This article is part 3 of 7 in the “Bitcoin in 21 Minutes” series. To start from the beginning, click here.

What if we had money that no bank, government, or central authority could endlessly print?

That’s Bitcoin.

Imagine the world we can build together when the people are in control of the money.

The Evolution of Money

Humanity has been using money for thousands of years. Money has constantly evolved in various forms to make trading and payments easier.

The U.S. dollar going digital has been a great convenience, but it has also made printing money and financial control easier.

This is where Bitcoin comes in, representing the next step in the evolution of money. Bitcoin can solve the downsides of the U.S. dollar without sacrificing its convenience.

Bitcoin Is Digital Gold

Bitcoin is often called “digital gold,” and for good reason. Just like gold, bitcoin is scarce, does not perish over time, and is recognized worldwide.

But bitcoin outshines gold in many ways:

- Easier to store

- Easier to send

- Easier to split into small amounts

- Easier to verify if it’s real

- Easier to transport across borders

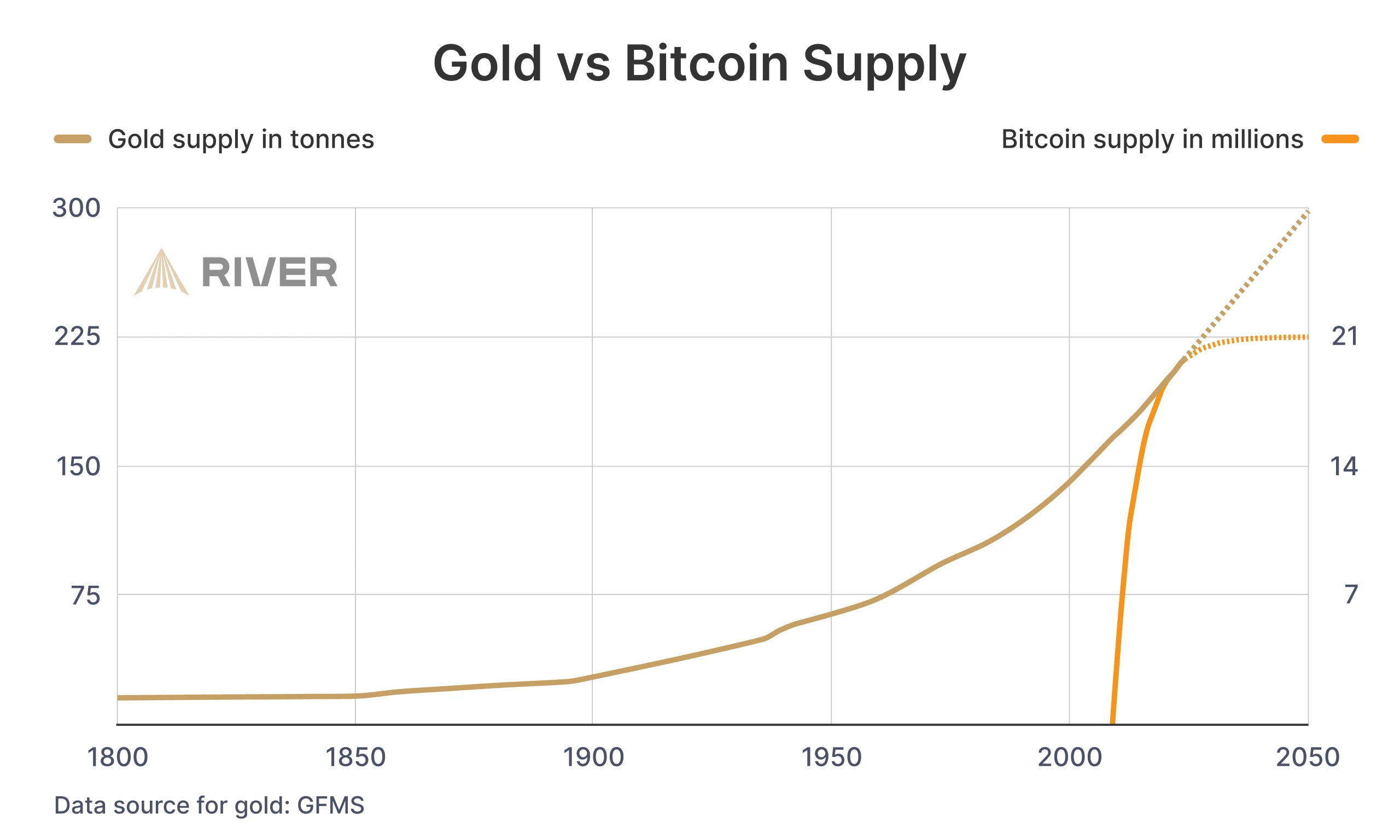

Even though gold is hard to find, no one knows exactly how much gold is still in the ground, and its supply keeps growing.

Bitcoin’s supply is permanently capped at 21 million coins. This limit is clear and can always be checked by anyone, offering a level of transparency that gold just can’t match.

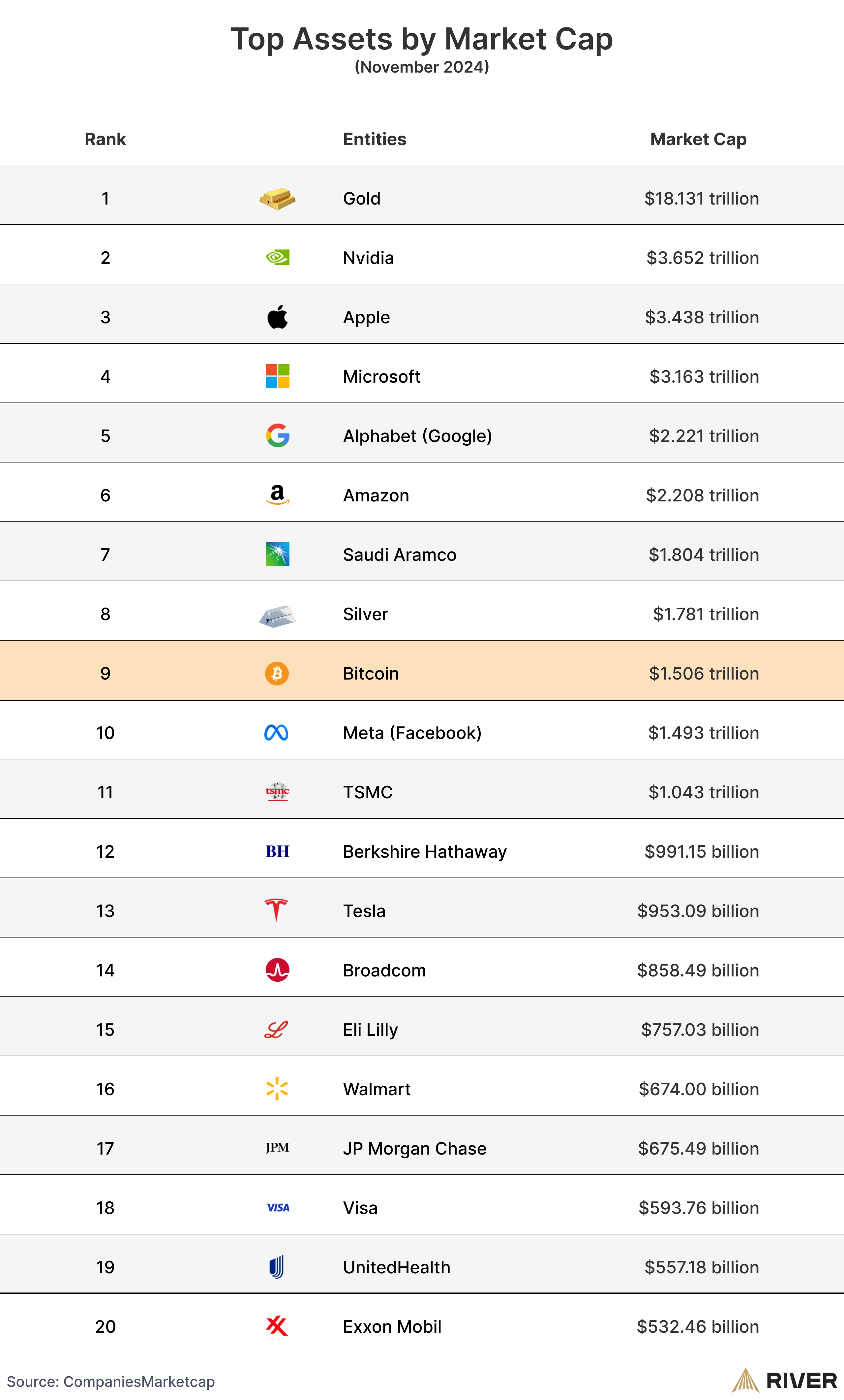

The global gold market is worth around $18 trillion. If Bitcoin captures even a portion of this market, the potential value could be significant. Look how close bitcoin is to the total market value of all the silver in the world!

If scarcity is what gives Bitcoin its value, what is the guarantee that supply won’t change in the future?

How Decentralization Protects Bitcoin Supply

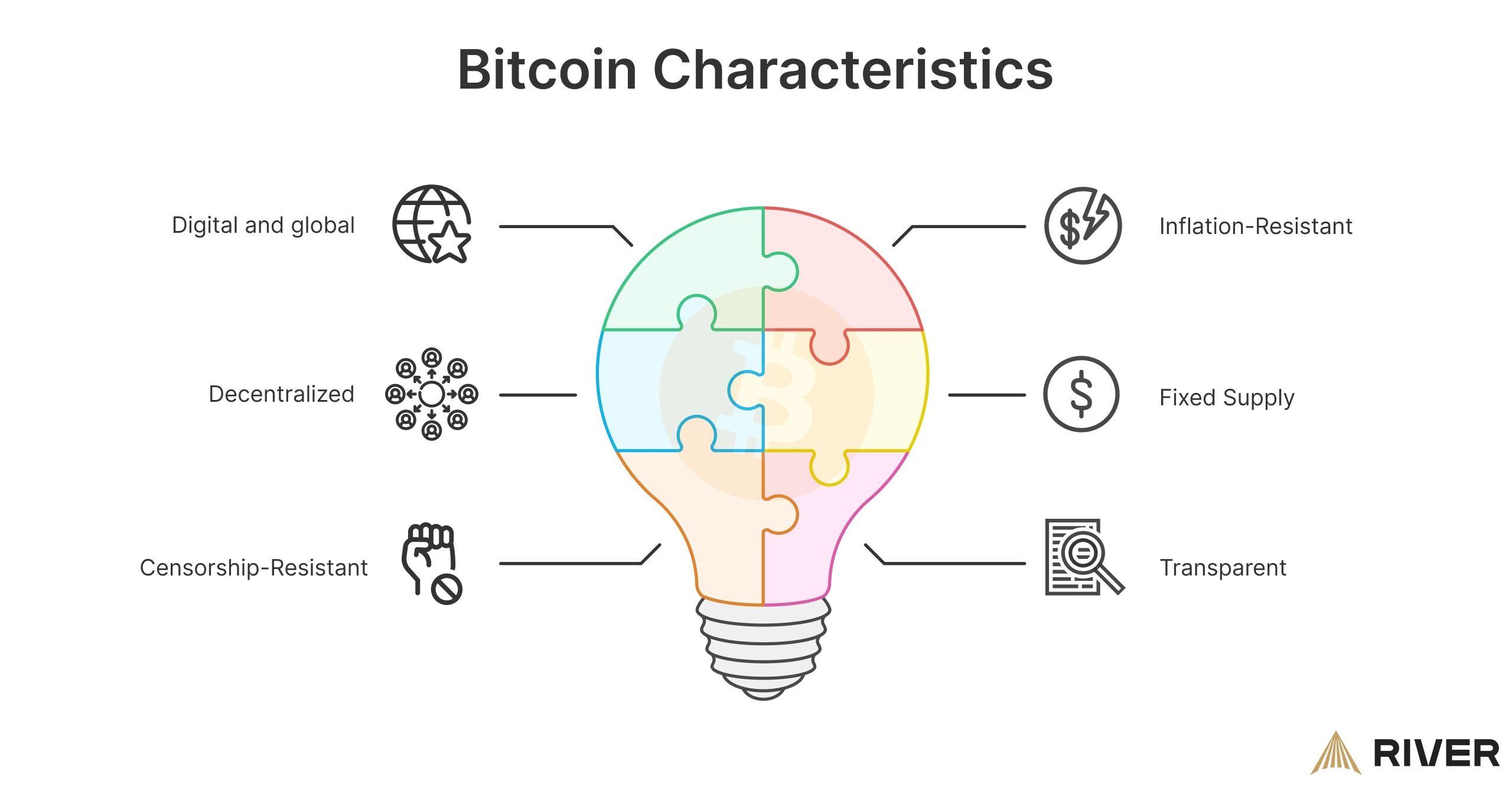

Bitcoin’s supply cannot be changed because it’s decentralized. But what does that really mean?

It means no single person or group controls Bitcoin. Instead, Bitcoin is maintained by a global network of computers that verify each transaction.

If anyone wanted to increase bitcoin’s supply, they would need to convince the entire network. But why would people agree to reduce the value of their own bitcoin?

Now, you might wonder, why should you care about decentralization?

In a world where a small group of leaders keep printing more money, Bitcoin offers a way to protect your savings from inflation.

Checkpoint

Congratulations on making it so far! You’ve covered a lot of ground.

So, what have you learned so far?

Key Takeaways

- Bitcoin is digital money that is used by over 100 million people for savings.

- Unlimited money printing leads to inflation and a loss of purchasing power. Bitcoin has a limited supply which makes it a powerful tool to preserve and grow wealth.

- Bitcoin is decentralized, secure, and transparent, with a fixed supply of 21 million coins.

- Bitcoin’s built-in scarcity gives it value. Some call it "digital gold."

As you continue to learn about Bitcoin, take the next step and start experiencing it for yourself.

By signing up on River, you can begin to buy bitcoin easily and securely.

Every person who buys even a little bit of bitcoin is contributing to a more honest and fair financial future.

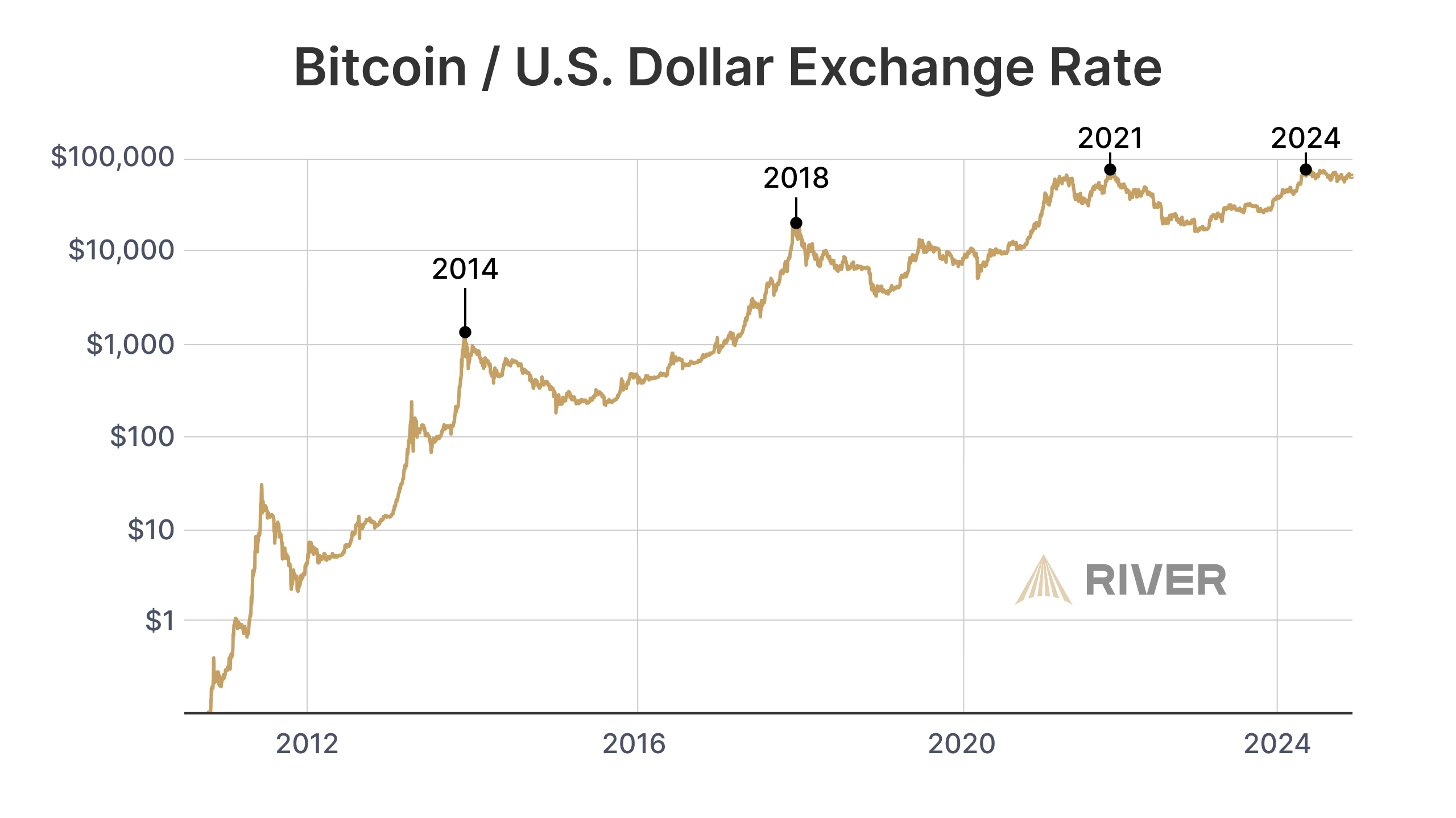

Over time, bitcoin has gone up in value, making it a powerful tool for preserving and growing your wealth.

You’re on a journey to take control of your financial future, and Bitcoin could be the key.

Let’s keep going.

Your future self will thank you.

Below the “Next Reads,” discover what makes the price of bitcoin move so quickly.

Notice: River does not provide investment, financial, tax, or legal advice. The information provided is general and illustrative in nature and therefore is not intended to provide, and should not be relied on for, tax advice. We encourage you to consult the appropriate tax professional to understand your personal tax circumstances.