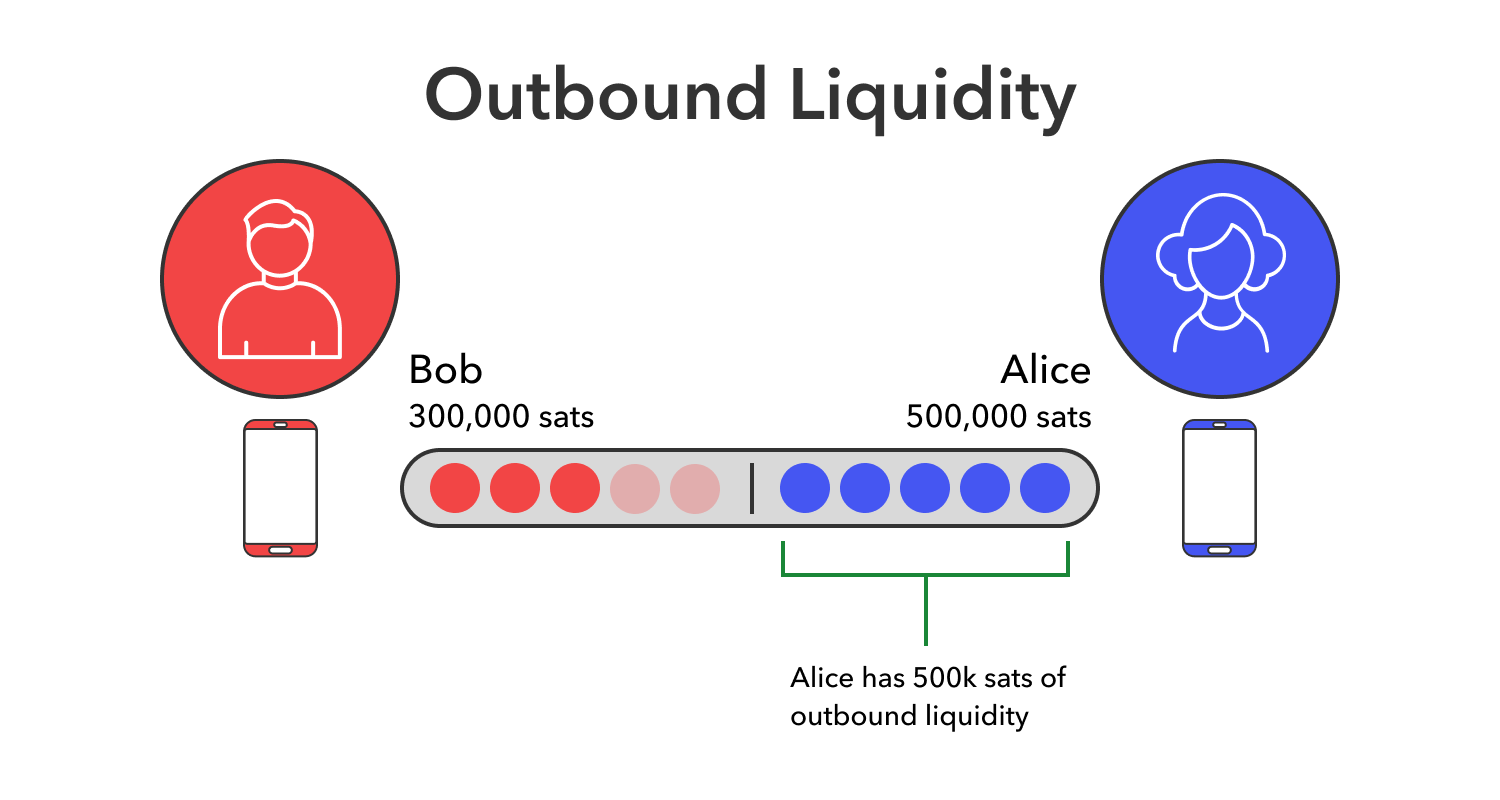

Outbound Liquidity

1 min read

Within the context of a Lightning channel, outbound liquidity refers to funds inside a node’s payment channels which can be used to send payments.

Outbound–or “local”–liquidity are funds within a channel that are owned by the node operators themselves, and are a part of the operator’s investment capital. The liquidity is “local” in the sense that the funds are on the operator’s side of the channel and can therefore be pushed to other network endpoints (nodes). Accordingly, if a channel is closed, outbound liquidity returns to the node operator.

Outbound liquidity is created:

- When the node operator opens a payment channel with another network node.

- When the node operator receives a payment in an existing channel.

- When payments are routed through the node and fees are received. (Fees become outbound liquidity in this case)

In the visualization above, outbound liquidity is represented by the beads on each counterparty’s side of the channel. Alice currently has 500,000 sats of outbound liquidity, whereas Bob has 300,000 sats. Since Bob has inbound liquidity, Alice can send up to 200,000 sats to Bob as the channel currently exists.