This article is part 4 of 7 in the “Bitcoin in 21 Minutes” series. To start from the beginning, click here.

Ever wonder what truly drives Bitcoin’s price? It’s not just the buzz or the headlines, but the powerful combination of two forces: supply and demand.

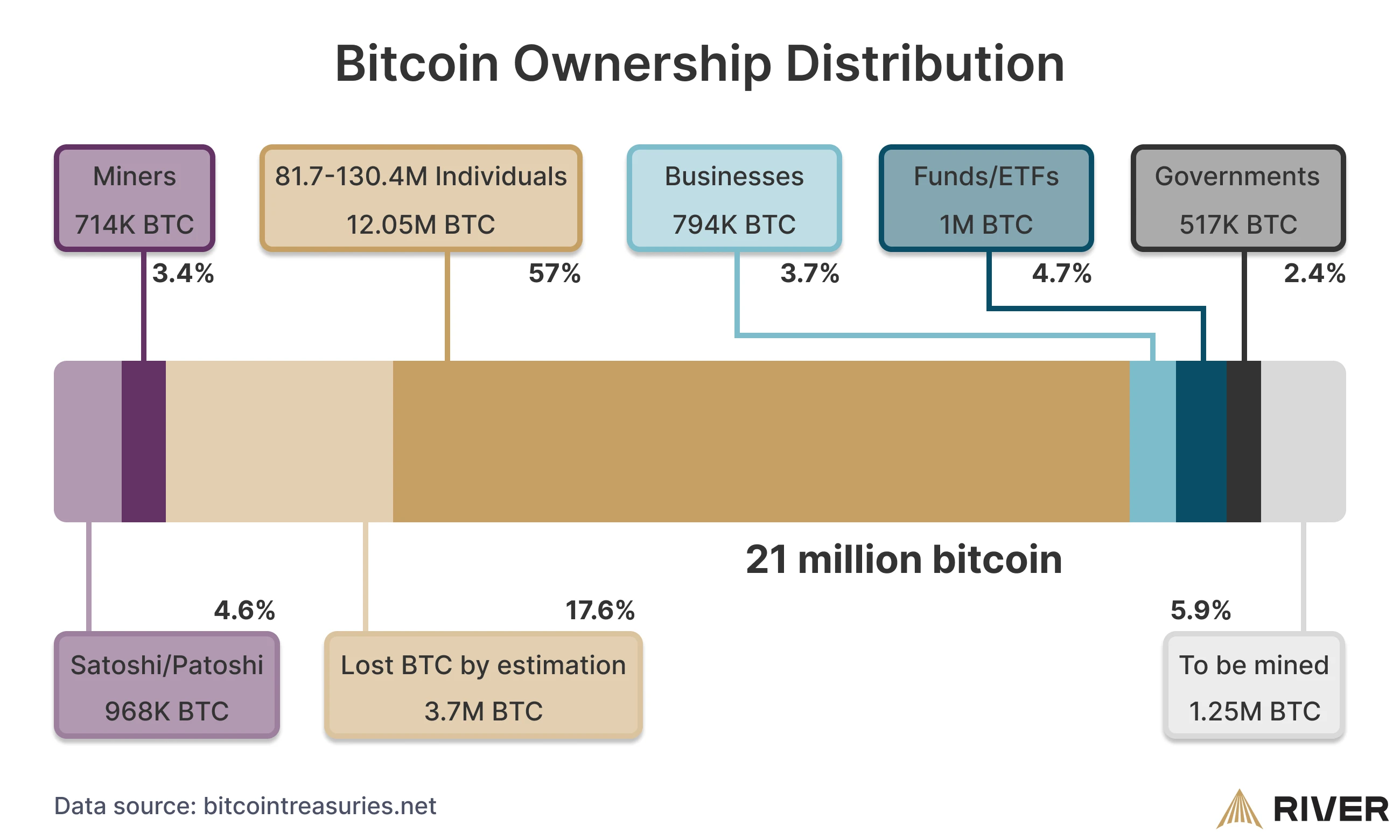

Bitcoin’s supply is widely distributed across different groups. The vast majority of bitcoin is held by individuals, but it’s also owned by businesses, funds, and even governments.

But scarcity alone doesn’t drive price. There needs to be demand. What drives the demand for Bitcoin and what does the future hold for it?

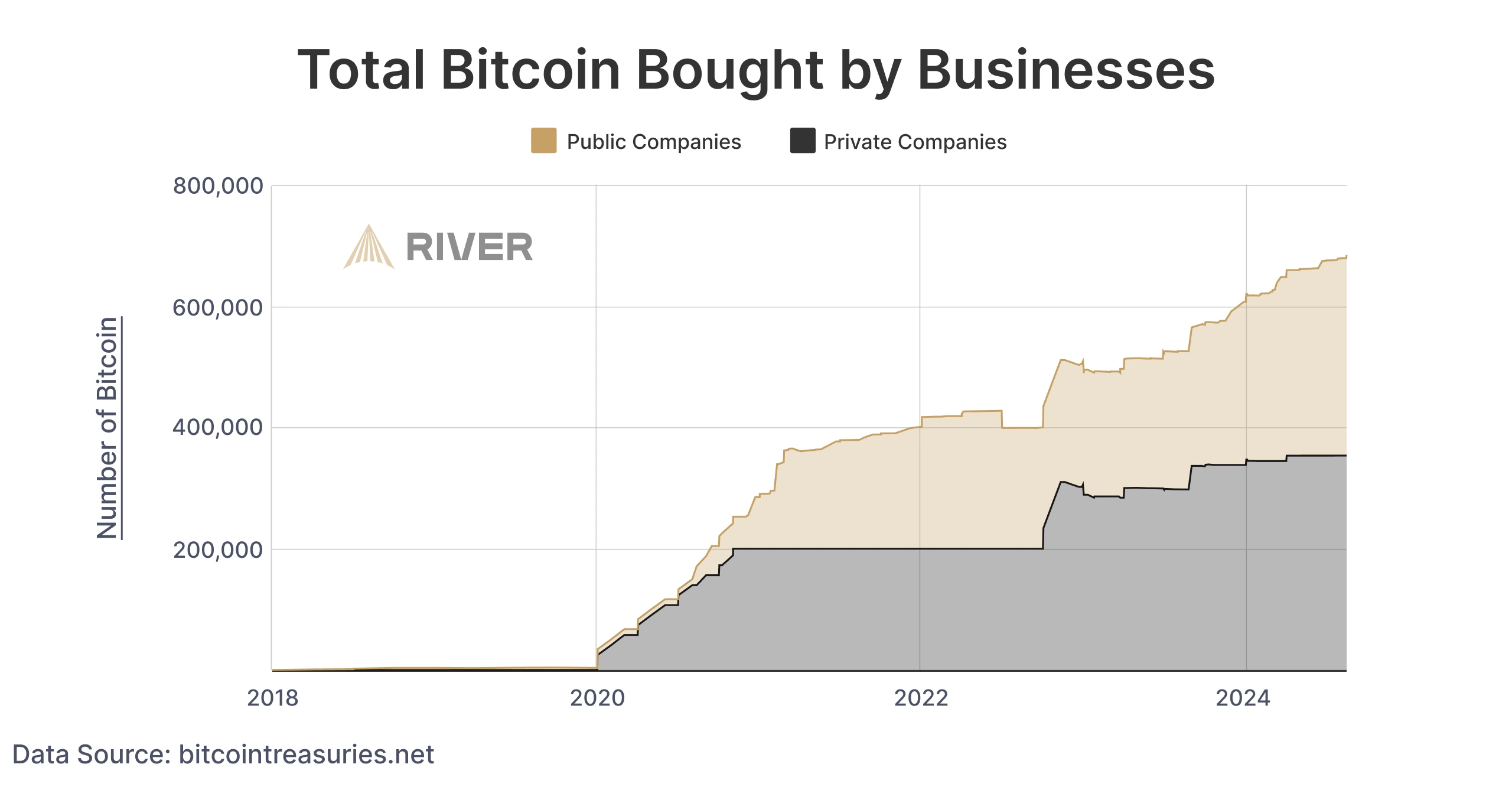

Businesses Rush to Accumulate Bitcoin

Businesses around the world are rapidly buying bitcoin, pushing demand to unprecedented levels. They’ve been buying an average of 250+ bitcoin per day and this number has been growing.

That’s a staggering 587% increase since 2020, showing a major shift in how businesses are positioning themselves for the future.

Do you recognize any of these companies?

They all own Bitcoin.

River has already helped over 1,000+ businesses get started with bitcoin including real estate companies, non-profit organizations, trusts, and more.

For individuals, the window of opportunity to buy bitcoin at current prices may be closing as more businesses continue to buy bitcoin.

Why You Can’t Afford to Ignore Bitcoin

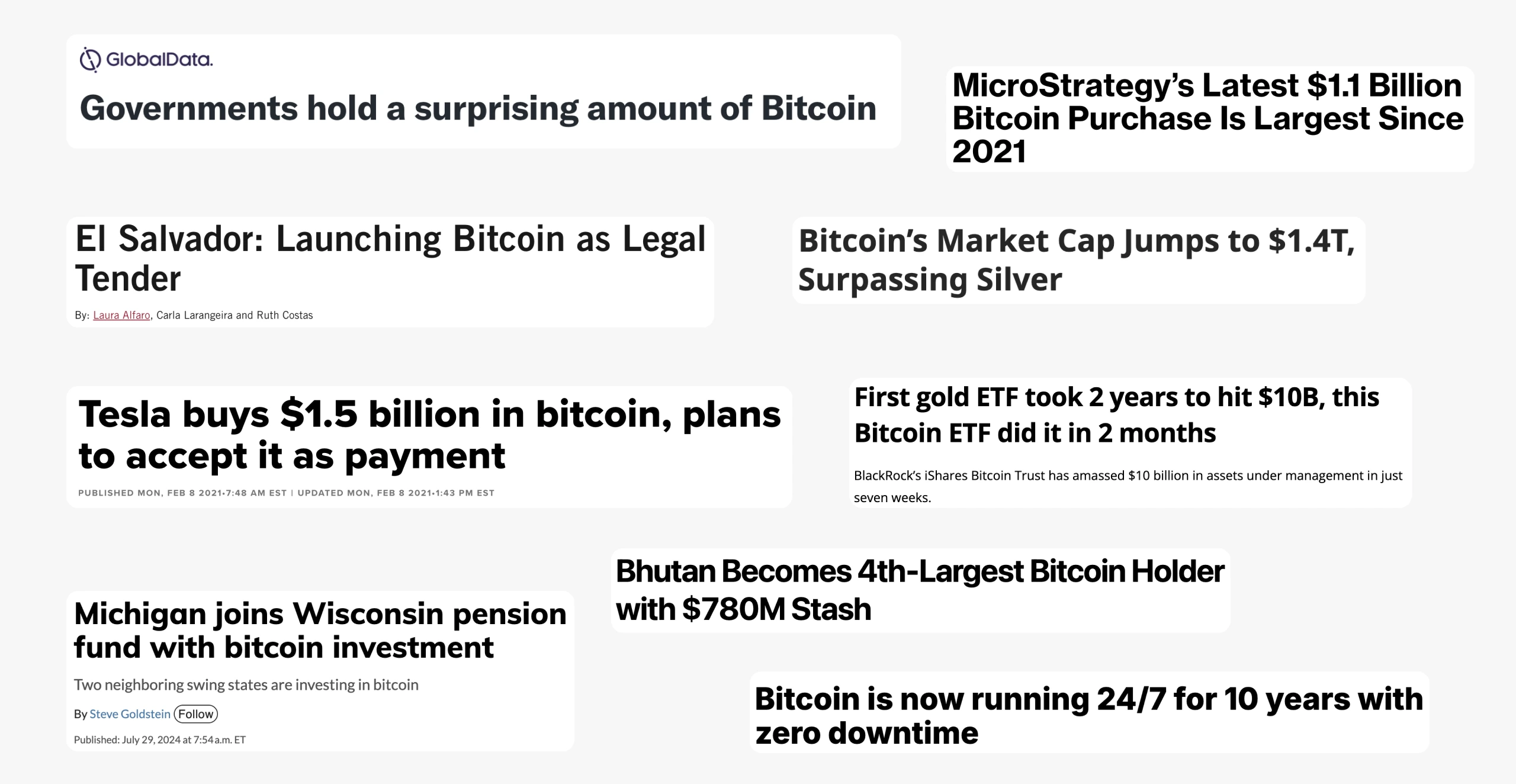

As Bitcoin’s demand shows no signs of slowing down, it’s clear this isn’t just a passing trend. Here are a few key milestones that highlight why Bitcoin is quickly becoming essential in the global economy.

- Reliability: In the past 10+ years, Bitcoin has never been offline, running 24/7.

- Legal Tender: Countries like El Salvador recognize bitcoin as an official currency.

- Market Value: Bitcoin’s market capitalization is greater than $1.4 trillion.

- Wall Street Adoption: The world’s largest firms like BlackRock and respected investment advisors are now offering Bitcoin products.

- Corporate Investments: Public companies own bitcoin, with MicroStrategy recently buying $1.1 billion (Sept 2024).

- Reserve Asset: A sitting U.S. senator has proposed a U.S. Strategic Bitcoin Reserve.

- Government Support: Over 200+ pro-bitcoin candidates have been elected to the House & Senate.

- Government Holdings: Over $31 billion worth of Bitcoin is held by governments globally.

- Institutional Investment: 52% of the top U.S. hedge funds and 600+ institutions have bitcoin exposure.

- Business Adoption: Bitcoin purchases by businesses have increased 587% since 2020.

Demand is rising for an asset that has a fixed supply. Over 100 million people own bitcoin today. What if 200 million people own bitcoin? A billion?

Where do you think the price would go?

Price can be volatile. But how can you deal with it? Explore bitcoin volatility in the “Next Reads” below.