This article is part 2 of 8 in the “Bitcoin in 21 Minutes” series. To start from the beginning, click here.

What Is Bitcoin?

Bitcoin is simply a new form of money that you can send & receive over the Internet and use to save your wealth.

Unlike the paper money in your wallet, Bitcoin is digital, just like the savings in your bank account.

Bitcoin was introduced in 2008 by an individual or group using the name “Satoshi Nakamoto;” it emerged as a response to the flaws in traditional financial systems.

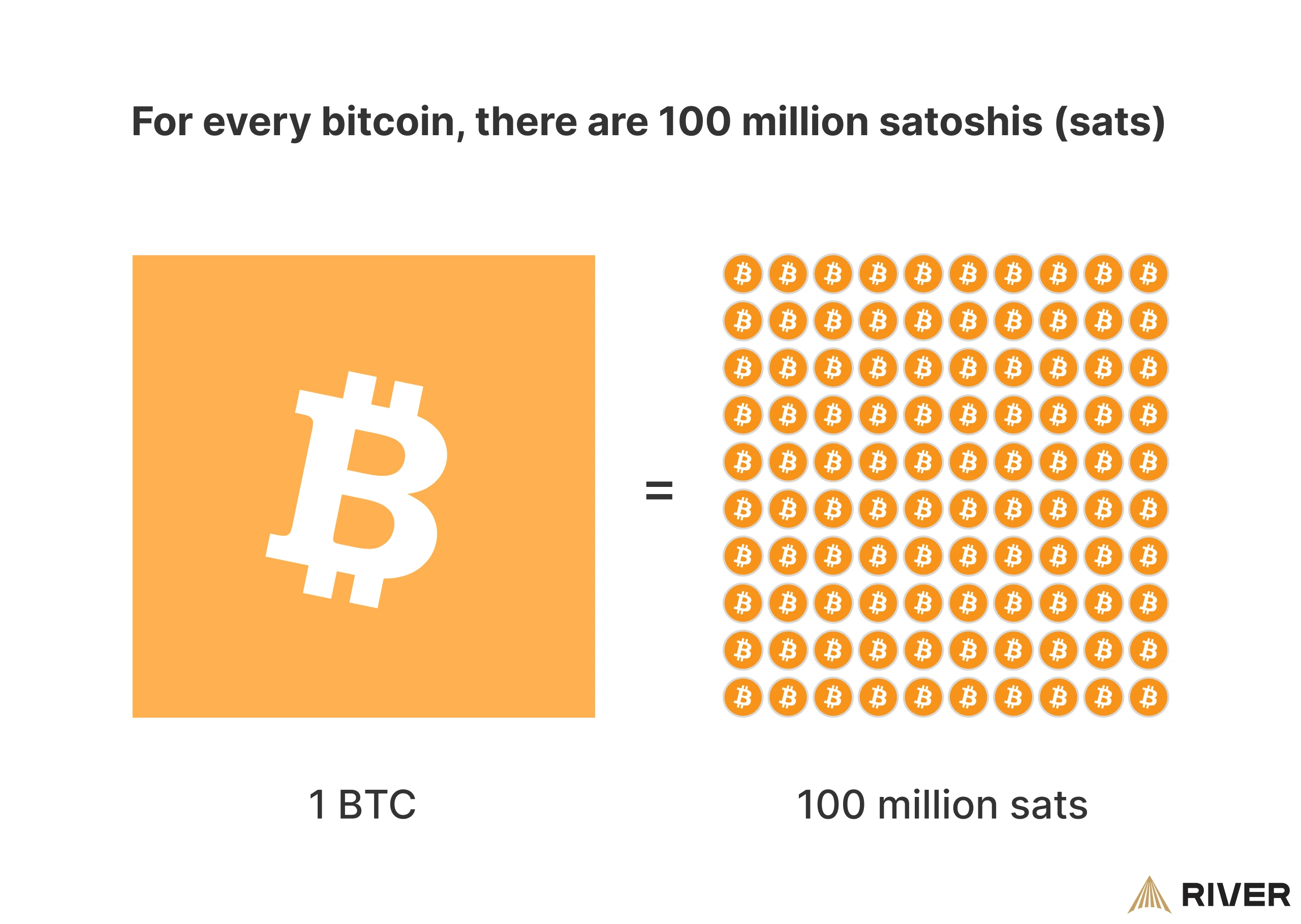

Much like how the dollar can be divided into 100 cents, a bitcoin can be divided into 100 million satoshis, often called “sats.”

This means that when investing, you don’t have to buy a full bitcoin; you can buy just a few dollars worth to get started.

The government can print an unlimited amount of U.S. dollars, but Bitcoin has a fixed supply of 21 million coins. Bitcoin cannot be inflated, which is why many people refer to Bitcoin as “digital gold.”

See what Larry Fink, Chairman and CEO of BlackRock, the world’s largest asset manager, says about Bitcoin.

It’s not just “Bitcoin-obsessed” people, but even traditional finance people are now recognizing the value of Bitcoin.

Bitcoin is already making a real difference in people’s lives.

- It’s offsetting the devastating impact of inflation.

- It’s helping families rebuild their savings.

- It’s opening the door to financial services for millions who’ve never had a bank account.

Bitcoin offers a way to protect and grow your wealth in an uncertain world.

Protect your wealth from what?

The government is quietly stealing your wealth by printing more money, making you poorer over time.

But you don’t have to accept this.

Bitcoin offers a way to protect and grow what you’ve worked so hard for. It’s about taking control of your finances and making sure your wealth is yours to keep.

Up Next: How money printing is a tax on your savings. Click on the image below the “Next Reads” to continue.