This article is part 7 of 7 in the “Bitcoin in 21 Minutes” series. To start from the beginning, click here.

Bitcoin is often called the “original cryptocurrency,” and there’s a reason for that. Even when the economy is shaky, Bitcoin has shown time and time again that it’s here to stay.

Take a look at the top cryptocurrencies from 2015 compared to today. Besides Bitcoin, which has always remained number one, there have been countless changes.

Many cryptocurrencies from 2014 have disappeared altogether.

When people ask why Bitcoin will last and why it won’t be replaced by something better, it comes down to Bitcoin’s unique strengths.

First Mover Advantage

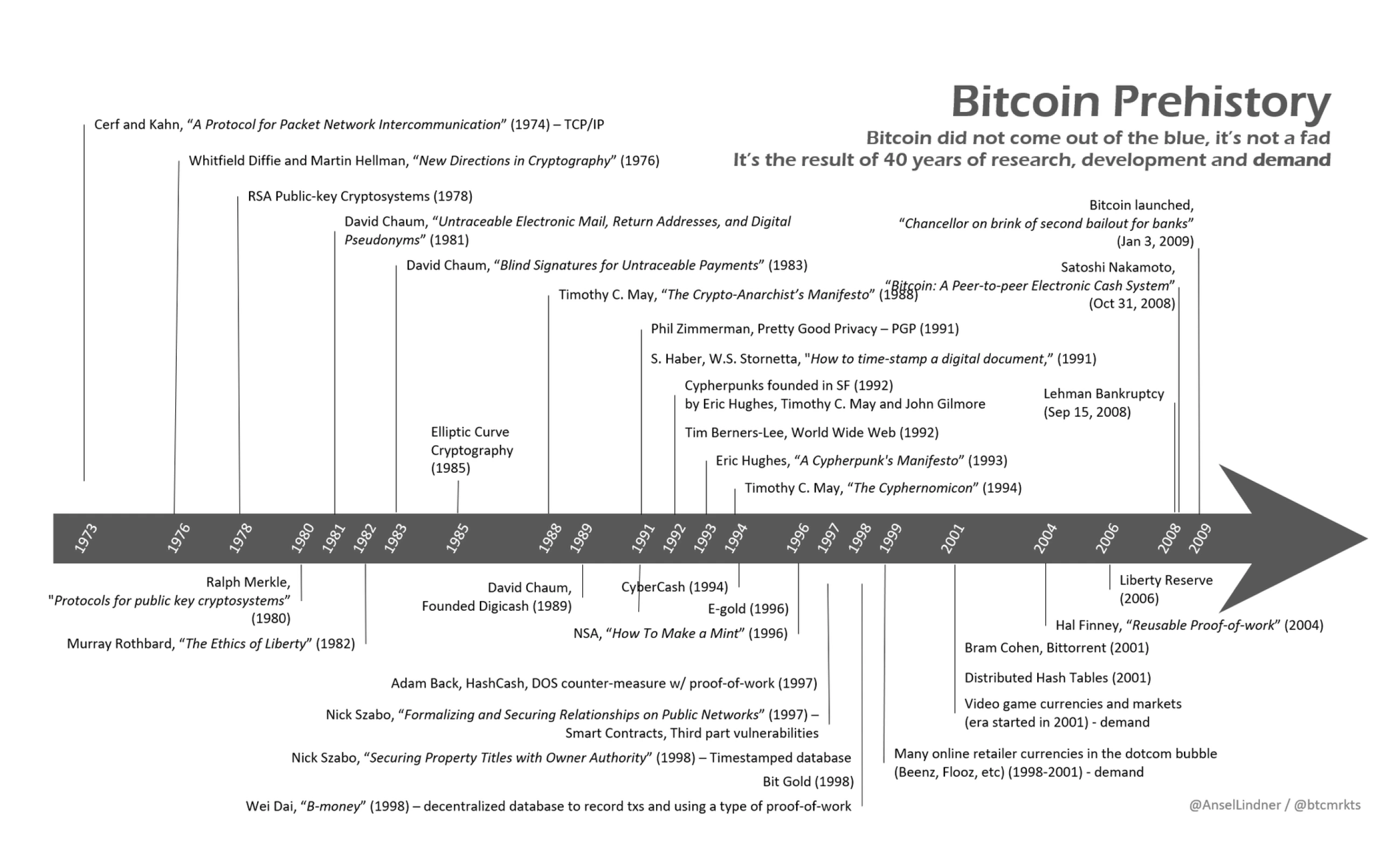

Bitcoin was the first to solve a problem that many people tried to solve for decades: how to send and receive money over the Internet without needing a middleman. Many gave it a shot before Bitcoin, but their systems always depended on a centralized authority or middleman.

As the first cryptocurrency, Bitcoin gained a significant head start, allowing it to build a large decentralized network of users who save and transact in bitcoin.

This network strengthens over time through what’s known as a network effect, where the value of a network increases exponentially as more people join.

This makes it challenging for other cryptocurrencies to surpass Bitcoin in terms of adoption and trust as a reliable store of value.

Decentralization

Bitcoin is the most decentralized cryptocurrency, which makes it incredibly difficult for any new cryptocurrency to take its place. But why does decentralization matter?

For Bitcoin to solve all of the problems with money we described so far, money must not be controlled by a single entity or small group of people. Control should be decentralized across all network participants. This is critical to ensure Bitcoin can’t be manipulated or shut down.

Today, there are thousands of cryptocurrencies, and it can be confusing. You’ve probably heard of Solana or Ethereum, and wondered what they’re all about.

But here’s the thing, most of these cryptocurrencies are run like companies, with CEOs, marketing teams, and are often financed by venture capital firms looking to make a quick buck.

These coins have a fundamentally different mission than Bitcoin, which aims to be a decentralized, global money.

Bitcoin’s decentralized design means its value isn’t dependent on the success of any one company or individual. Even if the largest companies in the industry disappeared tomorrow, Bitcoin would survive.

What’s Your Next Move?

Bitcoin price is driven by its fixed supply and growing demand. As governments continue to print even more money, Bitcoin’s fixed supply means that we see an endless increase in bitcoin’s dollar price over time. In other words, the more dollars printed, the higher the price of bitcoin.

Whether you’re looking to protect your savings from inflation, invest in a store of value, or preserve your financial freedom, Bitcoin offers a powerful solution.

It’s time to take control of your finances.