This article is part 5 of 7 in the “Bitcoin in 21 Minutes” series. To start from the beginning, click here.

The journey from a new asset class to a global store of value is inherently volatile, and many people have first heard about Bitcoin because of its price swings.

In the short term, bitcoin can have its ups and downs, but if you’re holding it for several years to preserve your wealth, then you won’t even notice the day-to-day price movements.

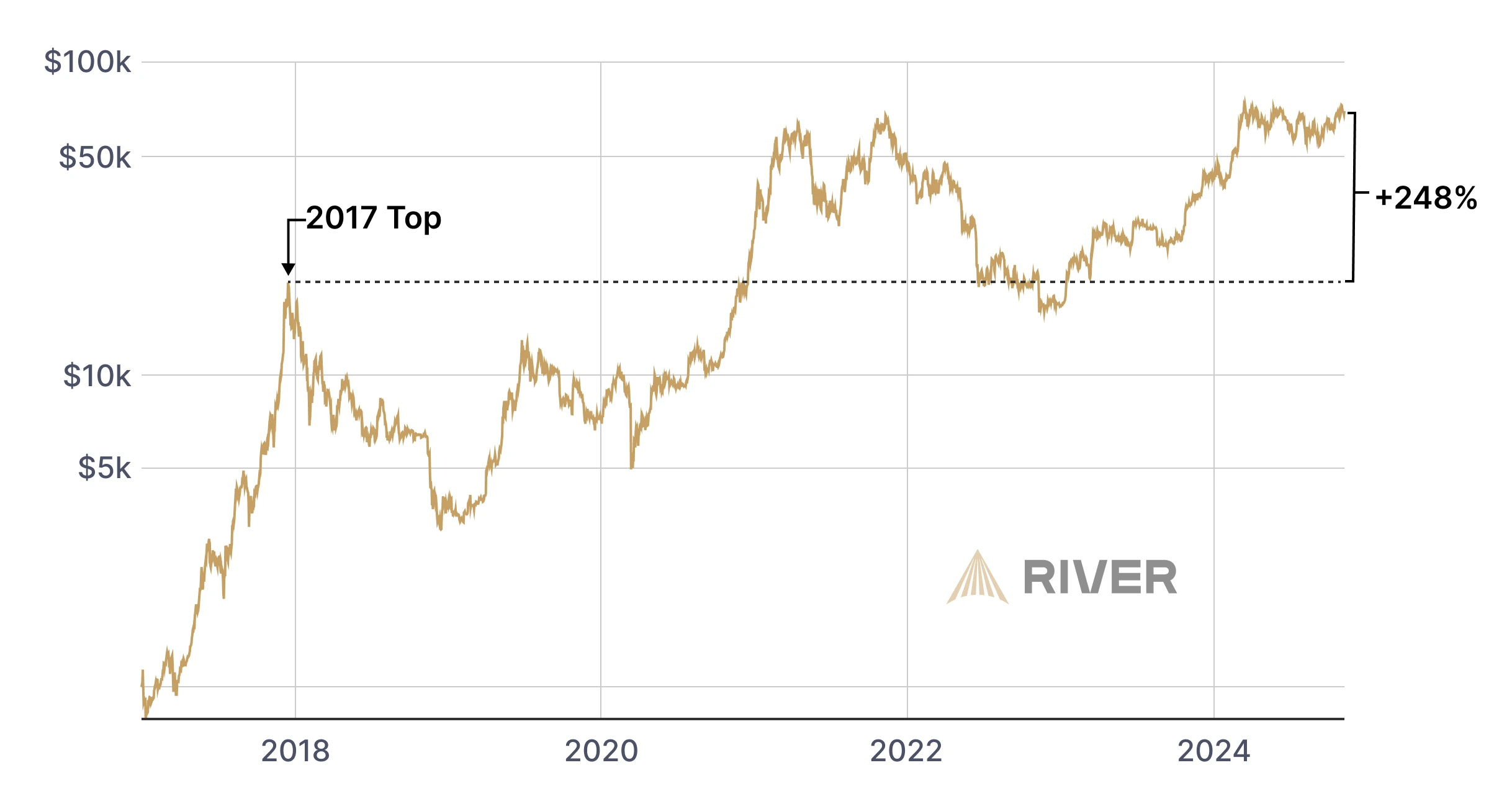

Bitcoin Price Growth

For example, if you had bought $10,000 worth of bitcoin at its peak in 2017, a year later, you’d be facing a painful -83% loss. But if you held on, that same investment would be worth around $34,800 in 2024 giving you a +248% increase.

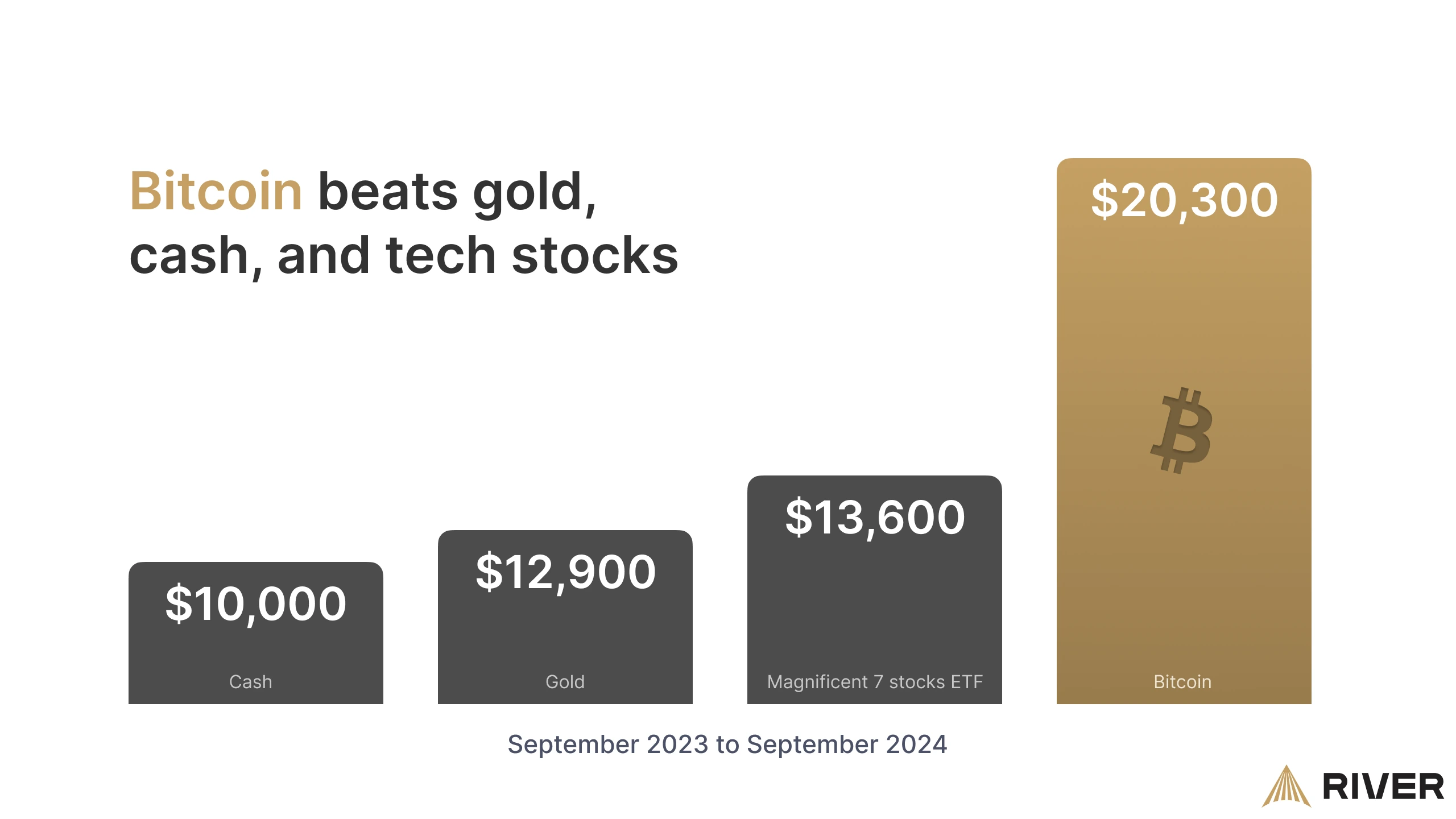

What about a year ago? If you had invested $10,000, it would be worth about $20,030 as of September 2024. Compare that to investing in gold or tech stocks, and you’ll see that bitcoin has outperformed them all.

But let’s not just look at the past year, what if it was just an exceptional year? Taking a look at the average of the past 5 years, bitcoin’s price grew by 44% each year compared to 13% for the S&P 500.

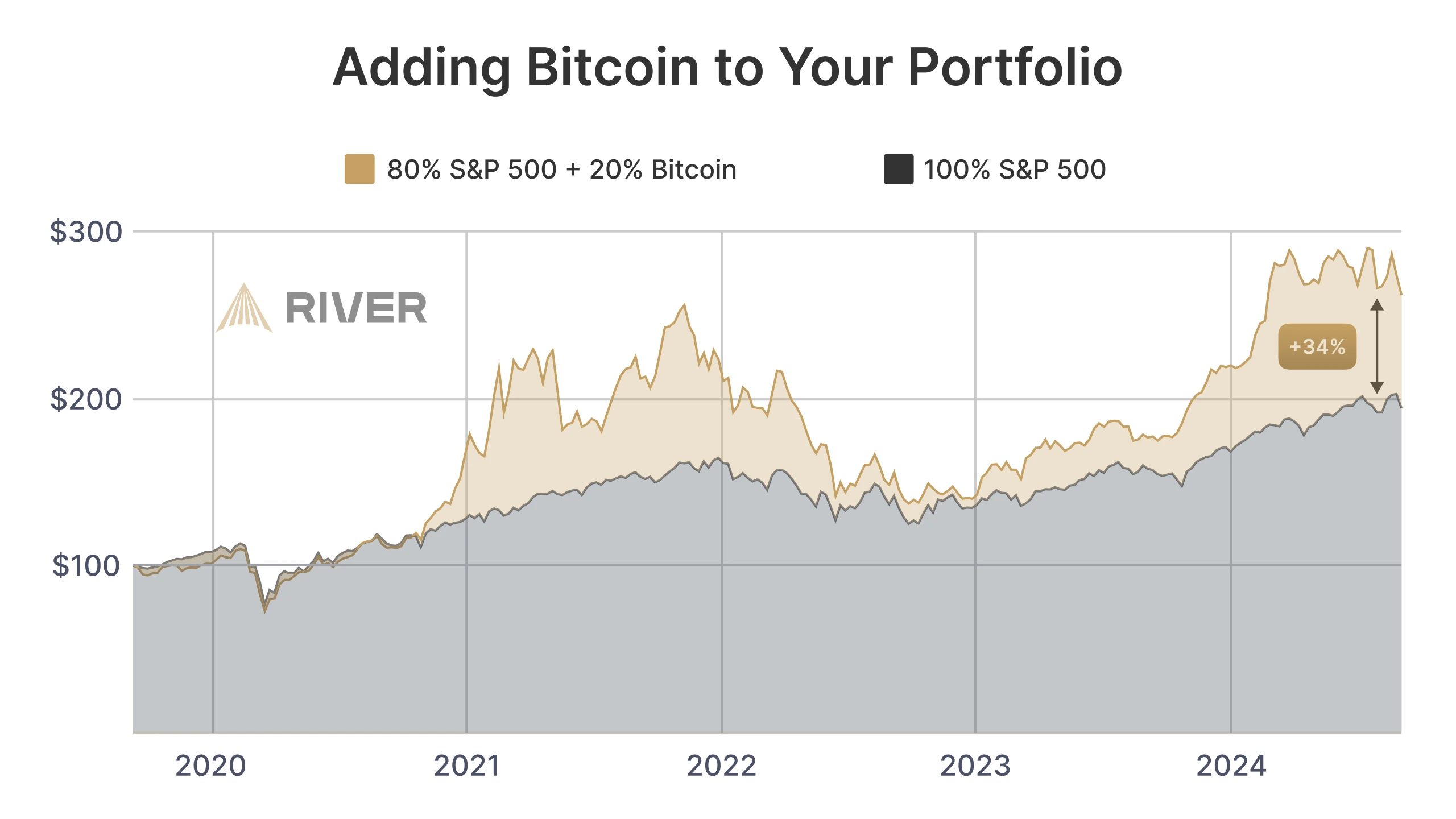

And here’s the best part: you don’t have to change your entire portfolio to benefit from bitcoin. Adding a small portion of bitcoin to your existing investments may already significantly boost your returns.

The chart below shows how allocating 20% of your portfolio to bitcoin would have increased your portfolio value by a further +34% over the past 5 years.

For many people, investing in bitcoin has given them more money to put towards their bills, paying off their mortgage, their kid’s tuition, or saving for retirement.

The key takeaway?

If you’re willing to ride out the waves and hold bitcoin for the long term, the ups and downs in the short-term won’t matter as much.

In the “Next Reads” below, discover a simple, yet effective strategy that investors rely on to minimize volatility.

Notice: River does not provide investment, financial, tax, or legal advice. The information provided is general and illustrative in nature and therefore is not intended to provide, and should not be relied on for, tax advice. We encourage you to consult the appropriate tax professional to understand your personal tax circumstances.