin’s Accounting Treatment Changed?

Historically, bitcoin purchases were initially recorded at cost and subject to losses if the fair value falls below the value previously recorded by a company. Even if the fair value of bitcoin increases, these losses could only be reversed once a sale is made. This was a complex and inefficient standard that required businesses to use bitcoin’s lowest observable value within a reporting period, often leading to an underrepresentation of treasury assets and discouraging corporations from holding bitcoin.

On December 13, 2023, the Financial Accounting Standards Board (FASB), a standard-setting body responsible for establishing and updating the Generally Accepted Accounting Principles (GAAP) within the United States, issued an update allowing companies to recognize bitcoin holdings at fair value. This standard will take effect in December 2024.

With the new and improved standards for bitcoin accounting, corporations that choose to hold bitcoin will no longer be disadvantaged in their financial statements.

Bitcoin Accounting and Tax Resources

Below is a list of important topics to be aware of regarding bitcoin’s accounting and tax treatment. For each topic, we provide references to relevant resources to help you gain a better understanding.

Bitcoin Holdings on a Balance Sheet

Companies are required to report all intangible assets on their balance sheet. Bitcoin holdings should be measured at fair vale separately from other intangible assets. For companies that present a schedule of investments, bitcoin should be included in the schedule if the company acquired the bitcoin as part of a capital appreciation strategy.

Bitcoin Holdings on an Income Statement

All remeasurements in the fair value of a company’s bitcoin holdings should be reflected in their net income. Changes in the value of bitcoin holdings should be presented separately from remeasurements of other intangible assets.

Bitcoin on a Statement of Cash Flows

Cash inflows from the sale of bitcoin received as company revenues are classified as cash flows from operating activities, granted that the bitcoin revenues were sold “nearly immediately” after receipt. Bitcoin donations that are sold shortly after receipt are reflected as cash flows from financing activities.

Bitcoin-Denominated Revenues

Bitcoin received as revenue and not immediately sold is a form of noncash consideration under FASB ASC 606.

- AICPA: Page 9,10

Selling Bitcoin

Companies should track the cost of bitcoin they purchase at different times and use this value for each unit of bitcoin upon derecognition when sold. Companies are at liberty to use their own methodology for determining which bitcoin is sold, such as the first-in-first-out (FIFO) method.

Disclosure of Bitcoin Holdings

For interim and annual reports, companies should disclose the number of bitcoin, cost basis, and fair value of significant bitcoin holdings. According to the FASB, a “significant” holding of bitcoin may be determined by the best judgement of the company, in alignment with FASB 350-60-50-1.