This article is part 2 of 7 in the “Bitcoin in 21 Minutes” series. To start from the beginning, click here.

How Money Printing Fuels Inflation

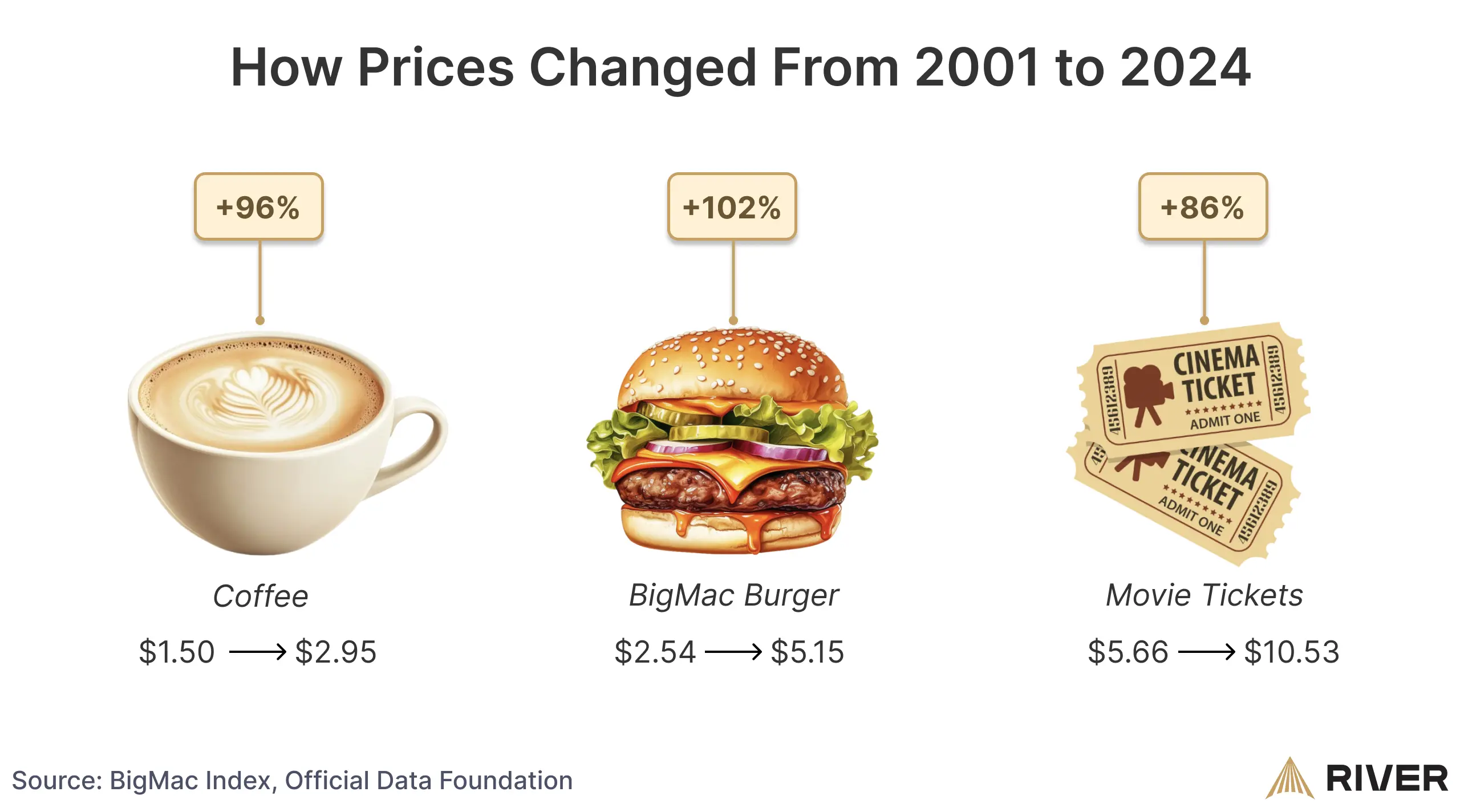

Your groceries cost more each year, but do you know why? Just think about how the prices of everyday items have skyrocketed in the last 20+ years.

It’s not that coffee has suddenly become more valuable, but rather, our money is worth less because of money printing.

The dollar is managed by the Treasury and the Federal Reserve – a small, unelected group of people whose decisions affect everyone, including you.

Federal Reserve Chairman Jerome Powell explains how the government prints money at will.

Yet, printing more dollars doesn’t make society richer, it makes everything more expensive.

Why is this the case?

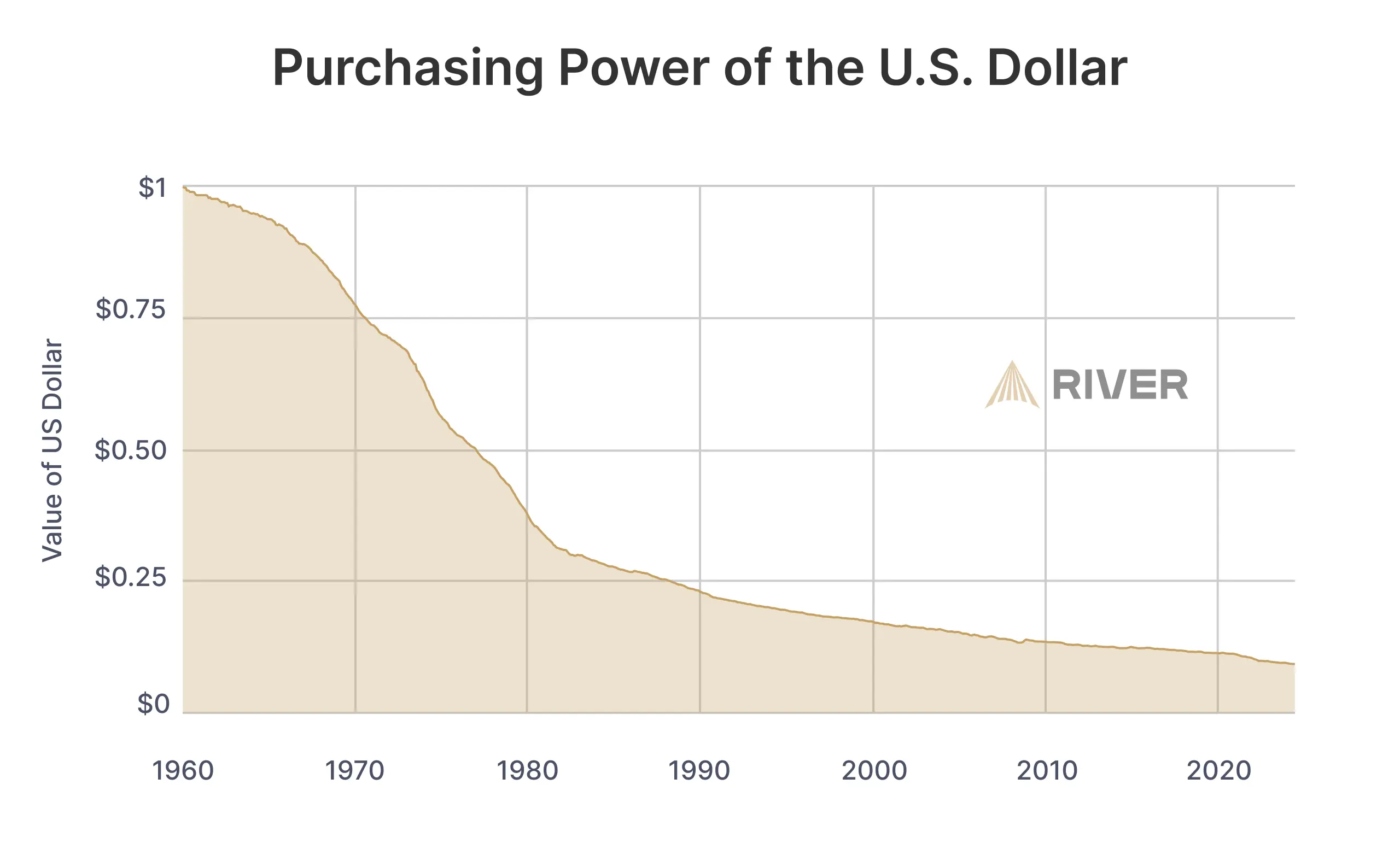

Money printing makes everything cost more because more money in the system makes each dollar worth less. In the end, the same amount of money buys less. As prices climb and each dollar buys less, saving in dollars just doesn’t hold up for the long-term.

While your $1 bill still physically remains $1, it no longer has the same buying power it did in the past.

This decline in purchasing power is why many people feel like their money doesn’t go as far as it used to.

The U.S. dollar is like ice cream. Everyone loves ice cream, but holding it for too long gets messy. The same goes for saving in dollars: your wealth is slowly melting away.

Imagine you’re paying $100 for groceries today. Now, let’s consider how inflation affects the same purchase over time.

In 10 years, if inflation continues at an average rate of 3% per year, that same $100 worth of groceries will cost you $134.39. That means you’re paying an additional $34.39 for the same items, even though your income may not keep pace with inflation.

So isn’t it a simple solution to just stop printing money?

If the government would do that, it would struggle to fund social programs, pay off its debt, and keep the economy stable. When people feel economic pain, they’re likely to vote out the politicians in charge. To avoid that, politicians will often keep the money printers running.

This inflationary system isn’t working for most people, and it’s a pressing reason why we need to start using a new kind of money.

In the “Next Reads” below: Why millions of people see Bitcoin as a new and better form of money.